- Home

- »

- Plastics, Polymers & Resins

- »

-

Thermoformed Plastics For Printing Market Report, 2030GVR Report cover

![Thermoformed Plastics For Printing Market Size, Share & Trends Report]()

Thermoformed Plastics For Printing Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Polycarbonate), By Process (Plug Assist Forming), By Application (Display & Outdoor Signages), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-223-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

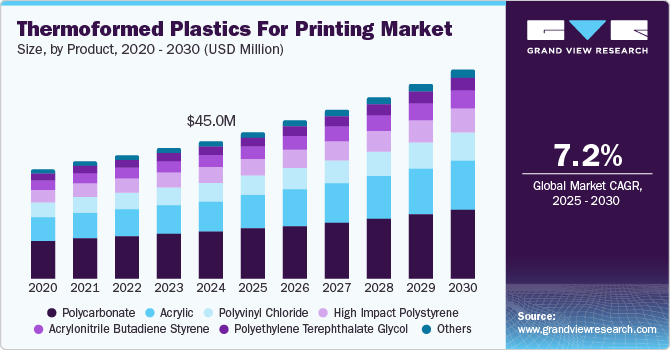

The global thermoformed plastics for printing market size was valued at USD 45.02 million in 2024 and is expected to expand at a CAGR of 7.2% from 2025 to 2030. This growth can be attributed to the expansion of the advertising industry, as companies increasingly invest in promotional materials such as printed signboards. In addition, the growing gaming industry has led to increased demand for visually appealing gaming panels. Furthermore, the rising consumer preference for online channels and advancements in print technology further enhance market opportunities.

Thermoformed plastics for printing refer to a category of materials created through the thermoforming process, where plastic sheets are heated and molded into specific shapes, allowing for detailed printing applications. A significant factor propelling the growth of this market is the increasing demand for lightweight and durable packaging solutions. These plastics are particularly favored for their strength and printability, making them suitable for diverse applications such as food, beverages, pharmaceuticals, and consumer goods.

The rising adoption of digital printing technologies provides advantages over traditional printing techniques, including greater flexibility, reduced lead times, and cost efficiency. In addition, there is a notable shift towards sustainable packaging solutions as consumers become more environmentally conscious. The demand for eco-friendly options is prompting companies to seek materials that offer recyclability and reusability. Thermoformed plastics align well with these sustainability goals due to their potential for recycling and biodegradability.

Furthermore, the thermoformed plastics for printing market is expected to expand due to technological innovations and changing consumer preferences. This combination of lightweight design, advanced printing capabilities, and a focus on sustainability positions thermoformed plastics as a key player in the future of packaging and promotional products.

Product Insights

The polycarbonate segment held the dominant position in the market, with the largest revenue share of 34.3% in 2024, primarily driven by its exceptional properties. Polycarbonates are highly durable and strong, making them suitable for various applications. In addition, their lightweight nature and ease of shaping enhance their usability in printing processes. Furthermore, certain grades of polycarbonate are optically transparent, allowing for high-quality printing outcomes.

The acrylic segment is expected to grow at a CAGR of 8.4% over the forecast period, owing to its excellent clarity and aesthetic appeal. Acrylic thermoformed plastics are favored for their ability to mimic glass while being significantly lighter and more impact-resistant. This makes them ideal for applications requiring visual transparency, such as display cases and signage. Furthermore, acrylic's resistance to UV light ensures that printed graphics remain vibrant over time, which is crucial for outdoor advertising. Moreover, as businesses increasingly seek visually striking materials, the demand for acrylic in the thermoformed plastics for printing market continues to rise.

Process Insights

The thick gauge thermoforming segment led the market and accounted for the largest revenue share of 49.2% in 2024. This growth can be attributed to its ability to produce large, robust parts with high durability and structural integrity. In addition, this process allows for the use of thicker plastic sheets, enabling manufacturers to create products that can withstand harsh environments and heavy-duty applications. Furthermore, thick gauge thermoforming supports intricate designs and customization, making it suitable for a wide range of industries, including automotive and medical.

Plug-assist forming is expected to grow at a CAGR of 7.1% from 2025 to 2030, owing to its enhanced precision and efficiency in creating complex shapes. This method utilizes a plug to assist in forming the plastic sheet, allowing for better control over material distribution and wall thickness. In addition, plug-assist forming is particularly advantageous for producing parts with deep draws and detailed features. Moreover, achieving high-quality finishes and reducing material waste further contribute to its appeal in the thermoformed plastics market.

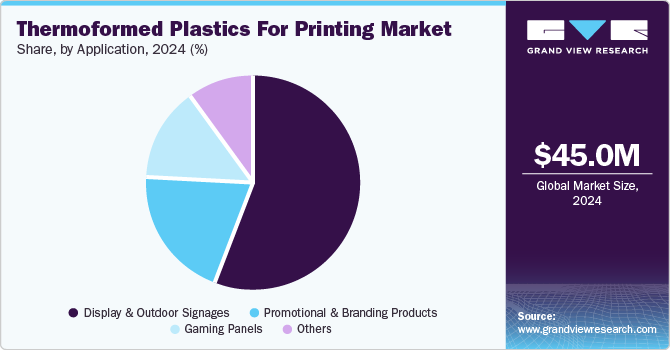

Application Insights

The display and outdoor signage segment dominated the market and accounted for the largest revenue share of 56.1% in 2024, primarily driven by the increasing demand for effective advertising solutions. In addition, businesses are investing significantly in visually appealing signage to attract customers, leading to a rise in the use of thermoformed plastics for creating durable and weather-resistant displays. Furthermore, these materials offer excellent print quality and versatility, making them ideal for various outdoor applications, including promotional boards and directional signs.

Promotional and branding products are expected to grow at a CAGR of 7.1% over the forecast period, owing to the rising need for customized merchandise that enhances brand visibility. In addition, thermoformed plastics are lightweight and can be easily molded into unique shapes, making them perfect for creating promotional items such as keychains, trophies, and packaging. Furthermore, as companies increasingly focus on innovative marketing strategies, the demand for eye-catching promotional products made from thermoformed plastics continues to grow, supporting brand recognition and customer engagement.

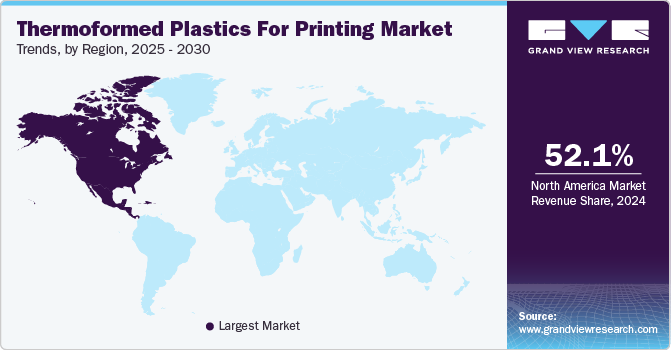

Regional Insights

The North America thermoformed plastics for printing market dominated the global market and accounted for the largest revenue share of 52.1% in 2024. This growth can be attributed to the region's robust advertising industry. In addition, companies are increasingly investing in effective marketing strategies, leading to a higher demand for display and outdoor signage made from thermoformed plastics. Furthermore, advancements in printing technology enhance the quality and versatility of these materials, making them ideal for promotional products. Moreover, the thriving healthcare sector also contributes to market expansion, as thermoformed plastics are widely used for medical packaging and devices.

The thermoformed plastics for printing market in the U.S. led the North American market and accounted for the largest revenue share in 2024, driven by various industries, including food packaging and consumer goods. In addition, the increasing focus on sustainable packaging solutions is prompting manufacturers to adopt recyclable materials, which aligns with consumer preferences. Furthermore, the rapid growth of e-commerce and online retailing further fuels the need for innovative packaging solutions that ensure product safety during transit.

Asia Pacific Thermoformed Plastics for Printing Market Trends

Asia Pacific thermoformed plastics for printing market is expected to grow at a CAGR of 7.9% over the forecast period, owing to rapid industrialization, and urbanization. In addition, the expanding population and rising disposable incomes contribute to increased demand for consumer goods and packaging solutions. Furthermore, the region's growing focus on sustainable practices encourages manufacturers to explore eco-friendly thermoformed plastic options. As various sectors, including automotive and electronics, continue to expand, the market for thermoformed plastics is expected to thrive.

The thermoformed plastics for printing market in China dominated the Asia Pacific market and accounted for the largest revenue share in 2024, driven by its status as a manufacturing powerhouse. The country's booming automotive and electronics industries drive significant demand for durable and lightweight packaging solutions. Furthermore, government initiatives promoting environmental sustainability are pushing manufacturers towards adopting recyclable thermoformed plastics. Moreover, as urbanization progresses and consumer preferences evolve, China's market for thermoformed plastics is poised for substantial growth.

Europe Thermoformed Plastics for Printing Market Trends

Europe thermoformed plastics for printing market is expected to grow significantly over the forecast period, primarily driven by experiencing growth fueled by increasing environmental awareness among consumers and businesses alike. In addition, the demand for sustainable packaging solutions is leading manufacturers to invest in eco-friendly materials, including recyclable thermoformed plastics. Furthermore, advancements in printing technologies are enhancing product customization capabilities, making these materials more appealing for promotional applications. Moreover, the thriving retail sector further supports market expansion as companies seek innovative ways to engage customers through effective branding.

The growth of the thermoformed plastics for printing market in Germany is expected to be driven by its strong manufacturing base and emphasis on quality. In addition, the country's focus on sustainability drives demand for recyclable packaging solutions across various industries, including food and pharmaceuticals. Furthermore, Germany's advanced technological landscape fosters innovation in printing techniques, enabling high-quality outputs on thermoformed plastics. Moreover, as businesses prioritize brand differentiation and environmental responsibility, the market for thermoformed plastics in Germany continues to grow.

Key Thermoformed Plastics For Printing Company Insights

Key companies in the global thermoformed plastics for printing industry include Omega Plastics LLC, Productive Plastics, Inc., Sulapac Oy, and others. These players are adopting various strategies to enhance their competitive edge. New product launches are a significant focus, with companies developing innovative thermoformed solutions tailored to meet evolving customer demands. In addition, strategic partnerships and collaborations with suppliers and technology providers are also common, facilitating access to advanced materials and production techniques. Furthermore, companies are investing in research and development to improve sustainability practices and expand their product offerings, ensuring alignment with market trends and consumer preferences.

-

Universal Plastics Group, Inc. specializes in custom thermoforming, injection molding, and blow molding, focusing on manufacturing large, complex plastic parts. The company operates in various segments, including medical device housings, aerospace components, and consumer products. Their expertise in thermoformed plastics allows them to produce aesthetically appealing and functional items, such as enclosures and trays, catering to diverse industries.

-

Aero-Plastics Inc. provides custom thermoforming solutions for various applications. The company operates within the packaging and display segments, manufacturing products such as protective packaging, trays, and promotional displays. Aero-Plastics focuses on delivering high-quality thermoformed products that meet the specific needs of its clients across industries such as food service, retail, and medical.

Key Thermoformed Plastics For Printing Companies:

The following are the leading companies in the thermoformed plastics for printing market. These companies collectively hold the largest market share and dictate industry trends:

- Omega Plastics LLC

- Productive Plastics, Inc.

- Universal Plastics Group, Inc

- Aero-Plastics Inc.

- Sulapac Oy

- Sriyug Print Production

- MANGALAM PLASTIC INDUSTRIES

- HIP LIK

- Zhejiang Sayeah Machinery Co.,ltd.

- Desu Technology (Shanghai) Co., Ltd.

Thermoformed Plastics For Printing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 47.91 million

Revenue forecast in 2030

USD 67.77 million

Growth Rate

CAGR of 7.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Tons, Revenue in USD Thousand, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, process, application, region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, China, India, Japan, Germany, UK, France, Italy

Key companies profiled

Omega Plastics LLC; Productive Plastics, Inc.; Universal Plastics Group, Inc.; Aero-Plastics Inc.; Sulapac Oy; Sriyug Print Production; MANGALAM PLASTIC INDUSTRIES; HIP LIK; Zhejiang Sayeah Machinery Co.,ltd.; Desu Technology (Shanghai) Co., Ltd.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

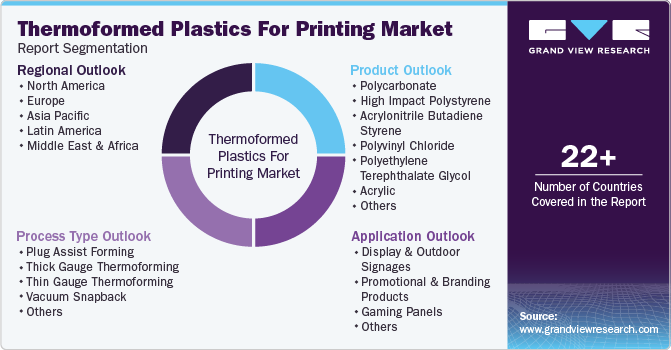

Global Thermoformed Plastics For Printing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global thermoformed plastics for printing market report based on product, process, application, and region.

-

Product Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Polycarbonate

-

High Impact Polystyrene (HIPS)

-

Acrylonitrile Butadiene Styrene

-

Polyvinyl Chloride (PVC)

-

Polyethylene Terephthalate Glycol (PETG)

-

Acrylic

-

Others

-

-

Process Type Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Plug Assist Forming

-

Thick Gauge Thermoforming

-

Thin Gauge Thermoforming

-

Vacuum Snapback

-

Others

-

-

Application Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Display & Outdoor Signages

-

Promotional & Branding Products

-

Gaming Panels

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Middle East and Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.