- Home

- »

- Organic Chemicals

- »

-

Trans-1,2-Dichloroethylene Market, Industry Report, 2033GVR Report cover

![Trans-1,2-Dichloroethylene Market Size, Share & Trends Report]()

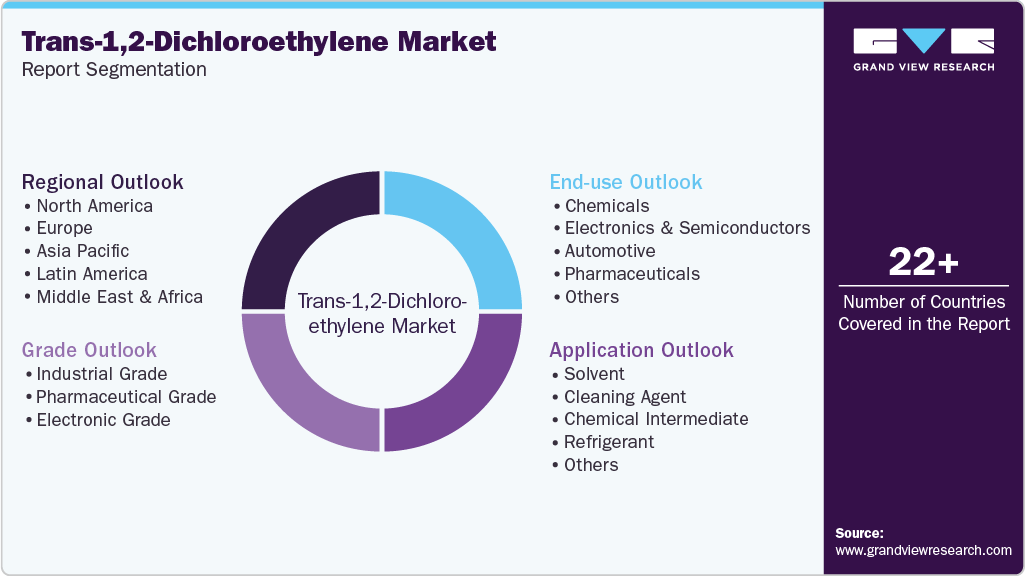

Trans-1,2-Dichloroethylene Market (2025 - 2033) Size, Share & Trends Analysis Report By Grade (Industrial Grade, Pharmaceutical Grade, Electronic Grade), By Application (Solvent, Cleaning Agent), By End-use (Chemicals, Automotive, Pharmaceuticals), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-819-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Trans-1,2-Dichloroethylene Market Summary

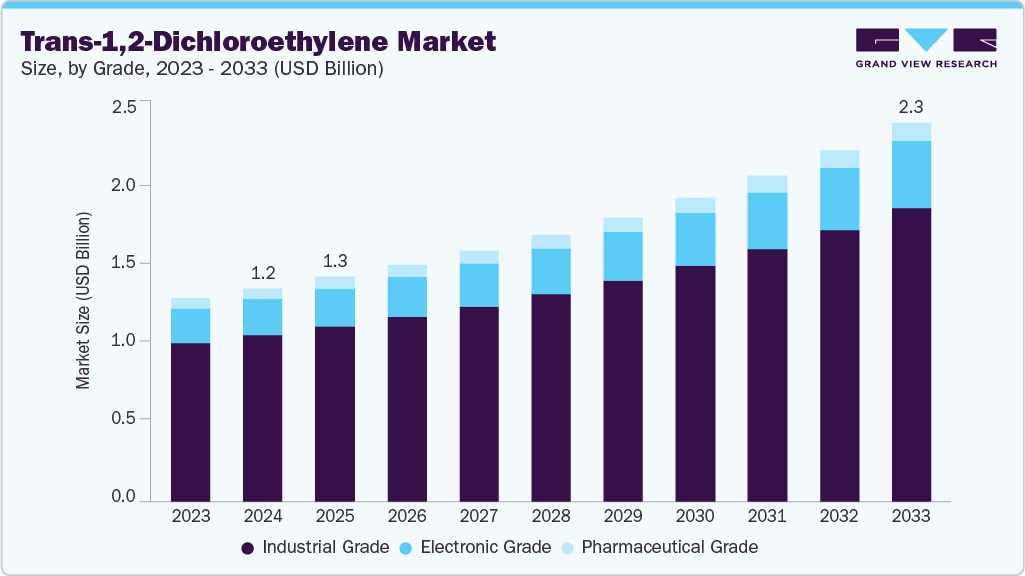

The global trans-1,2-dichloroethylene market size was estimated at USD 1,285.9 million in 2024 and is projected to reach USD 2,285.72 million by 2033, growing at a CAGR of 6.8% from 2025 to 2033. The market is expanding due to rising demand from the manufacturing and metalworking industries for efficient cleaning solutions.

Key Market Trends & Insights

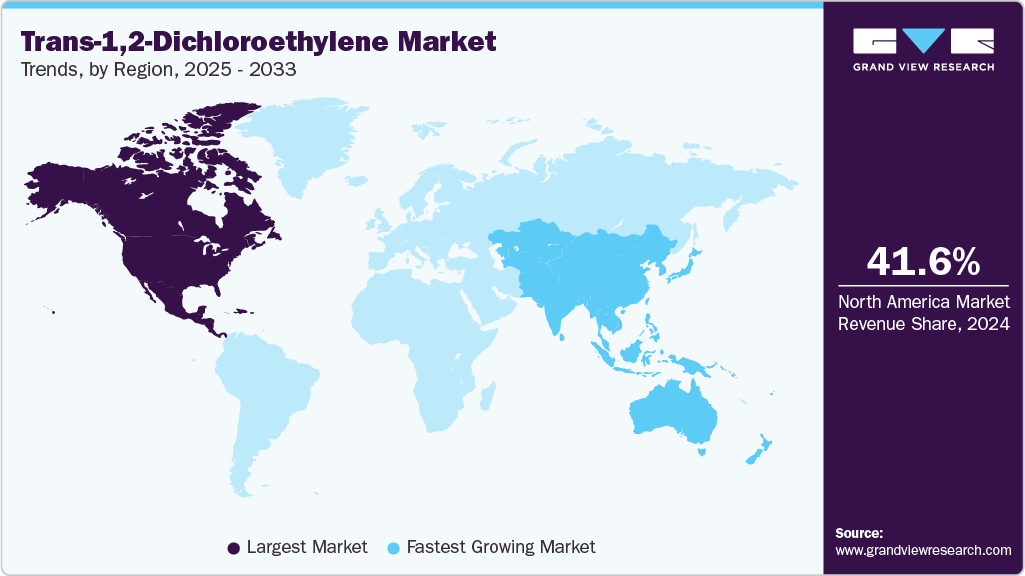

- North America 1,2-trans-dichloroethylene (DCE) industry dominated the global market with the largest revenue share of 41.6% in 2024.

- U.S. registered the highest CAGR of 6.8%, in terms of revenue, during the review period.

- By grade, the industrial grade segment dominated the market and accounted for the largest revenue share of 78.0% in 2024.

- By application, the solvent segment dominated the market with a revenue share of 43.6% in 2024.

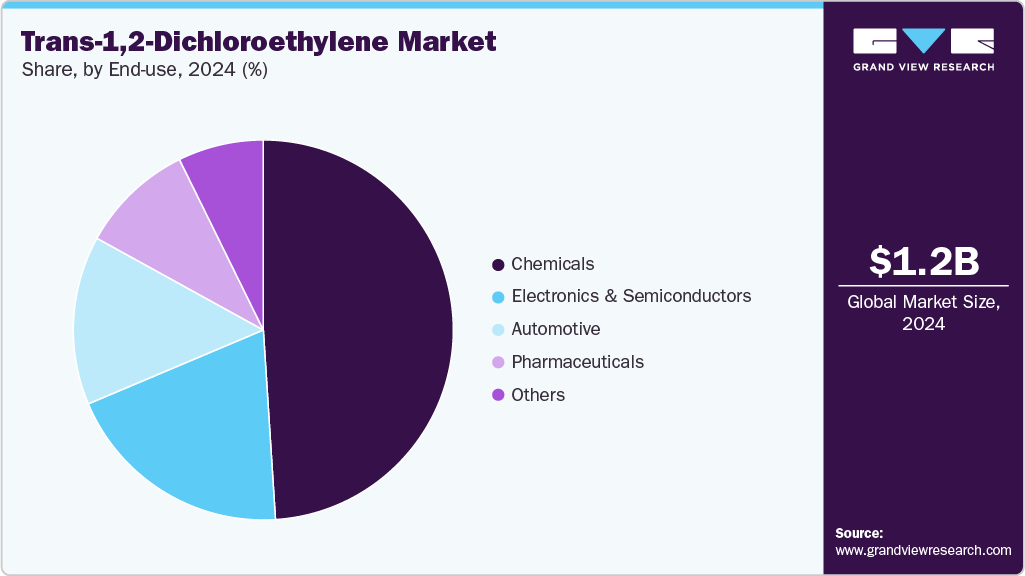

- By end-use, the chemicals segment dominated the market with a revenue share of 49.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,285.9 Million

- 2033 Projected Market Size: USD 2,285.7 Million

- CAGR (2025-2033): 6.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Trans-1,2-DCE’s strong solvency, quick drying, and safer profile drive its preference over traditional solvents. Its cost-effectiveness enhances adoption across key industries. Trans-1,2-DCE serves as a vital feedstock for producing next-generation refrigerants, such as HFCs and HFOs. Growing demand for low-GWP (Global Warming Potential) refrigerants under environmental regulations is accelerating consumption. The expanding HVAC and refrigeration industries are further strengthening the supply chain. Major producers are investing in capacity expansions to meet sustainable refrigerant demand.

Growing investment in semiconductor and electronics manufacturing is creating strong demand for high-purity trans-1,2-DCE used in precision cleaning and processing applications. Its ability to deliver superior performance with minimal residue supports strict quality requirements. Leading producers are focusing on developing ultra-pure grades tailored for advanced electronic components. This trend presents a lucrative opportunity for suppliers targeting high-technology industries.

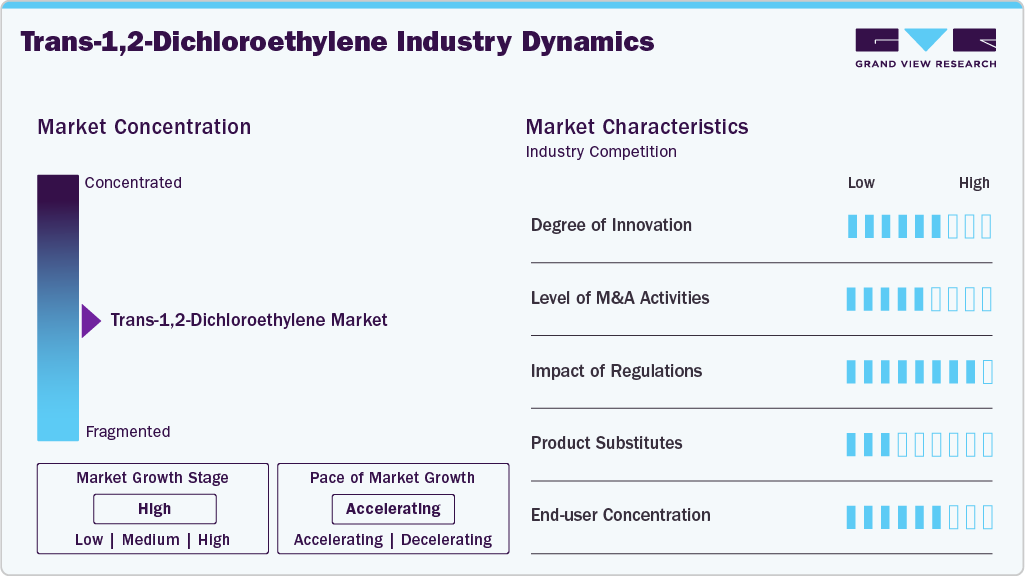

Market Concentration & Characteristics

The 1,2-trans-dichloroethylene (DCE) industry is moderately concentrated, with a few global chemical producers dominating production and supply. Key players such as Westlake Chemical, Solvay, and Arkema maintain strong control through established manufacturing capacities, technological expertise, and integrated supply chains. Smaller regional manufacturers primarily serve niche or localized demand, particularly in Asia-Pacific, where industrial expansion continues to drive market participation.

The market is characterized by high product purity requirements, stringent safety standards, and a strong focus on cost efficiency. Competitive differentiation is largely based on production consistency, purity levels, and regulatory compliance. With increasing demand from electronics, refrigerant, and specialty chemical sectors, the market is witnessing gradual capacity expansions and strategic partnerships to strengthen global supply security and product innovation.

Grade Insights

The industrial-grade segment dominated the market with a revenue share of 78.0% in 2024, due to its extensive use in metal cleaning, degreasing, and chemical processing. Its strong solvency and cost-effectiveness make it the preferred choice across automotive, aerospace, and manufacturing sectors. High consumption in large-scale industrial operations continues to drive volume demand. This segment maintains a strong competitive edge due to stable end use applications.

The electronic grade segment is anticipated to be the fastest-growing segment with a CAGR of 7.3% during the forecast period, driven by rising semiconductor manufacturing and advanced electronics production. Its ultra-high purity levels make it essential for precision cleaning and wafer-processing applications. Increasing investments in chip fabrication and global expansion of electronics supply chains are accelerating adoption. As purity requirements become increasingly stringent, demand for specialized electronic-grade formulations continues to rise.

Application Insights

The solvent segment dominated the market with a revenue share of 43.6% in 2024, due to its widespread use in industrial processing, chemical synthesis, and metal degreasing. Its strong solvency power, rapid evaporation rate, and cost efficiency make it a preferred choice across manufacturing industries. Stable demand from automotive, aerospace, and polymer sectors reinforces its leading position. The segment benefits from established applications that continue to drive high-volume consumption.

The cleaning agent segment is projected to be the fastest-growing segment with a CAGR of 7.2% during the forecast period, as industries are expected to shift toward high-performance, low-residue cleaning solutions. The compatibility of 1,2-trans-DCE with precision cleaning, particularly in electronics, medical devices, and high-tech components, is accelerating its adoption. Rising standards for surface cleanliness in advanced manufacturing further boost demand. This segment’s growth is fueled by increasing reliance on efficient, high-purity cleaning chemicals.

End-use Insights

The chemicals segment dominated the market with a revenue share of 49.0% in 2024, due to its extensive use as an intermediate in various synthesis and formulation processes. Its stability, compatibility, and effectiveness in chemical reactions support strong demand across specialty chemicals and industrial applications. Established supply chains and consistent consumption patterns reinforce its leading market share. This segment remains the backbone of overall DCE utilization.

The electronics and semiconductor segment is projected to witness the fastest CAGR of 7.2% during the forecast period, driven by escalating demand for ultra-clean solvents in chip fabrication and high-precision component manufacturing. 1,2-trans-DCE’s high purity and excellent cleaning performance make it essential for wafer processing and advanced electronic assemblies. Global investments in semiconductor capacity expansion are further accelerating uptake. Increasing technological sophistication continues to strengthen this segment’s growth trajectory.

Regional Insights

North America 1,2-trans-dichloroethylene (DCE) industry dominated the global market with the largest revenue share of 41.6% in 2024. North America’s established aerospace, automotive, and industrial manufacturing sectors are fueling demand for safer cleaning solvents. Trans-1,2-DCE offers a balance of strong performance and lower toxicity, aligning with health and safety standards. The market is supported by ongoing technological modernization in production facilities. Compliance with EPA regulations further promotes its adoption across industries.

U.S. Trans-1,2-Dichloroethylene Market Trends

U.S. registered the highest CAGR of 6.8%, in terms of revenue, during the review period. The 1,2-trans-dichloroethylene (DCE) industry in the U.S. is driven by the increasing transition of industries to safer, environmentally friendly solvents for cleaning and degreasing operations. Trans-1,2-DCE meets performance needs while reducing environmental impact. Strong demand from the aerospace, automotive, and electronics sectors continues to sustain growth. The focus on regulatory compliance and sustainable manufacturing reinforces market expansion.

Asia Pacific Trans-1,2-Dichloroethylene Market Trends

The Asia Pacific 1,2-trans-dichloroethylene (DCE) industry is anticipated to witness the fastest growth in the region, with a fastest CAGR of 7.1% over the forecast period. Rapid growth in electronics and semiconductor production across China, Japan, and South Korea is driving strong demand for high-purity trans-1,2-DCE. The chemical’s superior solvency and low residue make it ideal for precision cleaning applications. Expanding chip fabrication and electronic assembly industries continue to support market expansion. Investments in advanced material technologies further strengthen regional growth prospects.

China’s 1,2-trans-dichloroethylene (DCE) industry is driven by the vast chemical manufacturing infrastructure that continues to drive high demand for trans-1,2-DCE as a feedstock in fluorochemical production. The material’s essential role in refrigerant synthesis aligns with rising domestic and export demand. Government support for industrial modernization and clean production further promotes usage. Expanding capacity and technology investments ensure China’s leadership in the global market.

Europe Trans-1,2-Dichloroethylene Market Trends

Europe’s 1,2-trans-dichloroethylene (DCE) industry is driven by the stringent environmental and safety regulations which encourage the shift toward eco-friendly solvent systems. Trans-1,2-DCE fits within the region’s low-VOC and REACH-compliant chemical framework. Its use is increasing in specialty coatings, adhesives, and industrial applications. Continuous focus on sustainable manufacturing practices reinforces steady market growth.

Germany’s 1,2-trans-dichloroethylene (DCE) industry is driven by the advanced specialty chemicals and coatings industries that rely on high-quality solvents for precision formulations. Trans-1,2-DCE’s compliance with REACH and low-VOC standards makes it a preferred option. The nation’s strong commitment to green chemistry and safety-driven innovation supports market adoption. Continuous investment in R&D enhances its application scope in industrial processes.

Latin America Trans-1,2-Dichloroethylene Market Trends

The 1,2-trans-dichloroethylene (DCE) industry in Latin America is driven by the increase in demand of the need for effective solvent solutions in the expanding manufacturing capabilities and rising industrial output in Brazil and Mexico. Trans-1,2-DCE is gaining traction for its cost efficiency and cleaning performance in production environments. Growing automotive and infrastructure development are strengthening consumption trends. The region’s improving industrial base is expected to sustain long-term growth.

Middle East & Africa Trans-1,2-Dichloroethylene Market Trends

The 1,2-trans-dichloroethylene (DCE) industry in Middle East & Africa is driven by the industrial diversification programs and growing petrochemical capacities. The chemical’s role as an intermediate in refrigerant and specialty chemical production supports regional expansion. Countries like Saudi Arabia and the UAE are investing in downstream chemical manufacturing. This shift toward value-added production enhances market opportunities for DCE suppliers.

Key Trans-1,2-Dichloroethylene Company Insights

Dow and Westlake Corporation dominate the market due to their strong integration across the chlorinated chemicals value chain, advanced production technologies, and global supply reliability. Their large-scale manufacturing capacities, product quality, and focus on industrial-grade solvent solutions position them as key leaders in the global DCE market.

-

Dow maintains a leading position in the 1,2-trans-dichloroethylene industry with its strong integration across the chemical value chain and advanced production technologies. The company’s focus on high-quality, sustainable solvent solutions supports its dominance in industrial and specialty applications. Its global reach and consistent product innovation further strengthen its competitive advantage.

-

Westlake Corporation plays a major role in the DCE market through its extensive chlorovinyl production base and efficient supply network. The company’s VersaTRANS solvent line highlights its capability in delivering high-performance industrial-grade solutions. Strong operational efficiency and adherence to environmental standards reinforce its leadership in North America and global markets.

Key Trans-1,2-Dichloroethylene Companies:

The following are the leading companies in the trans-1,2-dichloroethylene market. These companies collectively hold the largest market share and dictate industry trends.

- Dow

- Westlake Corporation

- ANHUI MEISENBAO TECHNOLOGY CO., LTD.

- Ningbo Inno Pharmchem Co., Ltd.

- RCI Labscan Limited

- Nagase & Co., Ltd.

- Ereztech LLC.

- Tokyo Chemical Industry Co., Ltd. (TCI)

- Hefei TNJ Chemical Industry Co., Ltd.

- Jinan Qinmu Fine Chemical Co., Ltd.

Recent Developments

-

In May 2025, Merck KGaA was recognized as a leading supplier of ultra-high purity trans-1,2-dichloroethylene (≥6N grade) used in advanced semiconductor manufacturing. The company’s ongoing investments in R&D and electronic materials innovation are enhancing its capabilities to meet the rising demand for precision cleaning and processing solvents in chip fabrication.

Trans-1,2-Dichloroethylene Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,354.3 million

Revenue forecast in 2033

USD 2,285.7 million

Growth rate

CAGR of 6.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Grade, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Dow; Westlake Corporation; ANHUI MEISENBAO TECHNOLOGY CO., LTD.; Ningbo Inno Pharmchem Co., Ltd.; RCI Labscan Limited; Nagase & Co., Ltd.; Ereztech LLC.; Tokyo Chemical Industry Co., Ltd. (TCI); Hefei TNJ Chemical Industry Co.,Ltd.; Jinan Qinmu Fine Chemical Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Trans-1,2-Dichloroethylene Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global trans-1,2-dichloroethylene market report based on grade, application, end-use, and region:

-

Grade Outlook (Revenue, USD Million, 2018 - 2033)

-

Industrial Grade

-

Pharmaceutical Grade

-

Electronic Grade

-

-

Application Outlook (Revenue, USD Million, 2018 - 2033)

-

Solvent

-

Cleaning Agent

-

Chemical Intermediate

-

Refrigerant

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2033)

-

Chemicals

-

Electronics & Semiconductors

-

Automotive

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global trans-1,2-dichloroethylene market size was estimated at USD 1,285.9 million in 2024 and is expected to reach USD 1,354.3 million in 2025.

b. The global trans-1,2-dichloroethylene (DCE) market is expected to grow at a compound annual growth rate of 6.8% from 2025 to 2033 to reach USD 2,285.7 million by 2033.

b. North America dominated the market with largest revenue share of 41.6% in 2024. North America’s established aerospace, automotive, and industrial manufacturing sectors are fueling demand for safer cleaning solvents.

b. Some key players operating in the trans-1,2-dichloroethylene market include Dow, Westlake Corporation, ANHUI MEISENBAO TECHNOLOGY CO., LTD., Ningbo Inno Pharmchem Co., Ltd., RCI Labscan Limited, Nagase & Co., Ltd. , Ereztech LLC., Tokyo Chemical Industry Co., Ltd. (TCI), Hefei TNJ Chemical Industry Co.,Ltd., • Jinan Qinmu Fine Chemical Co., Ltd.

b. The market is expanding with rising demand from manufacturing and metalworking industries for efficient cleaning solutions. Trans-1,2-DCE’s strong solvency, quick drying, and safer profile drive its preference over traditional solvents. Its cost-effectiveness enhances adoption across key industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.