- Home

- »

- Healthcare IT

- »

-

Thailand Telehealth Market Size And Share, Report, 2030GVR Report cover

![Thailand Telehealth Market Size, Share & Trends Report]()

Thailand Telehealth Market Size, Share & Trends Analysis Report By Service Type, By Delivery Mode (Web-based, Cloud-based, On-premise), By Application, By Type, By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-196-4

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

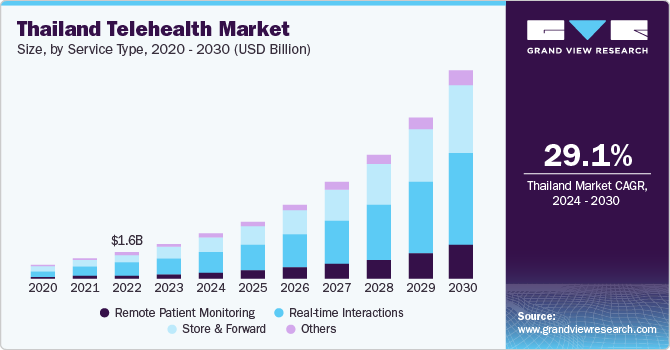

The Thailand telehealth market size was estimated at USD 1.60 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 29.1% from 2024 to 2030. The increasing adoption of digital healthcare and telehealth, the shortage of medical professionals, and the increasing demand for healthcare services contribute to market growth. With the widespread use of smartphones and the availability of advanced technology, innovators have begun to invest in delivering high-quality healthcare and comfort through mobile platforms. These platforms allow patients to track their fitness routines and obtain medical advice via phone or mobile applications. For instance, several apps such as Doctor On Call, Doctor Anywhere, and MorDee have been introduced to help patients track their medical prescriptions and consultations, book appointments, and store their healthcare information throughout the treatment.

As per a report published in Business Today in 2020, 70% of Thailand's population resides outside of Bangkok, and 70% of the country's medical specialists are concentrated in the capital city. This discrepancy has resulted in a significant healthcare access gap for the population outside the city. Thus, telemedicine has emerged as a promising solution to address this gap. Moreover, patients have shifted their preference toward telehealth due to movement restrictions and lockdowns during the COVID-19 pandemic. For instance, there was a significant increase in patients availing treatment services on the Doctor Raksa platform during the pandemic. There were over 10,000 medical visits per month during the pandemic.

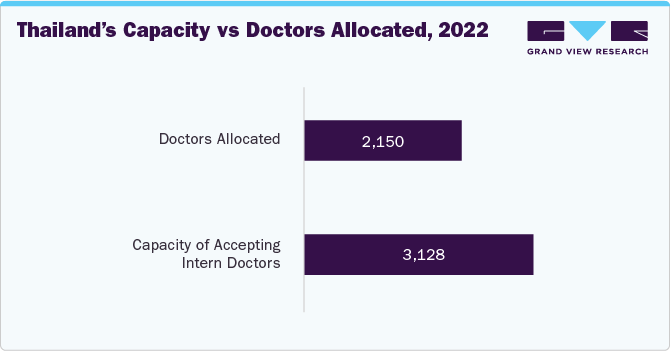

Furthermore, Thailand is facing a shortage of trained medical professionals. In 2023, Deputy Minister Dr. Taweesin Visanuyothin highlighted the issue of personnel shortage across all healthcare professions, including physicians, nurses, and radiologists. Within the public health system, there are 24,649 physicians i.e. 48% of the total physicians in Thailand. They provide care to approximately 75% to 80% of the population with a physician-to-population ratio of 1:2,000, a workload that is considered relatively heavy. Telehealth helps doctors reach more patients. It improves access to healthcare, enhances the use of time by doctors and patients, and helps decrease healthcare costs. People living in distant areas must travel for longer durations to gain access to treatment, but now, remote and rural areas can meet healthcare needs through telehealth.

Various initiatives by public and private bodies, such as awareness programs, partnerships, free consultations, and R&D funding, are expected to boost the telehealth market. In March 2019, the Thailand Public Health Ministry and the National Broadcasting and Telecommunications Commission (NBTC) introduced a telemedicine program in rural areas. Through this program, 32 hospitals were to be funded for setting up telemedicine equipment. This program mainly focuses on diabetes, high blood pressure, skin, and heart diseases. Similarly, in October 2019, the HIMSS Thailand National Digital Healthcare Workforce Development Initiative (WDI) was launched during the HIMSS AsiaPac 2019 conference in Bangkok, Thailand. The main objective of this initiative was to develop a 3-year work plan that will cater to the increasing demand for digital healthcare services by patients, aligning with the Thailand 4.0 digitization journey.

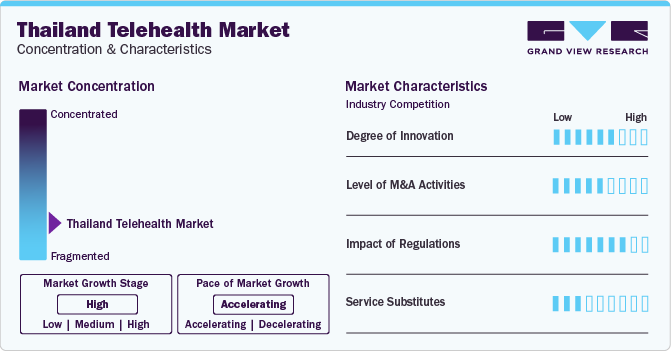

Market Concentration & Characteristics

The market growth stage is high and the pace is accelerating. The market for Thailand telehealth is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors such as advancements in artificial intelligence (AI), the availability of big data, and increasing internet penetration. The market players are undertaking various initiatives to advance and develop telehealth technologies.

The market is also characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This strategy enables companies to increase their capabilities, expand product portfolios, and improve competencies. For instance, in November 2021, Doctor Anywhere Pte Ltd.acquired Thailand’s largest telemedicine platform, Doctor Raksa. This acquisition helped the company become Thailand's leading tech-enabled omnichannel healthcare provider.

The Thailand telehealth industry is subject to high regulatory scrutiny level. Owing to data security concerns related to healthcare information, governments, healthcare organizations, and experts are hesitating to adopt digital solutions on a larger and national scale. Hence, to overcome these concerns, Thailand might impose strict regulations. These regulations could have a significant impact on the Thailand telehealth industry, affecting the development and adoption of telehealth technologies.

There are a limited number of direct product substitutes for telehealth. Many patients, doctors, and government bodies are increasingly adopting telehealth and telemedicine. Telehealth facilitates access to healthcare through specific applications and video consultations and enables communication between patients and doctors in remote locations, eliminating the need to visit hospitals or clinics.

Service Type Insights

The real-time patient interactions segment dominated with 45% of the market share in 2023. The ongoing technological advancements in telehealth are paving the way to provide services in rural areas for people seeking proper medical guidance for various health-related reasons. This is anticipated to impact the market growth positively. Furthermore, initiatives undertaken by the government to support internet usage for medical health, decrease pressure on healthcare facilities, and increase implementation of technologies, such as Artificial Intelligence (AI), big data, and 5G, have enabled the capability for real-time coordination. This is anticipated to drive the demand in this segment.

The remote patient monitoring segment is expected to grow at the fastest CAGR during the forecast period. The increasing internet usage, advancements in video conferencing systems, significant developments in 4G or 5G networks, and rising healthcare costs are expected to contribute to the segment's growth. Furthermore, the limited number of doctors in the region is expected to accelerate segment growth. According to an article published by Luma Health in December 2023, the ratio of doctors to people in Thailand is only 1:2065, much lower than WHO's recommended ratio of 1:439. These factors, as mentioned earlier, are predicted to boost the market.

Delivery Mode Insights

The web-based segment dominated the market with the largest revenue share in 2023. Web-based telehealth solutions are delivered to users through web servers using the internet protocol. Web-based solutions comprise four aspects: Internet connection, data administrator, web server, and software coding system. Utilizing the internet and web-based services provides access to the most remote areas using only one computer or monitoring device. Moreover, this data can be accessed and analyzed in real time, reducing decision-making time drastically. This mode also aggregates data at a central location, reducing the time required to transfer data from one system to another.

The cloud-based segment is expected to register the fastest CAGR during the forecast period. Cloud-based technology enables hosting applications, software & systems, and services remotely and can be accessed or used through the internet. The utilization of cloud-based technology has increased due to various security breaches in web-based and on-premises deployment. The old-generation systems require regular investments to upgrade the software and systems. Moreover, information sharing with clients and other stakeholders is a key concern with growing IT infrastructure needs and changing business requirements. Hence, several leading players are using cloud-based technology.

Application Insights

The diagnosis segment led the market in 2023. The growth is attributed to the government initiatives and various benefits offered by telehealth services. The government is encouraging and promoting the adoption of telehealth for diagnosis and treatment, especially for minor diseases. Furthermore, benefits offered by telehealth services, such as increased revenue, better work-life balance, less competition, and flexibility in scheduling, are driving its adoption among healthcare providers. Several doctors find their patients to be much more open to discussing health concerns through online/virtual settings compared to an office setting. These factors are anticipated to positively impact the market growth over the forecast period.

The prevention segment is projected to witness the highest CAGR over the forecast period. Healthcare systems in Thailand are under pressure due to the rising healthcare costs, increasing prevalence of chronic conditions, aging population, growing demand, and stagnating or shrinking healthcare workforces threatening its sustainability. The move to value-based healthcare to cater to the growing demand for better patient outcomes at a more sustainable cost is expected to drive the adoption of telehealth services. For instance, integrating radiology, telemedicine, and Artificial Intelligence (AI) can transform remote diagnostics and patient care. This integration aims to improve accessibility, accuracy, and efficiency in delivering healthcare services, particularly in remote or underserved areas.

Type Insights

The tele-hospital segment led the market in 2023. The growing health consciousness, rising demand for quick, easy, and affordable care, and rising geriatric population are some of the key factors contributing to the demand for telehealth solutions in Thailand. Moreover, key players continuously invest in telehealth due to substantial growth opportunities. In addition, several patients requiring health consultation prefer online care instead of in-person consultation to avoid unnecessary hospital visits.

The tele-home segment is expected to grow at the fastest CAGR over the forecast period. Tele-home facilitates access to healthcare through specific applications and video consultations and enables communication between patients and doctors in remote locations, eliminating the need for visits to hospitals and clinics. Video consultations are increasing as they enable patients to avail medical services from their medical professional over the phone. This helps avoid unnecessary doctor visits, booking appointments, and commuting, reducing unnecessary costs.

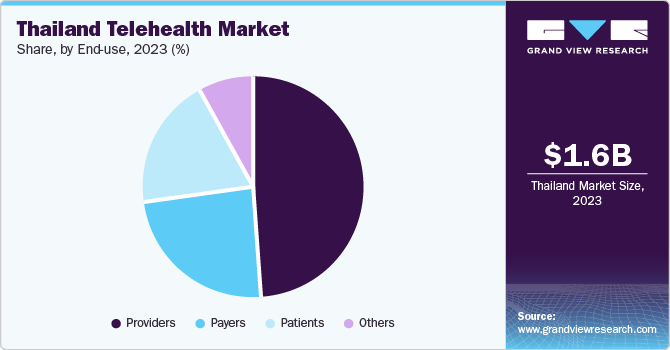

End-use Insights

The providers segment led the market in 2023. The growth is attributed to the government initiatives and various benefits offered by telehealth services. Providers comprise healthcare professionals, such as physicians & clinicians, hospitals, and clinics. The growing demand for reducing hospital admissions and improving hospital workflows drives the adoption of digital health technologies among healthcare providers. Furthermore, the rising number of partnerships and collaborations among various public and private healthcare organizations are expected to drive the adoption and accessibility of telehealth services, aiding segment growth. For instance, in September 2023, Doctor Anywhere (DA) partnered with Allianz Partners to provide comprehensive telehealth services to Allianz’s international health members in Thailand, Singapore, Malaysia, and the Philippines.

The patients segment is projected to witness the highest CAGR over the forecast period. The telecare platforms enable people to consult various doctors via audio, chat, and video calls. Telehealth has helped expand access to care during the pandemic that imposed severe restrictions on patients toward visiting their doctors. In addition, it has increased patient access to necessary care in places with shortages, such as behavioral soundness, to improve health outcomes and patient experience. Furthermore, the growing adoption of telehealth solutions among women due to physician shortage and rising demand for consultation and support in reproductive guidance, pre and post-natal care, and other services impact the market growth positively.

Key Thailand Telehealth Company Insights

Some of the key players operating in the market include HALODOC; MyDoc Pte. Ltd., Doctor Anywhere Pte Ltd.; and DoctorOnCall.

-

Halodoc is a health-tech platform that simplifies healthcare access by connecting patients with licensed insurance partners, doctors, pharmacies, and labs through its mobile application. In addition, its innovative technologies and patient-centric approach and services enable diverse solutions, such as medicine purchase and delivery, 24/7 doctor teleconsultation via voice, chat, or video, customer support, and lab services at home.

-

Doctor Anywhere Pte Ltd. is a technology-based health and wellness company that seamlessly integrates online and offline healthcare experiences and improves healthcare delivery. The company's digital platform bridges the gaps in the healthcare ecosystem through innovation and technology, enabling easy, effective health management via a mobile app.

-

HonestDocs, Ooca and MorDee are some of the emerging market participants.

-

Ooca is a mental health company that offers patients an online platform to talk to psychiatrists and psychologists via video calls on its web, iOS, or Android applications.

-

HonestDocs is a prominent healthcare and surgery marketplace operating in the emerging Southeast Asian region. The platform serves as a bridge between patients and clinics, hospitals, surgeons, and operating rooms while providing healthcare financing solutions to promote affordable care & surgeries.

Key Thailand Telehealth Companies:

The following are the leading companies in the Thailand telehealth market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these Thailand telehealth companies are analyzed to map the supply network.

- Halodoc

- MyDoc Pte. Ltd.

- Ooca

- Doctor Anywhere Pte Ltd.

- DoctorOnCall

- HonestDocs

- MorDee Application (True Digital Group Co., Ltd.)

Recent Developments

-

In September 2023, Doctor Anywhere Pte Ltd. partnered with Allianz Partners to provide comprehensive telehealth services to Allianz's international health members in Thailand, Singapore, Malaysia, and the Philippines.

-

In July 2023, Halodoc raised USD 100 million in a series D funding round. The investment would help the company provide quality healthcare to more people.

-

In February 2023, Ooca secured an undisclosed amount in its series A funding round from Bangkok Dusit Medical Services (BDMS), the largest private healthcare group in Thailand. The startup planned to work with BDMS to develop and promote initiatives aimed at improving access to mental health care for people.

Thailand Telehealth Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.05 billion

Revenue forecast in 2030

USD 9.51 billion

Growth rate

CAGR of 29.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, delivery mode, application, type, end-use

Country scope

Thailand

Key companies profiled

Halodoc; MyDoc Pte. Ltd.; Ooca; Doctor Anywhere Pte Ltd.; DoctorOnCall; HonestDocs; MorDee Application (True Digital Group Co., Ltd.)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Thailand Telehealth Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Thailand telehealth market report based on service type, delivery mode, application, type, and end-use:

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Remote Patient Monitoring

-

Real-time Interactions

-

Store and Forward

-

Others

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Web-based

-

Cloud-based

-

On-premises

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Prevention

-

Examination

-

Diagnosis

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Tele-hospital

-

Tele-home

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Providers

-

Payers

-

Patients

-

Others

-

Frequently Asked Questions About This Report

b. The Thailand telehealth market size was estimated at USD 1.60 billion in 2023 and is expected to reach USD 2.05 billion in 2024.

b. The Thailand telehealth market is expected to grow at a compound annual growth rate of 29.1% from 2024 to 2030 to reach USD 9.51 billion by 2030.

b. The providers segment led the market in 2023. The growth is attributed to the government initiatives and various benefits offered by telehealth services.

b. Some key players operating in the Thailand telehealth market include Halodoc; MyDoc Pte. Ltd.; Ooca; Doctor Anywhere Pte Ltd.; DoctorOnCall; HonestDocs; MorDee Application (True Digital Group Co., Ltd.)

b. Key factors that are driving the market growth include increasing adoption of digital healthcare and telehealth, the shortage of medical professionals, and the increasing demand for healthcare services.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."