- Home

- »

- Catalysts & Enzymes

- »

-

Textile Enzymes Market Size, Share & Trends Report, 2030GVR Report cover

![Textile Enzymes Market Size, Share & Trends Report]()

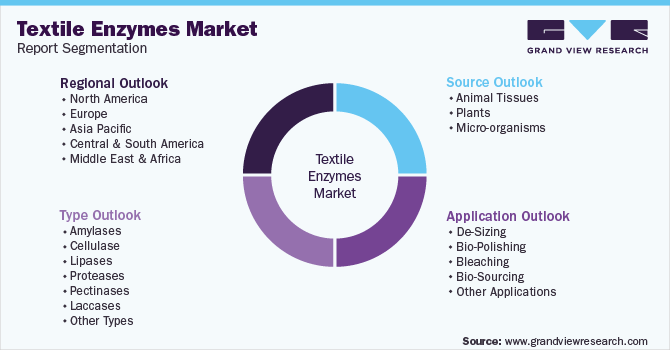

Textile Enzymes Market (2022 - 2030) Size, Share & Trends Analysis Report By Source (Animal Tissues, Micro-organisms, Plants), By Type (Amylases, Cellulase), By Application (De-sizing), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-997-8

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global textile enzymes market was valued at USD 438.2 million in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 5.3% from 2022 to 2030. This is attributable to the growing utilization of textile enzymes in the bleaching of textiles and their other applications such as de-sizing and bio-sourcing. The key enzymes used are cellulase, lipases, pectinases, and laccases among others. They help in degrading excess hydrogen peroxide, degrading lignin, bleaching textiles, and removing the starch from the textiles. Growing demand for lactases and cellulases for denim finishing and decolorization textile products is anticipated to trigger market growth during the forecast period. Furthermore, the demand for the product is anticipated to be driven by growing awareness of eco-friendly and non-toxic chemicals from textile manufacturers to reduce pollution from textile production.

Enzymes are an integral part of the textile industry because it is highly efficient and specific. Their use is very effective as they help to accelerate the reaction process, they can operate under milder temperatures, they are biodegradable and hence are used as a substitute for synthetic chemicals, and they are easy to control. Thus, due to the aforementioned factors, the market is anticipated to grow in the forecast period.

Increasing demand for apparel on account of the growing population in China, India, Brazil, and Mexico is expected to augment the product demand over the forecasted period. Moreover, properties, such as reduced chemical load and water consumption, non-toxic, lower energy consumption, eco-friendly, and improved fabric quality, are expected to augment the utilization of these products in the textile industry, which is likely to boost market growth in the coming years.

On the other hand, the COVID-19 pandemic influenced several end-use industries across the globe and created a supply-demand gap. The demand for enzymes in textiles was negatively impacted due to the supply-demand gap coupled with the shutdown of the textile industry worldwide which resulted in the halt of textile production and as a result lowered product consumption in the overall global market.

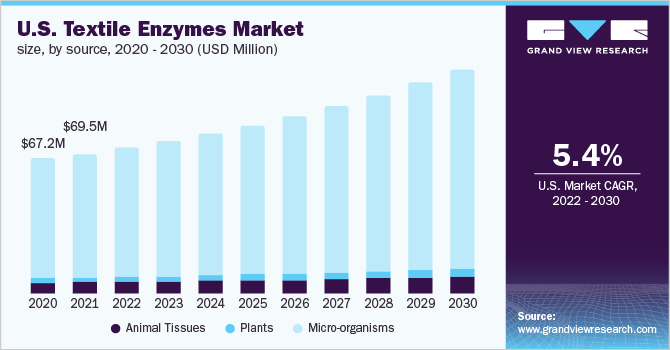

Source Insights

The micro-organisms segment dominated the market and accounted for the largest revenue share of 88.2% in 2021. This is attributable to the growing demand for enzymes due to their associated advantages like less toxicity, and more commercial production of enzymes, when compared to other sources.

Microorganisms-based enzymes are divided into three types, namely bacterial, fungal, and yeast. Fungi-based products include amylases, lipase, and proteases. The demand for fungi-based enzymes is rising on account of their increasing utilization in numerous end-use industries. They play a significant role in the preparation and production of several textile products.

Plant-based enzymes are sourced from plants, for instance, papain is derived from papaya. Prominent enzymes found in plants include lipase, cellulase, protease, and amylase. Amylase assists in the consequent absorption and breakdown of starch and carbohydrates. These are used to remove the starch and reduce the effectiveness of lignin, bleaching, and hydrogen peroxide from textiles. Furthermore, due to such factors, overall market growth is anticipated to boost in the coming years.

Type Insights

The cellulase segment dominated the market and accounted for the largest revenue share of more than 35% in 2021. This high share is attributed to its ability to accelerate abrasion during the finishing process of jeans. Moreover, cellulase is majorly used in the finishing of garments and textiles, which is further expected to drive the demand for textile enzymes during the forecast period.

The amylase type is expected to register growth during the forecast period owing to its specific action and higher efficiency without any damage or harmful effects on the fabric. In addition, the amylases are utilized in the preliminary finishing phase for de-sizing, and cellulases are utilized for softening of textiles, decreasing the piling of cotton textiles, and for bio-stoning.

Enzymes like protease and pectinases are also used in textile production and other processes. Initially, proteases were introduced into detergent products and their formulation to remove multiple organic protein-based stains from textile garment products. In addition, proteases among other enzymes are used to replace traditionally used aggressive chemicals in the textile production and finishing process. Such factors are expected to boost market growth in the near future.

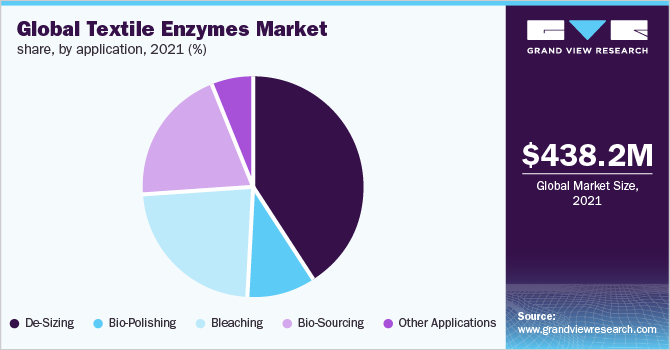

Application Insights

The de-sizing segment dominated the market and accounted for the largest revenue share of 40.58% in 2021. Its high share is attributable to the recent technological advancements made in the jeans desizing process and synthetic fabric finishing, which is in line with the latest trends among the younger population around the world. In addition, the increasing popularity, usage of soft fabric products, and lightweight denim are expected to have a positive impact on the market.

Bleaching is one of the key applications of textile enzymes. Enzymes like xylanase and laccases are used in the bleaching of indigo in denim fabrics and lignin-contained fibers. The main purpose of enzymatic bleaching on various textiles, especially cotton, is to decolorize natural pigments as well as to give a pure and clear white look. Traditionally the most common bleaching agent used was hydrogen peroxide. However, the need to replace hydrogen peroxide with enzymatic bleaching arises to obtain better quality products with lesser damage to fiber.

Scouring is the process of removing non-cellulosic particles from the cotton's surface. Enzymes like cellulase and pectinase are typically combined and utilized for bio-scouring. Moreover, the enzymatic sourcing process results in a very soft feel of fabrics as compared to the alkaline sourcing process which gives a relatively harsh feel to fabrics. Such factors are responsible for the growth of the market.

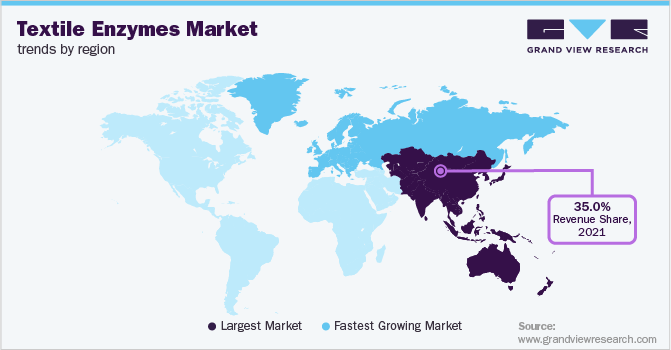

Regional Insights

Asia Pacific region dominated the textile enzymes market and accounted for a revenue share of over 35% in 2021. This is attributed to the presence of multiple enzyme manufacturing companies in countries like China, Singapore, and India. In addition, the growth in the overall textile market in the region is anticipated to propel the market growth over the forecast period.

The European textile enzymes market is fragmented in nature on the account of the dominance of a few players operating in the regional market. Manufacturers like Novozymes and AB Enzymes have their global headquarters in the region. In addition, countries like Germany, France, and Italy are some of the prominent producers and exporters of textile products. Such factors are driving the market growth in the region. On the other hand, regulations regarding the use of chemicals in the process of textile manufacturing are getting more stringent. This can act as a restraining factor to the overall market growth.

Moreover, the regional growth in the North American region is expected to grow at a moderate rate, except in the U.S., where the textile enzyme market is anticipated to witness notable growth on the account of higher demand for custom textile products from the younger population and the changing preference of clothing and apparel products.

Key Companies & Market Share Insights

The competition in the global textile enzymes market is highly dependent on the quality of the product, the number of manufacturers and distributors, and their geographical locations. These manufacturers are engaged in continuous R&D activities so as to develop various product ranges of high quality.

Multiple manufacturers are constantly aiming on enhancing their product portfolios, by the launch of various new products For instance, in February 2021, Kemin Auxiliaries Garmon, a subsidiary of Kemin Industries, announced the launch of its new product kemzymes, which is a relatively new enzyme brand, especially for garment washing purposes. Some of the prominent players in the textile enzymes market include:

-

Novozymes

-

BESTZYME BIO-ENGINEERING CO., LTD.

-

AB Enzymes

-

BASF SE

-

DENYKEM

-

DSM

-

Kemin Industries, Inc.

-

Advanced Enzyme Technologies

-

Ultreze

-

EPYGEN LABS LLC.

-

Sunsong Industry Group Co., Ltd.

-

Noor Enzymes

-

Antozyme Biotech Pvt. Ltd.

-

Nature BioScience Pvt. L.T.D.

-

Tex Biosciences (P) Ltd.

-

Infinita Biotech Private Limited

Textile Enzymes Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 456.5 million

Revenue forecast in 2030

USD 694.9 million

Growth rate

CAGR of 5.3% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Denmark; The Netherlands; China; India; Japan; South Korea; Singapore; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Novozymes; BESTZYME BIO-ENGINEERING CO., LTD.; AB Enzymes; BASF SE; DENYKEM; DSM; Kemin Industries, Inc.; Advanced Enzyme Technologies; Ultreze; EPYGEN LABS LLC.; Sunsong Industry Group Co., Ltd.; Noor Enzymes; Antozyme Biotech Pvt. Ltd.; Nature BioScience Pvt. L.T.D.; Tex Biosciences (P) Ltd.; Infinita Biotech Private Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Textile Enzymes Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global textile enzymes market report based on source, type, application, and region:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Animal Tissues

-

Plants

-

Micro-organisms

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Amylases

-

Cellulase

-

Lipases

-

Proteases

-

Pectinases

-

Laccases

-

Other Types

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

De-Sizing

-

Bio-Polishing

-

Bleaching

-

Bio-Sourcing

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

The Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Singapore

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global textile enzymes market size was estimated at USD 438.2 million in 2021 and is expected to reach USD 456.5 million in 2022.

b. The global textile enzymes market is expected to grow at a compound annual growth rate of 5.3% from 2022 to 2030 to reach USD 694.9 million by 2030.

b. Asia Pacific dominated the textile enzymes market with a share of 35.77% in 2021. This is attributable to the growth in overall textile production in the region, and the presence of multiple enzyme manufacturing companies in countries like China, Singapore, and India.

b. Some key players operating in the textile enzymes market include Novozymes, BESTZYME BIO-ENGINEERING CO., LTD., AB Enzymes, BASF SE, DENYKEM, DSM, Kemin Industries, Inc., Advanced Enzyme Technologies, Ultreze, EPYGEN LABS LLC., Sunsong Industry Group Co., Ltd., Noor Enzymes, Antozyme Biotech Pvt. Ltd., Nature BioScience Pvt. L.T.D., Tex Biosciences (P) Ltd., Infinita Biotech Private Limited.

b. Key factors that are driving the market growth include growing utilisation of textile enzymes in bleaching of textiles and their other applications such as de-sizing and bio-sourcing as well as growing awareness for eco-friendly and non-toxic chemicals from textile manufacturers in order to reduce pollution from textile production.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.