- Home

- »

- Consumer F&B

- »

-

Trail Mix Market Size, Share & Growth, Industry Report 2033GVR Report cover

![Trail Mix Market Size, Share & Trends Report]()

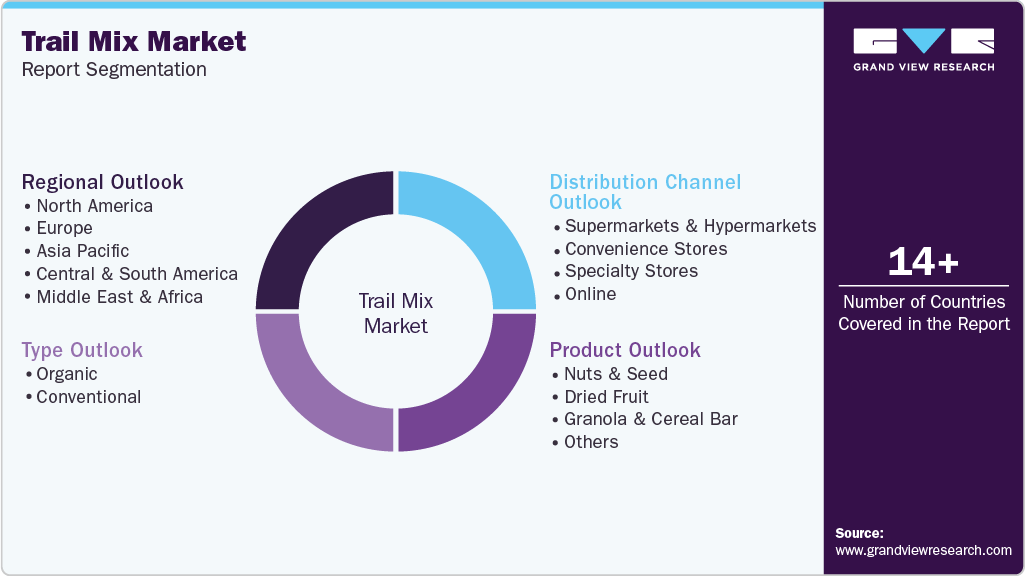

Trail Mix Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Nuts & Seeds, Dried Fruits), By Type (Organic, Conventional), By Distribution Channel (Convenience Stores, Specialty Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-647-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Trail Mix Market Summary

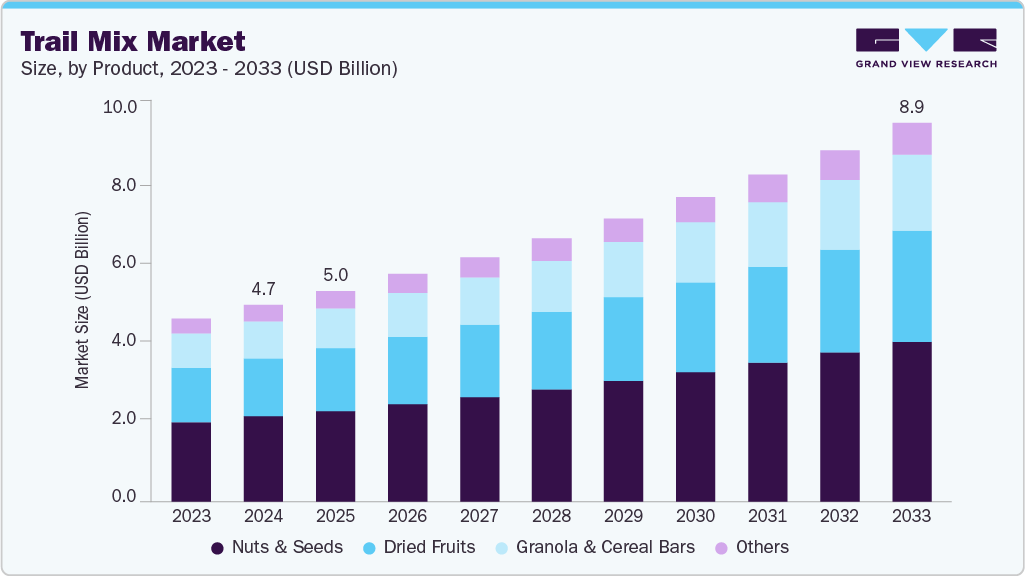

The global trail mix market size was estimated at USD 4.67 billion in 2024 and is projected to reach USD 8.99 billion by 2033, growing at a CAGR of 7.6% from 2025 to 2033. The increasing consumer demand for healthy and convenient snack options primarily drives the market's growth.

Key Market Trends & Insights

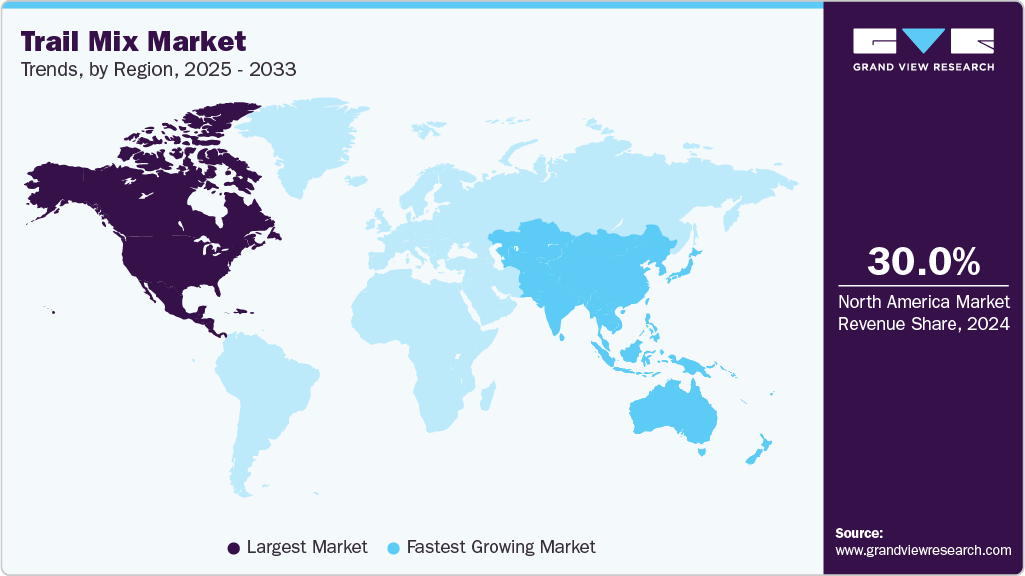

- North America held the largest share in the trail mix market, accounting for over 30% of the global market in 2024.

- The trail mix market is expected to grow fastest in China over the forecast period.

- By product, the nuts and seeds mix had the highest market share of 45% in 2024.

- Based on type, conventional trail mix held the largest share in 2024.

- By distribution channel, the sale of trail mix through the online channel is expected to grow at a CAGR of 8.0% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 4.67 Billion

- 2033 Projected Market Size: USD 8.99 Billion

- CAGR (2025-2033): 7.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

With rising health consciousness, more people are seeking snacks low in fat and sugar but rich in nutrients, such as nuts, seeds, and dried fruits, which are core ingredients in trail mixes. This shift towards healthier eating habits encourages manufacturers to innovate and offer organic, non-GMO, gluten-free, and plant-based trail mix products that cater to these preferences.Convenience is another significant factor fueling the trail mix market expansion. Consumers, especially millennials and busy professionals, prefer snacks that are easy to carry and consume on the go. Trail mixes fit this need perfectly as they provide a quick energy boost and nutritional benefits without requiring preparation. The rise in outdoor activities and fitness trends further supports this demand, as trail mix is a ready energy source for athletes and adventurers.

Flavor innovation also plays a crucial role in the market's growth. Brands introduce a wide variety of adventurous and unique flavor combinations such as honey, Cajun style, Caribbean, ranch, hot & spicy, BBQ, salted caramel, and chicken teriyaki. This creativity in flavoring attracts diverse consumer segments and keeps the product line exciting, which helps sustain and grow consumer interest.

The expansion of retail channels, particularly e-commerce, has significantly increased the accessibility of trail mix products. Online platforms allow consumers to conveniently purchase a wide range of trail mixes from the comfort of their homes. Major players such as PepsiCo and Kellogg’s leverage their websites and third-party online retailers to reach a broader audience. This growth in online sales complements traditional retail outlets such as supermarkets and hypermarkets, which continue to hold a significant market share.

Sustainability and ethical sourcing are becoming increasingly important to consumers, influencing their purchasing decisions. There is a growing preference for products made with sustainably sourced ingredients and environmentally friendly practices. This trend encourages manufacturers to adopt clean-label formulations and incorporate functional ingredients such as protein and probiotics, further enhancing the nutritional profile of trail mixes and appealing to health-conscious buyers.

Regional market dynamics contribute to the growth, with North America leading due to its well-developed market, high disposable incomes, and a strong consumer base focused on organic and premium snack products. The Asia-Pacific region is also emerging as a growth hotspot due to changing lifestyles and increasing health awareness. The competitive landscape includes both multinational corporations and smaller niche players, fostering innovation and diversity in product offerings.

Product Insights

Nuts & seeds mixes segment held the largest share in the trail mix market and were valued at USD 2.02 billion in 2024. This dominance is due to nuts and seeds being rich sources of protein, healthy fats, and essential nutrients, which align well with the increasing consumer focus on health and wellness. Their convenience as a portable, nutrient-dense snack makes them highly popular among fitness enthusiasts and busy consumers alike. The nuts & seeds segment is expected to grow steadily, supported by rising awareness of heart-healthy diets and plant-based protein sources.

Dried fruit mixes represent another significant product type, growing rapidly due to the rising demand for natural sweetness and fiber-rich snacks. Consumers increasingly prefer dried fruits for their antioxidant properties and as a source of vitamins, making this segment attractive for health-conscious buyers. The growth of organic and non-GMO dried fruit options further fuels this segment’s expansion. Dried fruits also appeal to vegan and gluten-free consumers, broadening their market reach.

Granola and cereal bars is expected to grow fastest at a CAGR of 8.1% from 2025 to 2033. Granola & cereal bar mixes form a smaller but fast-growing segment within the trail mix market. These mixes combine grains, nuts, and dried fruits into convenient bar formats, catering to consumers seeking quick, on-the-go energy solutions. Their growth is driven by the popularity of breakfast and snack bars as meal replacements or supplements, especially among millennials and working professionals. Innovation in flavors and incorporating superfoods and functional ingredients (like protein and probiotics) also contribute to the rising demand in this category.

Type Insights

Conventional trail mixes dominate the market in volume and revenue due to their affordability, wide availability, and extensive flavor variety. These products cater to mainstream consumers who prioritize convenience and taste but may be more price-sensitive or less focused on organic certification. Conventional trail mixes are widely distributed through supermarkets, hypermarkets, convenience stores, and online retailers, ensuring easy accessibility for a broad consumer base. The variety of packaging sizes and flavor options, including sweet, savory, and spicy blends, further enhances their appeal to different demographic groups.

The growth of inorganic trail mixes is propelled by the increasing demand for convenient, nutritious snacks that fit busy lifestyles, especially among millennials, working professionals, and outdoor enthusiasts. Innovations in flavor profiles, packaging, and marketing campaigns emphasizing energy-boosting and health benefits help maintain consumer interest. While the segment grows steadily, challenges such as fluctuating raw material costs and increasing competition from organic and specialty products exist. Nonetheless, conventional trail mixes remain the backbone of the market due to their broad appeal and cost-effectiveness, particularly in emerging markets with higher price sensitivity.

The organic trail mix segment is experiencing robust growth driven by increasing consumer awareness and preference for natural, chemical-free, and sustainably sourced foods. Consumers are becoming more health-conscious and environmentally aware, seeking products free from synthetic pesticides, fertilizers, and additives. Organic trail mixes appeal to niche markets such as vegans, vegetarians, and individuals with dietary restrictions who prioritize clean-label and ethically produced foods. The availability of organic certifications further assures consumers of product authenticity and quality, boosting trust and demand. Additionally, manufacturers are innovating with exotic nuts, seeds, superfoods like chia and goji berries, and unique flavor combinations to attract health-focused consumers, which helps differentiate organic trail mixes in a competitive market.

This segment’s growth is also supported by the global shift towards wellness and sustainability trends, with consumers willing to pay premium prices for organic products perceived as healthier and better for the environment. Regions such as North America and Europe lead in organic trail mix consumption, while emerging markets in Asia-Pacific are witnessing rapid adoption due to rising disposable incomes and increasing health awareness. The organic trail mix market is expected to grow faster than the conventional segment, driven by these evolving consumer preferences and the expansion of retail channels, including online platforms that facilitate access to specialty organic products.

Distribution Channel Insights

Supermarkets and hypermarkets segment held the largest revenue share, accounting for USD 1.7 billion in 2024. Supermarkets and hypermarkets remain the dominant distribution channels for trail mix products, accounting for a substantial share of total sales globally. Their growth is driven by their extensive reach, established supply chains, and ability to offer various trail mix brands and flavors under one roof. These large-format stores provide high visibility and easy accessibility, attracting a broad consumer base including families and budget-conscious shoppers. Competitive pricing, frequent in-store promotions, and strategic product placements in snack aisles encourage impulse purchases, further boosting sales. Additionally, supermarkets and hypermarkets serve as convenient one-stop shopping destinations, where consumers can purchase trail mixes alongside regular groceries, making these channels a preferred choice for bulk and repeat purchases.

The sale of trail mix through the online channel is expected to grow at a CAGR of 8.0% over the forecast period. The online retail channel for trail mix is experiencing rapid growth, emerging as a significant force in the market due to evolving consumer shopping habits and the convenience offered by e-commerce platforms. Consumers increasingly prefer online shopping for its ease of access, ability to browse a wide variety of products, compare prices, and read reviews before making a purchase. Online platforms also enable manufacturers and retailers to offer targeted products such as customized trail mix blends, subscription services, and specialty or organic varieties that may not be widely available in physical stores. The COVID-19 pandemic accelerated this shift by increasing consumer comfort with digital purchases and home delivery services.

Regional Insights

North America trail mix market was the largest market for and accounted for a revenue of over 30.0% in 2024. A well-established snacking culture, high disposable incomes, and widespread availability of trail mix products across various retail channels, including supermarkets, convenience stores, and online platforms, drive this dominance. The region’s consumers are highly health-conscious, favoring nutritious, portable snacks that fit busy and active lifestyles. Additionally, the popularity of outdoor activities such as hiking and camping boosts demand for trail mix as a convenient energy source. The presence of major industry players and continuous product innovation, including organic and specialty trail mixes, further supports market growth in North America.

U.S. Trail Mix Market Trends

The trail mix market in the U.S. benefits from a well-established snacking culture and high consumer health consciousness in the U.S. Busy lifestyles and the popularity of outdoor activities such as hiking, camping, and fitness regimes drive demand for nutritious, convenient energy-boosting snacks like trail mixes. The U.S. market is supported by extensive retail channels, including supermarkets, convenience stores, and a rapidly growing online segment. This provides consumers easy access to a range of premium, organic, and customized trail mix products. Major players such as PepsiCo, General Mills, and Frito-Lay leverage brand recognition and innovative product offerings to capture market share. Additionally, American consumers’ increasing preference for natural, organic, and functional foods aligns with the trend toward healthier snacking, sustaining steady market growth. Marketing efforts highlighting trail mix as a wholesome snack for active lifestyles further enhance its appeal.

Asia Pacific Trail Mix Market Trends

The Asia Pacific region is expected to grow at the fastest CAGR of 8.0% from 2025 to 2033. This rapid expansion is primarily driven by rapid urbanization, rising disposable incomes, and increasing health awareness among consumers in countries like China, India, Japan, and South Korea. Urban lifestyles are shifting toward convenience and nutritious snacking, which fuels demand for trail mixes as quick, healthy, and portable snacks. The growing middle class in these countries is adopting Western eating habits, including snacking between meals, further boosting market penetration. Additionally, expanding e-commerce platforms and modern retail infrastructure facilitate easier access to various trail mix products, including organic and specialty blends tailored to local tastes. Innovation, incorporating regional ingredients and flavors, also supports growth, as does the rising popularity of fitness and wellness trends across the region.

Key Trail Mix Company Insights

The competitive landscape of the global trail mix market is moderately concentrated, with several major multinational companies holding significant market shares alongside numerous domestic and regional players. Key industry leaders include The J.M. Smucker Company, PepsiCo, Inc., Second Nature Brands, Hormel Foods Corporation, and Texas Star Nut & Food Co. These companies dominate the market through extensive product portfolios that cover a wide range of trail mix varieties, including organic, flavored, and functional blends. Their strong distribution networks across supermarkets, convenience stores, and online platforms enable broad market reach. These players focus on product innovation, introducing new flavors, healthier ingredient combinations, and convenient packaging formats that cater to evolving consumer preferences for nutritious and on-the-go snacks to enhance their market position.

Key Trail Mix Companies:

The following are the leading companies in the trail mix market. These companies collectively hold the largest market share and dictate industry trends.

- The J.M. Smucker Company

- PepsiCo, Inc.

- General Mills, Inc.

- Kellogg Company

- Mars, Incorporated

- Hormel Foods Corporation

- Second Nature Brands

- Texas Star Nut & Food Co

- National Raisin Company

- Mouth Foods

- Whitworths

- Oberto Snacks Inc.

- Creative Snacks Co.

- Kind LLC

- Clif Bar & Company

Trail Mix Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.02 billion

Revenue forecast in 2033

USD 8.99 billion

Growth rate (Revenue)

CAGR of 7.6% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada, Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; UAE

Key companies profiled

The J.M. Smucker Company; PepsiCo, Inc.; General Mills, Inc.; Kellogg Company; Mars, Incorporated;

Hormel Foods Corporation; Second Nature Brands; Texas Star Nut & Food Co; National Raisin Company;

Mouth Foods; Whitworths; Oberto Snacks Inc.; Creative Snacks Co.; Kind LLC; Clif Bar & Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Trail Mix Market Report Segmentation

This report forecasts revenue growth globally, regionally, and country-wide and analyzes the latest industry trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global trail mix market report by product, type, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Nuts & Seed

-

Dried Fruit

-

Granola & Cereal Bar

-

Others

-

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Organic

-

Conventional

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Specialty Stores

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global trail mix market was valued at USD 4.67 billion in 2024 and is expected to reach USD 5.02 billion in 2025.

b. The global trail mix market is expected to reach USD 8.99 billion by 2033, growing at a CAGR of 7.7% from 2025 to 2033.

b. The sale of trail mix through the online channel is expected to grow at a CAGR of 8% over the forecast period. The online retail channel for trail mix is experiencing rapid growth, emerging as a significant force in the market due to evolving consumer shopping habits and the convenience offered by e-commerce platforms. Consumers increasingly prefer online shopping for its ease of access, ability to browse a wide variety of products, compare prices, and read reviews before making a purchase. Online platforms also enable manufacturers and retailers to offer targeted products such as customized trail mix blends, subscription services, and specialty or organic varieties that may not be widely available in physical stores. The COVID-19 pandemic accelerated this shift by increasing consumer comfort with digital purchases and home delivery services.

b. Some of the key players operating in the market include: - • The J.M. Smucker Company • PepsiCo, Inc. • General Mills, Inc. • Kellogg Company • Mars, Incorporated • Hormel Foods Corporation • Second Nature Brands • Texas Star Nut & Food Co • National Raisin Company • Mouth Foods • Whitworths • Oberto Snacks Inc. • Creative Snacks Co. • Kind LLC • Clif Bar & Company

b. With rising health consciousness, more people are seeking snacks low in fat and sugar but rich in nutrients, such as nuts, seeds, and dried fruits, which are core ingredients in trail mixes. This shift towards healthier eating habits encourages manufacturers to innovate and offer organic, non-GMO, gluten-free, and plant-based trail mix products that cater to these preferences.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.