- Home

- »

- Clinical Diagnostics

- »

-

Transaminase Test Market Size, Share, Industry Report 2033GVR Report cover

![Transaminase Test Market Size, Share & Trends Report]()

Transaminase Test Market (2025 - 2033) Size, Share & Trends Analysis Report By Test Type (ALT Test, AST Test, Combined Transaminase Panels), By Technology (Automated Analyzers, Semi-Automated & Manual Systems), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-710-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2035 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Transaminase Test Market Summary

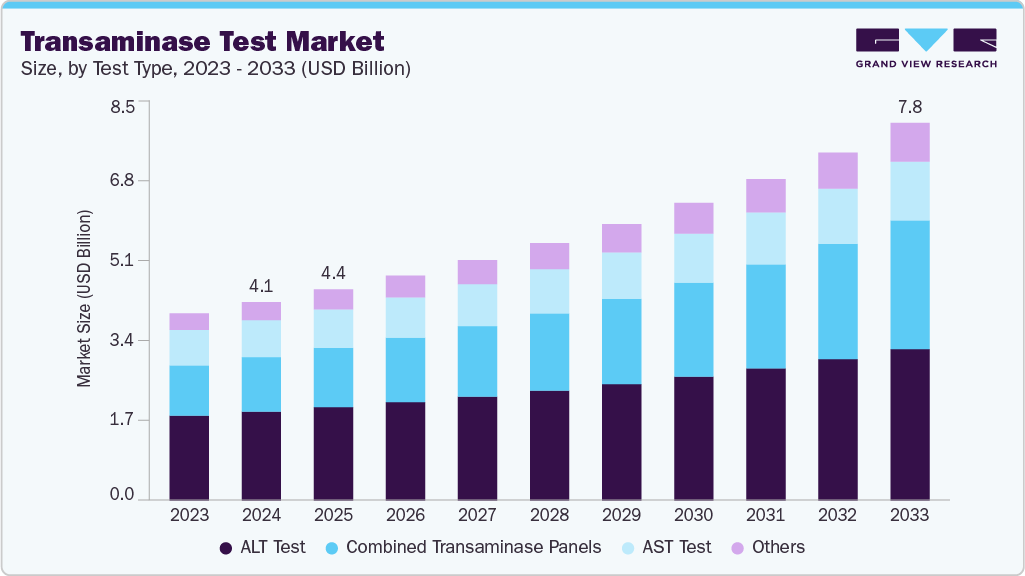

The global transaminase test market size was estimated at USD 4.10 billion in 2024 and is projected to reach USD 7.81 billion by 2033, growing at a CAGR of 7.54% from 2025 to 2033. This market centers on rapid, accurate diagnostic platforms, such as AST (Aspartate Transaminase) and GOT (Glutamic Oxaloacetic Transaminase) assays, used extensively in liver function assessment, disease monitoring, and general health screening.

Key Market Trends & Insights

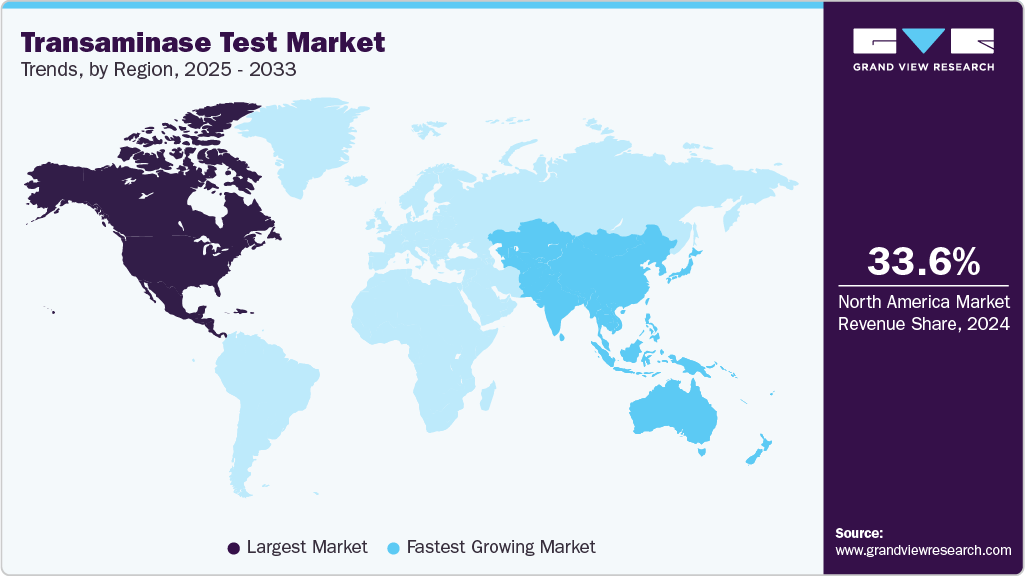

- North America transaminase test market dominated with the largest global revenue share of 33.57% in 2024.

- The U.S. led the North America market with the largest revenue share in 2024.

- Based on test type, the ALT test segment accounted for the largest revenue share of 44.22% in 2024.

- Based on technology, the automated analyzers segment dominated with the largest revenue share of 53.29% in 2024.

- Based on application, the liver disease diagnosis & monitoring segment held the largest revenue share of 60.11% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.10 Billion

- 2033 Projected Market Size: USD 7.81 Billion

- CAGR (2025-2033): 7.54%

- North America: Largest Market in 2024

- Asia Pacific: Fastest growing market

These platforms support timely clinical decisions, driven by increasing awareness of liver diseases and widespread integration into hospital, clinical, and point-of-care settings. The growth in the transaminase test industry is propelled by a combination of advancing technology and increasing access in emerging markets. Innovations in point-of-care AST/GOT devices-bolstered by AI-enabled interpretation-are reducing turnaround times and improving precision. Accessibility is expanding beyond well-resourced labs to outpatient clinics and rural settings, thanks to portable formats and software-driven automation.Another major growth driver is the rising global burden of liver disease. The increasing prevalence of non-alcoholic fatty liver disease (NAFLD), viral hepatitis, and alcohol-related liver conditions underscores the need for regular transaminase screening. Coupled with aging populations and preventive health programs, demand is mounting for reliable, cost-effective liver biomarker tests.

In March 2025, the European Medicines Agency (EMA) approved the use of the artificial intelligence (AI) tool AIM-NASH in clinical trials to assess the severity of metabolic dysfunction-associated steatohepatitis (MASH), a severe form of fatty liver disease. Developed using machine learning, AIM-NASH was trained with over 100,000 annotations from 59 pathologists and evaluated more than 5,000 liver biopsies across nine large clinical trials. The EMA's human medicines committee confirmed that AIM-NASH can reliably determine disease activity from biopsies with less variability than the current standard, which typically relies on a consensus of three pathologists. This advancement is expected to enhance the clarity of evidence regarding the benefits of new treatments in clinical trials.

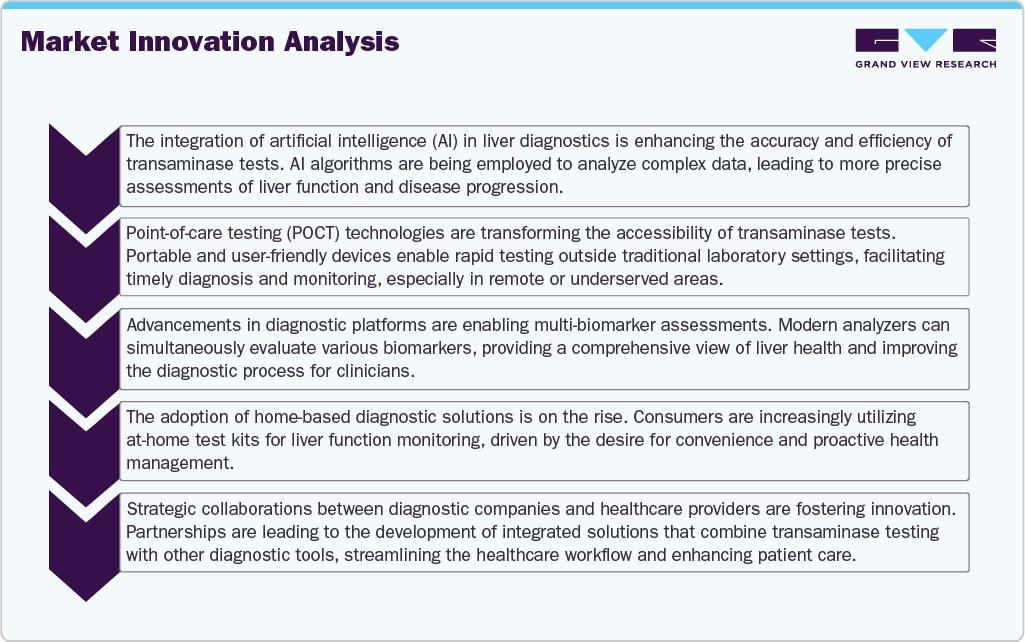

Overall, the global transaminase test market is experiencing significant transformation, driven by technological advancements and evolving healthcare needs. Integrating artificial intelligence (AI) into diagnostic platforms enhances the precision and efficiency of liver function assessments, enabling earlier detection and personalized treatment strategies. Point-of-care testing (POCT) expands access to liver diagnostics, particularly in remote and underserved regions, by providing rapid and convenient testing options. Furthermore, developing non-invasive diagnostic tools reduces reliance on traditional biopsy procedures, aligning with the growing preference for less invasive methods among patients and healthcare providers.

These innovations are improving patient outcomes and reshaping the competitive landscape, prompting key players to invest in research and development to stay at the forefront of the market. With the demand for efficient and accessible liver diagnostics continuing to rise, the market is well-positioned for sustained growth, offering opportunities for companies to leverage emerging technologies and meet the evolving needs of the global healthcare ecosystem.

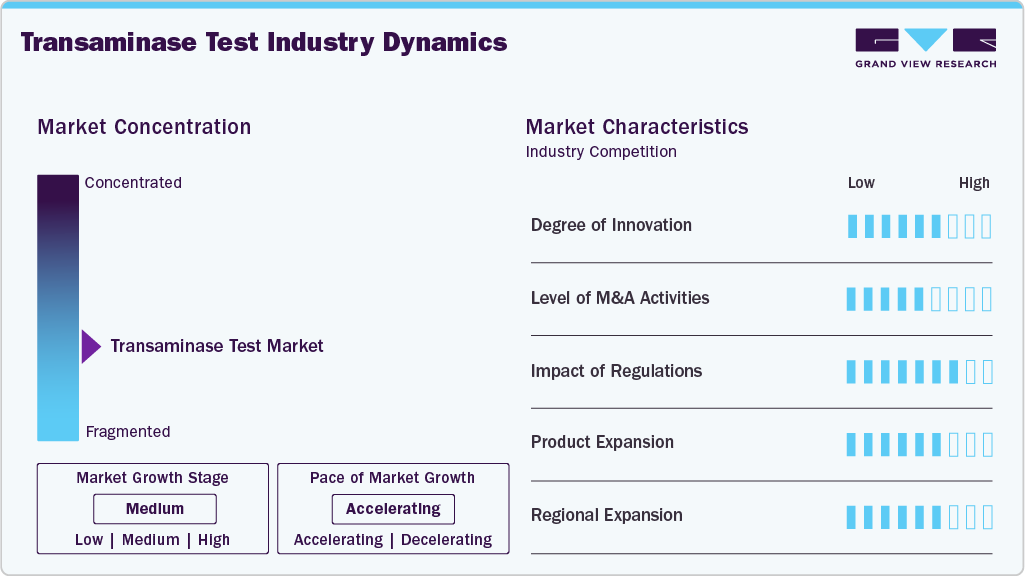

Market Concentration & Characteristics

Innovation in the transaminase test market is moderate, driven by the demand for enhanced test accuracy and faster turnaround times. Developments in automated analyzers, point-of-care devices, and assay sensitivity are improving clinical utility. Integration with laboratory information systems and digital platforms is becoming more common to streamline workflows and data management.

Mergers and acquisitions activity is steady, with key diagnostic companies acquiring smaller firms to broaden their testing capabilities and geographic presence. These deals often focus on acquiring technologies that complement existing enzyme testing platforms or expanding into emerging markets.

Regulatory frameworks remain pivotal in market dynamics. Authorities like the FDA and EMA enforce rigorous evaluation standards, ensuring test reliability and safety. Regional certifications such as CE marking support market access, while ongoing updates to regulatory guidelines influence product development and approval timelines.

Companies in the transaminase test industry are diversifying their transaminase test offerings by enhancing assay sensitivity and throughput. Some firms are developing multiplex testing platforms that can measure multiple liver function markers simultaneously. Efforts to develop compact, user-friendly systems aim to support both centralized laboratories and decentralized clinical settings.

North America and Europe maintain significant market shares due to advanced healthcare infrastructure and established diagnostic networks. Increasing focus on Asia-Pacific and Latin America arises from rising liver disease incidence and improving healthcare accessibility. Collaborations with local distributors and investments in manufacturing facilities contribute to market growth in these regions.

Test Type Insights

The ALT test segment accounted for the largest market share of 44.22% in 2024, due to rising global prevalence of liver diseases such as hepatitis, fatty liver disease, and cirrhosis-conditions in which ALT serves as a sensitive early biomarker. Increased alcohol consumption, obesity, and metabolic syndrome are driving higher screening demand. Technological advances, including automated enzymatic assays and integration into multiplex liver panels, have improved test accuracy and turnaround time, encouraging broader clinical adoption. Additionally, growing awareness among physicians and patients about preventive health has boosted demand for routine liver function screening, particularly in high-risk populations. The expansion of point-of-care testing and home-based diagnostic kits is further accelerating market penetration, especially in remote or resource-limited settings. Supportive government screening programs, coupled with rising healthcare expenditure in emerging markets, are expected to keep the ALT test segment on a high-growth trajectory.

The combined transaminase panels segment is expected to be the most lucrative application area in the transaminase test industry, due to their ability to deliver comprehensive liver function insights via a single test, streamlining diagnostics and improving clinical speed. With the rising prevalence of liver conditions such as fatty liver disease, viral hepatitis, and alcohol-related liver damage, clinicians favor panel testing for early, efficient assessment-thereby boosting demand. Technological advancements, particularly automated multiplex analyzers, enable the rapid processing of multiple enzymes and biomarkers simultaneously. This boosts laboratory efficiency, reduces turnaround time, and supports better workflow integration.

Technology Insights

The automated analyzers segment led the transaminase test market with the largest share of 53.29% in 2024, due to the rising need for high-throughput, accurate, and cost-efficient liver enzyme testing. Automated analyzers reduce human error, improve reproducibility, and handle large sample volumes, making them indispensable in clinical laboratories and hospital settings. Increasing global liver disease burden, coupled with the growing demand for routine health screenings and multiplex testing, is driving adoption. Technological advancements, such as integrated workflow automation, barcoding for sample tracking, and AI-driven result interpretation, further enhance speed and reliability. Additionally, the shift toward centralized laboratory networks in both developed and emerging markets supports the use of high-capacity automated systems. Vendors are also offering compact, bench-top versions, enabling smaller labs to benefit from automation. As healthcare systems aim for efficiency and scalability, automated analyzers are becoming the preferred platform for transaminase and other liver function testing.

The paper-based / lab-on-a-chip platform-based transaminase test segment is expected to grow at the fastest CAGR during the forecast period. These devices use capillary-driven paper microfluidics to split finger-prick blood into multiple assay zones, enabling rapid, semi-quantitative ALT/AST detection in under 15 minutes with over 90% accuracy, despite requiring no power, specialized equipment, or complex sample prep. Advancements in microfluidic design and material sciences, including 3D multilayer structures and colorimetric detection chemistries, have significantly enhanced usability and diagnostic performance. Additionally, broader lab-on-a-chip market trends-such as rising demand for POCT, regulatory support, and technological innovation-are fueling adoption across various diagnostics sectors.

Application Insights

In 2024, the liver disease diagnosis & monitoring segment dominated the transaminase test industry with the highest share of 60.11%. The growing prevalence of these conditions, driven by obesity, metabolic syndrome, alcohol misuse, and viral hepatitis, is fueling sustained demand. Elevated transaminases, commonly found in early stages of liver disease (e.g., steatosis and inflammation), are effective early indicators that support timely intervention. Healthcare providers increasingly favor these assays due to their non-invasive nature, cost-effectiveness, and potential integration with advanced automated and AI-powered platforms that improve speed, accuracy, and longitudinal monitoring.

The drug-induced liver injury (DILI) monitoring segment is expected to grow at the fastest CAGR during the forecast period. ALT in particular is highly sensitive to hepatocellular damage, helping with early DILI detection and progression assessment. Regulatory authorities and clinical guidelines underscore regular liver enzyme monitoring, especially in clinical trials and treatment regimens, as critical for patient safety and to guide drug dosing or discontinuation decisions. Moreover, DILI is a leading cause of acute liver failure and a frequent reason for drug withdrawals or halting clinical trials, making robust monitoring essential. Emerging biomarkers (like miR-122, GLDH, HMGB1) are enhancing early detection and specificity, but standard transaminase tests remain indispensable due to their widespread availability, cost-efficiency, and established clinical utility.

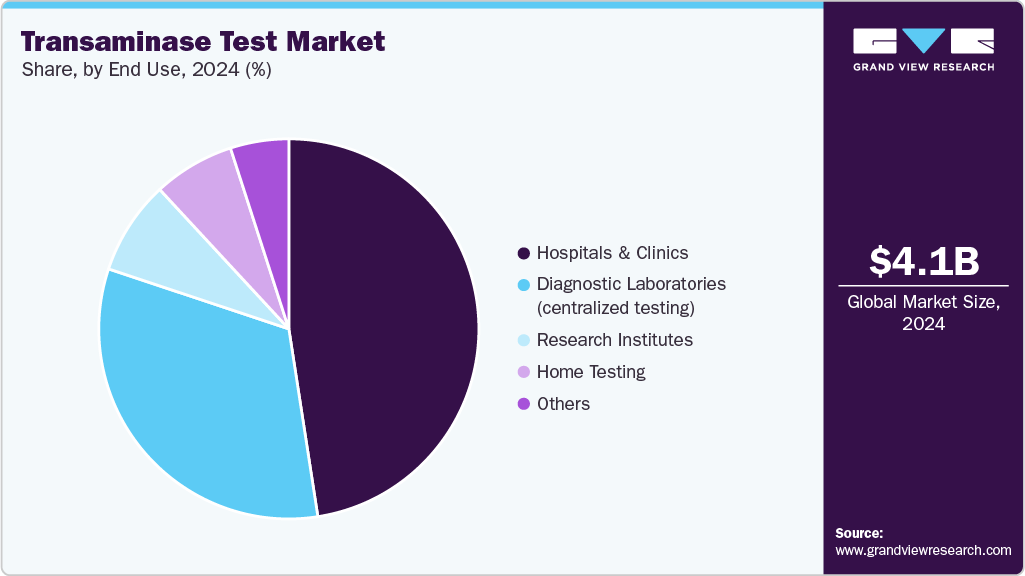

End Use Insights

In 2024, the hospitals & clinics segment held the highest share of 47.56% in the global transaminase test market, driven by their role as primary access points for comprehensive liver function assessment. Hospitals control a dominant share due to acute care demands, inpatient monitoring, pre-operative screenings, and management of chronic liver conditions, where rapid ALT/AST results are essential for clinical decision-making. Technological innovations, like high-throughput analyzers and POCT platforms integrated into hospital workflows, further enhance turnaround times and diagnostic throughput, driving adoption. Additionally, broader government health programs, preventive screenings, and routine inclusion of liver panels in wellness checkups are increasing test utilization in outpatient clinics and hospital outpatient departments.

The home care segment is expected to grow at the fastest CAGR over the forecast period, fueled by increasing consumer demand for convenient, private, and proactive health monitoring. Growing awareness of liver health, driven by rising cases of fatty liver disease, hepatitis, and lifestyle-related liver damage, has boosted interest in at-home ALT/AST kits. Advances in point-of-care biosensors, lab-on-a-chip technology, and digital health integration now allow individuals to perform liver enzyme tests with minimal training and receive results via smartphone apps or telehealth platforms. The COVID-19 pandemic accelerated acceptance of remote diagnostics, with patients and healthcare providers recognizing the value of reducing clinic visits while maintaining regular health surveillance. Home testing also supports long-term therapy monitoring for patients on hepatotoxic medications. Affordability, improved accuracy, and direct-to-consumer availability through e-commerce are further accelerating adoption. Together, these factors are making home testing a significant growth driver in the decentralization of liver health diagnostics.

Regional Insights

North America dominates the transaminase test market due to its well-established healthcare infrastructure, widespread adoption of advanced diagnostic technologies, and high awareness of liver-related health issues. The presence of major diagnostic companies and continuous investments in research and development support the availability of innovative testing solutions. Strong regulatory frameworks and reimbursement policies further facilitate market growth. Additionally, the growing prevalence of liver diseases and the increasing demand for routine liver function testing in clinical settings contribute to steady market expansion. The U.S. remains the largest contributor within the region, driven by technological advancements and strategic partnerships enhancing test accessibility.

U.S. Transaminase Test Market Trends

The U.S. leads the transaminase test industry with its advanced healthcare system and significant investment in diagnostic innovation. In September 2023, the American Liver Foundation reported that over 100 million people in the U.S. have some form of liver disease, with approximately 4.5 million adults diagnosed, driving consistent demand for accurate and timely testing. Regulatory support from agencies like the FDA and favourable reimbursement policies encourage the adoption of novel diagnostic platforms. Moreover, the presence of key diagnostic companies and ongoing collaborations with research institutions fuel the continuous development of enhanced transaminase assays and point-of-care solutions. Increasing awareness among healthcare professionals about liver health also contributes to market growth in the country.

Europe Transaminase Test Market Trends

Europe holds a significant position in the transaminase test industry, supported by a well-established healthcare infrastructure and an increasing focus on early diagnosis of liver diseases. Countries like Germany, France, and the UK have substantial patient populations affected by hepatitis, alcoholic liver disease, and non-alcoholic fatty liver disease, driving demand for effective liver function testing. Supportive regulatory frameworks and reimbursement policies across European nations facilitate the adoption of advanced diagnostic technologies. Continuous research collaborations and investments by diagnostic companies in the region foster innovation in transaminase assays and point-of-care solutions, enhancing clinical management of liver conditions. Growing public awareness about liver health further stimulates market growth across Europe.

The UK transaminase test market is shaped by ongoing research into liver injury diagnostics, with growing interest in biomarker-based assays such as glutamate dehydrogenase (GLDH). While regulatory bodies like the Medicines and Healthcare products Regulatory Agency (MHRA) and the European Medicines Agency (EMA) currently focus primarily on traditional transaminase assays (ALT and AST), research institutions in the UK are actively exploring novel biomarkers, including transcriptomic signatures, to improve the accuracy of liver function testing. These scientific developments indicate a gradual shift toward more precise and reliable diagnostics, which could influence the future landscape of transaminase testing in the region.

The transaminase test market in Germany is experiencing steady growth due to a rising incidence of liver diseases such as non-alcoholic fatty liver disease and hepatitis, alongside an aging population that increases demand for liver health monitoring. Technological advancements in diagnostic tools, including point-of-care and home testing kits, are improving accessibility and convenience for patients. Supported by stringent EU regulatory standards and healthcare policies promoting preventive care, the market is positioned for continued expansion in the coming years.

Asia Pacific Transaminase Test Market Trends

Asia Pacific is emerging as the fastest-growing region in the transaminase test industry, with the fastest CAGR driven by a growing burden of liver diseases and expanding healthcare infrastructure. Countries such as China, India, Japan, and Australia experience rising demand for efficient liver function diagnostics due to increasing awareness and government initiatives promoting early disease detection. Rapid urbanization and improvements in healthcare access support market expansion, while ongoing investments in diagnostic technology adoption strengthen testing capabilities. Regulatory authorities in the region are aligning with global standards to facilitate approval and commercialization of innovative transaminase testing solutions. Collaborations between local manufacturers and international firms play a key role in broadening product availability and affordability.

The Japan transaminase test marketholds a key position in Asia Pacific, driven by its advanced healthcare infrastructure and aging population with a high prevalence of liver diseases such as hepatitis B and C. The government’s proactive health screening programs and supportive regulatory environment promote early detection and monitoring of liver conditions. Continuous innovation by domestic diagnostic companies, along with collaborations with academic and research institutions, supports the development of sensitive and rapid transaminase assays. Growing public awareness about liver health and routine health check-ups further contributes to the sustained demand for transaminase testing in Japan.

The transaminase test market in China holds a prominent position within Asia Pacific, driven by a high prevalence of liver diseases such as hepatitis B and non-alcoholic fatty liver disease. The country’s expanding healthcare infrastructure and increasing government support for early disease screening contribute significantly to market growth. Rapid adoption of advanced diagnostic technologies, including point-of-care testing and automated analyzers, enhances liver function assessment capabilities. Regulatory authorities in China are progressively streamlining approval processes, encouraging the introduction of innovative transaminase testing products. Strategic partnerships between domestic companies and global diagnostic firms further facilitate technology transfer and market expansion.

Latin America Transaminase Test Market Trends

Latin America is witnessing steady growth in the transaminase test industry, driven by increasing awareness of liver diseases and expanding healthcare infrastructure in countries like Brazil and Argentina. The region faces a rising burden of hepatitis and non-alcoholic fatty liver disease, which fuels demand for effective liver function diagnostics. Government initiatives aimed at improving disease screening and prevention, along with improving reimbursement frameworks, support market adoption. Collaboration between local diagnostic companies and international players helps introduce advanced transaminase testing technologies. Growing public health campaigns focused on liver wellness also contribute to the market’s expansion in Latin America.

The Brazil transaminase test market is a key contributor in Latin America, supported by a large patient population affected by liver diseases such as hepatitis and fatty liver disease. The country’s expanding healthcare infrastructure and government programs aimed at improving early diagnosis and management of liver conditions drive demand for reliable transaminase tests. Regulatory support and evolving reimbursement policies encourage the adoption of advanced diagnostic technologies. Partnerships between local diagnostic firms and global companies promote innovation in transaminase assays. Additionally, increasing awareness about liver health among healthcare providers and patients contributes to sustained market growth in Brazil.

Middle East and Africa Transaminase Test Market Trends

The MEA region is experiencing growing demand for transaminase testing due to the high prevalence of liver diseases such as viral hepatitis and non-alcoholic fatty liver disease. Countries like Saudi Arabia, the UAE, and South Africa are investing in expanding healthcare infrastructure and improving diagnostic capabilities. Supportive regulatory policies and government initiatives focused on early disease detection foster market adoption of advanced transaminase assays. Collaborations between local healthcare providers and international diagnostic companies drive innovation and the availability of point-of-care testing solutions. Increasing awareness about liver health and screening programs also contributes to the steady growth of the regional market.

Key Transaminase Test Company Insights

Key players in the global transaminase test market are actively focusing on developing new tests and obtaining regulatory approvals to broaden their product portfolios. In addition, companies are engaging in strategic initiatives such as partnerships, collaborations, mergers, and acquisitions to strengthen their market position. These efforts aim to expand technology categories, enhance geographic coverage, and improve the availability of rapid and accurate transaminase diagnostic solutions across various healthcare environments.

Key Transaminase Test Companies:

The following are the leading companies in the transaminase test market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche AG

- Abbott

- Thermo Fisher Scientific

- Siemens Healthineers

- Danaher

- Randox Laboratories Ltd

- ELITechGroup

- Horiba Medical

- Alpha Laboratories

- Laboratory Corporation of America Holdings (LabCorp)

- Bio-Rad Laboratories, Inc.

- bioMérieux

Recent Developments

-

In July 2025, LuminoDx announced it will present and exhibit at the World Transplant Congress in San Francisco, showcasing its CLIA-certified liquid biopsy test, HepatoTrack. This innovative assay offers a more accurate and cost-effective alternative to conventional liver function tests such as AST and ALT, as well as liver biopsies. HepatoTrack is designed to help physicians monitor and adjust immunosuppressive therapy following liver transplantation by providing real-time insights into graft health. The test’s enhanced sensitivity and specificity have the potential to significantly influence liver disease diagnostics and patient management.

-

In May 2025, Roche introduced the Elecsys PRO-C3 test, a novel biomarker assay designed to assess liver fibrosis severity. Utilizing the ADAPT formula (Age, Diabetes status, PRO-C3, Platelets), this test enables earlier identification of patients with significant liver fibrosis, potentially improving outcomes through timely management and access to emerging therapies. The test delivers results in just 18 minutes on Roche’s cobas analysers, providing a fast and reliable diagnostic method.

Transaminase Test Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.36 billion

Revenue forecast in 2033

USD 7.81 billion

Growth rate

CAGR of 7.54% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test type, technology, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

F. Hoffmann-La Roche AG; Abbott; Thermo Fisher Scientific; Siemens Healthineers; Danaher; Randox Laboratories Ltd; ELITechGroup; Horiba Medical; Alpha Laboratories; Laboratory Corporation of America Holdings (LabCorp); Bio-Rad Laboratories, Inc.; bioMérieux

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Transaminase Test Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the transaminase test market on the basis of test type, technology, application, end use, and region:

-

Test Type Outlook (Revenue, USD Million, 2021 - 2033)

-

ALT Test

-

AST Test

-

Combined Transaminase Panels

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Automated Analyzers

-

Semi-Automated & Manual Systems

-

Point-of-Care (POC) Devices

-

Paper-Based / Lab-on-a-Chip Platforms

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Liver Disease Diagnosis & Monitoring

-

Hepatitis Screening

-

Drug-Induced Liver Injury (DILI) Monitoring

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Clinics

-

Diagnostic Laboratories (centralized testing)

-

Research Institutes

-

Home Testing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global transaminase test market size was estimated at USD 4.10 billion in 2024 and is expected to reach USD 4.36 billion in 2025

b. The global transaminase test market is expected to grow at a compound annual growth rate of 7.54% from 2025 to 2033 to reach USD 7.81 billion by 2033.

b. North America dominates the transaminase test market due to its well-established healthcare infrastructure, widespread adoption of advanced diagnostic technologies, and high awareness of liver-related health issues.

b. Some key players operating in the transaminase test market include F. Hoffmann-La Roche AG, Abbott, Thermo Fisher Scientific, Siemens Healthineers, Danaher, Randox, Laboratories Ltd, ELITechGroup, Horiba Medical, Alpha Laboratories

b. This market centers on rapid, accurate diagnostic platforms—such as AST (Aspartate Transaminase) and GOT (Glutamic Oxaloacetic Transaminase) assays—used extensively in liver function assessment, disease monitoring, and general health screening. These platforms support timely clinical decisions, driven by increasing awareness of liver diseases and widespread integration into hospital, clinical, and point-of-care settings

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.