- Home

- »

- Consumer F&B

- »

-

Tonic Water Market Size, Share, Global Industry Report, 2027GVR Report cover

![Tonic Water Market Size, Share & Trends Report]()

Tonic Water Market (2020 - 2027) Size, Share & Trends Analysis Report By Product (Regular, Diet), By Distribution Channel (Hypermarkets, Supermarkets & Convenience Stores, On-trade, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-900-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Tonic Water Market Summary

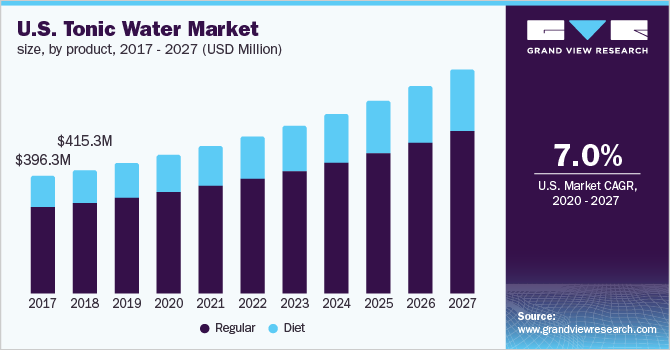

The global tonic water market size was valued at USD 1.72 billion in 2019 and is projected to reach USD 3.0 billion by 2027, growing at a CAGR of 7.2% from 2020 to 2027. Increasing consumption of alcoholic beverages such as gin, vodka, and other various types of cocktails is the key driving factor for the market.

Key Market Trends & Insights

- North America was the largest market for tonic water and accounted for a share of more than 30.0% in 2019.

- Asia Pacific is anticipated to be the fastest-growing region with a CAGR of 7.7% from 2020 to 2027.

- By product, the regular tonic water was the largest product segment with a market share of more than 75.0% in 2019.

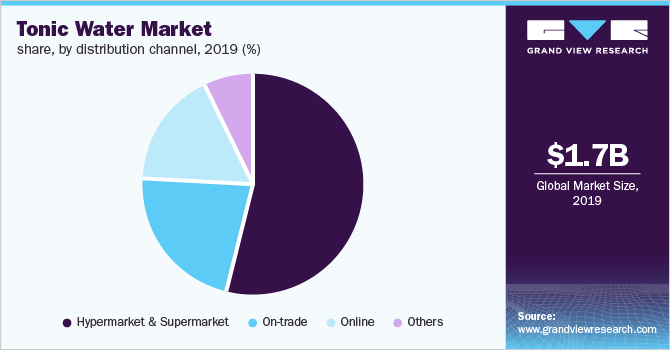

- By distribution channel, the hypermarkets, supermarkets, and convenience stores was the largest segment with a share of more than 54.0% in 2019.

Market Size & Forecast

- 2019 Market Size: USD 1.72 Billion

- 2027 Projected Market Size: USD 3.0 Billion

- CAGR (2020-2027): 7.2%

- North America: Largest market in 2019

- Asia Pacific: Fastest growing market

Moreover, tonic water contains a good amount of quinine, which helps reduce the chances of malaria and other leg related medical issues. These medicinal properties are expected to fuel market growth over the forecast period. Tonic water is one of the widely consumed soft drinks with spirits across the globe. Many drinks have a strong base of tonic water, which provides a bitter edge to cocktails. Gin and Tonic have become one of the famous mixes consumed by the drinkers around the globe and is generally known as ‘G and T’primarily in countries including the U.S., Canada, the U.K., Ireland, Australia, and New Zealand. Generally, most of the recipes contain 1:1 to 1:3 tonic water to gin ratio. These trends are anticipated to remain the favorable factors for the industry over the forecast period.

Tonic water is also widely consumed as a healthy drink across the globe owing to the presence of quinine substance, which is a medication used to treat malaria and babesiosis. This tonic water contains 83 mg of quinine per liter with excellent medicinal effects. Manufacturers in the market offering a wide range of products with added sugars and flavors. These medicinal advantages associated with tonic water are also propelling the product’s demand on a global level.

It is primarily consumed with gin and the use of gin in various countries has been increasing significantly over the past few years. Moreover, in countries like the U.K. and the U.S., 19th October is celebrated as International Gin and Tonic day since 2010. According to the WorldAtlas, Spain, Belgium, Netherlands, the U.K., and Ireland are the largest gin consuming countries in the world followed by Canada and the U.S. These countries are boosting the demand for tonic water owing to increasing consumption of gin.

Tonic Water Market Trends

The consumption of cocktail drinks is gradually becoming more popular than spirit drinks due to the rising consumers’ preference for drinks with new tastes and flavors. Millennials and young working professionals are preferring taste over the alcohol content of the drinks. Consumers in the region have become more health-conscious and have started to switch to low alcohol cocktails.

Cocktails offer a wide range of choices to consumers, in terms of both, innovative products and healthier options such as cocktails infused with quinine, ginger, or lavender that are beneficial for one’s health. As a result, bartenders are focusing on innovating new cocktails using healthy ingredients. This will create growth opportunities for tonic water producers globally.

Millennials and younger generations are the major consumers of gin & tonic water. These consumers are looking for premium products with innovative flavors, package designs, and brands. Consumers across the globe have been switching to premium brands of cocktails and their ingredients with high product quality.

Young consumers have become more sophisticated with their choices and taste in alcohol. Rather than spending money on regular alcoholic drinks such as gin & tonic, consumers have started spending on drinks that provide an enjoyable experience, which is driving the market for tonic water.

The demand for non-alcoholic beverages is significantly rising owing to increasing health-consciousness among the consumers. Young people are shifting to plant-based beverages from alcoholic beverages. These beverages can also be consumed by anyone without any age restrictions. Additionally, due to the outbreak of COVID-19, consumers are seeking products that are fortified with vitamins and minerals, which claim to provide health benefits and boost immunity. Moreover, the demand for juices with botanical ingredients and energy drinks is also expected to restrain the growth of the tonic water market.

Product Insights

Regular tonic water was the largest product segment with a market share of more than 75.0% in 2019 and expected to maintain dominance over the forecast period. This is owing to a wide range of products available in the market. Moreover, the regular tonic water has added sugar and a wide range of flavors, which attracts the customers in the global market.

Diet tonic water is anticipated to be the fastest-growing product segment with a CAGR of 7.7% from 2020 to 2027. This is owing to the rising popularity of sugarless and low-calorie products among consumers across the globe. Consumers are increasingly adopting a healthy lifestyle, which is changing the food and beverages preference to low-sugar or sugar-free soft drinks. Diet tonic water contains artificial sweeteners, which offer sweet taste without sugar.

Distribution Channel Insights

Hypermarkets, supermarkets, and convenience stores was the largest segment with a share of more than 54.0% in 2019 and anticipated to maintain dominance over the forecast period. A large number of supermarket giants such as Walmart, Tesco, 7Eleven, Auchan, Sainsbury's, Apar, and Aldi have maximum customer penetration in North America and Europe. These deep-pocket companies offer a wide range of grocery products and have a large chain of stores for maximum customer engagement. Therefore, all the manufacturers offer full product portfolio in these hypermarkets, supermarkets, and convenience stores for maximum profit.

Online sale of tonic water is significantly increasing across the globe owing to the huge convenience associated with it. Moreover, all the hypermarkets, supermarkets, and convenience stores giants are entering e-commerce owing to increasing penetration of the internet and smartphones among consumers. In addition to this, these e-commerce shopping portals offer maximum customer engagement with increasing online shopping from people around the globe. However, on-trade sale of tonic water with gin and other spirits is offering decent opportunities to the tonic water market.

Regional Insights

North America was the largest market for tonic water and accounted for a share of more than 30.0% in 2019. The U.S. and Canada are the largest consumers of tonic water, which offers a huge opportunity for the market in North America. Moreover, these two countries are also large consumers of gin, which, in turn, increases the consumption of tonic water. Increasing the consumption of these spirits is fueling the demand for tonic water in the region.

Owing to the prevalence of binge drinking in the U.S., the demand for tonic water is expected to rise in the upcoming years. According to the 2019 National Survey on Drug Use and Health (NSDUH), nearly 25.8%of consumers aged 18 and older (29.7% men and 22.2% women) reported excessive alcohol consumption in 2019.

The growing trend for cocktails in Canada has contributed to the development of super-premium drinks since bartenders at pubs and bars have started blending premium tonic water in top-level spirit brands. Furthermore, socioeconomic factors, such as changing lifestyles in Canada and significant urbanization have a positive impact on the development and consumption of alcoholic drinks, and, consequently, on blenders such as tonic water.

Asia Pacific is anticipated to be the fastest-growing region with a CAGR of 7.7% from 2020 to 2027. The consumption of various types of spirits such as gin, whiskey, vodka, and rum has been gradually increasing in countries like India, China, and Indonesia. The rise in the consumption of various types of alcohol is propelling the demand for tonic water in the region.

Key Companies & Market Share Insights

The market is highly fragmented across the globe owing to the presence of a large number of domestic as well as international players. Key manufacturers have significant market share in Europe, North America, and some parts of Asia.

A growing trend of healthy intake is anticipated to focus on quality and low-calorie products. A large number of manufacturers are offering healthy alternatives for high sugar products and is anticipated to be a primary factor for growing market share. Increasing product launches with artificial sweeteners in the market are also anticipated to positively impact industry growth. Some of the prominent players in the tonic water market include:

-

FENTIMANS

-

Fever-Tree

-

Keurig Dr Pepper

-

Q MIXERS

-

THE COCA-COLA COMPANY

-

White Rock Products Corporation

-

Zevia

-

Asahi Group Holdings, Ltd.

-

Hansen Beverage

-

Bradleys Tonic Co.

Tonic Water Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 1.83 billion

Revenue forecast in 2027

USD 3.0 billion

Growth Rate

CAGR of 7.2% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

The U.S.; The U.K.; Germany; France; China; Japan; Brazil

Key companies profiled

FENTIMANS; Fever-Tree; Keurig Dr Pepper; Q MIXERS; THE COCA-COLA COMPANY; White Rock Products Corporation; Zevia; Asahi Group Holdings, Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tonic Water Market SegmentationThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global tonic water market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2027)

-

Regular

-

Diet

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2027)

-

Hypermarkets, Supermarkets & Convenience Stores

-

On-trade

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

-

Europe

-

The U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global tonic water market size was estimated at USD 1.72 billion in 2019 and is expected to reach USD 1.83 billion in 2020.

b. The global tonic water market is expected to grow at a compound annual growth rate of 7.2% from 2020 to 2027 to reach USD 3.01 billion by 2027.

b. North America dominated the tonic water market with a share of 32.6% in 2019. This is attributable to the high consumption of tonic water in the U.S. and Canada.

b. Some key players operating in the tonic water market include FENTIMANS, Fever-Tree, Keurig Dr Pepper, Q MIXERS, THE COCA-COLA COMPANY, White Rock Products Corporation, Zevia, Asahi Group Holdings, Ltd.

b. Key factors that are driving the market growth include increasing consumption of alcoholic beverages such as gin, vodka, and other various types of cocktails and new product launches.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.