- Home

- »

- Automotive & Transportation

- »

-

Terminal Tractor Market Size, Share & Growth Report, 2030GVR Report cover

![Terminal Tractor Market Size, Share & Trends Report]()

Terminal Tractor Market (2024 - 2030) Size, Share & Trends Analysis Report By Drive Type (4x2, 4x4), By Propulsion, By Application, By Tonnage, By Vehicle Type (Manual, Automated), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-261-5

- Number of Report Pages: 119

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Terminal Tractor Market Summary

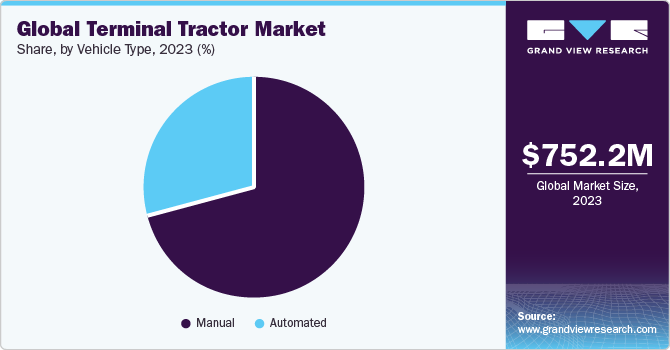

The global terminal tractor market, valued at USD 752.2 million in 2023 and is projected to reach USD 1.03 billion by 2030, growing at a CAGR of 4.7% from 2024 to 2030. Terminal tractors, also known as yard trucks, hostlers, or shunt trucks, are specialized vehicles designed for moving trailers and containers within confined spaces such as terminals, distribution centers, warehouses, and ports.

Key Market Trends & Insights

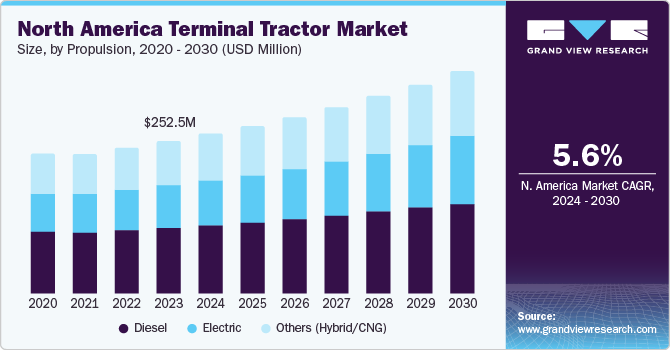

- North America was the largest regional market with a 33.6% share in 2023.

- The Asia Pacific region is anticipated to witness the fastest growth in the market.

- By drive type, the 4x2 segment dominated the market in 2023 with a 41.6% market share in 2023.

- By propulsion, the electric segment is projected to register the fastest CAGR from 2024 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 752.2 Million

- 2030 Projected Market Size: USD 1.03 Billion

- CAGR (2024-2030): 4.7%

- North America: Largest market in 2023

These vehicles play a crucial role in facilitating efficient cargo movement between different facility areas or transportation modes, such as ships, trains, and trucks. The market growth is driven by the rising demand for efficient cargo handling and the expansion of e-commerce and retail logistics.The increase in global trade volumes has led to a corresponding rise in the demand for efficient cargo-handling processes across various logistics and transportation hubs worldwide. Terminal tractors have emerged as a critical component of these operations, becoming imperative for businesses and organizations operating in these domains to optimize their deployment and utilization of terminal tractors to enhance operational efficiency and productivity. According to the World Trade Organization (WTO), China exported USD 100.91 billion of iron and steel, Japan USD 36.04 billion, South Korea USD 32.47 billion, Indonesia USD 28.42 billion and India USD 18.40 billion in 2022.

Moreover, the rapid expansion of e-commerce platforms and the ever-changing landscape of retail logistics are transforming the requirements and dynamics of the terminal tractor market. With consumers' increasing reliance on online shopping for their purchasing needs, there has been a corresponding surge in the volume of goods flowing through distribution centers, fulfillment centers, and last-mile delivery facilities. Terminal tractors are crucial in these operations as they adeptly maneuver trailers and containers, facilitating the rapid movement of goods from warehouses to delivery vehicles.

The COVID-19 pandemic had a negative impact on the terminal tractor market, leading to disruptions in global supply chains and changes in consumer behavior, resulting in a rise in e-commerce activity. Due to decreased shipping activity and operational constraints, port operations faced challenges, leading to terminal tractor deployment strategy adjustments.

Market Concentration & Characteristics

The global terminal tractor market is fragmented, characterized by the presence of numerous manufacturers offering a variety of products and solutions. While there are several well-established companies with significant market share, there's also a plethora of smaller players catering to niche markets or specific regional needs.

The growth stage is low, and the pace of the market growth is accelerating. The market is characterized by a high degree of innovation owing to the rapid technological advancements driven by the increasing demand for automation and autonomous driving systems, telematics and connectivity, and electric and alternative fuel technologies. In March 2023, Fernride, an autonomous trucking solutions developer, and Terberg, a terminal tractor manufacturer, collaborated to develop a CE-certified automated terminal tractor, combining teleoperated and autonomous driving capabilities for gradual autonomy. This collaboration accelerates the transition to autonomy in yard operations, enhancing productivity and safety.

Compliance with regulations is a vital aspect of the terminal tractor industry, with safety standards, emissions requirements, and technological advancements being significantly influenced by regulatory frameworks. Manufacturers are required to adhere to safety regulations, which has led to the integration of advanced features such as collision avoidance technology and improved visibility. Furthermore, rigorous emissions standards have resulted in the development of innovative engine technologies, prompting investments in cleaner alternatives such as electric or hybrid powertrains. Regulatory mandates also drive technological advancements like autonomous driving capabilities and telematics systems, which enhance operational efficiency and safety.

Drive Type Insights

The 4x2 segment dominated the market with a market share of 41.6% in 2023 and is expected to witness the fastest CAGR during the forecast period. Terminal operators are increasingly inclining towards terminal tractors that offer improved fuel efficiency and operational productivity. The 4x2 models have improved fuel economy compared to the heavier 6x4 models. The operational efficiency and cost-effectiveness of the 4x2 models, particularly in logistics operations that prioritize sustainability, are driving the growth of this segment.

The 4x4 segment is anticipated to grow at a substantial CAGR over the forecast period. Terminal operators operating in rough terrain or challenging environments require terminal tractors with superior traction and off-road capability. The 4x4 configuration offers enhanced traction on uneven surfaces, gravel, or unpaved roads, making it suitable for applications such as intermodal yards, construction sites, and industrial facilities, further driving the segment.

Propulsion Insights

The diesel segment captured the largest market share in 2023 due to the established infrastructure and the need for high power and torque. The diesel sector is benefiting from a well-established infrastructure for diesel fuel distribution and refueling facilities present at terminals, ports, and logistics hubs globally. Moreover, diesel engines offer high power and torque capabilities, rendering them highly suitable for heavy-duty applications in terminal operations. Terminal tractors propelled by diesel engines can efficiently tow and maneuver heavy loads, containers, and trailers within terminal facilities, which leads to optimal performance and productivity.

The electric segment is expected to grow at a significant CAGR through the forecast period. With mounting concerns over environmental sustainability and ever-stringent emissions regulations, electric terminal tractors provide a cleaner and greener alternative to conventional diesel-powered models. This compelling proposition of electric terminal tractors appeals to environmentally conscious terminal operators and other stakeholders. Companies are taking strategic initiatives to cater to this increasing demand; for instance, in August 2023, Kalmar, a division of Cargotec, acquired the product rights for Lonestar Specialty Vehicles' (LSV) electric terminal tractor line in the U.S. As part of this arrangement, immaterial assets were transferred, and LSV acted as Kalmar's contract manufacturing partner for the acquired product line.

Application Insights

The port terminal segment led the market in 2023 and is expected to witness substantial growth over the forecast period. The increasing adoption of containerization in maritime shipping is driving demand for terminal tractors in port terminals. Containers are a standardized and efficient means of transporting goods, and port terminals require specialized equipment, including terminal tractors, to handle these containers effectively. Terminal tractors are essential for moving containers within the terminal yard, positioning them for loading onto ships, or transferring them to storage areas, contributing to the efficient functioning of container terminals.

The distribution centers segment is expected to grow substantially during the forecast period. Safety and ergonomics are paramount considerations in distribution center operations to ensure employees' safe and productive working environment. Terminal tractors with advanced safety features, such as collision avoidance systems, ergonomic designs, and driver assistance technologies, help mitigate the risk of accidents and injuries during material handling activities. By prioritizing safety and ergonomics, distribution centers can improve employee morale, reduce downtime due to injuries, and enhance overall operational efficiency.

Tonnage Insights

The <50 ton segment dominated the market in 2023 and is expected to witness the fastest CAGR over the forecast period. Due to increasing urbanization and the growth of e-commerce, there is a rising demand for efficient last-mile delivery solutions. Terminal tractors with less than 50 tons capacity are ideal for navigating urban environments and delivering goods to their final destinations, such as retail stores, businesses, and residential areas. The need for agile and maneuverable vehicles in congested urban settings drives this segment's demand for smaller terminal tractors.

The 50-100 ton segment is anticipated to grow substantially through the forecast period. The development of industrial and manufacturing activities, including automotive, construction, and heavy machinery sectors, drives demand for terminal tractors in the segment. These industries require robust terminal tractors capable of handling heavy loads within manufacturing facilities, warehouses, and distribution centers, such as oversized machinery, equipment, and components. As industrial production scales up to meet growing demand, there is a corresponding need for reliable and powerful terminal tractors to support material handling operations.

Vehicle Type Insights

The manual segment held the largest share of the market in 2023. Terminal tractors that are operated manually are often more cost-effective than their automated or electric counterparts. This is attributed to its lower upfront cost and requires less investment in infrastructure, such as charging stations for electric tractors or automation technology for autonomous vehicles. Due to this cost-effectiveness, there is a growing demand for manual terminal tractors for companies with budget constraints or operating in environments where automation may not be feasible.

The automated segment is expected to witness a rapid CAGR over the forecast period owing to the rising need for labor savings and workforce optimization. Automated terminal tractors reduce the need for manual labor in material handling operations, resulting in labor savings and workforce optimization. Automating repetitive tasks such as trailer spotting, container movement, and yard shunting, automated terminal tractors minimize the reliance on human operators, freeing up personnel for higher-value tasks and reducing labor costs. This workforce optimization allows terminal operators to reallocate resources more effectively, improving operational efficiency and cost-effectiveness.

Regional Insights

North America dominated the market and accounted for a 33.6% share in 2023. Intermodal transportation is growing significantly in North America due to the region's extensive transportation. The growth is fueled by key trade corridors such as the Transcontinental Railroad and major port cities such as Los Angeles, New York, and Houston that play a crucial role in facilitating the movement of goods efficiently across different modes of transportation. This interconnected network enhances the efficiency and cost-effectiveness of transporting goods, leading to the growth of terminal tractors in the region. Additionally, advancements in technology and logistics management have further contributed to expanding intermodal transportation in North America.

U.S. Terminal Tractor Market Trends

The U.S. accounted for over 25% of the global market in 2023. The rapid expansion of e-commerce in the U.S. has increased demand for efficient logistics and distribution solutions. Terminal tractors play a critical role in streamlining operations within distribution centers and fulfillment facilities, facilitating the movement of trailers and containers to meet the growing demands of online retail.

Europe Terminal Tractor Market Trends

Europe terminal tractor market is identified as a lucrative region in the industry. Europe boasts a highly integrated and interconnected network of transportation modes, including road, rail, sea, and inland waterways. The region's strategic location and well-developed infrastructure facilitate the efficient movement of goods within Europe and beyond. Terminal tractors play a crucial role in intermodal terminals, ports, and logistics hubs, where they support the seamless transfer of cargo between different modes of transportation.

The terminal tractor market in Germany held a substantial share in the region. Germany is renowned for its technological innovation and engineering excellence, which are driving advancements in terminal tractor technology. German manufacturers are at the forefront of developing innovative terminal tractor solutions with automation, telematics, and connectivity to enhance operational efficiency, safety, and productivity. Terminal operators and logistics providers in Germany prioritize quality, reliability, and performance when selecting terminal tractor equipment, driving demand for high-quality German-engineered solutions.

The UK terminal tractor market is expected to grow at a significant rate. The UK has several major ports, including the Port of Felixstowe, the Port of Southampton, and the Port of London, which handle a significant portion of the country's maritime trade. These ports serve as vital gateways for imports and exports. Terminal tractors play a crucial role in port operations, container handling, and intermodal transportation, supporting the efficient movement of goods within port terminals and contributing to the competitiveness of the UK's maritime trade.

Asia Pacific Terminal Tractor Market Trends

The Asia Pacific region is anticipated to witness the fastest growth in the market. The region is experiencing rapid urbanization, with a significant portion of the global population residing in urban areas. This demographic shift has increased demand for infrastructure development projects, including constructing ports, logistics hubs, and transportation networks. In order to support these infrastructure developments, terminal tractors play a crucial role in facilitating the movement of goods within ports, warehouses, and distribution centers.

The terminal tractor market in China is substantial in the region and is expected to grow over the forecast period. The Chinese government invests heavily in infrastructure projects to support economic growth and development. Initiatives such as the Belt and Road Initiative (BRI) and the Yangtze River Economic Belt Development Plan allocate funding for transportation infrastructure projects, including ports, railways, and logistics centers. Terminal tractors play a vital role in supporting these infrastructure developments, facilitating the movement of goods within transportation hubs and logistics parks.

The India terminal tractor market is expected to witness significant regional growth over the forecast period. India increasingly prioritizes sustainable transport solutions to address environmental concerns, reduce emissions, and mitigate climate change. The Indian government has implemented initiatives such as the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme to promote the adoption of electric vehicles, including electric terminal tractors. India's terminal operators and logistics providers invest in eco-friendly terminal tractor solutions to comply with regulations, minimize environmental impact, and achieve sustainability goals.

Middle East & Africa Terminal Tractor Market Trends

The Middle East & Africa (MEA) region is expected to grow substantially in the forecast period. The MEA region is witnessing significant growth in logistics and trade hubs, driven by factors such as strategic location, expanding trade networks, and government investments in infrastructure. Countries such as the United Arab Emirates (UAE), Saudi Arabia, and Egypt serve as key logistics and trade hubs, connecting markets in Europe, Asia, and Africa, further driving the market.

Key Terminal Tractor Company Insights

Some of the key players operating in the market include Kalmar, Konecranes, Terberg Group, and Sany Group.

-

Kalmar, a part of Cargotec Corporation, is a provider of heavy-duty material handling equipment and services. The company offers a wide range of solutions, including terminal tractors, to facilitate efficient cargo handling in various industries, such as ports, terminals, and distribution centers. Their terminal tractor offerings include Kalmar TX Electric, T2i, Ottawa T2, TR618i, and TT618i.

-

Konecranes is a global developer of lifting equipment and services, providing a wide range of solutions for various industries, such as manufacturing, ports, and terminals. The company offers a diverse portfolio of products that include cranes, lift trucks, and automation technologies. Konecranes is known for its innovative approach to material handling solutions and its commitment to safety and sustainability. It offers YF 230, YL 230, and RL 230 models of terminal tractors.

Key Terminal Tractor Companies:

The following are the leading companies in the terminal tractor market. These companies collectively hold the largest market share and dictate industry trends.

- Kalmar

- Konecranes

- Terberg Group

- Sany Group

- Hyster-Yale Materials Handling

- CVS Ferrari

- MAFI Transport-System

- TICO Tractors

- Mol CY

- Capacity Truck

- Outrider Technologies, Inc.

- Fernride

Recent Developments

-

In January 2023, Kalmar, a division of Cargotec, partnered with Ricardo and Toyota Tsusho America to develop fuel cell technology for Ottawa terminal tractors. This move promises extended operational uptime and reduces reliance on electrical grid infrastructure, offering advantages over battery-powered solutions.

-

In January 2023, Outrider Technologies Inc., a startup developing autonomous yard trucks, secured USD 73 million in Series C funding led by FM Capital. Based in Golden, Colorado, Outrider's electric yard trucks autonomously tow trailers from parking areas to loading docks using onboard navigation software and robotic arms to connect brake and electric lines automatically. The company's cloud-based logistics platform, Mission Control, coordinates trailer movements.

-

In August 2022, Terberg Taylor Americas Group, LLC, a collaboration between Taylor Group of Companies and Royal Terberg Group, established a manufacturing facility in Mississippi with a USD 20 million investment. This venture aims to build, sell, and rent Terberg terminal tractors, with the first tractor expected to roll out by mid-2024. Leveraging the successful partnership between the two family-owned businesses, Terberg Taylor Americas Group will utilize scalable designs to meet production demands and customize various Terberg models according to customer specifications.

Terminal Tractor Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 782.0 million

Revenue forecast in 2030

USD 1.03 billion

Growth rate

CAGR of 4.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drive type, propulsion, application, tonnage, vehicle type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Kalmar; Konecranes; Terberg Group; Sany Group; Hyster-Yale Materials Handling; CVS Ferrari; MAFI Transport-System; TICO Tractors; Mol CY; Capacity Truck; Outrider Technologies, Inc.; Fernride

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Terminal Tractor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global terminal tractor market report based on drive type, propulsion, application, tonnage, vehicle type, and region:

-

Drive Type Outlook (Revenue, USD Million, 2017 - 2030)

-

4x2

-

4x4

-

Others (6x4 and 8x4)

-

-

Propulsion Outlook (Revenue, USD Million, 2017 - 2030)

-

Diesel

-

Electric

-

Others (Hybrid/CNG)

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Port Terminal

-

Distribution Centers

-

Warehouse

-

Others (Manufacturing and Utilities)

-

-

Tonnage Outlook (Revenue, USD Million, 2017 - 2030)

-

<50 Ton

-

50-100 Ton

-

>50 Ton

-

-

Vehicle Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Manual

-

Automated

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global terminal tractor market size was estimated at USD 752.2 million in 2023 and is expected to reach USD 782.0 million in 2024

b. The global terminal tractor market is expected to grow at a compound annual growth rate of 4.7% from 2024 to 2030, reaching USD 1.03 billion by 2030

b. North America dominated the market, with a revenue share of 33.6% in 2023. This dominance is attributed to advancements in technology and logistics management, which have contributed to expanding intermodal transportation in North America.

b. Some key players operating in the terminal tractor market include Kalmar; Konecranes; Terberg Group; Sany Group; Hyster-Yale Materials Handling; CVS Ferrari; MAFI Transport-System; TICO Tractors; Mol CY; Capacity Truck; Outrider Technologies, Inc.; Fernride

b. Factors such as the rising demand for efficient cargo handling and the expansion of e-commerce and retail logistics.are driving the growth of the terminal tractor market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.