- Home

- »

- IT Services & Applications

- »

-

Trade Management Software Market Size Report, 2030GVR Report cover

![Trade Management Software Market Size, Share & Trends Report]()

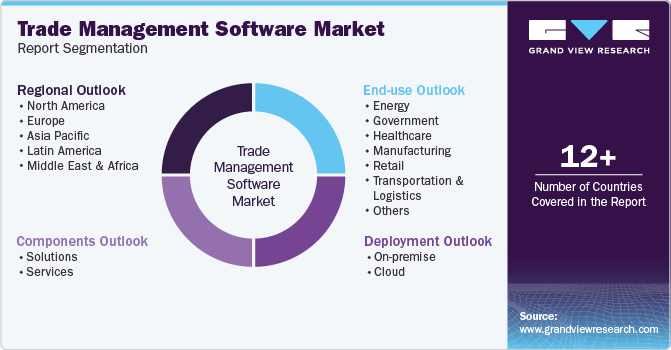

Trade Management Software Market (2024 - 2030) Size, Share & Trends Analysis Report By Components (Solutions, Services), By Deployment (On-premise, Cloud), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-130-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Trade Management Software Market Summary

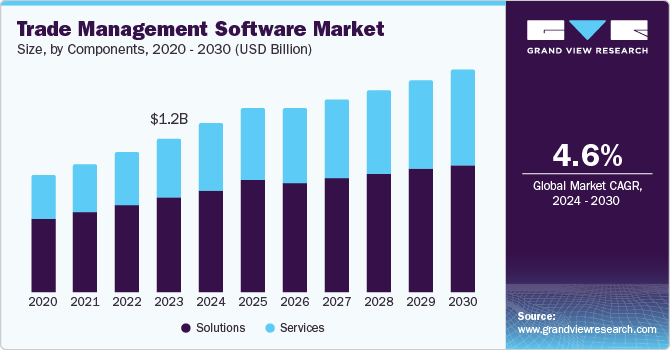

The global trade management software market size was estimated at USD 1,194.7 million in 2023 and is projected to reach USD 1,717.6 million by 2030, growing at a CAGR of 4.6% from 2024 to 2030. The globalization of businesses has resulted in a significant rise in international trade.

Key Market Trends & Insights

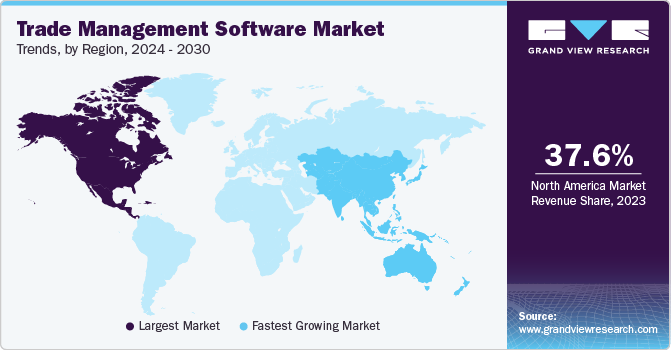

- North America trade management software market dominated the market with a revenue share of 37.6% in 2023.

- The U.S. dominated the regional trade management software market in 2023.

- By components, the solution segment dominated the market and accounted for a revenue share of 61.7% in 2023.

- By deployment, the on-premise deployment segment accounted for the largest revenue share in 2023.

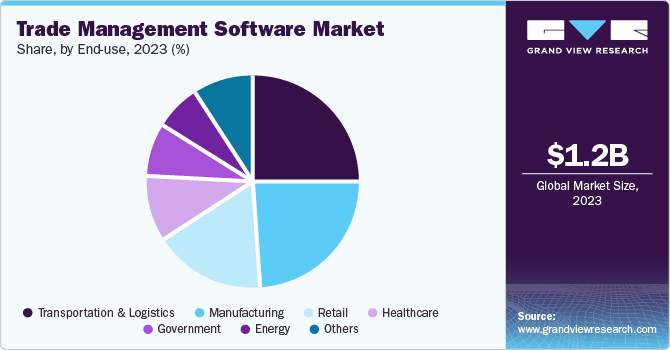

- By end-use, the transportation & logistics segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1,194.7 Million

- 2030 Projected Market Size: USD 1,717.6 Million

- CAGR (2024-2030): 4.6%

- North America: Largest market in 2023

Organizations face a critical challenge in managing complex supply chains across various countries and regions. Trade management software provides a solution by delivering visibility, control, and automation across these complex networks. The increasing intricacy of trade regulations, tariffs, and customs procedures is also fueling the need for trade management software.

Supply chain disruptions, such as natural disasters, geopolitical conflicts, and economic changes, have emphasized the significance of having visibility throughout the supply chain. Trade management software lets companies track their supply chains in real-time, detect possible risks, and make well-informed decisions. Furthermore, these solutions help in enhancing transportation, inventory control, and logistics operations, leading to increased efficacy and reduced expenses.

Numerous regulations, tariffs, and trade agreements define the global trade environment. It is crucial to follow these intricate regulations to avoid penalties and interruptions to business activities. Trade management software assists companies in handling compliance risks through automated customs procedures, generation of necessary documentation, and staying up-to-date with regulatory modifications. Moreover, these solutions may help identify and reduce supply chain risks, such as trade sanctions, counterfeit products, and product recalls.

Components Insights

The solution segment dominated the market and accounted for a revenue share of 61.7% in 2023. The increasing complexity of global trade, characterized by intricate regulations, evolving trade policies, and geographically dispersed supply chains, requires efficient and compliant trade operations. Trade management software solutions address these challenges by automating routine tasks, ensuring regulatory compliance, optimizing customs processes, increasing supply chain visibility, and improving overall trade performance. Additionally, the growing focus on data-driven decision-making, risk mitigation, and cost reduction drives the demand for advanced trade management software solutions.

The services segment is expected to register the fastest CAGR during the forecast period. The rising complexity of trade rules drives the rapid growth of the services segment, the increasing necessity for specialized expertise in trade compliance and process optimization, and the growing demand for consulting, implementation, and support services related to trade management software solutions. Moreover, with organizations aiming to optimize their software investments, the requirement for continuous maintenance, updates, and training services is increasing, leading to expanding the services segment.

Deployment Insights

The on-premise deployment accounted for the largest revenue share in 2023. Companies managing sensitive trade information and the existing IT infrastructure investments attribute this dominance to the increased focus on security and control. Furthermore, established companies tend to be cautious towards cloud mitigation, preferring on-premise solutions for their perceived reliability and customization capabilities. The need for data residency and compliance with industry regulations are additional factors that contribute to the enduring appeal of on-premise trade management software.

The cloud deployment is expected to register the fastest CAGR during the forecast period. The rapid growth is primarily due to the inherent benefits of cloud-based solutions, such as increased scalability, cost efficiency, accessibility, and quick implementation. Moreover, the rise in preference for adaptable and subscription-driven models and the widespread integration of cloud technologies in various sectors is driving the transition towards cloud-based trade management software. Moreover, the seamless integration of cloud solutions with enterprise systems and real-time data analytics further propels their increased adoption.

End-use Insights

The transportation & logistics segment dominated the market in 2023. Adopting advanced software solutions in transportation and logistics has become necessary due to the growing complexity of global supply chains and the need for improved visibility and efficiency in freight operations. Moreover, the surge in e-commerce activities has caused immense pressure on logistics providers to optimize their operations, leading to a higher need for software for managing trade. Furthermore, strict regulatory compliance demands in different regions have forced businesses to invest money into technology-based solutions to guarantee compliance with trade regulations. The adoption of advanced software solutions has become necessary due to the growing complexity of global supply chains and the need for improved visibility and efficiency in freight operations.

The retail segment is projected to grow at the fastest CAGR over the forecast period. The growing intricacy of worldwide supply chains and the rising need for effective inventory control and order processing have made it essential to implement advanced trade management solutions. Furthermore, the increasing popularity of omni-channel retailing, which demands the smooth blending of online and offline sales channels, has heightened the demand for software that can efficiently manage various commerce activities. Moreover, the increasing competition in the retail industry is driving companies to minimize their supply chain expenses and enhance operational productivity, leading to a growing need for trade management software solutions.

Regional Insights

North America trade management software market dominated the market with a revenue share of 37.6% in 2023. The region's strong economy, along with many multinational corporations, has created a favorable environment for implementing advanced trade management solutions. The intricate rules and regulations governing international trade in North America have required the use of advanced technology to ensure compliance. Moreover, the rapid implementation of technological advancements and a strong IT infrastructure in the region have speeded up the use of trade management software in various industries, driving market expansion.

U.S. Trade Management Software Market Trends

The U.S. dominated the regional trade management software market in 2023 due to its extensive trade relations with nations globally, which require strong trade management systems to navigate complicated customs rules, tariffs, and supply chain complexities. Moreover, numerous multinational corporations based in the U.S. have increased the need for advanced software to handle global business operations efficiently. Additionally, the nation's prompt integration of technological advancements and well-developed IT system has established a favorable environment for its expansion of trade management tools.

Europe Trade Management Software Market Trends

Europe trade management software market is expected to grow at a significant CAGR during the forecast period. The demand for advanced software solutions has arisen due to the region's intricate trade environment and diverse regulations in multiple countries to ensure compliance and improve efficiency. Moreover, the growing emphasis on enhancing supply chain efficiency and cost reduction among European organizations has driven the requirement for trade management solutions. Moreover, the increasing significance of sustainability and ethical sourcing within the region has led to the utilization of software capable of tracking the origins of products and their environmental effects, driving the market's growth.

The UK trade management software market is expected to grow rapidly in the coming years due to the UK's status as a global trading hub, along with its intricate customs regulations and trade agreements, which have resulted in high demand for effective trade management systems. Additionally, the use of advanced software to streamline operations has been driven by the rising complexity of supply chains and the increasing focus on supply chain transparency. Furthermore, the UK's dedication to global trade and its role as a pioneer in e-commerce have fueled the growing demand for trade management solutions that can effectively manage international transactions.

Asia Pacific Trade Management Software Market Trends

Asia Pacific's trade management software market is anticipated to witness the fastest CAGR over the forecast period. The region's growing economies and the growing complexity of worldwide supply chains have generated a crucial demand for effective trade management solutions. Moreover, the increasing focus on online shopping and international trade in Asia has driven the need for software that can efficiently manage global transactions. Furthermore, government initiatives to enhance trade facilitation and infrastructure development foster a favorable atmosphere for adopting trade management technology. The varied regulatory rules in the region, along with the increasing focus on supply chain transparency and risk mitigation, are also playing a role in the market's strong expansion.

China's trade management software market held a substantial market share in 2023 owing to the country's status as a global manufacturing and exporting powerhouse, which has required robust trade management solutions to deal with intricate supply chains and to navigate strict customs rules. In addition, the Chinese government's efforts to support e-commerce and international trade have established a favorable setting for suppliers of trade management software. Moreover, the rising intricacy of global trade and the increasing emphasis on supply chain transparency and risk control have prompted the need for sophisticated software solutions in China.

Key Trade Management Software Company Insights

Some of the key companies in the market include Amber Road, Inc., Aptean, Integration Point, Inc., Livingston International, MIC, and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

E2open, LLC, is a cloud-based supply chain management software solution provider with strong trade management capabilities. After acquiring Amber Road, the company became a significant competitor in the market. E2open's comprehensive platform empowers companies to improve global trade operations, manage intricate supply chains, and increase transparency.

-

Aptean is a specialized solutions provider for different industries in the enterprise software sector. Its broad range of services includes solutions for other aspects of international trade, including import/export regulations, customs handling, and supply chain monitoring. The company simplifies trade operations, manages risks, and ensures regulatory compliance, serving businesses of every size.

Key Trade Management Software Companies:

The following are the leading companies in the trade management software market. These companies collectively hold the largest market share and dictate industry trends.

- E 2open, LLC. (Amber Road, Inc.)

- Aptean

- Integration Point, Inc.

- Livingston International

- MIC.

- Noatum Logistics (MIQ Logistics, LLC)

- Precision Software LLC

- Oracle

- Descartes QuestaWeb

- THE DESCARTES SYSTEMS GROUP INC

Recent Developments

-

In July 2024, Aptean Inc., a leading worldwide provider of AI-driven ERP solutions for the food and beverage sector, announced a significant and ongoing investment in its specialized solution suite. These strategic investments aim to enhance industry-specific capabilities and customer-oriented services to address food and beverage businesses' unique needs.

-

In June 2023, Aptean broadened its supply chain services by acquiring TOTALogistix. With this acquisition, TOTALogistix is expected to gain advantages from Aptean's scale, resources, and technical knowledge.

Trade Management Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.31 billion

Revenue forecast in 2030

USD 1.72 billion

Growth rate

CAGR of 4.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Components, deployment, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America

Country scope

U.S., Canada, Mexico, Germany, UK, China, Japan, India, Brazil

Key companies profiled

E 2open, LLC. (Amber Road, Inc.); Aptean; Integration Point, Inc.; Livingston International; MIC.; Noatum Logistics (MIQ Logistics, LLC); Precision Software LLC; Oracle; Descartes QuestaWeb; THE DESCARTES SYSTEMS GROUP INC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Trade Management Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the trade management software market report based on components, deployment, end-use, and region:

-

Components Outlook (Revenue, USD Million, 2018 - 2030)

-

Solutions

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Energy

-

Government

-

Healthcare

-

Manufacturing

-

Retail

-

Transportation & logistics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.