- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Tempered Glass Market Size & Share, Industry Report, 2033GVR Report cover

![Tempered Glass Market Size, Share & Trends Report]()

Tempered Glass Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Plain, Colored), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-704-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Tempered Glassd Market Summary

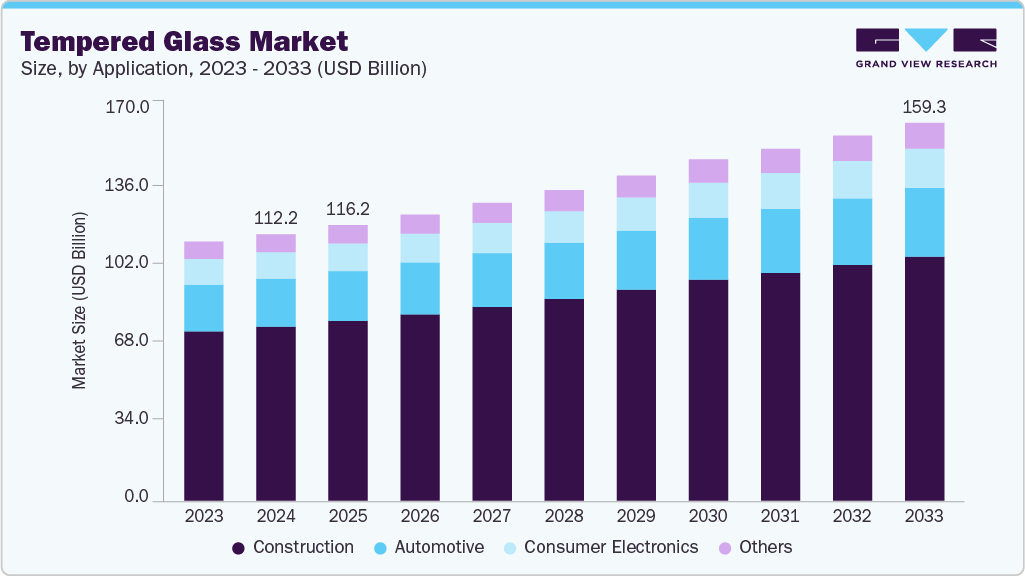

The global tempered glass market size was valued at USD 112.21 billion in 2024 and is projected to reach USD 159.27 billion by 2033, at a CAGR of 4.0% from 2025 to 2033. The tempered glass market is growing rapidly due to rising awareness about safety and durability. Governments and construction authorities emphasize using stronger materials in buildings and public spaces.

Key Market Trends & Insights

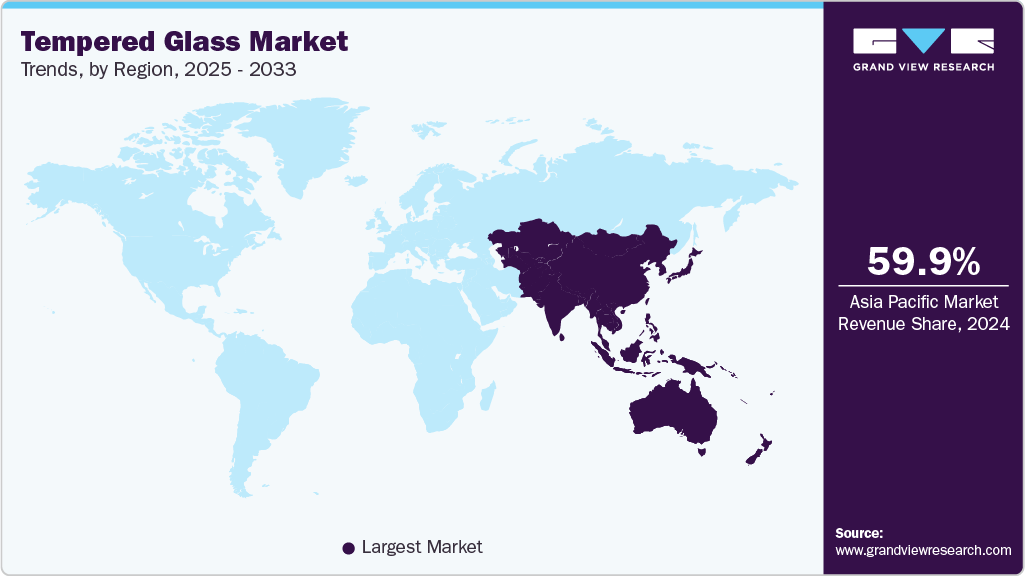

- Asia Pacific dominated the tempered glass market with the largest market revenue share of 59.9%.

- The tempered glass market in the U.S. is experiencing robust growth, primarily driven by advancements in various sectors.

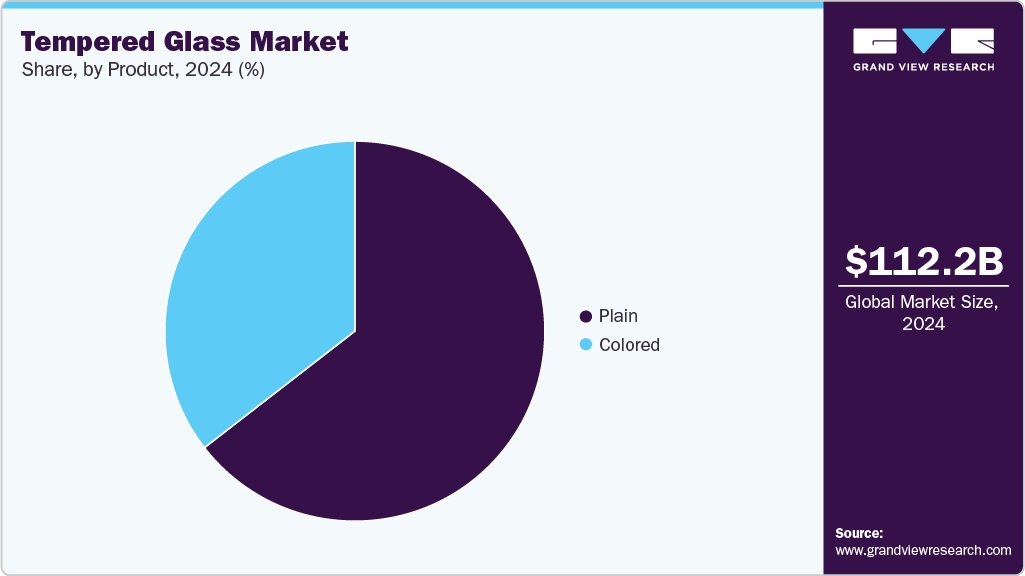

- By product, plain accounted for the largest market revenue share of 64.5% in 2024.

- By application, consumer electronics segment is anticipated to register a CAGR of 4.4% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 112.21 Billion

- 2033 Projected Market Size: USD 159.27 Billion

- CAGR (2025-2033): 4.0%

- Asia Pacific: Largest Market Region in 2024

Tempered glass is preferred because it is much stronger than regular glass. It shatters into small, blunt pieces instead of sharp shards when broken. This makes it safer for use in schools, hospitals, offices, and other crowded areas. As more countries adopt strict building safety codes, the demand for tempered glass continues to rise.The growing construction and automotive industries are key contributors to market growth. Temporary glass is used in modern architecture in office buildings, hotels, and residential towers for aesthetics and safety. For instance, projects like Burj Khalifa in Dubai and Shanghai Tower in China use tempered glass panels to achieve transparency and strength. In the automotive industry, companies such as Toyota and Tesla use tempered glass for side and rear windows, sunroofs, and panoramic roofs. The increase in electric vehicle production and luxury car models with larger glass surfaces is expanding the demand even further.

Technological advancements in manufacturing and coating processes are another major growth driver. Improved furnace designs and precision cooling systems allow the production of high-quality tempered glass with fewer distortions. Companies like Saint-Gobain and Guardian Glass have introduced products with anti-reflective, scratch-resistant, and energy-efficient coatings. These innovations have expanded the use of tempered glass in smart buildings, consumer electronics, and solar applications. For example, smartphones such as the iPhone and Samsung Galaxy use chemically strengthened tempered glass for screen protection, which has become a standard in the electronics industry.

Energy efficiency and environmental sustainability trends are also pushing market demand. Builders and homeowners increasingly adopt double-glazed units made with tempered glass to reduce heat loss and control solar gain. Green building certifications such as LEED and BREEAM encourage using such materials. For example, office towers like The Shard in London and One World Trade Center in New York use energy-efficient tempered glass to maintain indoor temperature and reduce energy costs. This shift toward sustainable architecture is creating strong long-term growth opportunities.

Rising consumer preferences for modern designs and durable products are broadening the application of tempered glass in daily life. Home interiors now feature glass staircases, shower enclosures, and balcony railings made from tempered glass. In the electronics industry, it is used for televisions, ovens, and tablets to improve durability and appearance. Additionally, solar energy companies increasingly use tempered glass to cover photovoltaic modules, as seen in panels like JinkoSolar and Trina Solar. These wide-ranging applications strengthen the global market and make tempered glass an essential material across multiple industries.

Drivers, Opportunities & Restraints

The increasing demand from the construction and automotive industries primarily drives the tempered glass market. Rapid urbanization and infrastructure expansion have led to higher usage of tempered glass in windows, facades, and interior applications due to its strength, safety, and thermal resistance. In the automotive sector, manufacturers are increasingly adopting tempered glass for windshields, side, and rear windows to enhance passenger safety and meet stringent regulatory standards. Additionally, the growing use of tempered glass in consumer electronics such as smartphones, tablets, and laptops supports market growth as consumers seek durable and scratch-resistant materials.

The tempered glass market opportunities arise from technological advancements and the growing adoption of smart glass solutions. Developing energy-efficient glass with UV protection, glare reduction, and heat insulation has expanded applications in green buildings and modern infrastructure projects. Increasing investments in solar energy also present new prospects, as tempered glass is widely used in solar panels for its durability and light transmission properties. Moreover, emerging economies in the Asia Pacific, Latin America, and the Middle East are witnessing a surge in construction activities, creating significant opportunities for market expansion.

The market, however, faces restraints related to high manufacturing costs and production complexities. Tempered glass requires precise temperature control and specialized machinery, leading to increased energy consumption and higher production costs. The risk of spontaneous breakage due to nickel sulfide impurities remains a concern, affecting consumer trust in certain applications.

Product Insights

The growth of the plain tempered glass segment is strongly supported by its extensive use in the construction and automotive industries. Plain tempered glass is widely used for doors, windows, and facades in the building sector due to its safety and thermal resistance. For instance, according to the World Green Building Council, global floor area in green buildings is expected to double by 2030, directly increasing demand for durable and energy-efficient materials such as plain tempered glass. Infrastructure initiatives like Smart Cities Mission and increasing commercial building projects are further driving adoption in India. Similarly, in the automotive industry, the growing production of passenger vehicles, over 92 million units produced globally in 2024, has boosted the consumption of tempered glass for side windows and rear windshields, where plain variants are most commonly used.

Colored is anticipated to register the fastest CAGR over the forecast period. Architects and designers increasingly incorporate colored glass into modern structures to enhance visual appeal while maintaining safety and functionality. For instance, colored tempered glass is widely used in building facades, skylights, and interior partitions in commercial spaces such as malls, airports, and corporate offices. The trend of sustainable construction and green buildings further supports its use, as tinted or coated colored glass helps regulate indoor temperatures by reducing heat gain, thus improving energy efficiency. According to the International Energy Agency, buildings account for nearly 30% of global energy consumption, encouraging developers to adopt materials like colored tempered glass that can reduce cooling costs and improve environmental performance.

Application Insights

Tempered glass is extensively used in windows, doors, facades, skylights, and interior partitions because of its superior strength, safety, and thermal resistance. The global construction industry’s steady growth, supported by large-scale infrastructure investments, fuels the demand for durable and energy-efficient materials. For instance, according to Oxford Economics, global construction output is projected to grow by over 42% by 2030, driven by rising investments in urban development and smart city projects. The adoption of building codes emphasizing occupant safety and sustainability has increased the preference for tempered glass, which offers high impact resistance and shatters into small, harmless pieces upon breakage.

The consumer electronics segment is anticipated to register the fastest CAGR over the forecast period due to the rising demand for smartphones, tablets, laptops, and smartwatches. Tempered glass is widely used as a protective layer for display screens, offering high durability, scratch resistance, and impact protection. With over 1.24 billion smartphones shipped globally in 2024, the need for screen protection materials has increased significantly. Manufacturers such as Apple, Samsung, and Xiaomi are incorporating tempered glass to enhance product lifespan and visual clarity. The growing trend of larger and edge-to-edge displays has further accelerated the use of thin, high-strength tempered glass to maintain aesthetic appeal and functional performance.

Regional Insights

Asia Pacific Tempered Glass Market Trends

Asia Pacific’s rapid urbanization and large-scale infrastructure spending are major drivers of tempered glass demand. Cities across China, India, Southeast Asia and Australia are expanding commercial and residential developments, and developers increasingly prefer tempered glass for facades, curtain walls, windows and balustrades because of its strength and aesthetic flexibility. This surge in construction activity is creating consistent demand for architectural and flat glass solutions in the region.

North America Tempered Glass Market Trends

The construction and real estate sectors largely drive the tempered glass market in North America. Commercial, residential, and infrastructure projects increasingly demand tempered glass for windows, facades, doors, and interior partitions because of its strength, safety, and aesthetic appeal. Urban development, office expansions, and renovation projects are creating a steady need for high-performance architectural glass solutions across the U.S., Canada, and Mexico.

U.S. Tempered Glass Market Trends

The tempered glass market in the U.S. is experiencing robust growth, primarily driven by advancements in various sectors. In the automotive industry, tempered glass is integral to vehicle safety and is utilized in windshields, side windows, and sunroofs. Its durability and shatter-resistant properties align with stringent safety regulations and consumer demand for enhanced vehicle protection. This demand is further amplified by the proliferation of electric vehicles (EVs) and the integration of advanced driver-assistance systems (ADAS), which necessitate specialized glass solutions. Similarly, the construction industry is witnessing a surge in the adoption of tempered glass for architectural applications.

Europe Tempered Glass Market Trends

The tempered glass market in Europe is experiencing significant growth, primarily driven by advancements in the automotive and construction sectors. In the automotive industry, the increasing demand for lightweight, durable, and energy-efficient materials is propelling the use of tempered glass in vehicle windows and windshields. This trend is further supported by stringent EU safety and emission regulations, which encourage the adoption of high-performance materials. Additionally, the rise of electric, hybrid, and autonomous vehicles, which often feature larger glass surfaces for enhanced visibility and passenger experience, contributes to the growing demand for tempered glass in the automotive sector.

Middle East & Africa Tempered Glass Market Trends

The tempered glass market in the Middle East and Africa (MEA) is experiencing robust growth, primarily driven by the expanding construction and automotive industries. Rapid urbanization and increasing infrastructure development are leading to a surge in demand for energy-efficient and durable building materials in the construction sector. This trend is particularly evident in countries like Saudi Arabia, the UAE, and South Africa, where large-scale projects such as NEOM city and high-rise developments are underway. Adopting energy-efficient glazing solutions, including tempered glass, is further encouraged by South Africa's SANS 10400-XA:2021 regulations, which mandate building energy usage standards.

Latin America Tempered Glass Market Trends

The Latin American tempered glass market is experiencing significant growth, primarily driven by the expansion of the construction and automotive sectors. The region's rapid urbanization and infrastructure development have increased demand for durable and aesthetically appealing materials in building facades, windows, and doors.

Key Tempered Glass Company Insights

Some of the key players operating in the market include AGC Inc., Guardian Industries, and others.

-

AGC Inc., established in 1907 in Japan, is a global leader in glass manufacturing, operating across various sectors such as automotive, architecture, electronics, and chemicals. The company is significant in the tempered glass market, offering products known for their strength, durability, and optical clarity. AGC's advanced tempered glass solutions cater to various applications, from consumer electronics to architectural structures. AGC provides high-performance products like Dragontrail and DT Star2 in the tempered glass segment. Dragontrail is a lightweight, flexible, and scratch-resistant glass used as a protective cover for electronic devices, offering exceptional strength and durability.

-

Guardian Industries is a prominent U.S.-based glass and building products manufacturer known for its innovative architectural, automotive, and specialty glass solutions. The company operates globally, supplying glass and related products for residential, commercial, and industrial applications. It focuses on high-quality, durable, and energy-efficient products while integrating advanced technologies to meet evolving market demands. Guardian also emphasizes sustainability by producing glass that improves energy performance and reduces environmental impact.

Key Tempered Glass Companies:

The following are the leading companies in the tempered glass market. These companies collectively hold the largest market share and dictate industry trends.

- Asahi Glass Co., Ltd.

- Dlubak Specialty Glass Corporation

- Guardian Industries

- Nippon Sheet Glass (NSG), Co. Ltd

- Press Glass SA

- Romag

- Saint-Gobain S.A

- Taiwan Glass Ind. Corp.

- Virginia Mirror Co

- Fuso India Pvt Ltd.

Recent Development

-

In August 2025, Optiemus Electronics partnered with global leader Corning Inc. and inaugurated India's first tempered glass manufacturing facility for mobile devices in Noida. This strategic collaboration marks a pivotal step in India's drive for electronics self-reliance, with the new plant aiming to serve both domestic and international markets through "Engineered by Corning" branded tempered glass.

Tempered Glass Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 116.18 billion

Revenue forecast in 2033

USD 159.27 billion

Growth rate

CAGR of 4.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

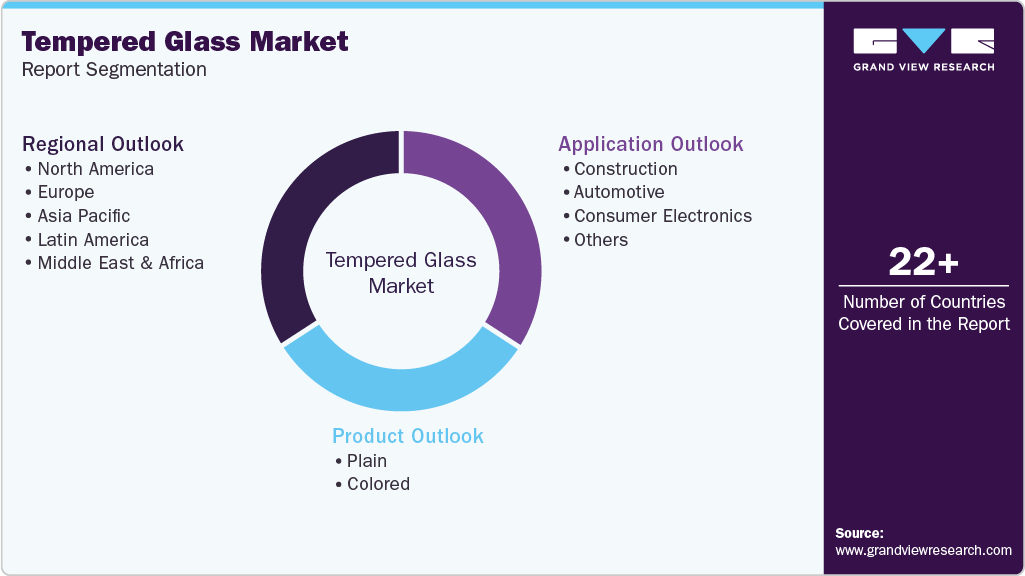

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Saudi Arabia, UAE

Key companies profiled

Asahi Glass Co., Ltd.; Dlubak Specialty Glass Corporation; Guardian Industries; Nippon Sheet Glass (NSG), Co. Ltd; Press Glass SA; Romag; Saint-Gobain S.A; Taiwan Glass Ind. Corp.; Virginia Mirror Co; Fuso India Pvt Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tempered Glass Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global tempered glass market report on the basis of application, product, and region.

-

Product Outlook (Revenue, USD Million; Volume, Kilotons; 2021 - 2033)

-

Plain

-

Colored

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons; 2021 - 2033)

-

Construction

-

Automotive

-

Consumer Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global tempered glass market size was estimated at USD 112.21 billion in 2024 and is expected to reach USD 116.18 billion in 2025.

b. The global tempered glass market is expected to grow at a compound annual growth rate of 4.0% from 2025 to 2033 to reach USD 159.27 billion by 2033.

b. The plain segment dominated the market with a revenue share of 65.7% in 2024.

b. Some of the key players of the global tempered glass market are Asahi Glass Co., Ltd., Dlubak Specialty Glass Corporation, Guardian Industries, Nippon Sheet Glass (NSG), Co. Ltd, Press Glass SA, Romag, Saint-Gobain S.A, Taiwan Glass Ind. Corp., Virginia Mirror Co, Fuso India Pvt Ltd., and others.

b. The key factor driving the growth of the global tempered glass market is the rising demand for durable and safety-enhanced glass products across automotive, construction, and consumer electronics industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.