- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Thermal Barrier Coatings Market Size & Share Report, 2030GVR Report cover

![Thermal Barrier Coatings Market Size, Share & Trends Report]()

Thermal Barrier Coatings Market Size, Share & Trends Analysis Report By Product (Ceramics, Metals), By Application (Aerospace, Automotive), By Technology (Plasma Barrier, HVOF), By Combination, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-128-3

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Report Overview

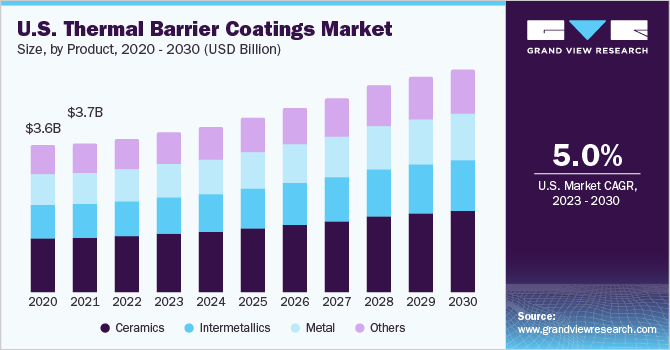

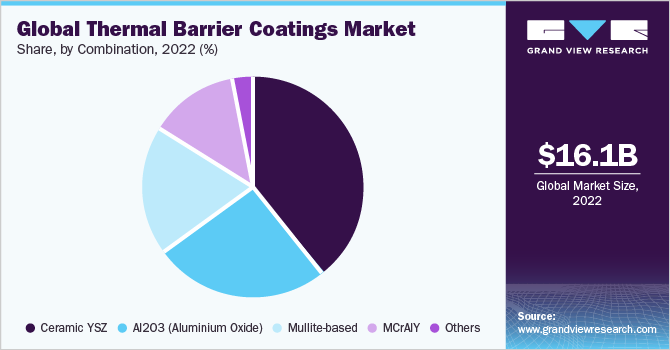

The global thermal barrier coatings market size was valued at USD 16.1 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.1% from 2023 to 2030. Rapidly increasing demand for Thermal Barrier Coatings (TBC) in various applications, such as automotive, energy, and aerospace, is expected to be the key market driver. A rapid upsurge in global automobile production on account of increasing demand from emerging economies is likely to propel the product demand during the forecast period. In addition, technological developments in the automotive sector resulted in a growing requirement for advanced coating technologies, thereby fueling market growth. Thermal barrier coatings are manufactured using epoxy resins, polymers, aluminates, and zirconia.

Industry participants are engaged in extensive R&D for the development of efficient application technologies and products, while also taking several measures to increase production to fulfill the growing demand. On the other hand, volatile prices of raw materials may hinder industry growth.

Thermal barrier coatings are witnessing high demand from the automotive industry. In automotive applications, TBC helps reduce heat loss from engine exhaust system components, including exhaust manifolds, turbocharger casings, exhaust headers, downpipes, and tailpipes. A gradual increase in Electric Vehicles (EVs) on roads is expected to positively propel the growth of the automotive industry. This, in turn, is further projected to create demand for TBCs during the forecast period.

However, the COVID-19 outbreak immensely affected the production of automobiles and disrupted the value chain of the automotive industry in 2020. A slowdown or halt in manufacturing activities and declining demand from consumers hampered the automotive industry in 2020. However, with the recommencing of industrial operations, the demand for TBCs in applications such as automotive, aerospace, power plants, and others is expected to positively influence market growth in the coming years.

Product Insights

The ceramics product segment led the market and accounted for 35.1% of the global revenue share in 2022. The most commonly used TBC material is yttria-stabilized zirconia, which is a form of ceramic. The key properties of this material include low thermal conductivity, high thermal expansion coefficient, and good erosion resistance. For high operating temperature applications, the common technologies used are physical vapor deposition, air plasma spray, and High-Velocity Oxyfuel (HVOF).

The ceramic product segment is expected to remain dominant by growing at the fastest CAGR of 5.5% during the forecast period, owing to the superior thermal resistance properties offered, which enable gas turbines to operate at high operating temperatures with higher efficiencies. The growing demand for ceramic coatings in the automotive and aerospace industries, primarily applied in the exhaust systems of automobiles, is expected to drive market growth over the forecast period.

Application Insights

The aerospace application segment led the market with a revenue share of around 30.0% in 2022. The increasing purchasing power of consumers has resulted in increased air passenger traffic over the past few years. As a result, there is a growing requirement for advanced and highly efficient aero-engine technologies to cater to the rapidly growing demand in the aviation industry.

The stationary power plants segment is expected to grow at the fastest CAGR of 5.6% over the forecast period as they are a major source of pollution, and there is growing demand for cleaner and more efficient power generation methods. Thermal barrier coatings can help to improve the efficiency of power plants by reducing heat loss, which can lead to lower emissions. Emerging economies such as China and India are experiencing rapid economic growth, which is leading to an increase in the demand for electricity. This is driving the construction of new stationary power plants, which is creating new opportunities for the thermal barrier coatings (TBC) market.

Technology Insights

The HVOF technology segment dominated the market with a revenue share of 35.8% in 2022. HVOF can achieve deposition rates that are up to 10 times faster than other thermal spray methods. This allows for faster coating application and reduces the overall cost of the coating process. HVOF can be used to apply a wide range of coating materials, including ceramics, metals, and alloys. This makes it a versatile technology that can be used for a variety of applications. This technology provides a variety of benefits including improved performance, improved efficiency, low costs, superior electrical properties, the ability of components to operate in higher/lower temperatures and within harsh chemical environments, and enhanced lifespan of components. The technology is used in the power, oil & gas, water, mining, engineering chemicals, petrochemicals, aerospace, paper, and manufacturing sectors.

The flame barrier technology segment is expected to grow at the fastest CAGR of 5.4% over the forecast period. Flame barrier coatings can provide up to 50% greater thermal insulation than other TBC technologies. This is because the flame barrier coating creates a protective layer of gas between the hot substrate and the cooler air, which helps to slow down the heat transfer process. Flame barrier coatings are more durable than other TBC technologies. This is because the flame barrier coating is less susceptible to cracking and spalling, which are two of the main causes of TBC failure.

Combination Insights

The ceramic yttria-stabilized zirconia (YSZ) combination segment led the market and accounted for 38.6% revenue share in 2022 and is expected to grow at the fastest CAGR of 5.5% over the forecast period. YSZ is a ceramic in which the crystal structure of zirconium oxide is made stable at room temperature by adding yttrium oxide. These oxides are commonly called zirconia and yttria. The most important application of this material is in TBCs for gas turbines. The rising demand for gas turbines from key end-use industries, such as power generation and aerospace, is expected to drive the demand for ceramic YSZ, thereby also driving the overall market.

The Al2O3 combination coating segment held a significant revenue share in 2022 and is anticipated to grow at a considerable CAGR over the forecast period. Al2O3 is a relatively inexpensive material, which makes it a cost-effective option for thermal barrier coatings. It has good thermal properties, making it an effective barrier against heat. It is also a relatively inert material, which means that it is not easily corroded or damaged by chemicals.

Mullite is a compound of alumina and silica, with the formula 3Al2O3-2SiO2. It has low density, good mechanical properties, high thermal stability, low thermal conductivity, and is corrosion and oxidation resistant. However, it gets crystallized, which leads to cracking and delamination. Therefore, this material is suitable as a zirconia alternative for applications such as diesel engines. The rapidly growing demand for advanced coating technologies in the automotive industry is expected to have a considerable impact on the growth of this segment over the forecast period.

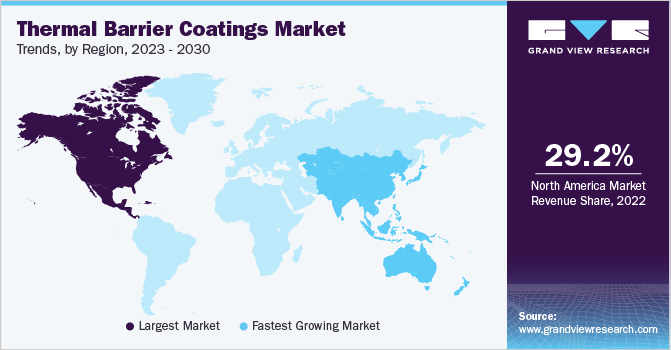

Regional Insights

North America dominated the global market and accounted for the largest revenue share of 29.2% in 2022. The U.S. dominated the North American regional market in 2022 and the trend is projected to continue over the forecast period. Growing product demand from various applications, such as stationary power plants, aerospace, automotive, and others, is anticipated to create lucrative opportunities for the growth of the regional market in the coming years.

Aerospace is one of the key markets for TBCs. The presence of developed economies, such as the U.S. and Canada, has led to the large-scale development of the aviation industry in the region. The availability of highly skilled labor, high disposable incomes, and the strong economy of countries in the region are the key reasons for a rise in air traffic in North America. Thus, the growth of the aerospace industry is anticipated to potentially drive the market in North America during the forecast period.

Asia Pacific is expected to grow at the fastest CAGR of 5.7% over the forecast period as the region is a major hub for the automotive and aerospace industries, which are two of the largest end-user markets for thermal barrier coatings. The increasing demand for fuel-efficient and lightweight vehicles, as well as the growing need for improved safety and performance in aircraft, is driving the demand for thermal barrier coatings in these industries.

Key Companies & Market Share Insights

The global market is highly fragmented with the presence of various key players. The competition in the market is primarily driven by the application scope and use of thermal spray coatings in various industries. Strategic partnerships, acquisitions, and geographical expansions are among the prominent strategies adopted by the players operating in the market. For instance, in November 2019, Praxair Surface Technologies and GE Aviation opened their second facility in Singapore for their PG Technologies business. The facility contains the latest Electron Beam Physical Vapor Deposition (EBPVD) coater as well as other coating processes of PG Technologies. Some of the prominent players in the global thermal barrier coatings market include:

-

Praxair Surface Technologies

-

Metallisation Ltd.

-

Flame Spray Coating Co.

-

Precision Coating, Inc.

-

MesoCoat Inc.

-

Cincinnati Thermal Spray, Inc.

-

ASB Industries Inc.

-

Thermion

-

A&A Company

-

TWI Ltd.

Recent Developments

-

In May 2023, Cabot Corporation introduced their new ENTERA aerogel particle range. ENTERA aerogel particles are a thermal insulation additive that enables the construction of ultra-thin thermal barriers for lithium-ion batteries used in electric vehicles (EVs). Cabot launched three ENTERA aerogel solutions in this portfolio, which formulators can combine into a variety of thermal barrier forms such as pads, sheets, films, blankets, foams, and coatings.

-

In January 2021, ASB Industries & Hannecard announced a joint venture to operate under the name Hannecard Roller Coatings, Inc. Hannecard will be able to spread ASB's well-known technology throughout Asia, Europe, and Africa. In addition, ASB will expand Hannecard’s present offerings to include a wide range of rubber, polyurethane & thermal spray coatings for rollers in a variety of sectors and is likely to benefit from Hannecard’s global knowledge and R&D.

-

In March 2020, a U.S.–based company, Praxair Surface Technologies (PST), and Siemens, a German company, agreed on a new contract that covered a variety of coating services across all products of Siemens. Aerospace and industrial gas turbine components such as casings, vanes, blades and discs will be coated by PST’s slurry, aluminizing, platinum aluminizing, & thermal spray processes.

Thermal Barrier Coatings Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 16.6 billion

Revenue forecast in 2030

USD 23.6 billion

Growth rate

CAGR of 5.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, technology, combination, region

Regional scope

North America; Europe; Asia Pacific; Central & South America (CSA); MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Belgium; Russia; China; Japan; India; South Korea; SouthEast Asia; Argentina; Brazil; South Africa; Saudi Arabia

Key companies profiled

Praxair Surface Technologies; Metallisation Ltd.; Flame Spray Coating Co.; Precision Coating, Inc.; MesoCoat, Inc.; Cincinnati Thermal Spray, Inc.; ASB Industries, Inc.; Thermion; A&A Company; TWI Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Thermal Barrier Coatings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global thermal barrier coatings market report on the basis of product, application, technology, combination, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Metals

-

Ceramics

-

Intermetallics

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Stationary Power Plants

-

Aerospace

-

Automotive

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Cold Barrier

-

Flame Barrier

-

Plasma Barrier

-

High-Velocity Oxy-Fuel (HVOL)

-

Electric Arc Barrier

-

-

Combination Outlook (Revenue, USD Million, 2018 - 2030)

-

Ceramic YSZ

-

Al2O3 (Aluminium oxide)

-

MCrAlY

-

Mullite-based

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Belgium

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

SouthEast Asia

-

-

Central & South America

-

Argentina

-

Brazil

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global thermal barrier coatings market size was valued at at USD 16.1 billion in 2022 and is expected to reach USD 16.6 billion in 2030.

b. The global thermal barrier coatings market is expected to grow at a compound annual growth rate of 5.1% from 2023 to 2030 to reach USD 23.6 billion by 2030.

b. North America dominated the thermal barrier coatings market with a share of 29% in 2022. This is attributable to rising adoption of air plasma and high-velocity oxygen fuel (HVOF) technologies in automotive and aerospace application.

b. Some key players operating in the thermal barrier coatings market include Air Products & Chemicals, Inc.; The Welding Institute (TWI) Ltd.; H.C. Starck, Inc.; and ASB Industries Inc.

b. Key factors that are driving the thermal barrier coatings market growth include thermal barrier coatings application for engine components, such as pistons, cylinder heads, and related components in automobiles, and its application for gas turbines in stationary power plants.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."