- Home

- »

- IT Services & Applications

- »

-

Translation Management Systems Market Size Report, 2030GVR Report cover

![Translation Management Systems Market Size, Share & Trends Report]()

Translation Management Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Business Function, By Content Type, By Application, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-624-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Translation Management Systems Market Summary

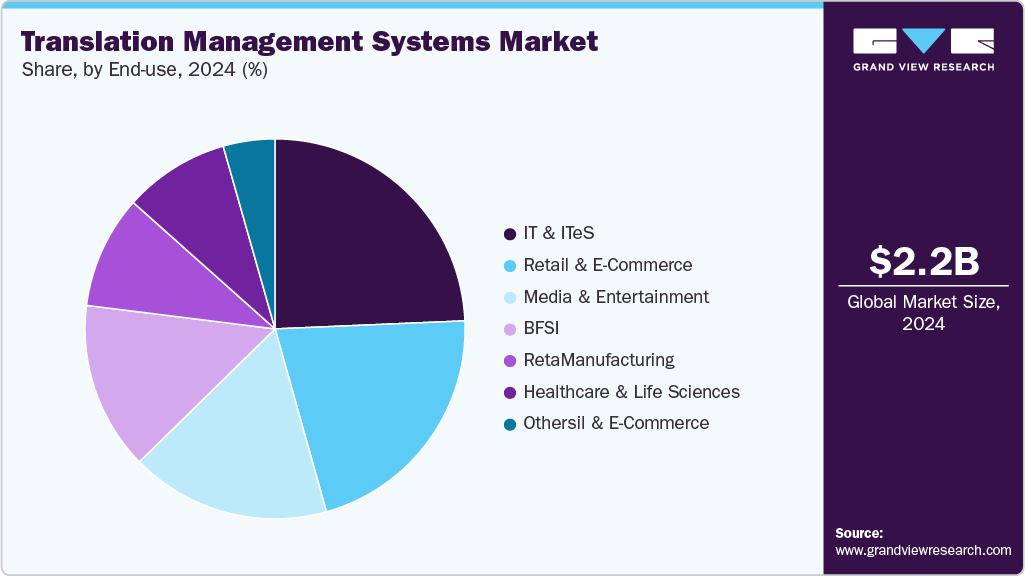

The global translation management systems market size was estimated at USD 2.16 billion in 2024 and is projected to reach USD 5.47 billion by 2030, growing at a CAGR of 17.2% from 2025 to 2030. The growth of digital content across platforms has fueled the adoption of translation management systems (TMS).

Key Market Trends & Insights

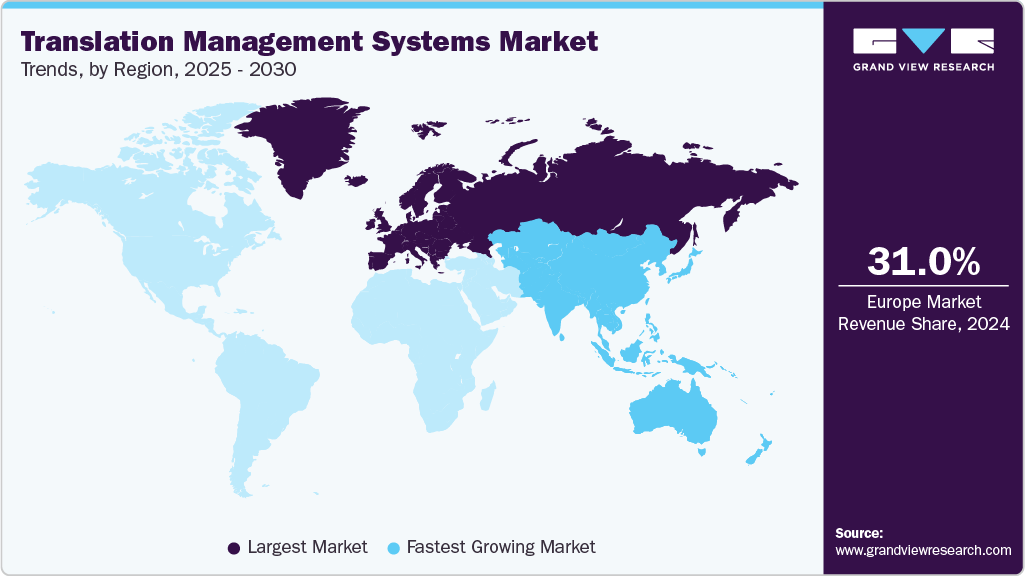

- Europe dominated the translation management systems market with the largest revenue share of 31.0% in 2024.

- The translation management systems market in the U.S. is projected to grow at the fastest CAGR during the forecast period.

- By component, the software segment led the market with the largest revenue share of 71.6% in 2024.

- By business function, the finance & accounting segment led the market with the largest revenue share of 41.85% in 2024.

- By content type, the text-based content segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.16 Billion

- 2030 Projected Market Size: USD 5.47 Billion

- CAGR (2025-2030): 17.2%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Businesses publish and manage content on websites, mobile apps, social media, and digital advertising channels simultaneously, creating a complex multilingual content ecosystem. TMS platforms provide centralized control over translation processes, integrating with content management systems (CMS), digital asset management (DAM) systems, and customer relationship management (CRM) tools to enable real-time localization. This integration not only enhances operational efficiency but also supports consistent brand messaging across all touchpoints.The growing adoption of cloud-based solutions across industries is driving market growth. Cloud-based TMS platforms offer scalability, flexibility, and ease of access, allowing teams to collaborate globally without infrastructure limitations. This is particularly beneficial for multinational companies that operate across multiple time zones and require real-time coordination among translators, editors, and project managers. Cloud TMS solutions also offer seamless updates, lower upfront costs, and better integration with modern SaaS-based enterprise tools for both large enterprises and small-to-medium businesses looking to streamline their localization processes.

The increasing role of e-learning and digital education is a critical factor contributing to market growth. Educational institutions, online course providers, and corporate training departments are investing in multilingual content to reach diverse audiences worldwide. TMS platforms enable them to manage and localize large volumes of instructional materials efficiently, ensuring consistency and accuracy in translation. This is particularly important in education, where precise wording and cultural appropriateness can significantly impact learners’ comprehension and engagement. As global demand for remote learning continues to rise, so does the reliance on TMS platforms to manage content localization effectively.

In the media and entertainment industry, the demand for subtitling, dubbing, and localized video content is rapidly increasing. Streaming services, gaming companies, and digital media producers rely heavily on TMS platforms to coordinate the translation and adaptation of content into multiple languages simultaneously. These platforms help streamline the complex workflows involved in multimedia localization, such as managing translation assets, synchronizing subtitles, and coordinating voice-over projects. As audiences continue to consume content across various languages and formats, TMS platforms serve as critical infrastructure in managing the end-to-end localization lifecycle in the entertainment sector.

Component Insights

The software segment led the market with the largest revenue share of 71.6% in 2024. The software segment benefits from the rise of remote work and globally distributed teams. TMS software supports collaborative translation processes by allowing multiple stakeholders, translators, reviewers, project managers, and clients to work on a unified platform regardless of their physical location. Features like cloud-based access, real-time progress tracking, in-context editing, and centralized communication tools make the software essential for managing complex localization projects across time zones. The efficiency and transparency this collaboration fosters are critical in reducing errors, improving turnaround times, and maintaining high-quality multilingual content.

The services segment is anticipated to grow at the fastest CAGR during the forecast period. Training and onboarding services are critical components driving this segment. Implementing a TMS platform requires users, including project managers, translators, reviewers, and content creators, to understand how to use the system effectively. Service providers deliver structured training programs, user manuals, and onboarding sessions that help organizations maximize the value of their investments. This is particularly important when deploying enterprise-grade TMS solutions across global teams, where inconsistent user proficiency can lead to underutilization of features or operational inefficiencies.

Business Function Insights

The finance & accounting segment led the market with the largest revenue share of 41.85% in 2024. The growing trend toward digital transformation in the finance industry is contributing to increased TMS adoption. Financial institutions are moving away from manual, paper-based workflows and adopting cloud-based platforms to streamline operations. TMS platforms that integrate with financial software, enterprise resource planning (ERP) systems, and document management tools allow finance teams to automate and accelerate translation processes. This level of automation enhances operational efficiency and allows finance professionals to focus on analysis and strategy rather than logistics.

The sales & marketing segment is expected to register at the fastest CAGR from 2025 to 2030. The increasing focus on personalized customer experiences is driving segment growth. Modern marketing strategies rely on data-driven segmentation and dynamic content, where messaging is tailored to individual customer profiles. This creates a significant demand for localized content at scale. TMS platforms that support real-time translation and content variations can help marketers deliver personalized experiences in the customer’s preferred language, thereby increasing engagement and conversion rates. Moreover, with integrations into content management systems (CMS), customer relationship management (CRM) tools, and marketing automation platforms, TMS software enables seamless workflows that fit into existing marketing ecosystems.

Content Type Insights

The text-based content segment accounted for the largest market revenue share in 2024. The shift toward omnichannel digital engagement strategies has increased the demand for consistent, localized text across various platforms, including websites, mobile apps, chatbots, and social media. Organizations can no longer afford fragmented or delayed translation processes. They require centralized systems like TMS platforms that enable real-time content updates and translations across all touchpoints. These systems are designed to handle continuous content deployment, integrating directly with content management systems (CMS) and marketing automation tools to ensure that new updates are instantly captured and localized. This is particularly crucial for businesses that operate in competitive industries such as e-commerce, SaaS, and digital media, where rapid content turnover and accuracy are vital for staying ahead.

The audio-based content segment is expected to register at the fastest CAGR from 2025 to 2030. The increasing use of audio and video in marketing and brand communication is driving segment growth. Global companies are investing heavily in multimedia campaigns that include explainer videos, brand storytelling, interviews, and podcasts, many of which are distributed on social media or embedded in digital platforms. To effectively reach non-native-speaking audiences, these audio assets must be accurately translated and localized while preserving their tone, pacing, and emotional resonance. A TMS that supports multimedia localization enables marketers to manage translation assets such as scripts, voice talent, and subtitles, ensuring consistency and brand alignment across all formats. This functionality is especially important in maintaining a professional and culturally relevant presence in international markets.

Application Insights

The translation segment accounted for the largest market revenue share in 2024. The increasing adoption of machine translation (MT) technologies is a significant factor fueling growth in the translation segment. Modern TMS platforms often incorporate AI-powered MT engines to provide draft translations that human translators can then post-edit. This hybrid approach enhances efficiency by enabling faster turnaround times and reducing the workload on linguists. In addition, neural machine translation (NMT) has improved the quality of automated translations, making it a viable option for less critical content or initial drafts. The integration of MT within TMS platforms is transforming traditional translation workflows, helping companies scale their multilingual efforts without a proportional increase in costs or time.

The terminology management segment is expected to register at the fastest CAGR from 2025 to 2030. The increasing complexity of multilingual projects contributes to the rising importance of terminology management. Large-scale translation efforts often involve multiple translators working on diverse content types simultaneously. Without a centralized terminology system, inconsistencies are common, resulting in confusion and rework. TMS platforms address this challenge by providing collaborative environments where terminology can be continuously updated, approved, and shared in real-time among all project stakeholders. This dynamic approach allows organizations to respond quickly to evolving language needs, industry changes, or regulatory updates, ensuring that terminology remains relevant and accurate.

End Use Insights

The IT & ITeS segment accounted for the largest market share in 2024. The fast-paced nature of software development cycles and the need for continuous localization drive the adoption of TMS in this segment. Agile development methodologies, frequent software releases, and the rise of DevOps practices mean that new content and updates must be translated and deployed rapidly without causing delays in product launches. TMS platforms enable seamless integration with development environments and content management systems through APIs and plugins, allowing localization workflows to keep pace with development timelines. This integration minimizes bottlenecks and ensures that localized versions of software and digital products are synchronized with source content, improving time-to-market in competitive technology markets.

The retail & e-commerce segment is anticipated to register at the fastest CAGR of 18.2% during the forecast period. The surge in mobile commerce and omnichannel retailing further propels the demand for sophisticated translation management. Consumers interact with brands across multiple devices and channels, including websites, mobile apps, social media, and email campaigns. Each touchpoint requires localized content that is culturally relevant and linguistically precise. TMS platforms enable retailers to maintain consistency across all channels by centralizing translation assets such as glossaries, style guides, and translation memories. This centralized approach enhances brand cohesion and reduces costs by reusing previous translations, speeding up the localization process, and minimizing errors.

Regional Insights

The translation management systems market in North America is expected to grow at a significant CAGR of 16.8% from 2025 to 2030. The booming e-commerce and retail sectors in North America also contribute significantly to the adoption of translation management systems. Retailers and online marketplaces target international customers and multicultural consumers by localizing product descriptions, marketing campaigns, and customer support services. The dynamic nature of retail content, which frequently changes with new product launches, seasonal promotions, and customer interactions, requires TMS solutions capable of managing fast turnaround times and content consistency across multiple languages and platforms. The integration of TMS with popular content management and e-commerce systems streamlines these workflows, enabling North American businesses to maintain competitive advantages in both domestic and international markets.

U.S. Translation Management Systems Market Trends

The translation management systems market in the U.S. is projected to grow at the fastest CAGR during the forecast period. The healthcare and pharmaceutical industries in the U.S. drive significant demand for translation management systems. These sectors require precise, compliant translations of patient information leaflets, clinical trial documentation, regulatory filings, and educational materials to serve a linguistically diverse patient population and meet stringent regulatory requirements. High-quality translation and consistent terminology are critical to ensuring patient safety and regulatory adherence. TMS platforms equipped with robust quality assurance, workflow management, and secure data handling features provide valuable support in meeting these complex demands.

Europe Translation Management Systems Market Trends

Europe dominated the translation management systems market with the largest revenue share of 31.0% in 2024. Europe’s industrial landscape plays a pivotal role in shaping the TMS market. The continent is a global leader in industries such as automotive, aerospace, pharmaceuticals, financial services, and manufacturing sectors, where precise technical documentation and regulatory compliance are critical. These industries produce vast volumes of complex, specialized content that must be translated accurately to ensure user safety, legal conformity, and product efficacy. Translation management systems equipped with advanced features like terminology databases, translation memories, and quality assurance tools help companies reduce errors and improve consistency in technical translations. This reduces costs and shortens time-to-market, giving European manufacturers and service providers a competitive edge internationally.

The translation management systems market in the UK is expected to grow at the fastest CAGR during the forecast period. The UK financial services sector also significantly influences the growth of the translation management industry. As London remains one of the world’s leading financial capitals, banks, insurance companies, and investment firms operate in highly regulated environments that demand precise, reliable translations of contracts, compliance documents, reports, and marketing materials. The complexity and volume of content, combined with stringent legal and regulatory requirements, necessitate the use of sophisticated TMS platforms that offer quality assurance, audit trails, and integration with content management systems. These capabilities help financial institutions reduce risks related to miscommunication, legal non-compliance, and reputational damage.

Asia Pacific Translation Management Systems Market Trends

The translation management systems market in Asia Pacific is expected to grow at the fastest CAGR of 17.9% from 2025 to 2030. The rise of global outsourcing and IT-enabled services in countries such as India, the Philippines, and Malaysia increases the complexity and volume of multilingual communication. These sectors require efficient translation workflows to handle diverse client demands and produce localized content ranging from technical documentation to customer service scripts. TMS platforms facilitate the management of multiple projects and language vendors, enhancing operational efficiency and quality control.

The India translation management systems market is projected to grow at a significant CAGR during the forecast period. Government initiatives and public sector digitalization also play a critical role in expanding the TMS market in India. Programs aimed at digital inclusion, smart governance, and accessible public services require multilingual communication strategies to reach diverse populations. For example, translating health advisories, educational materials, legal documents, and social welfare information into regional languages is vital for ensuring equity and compliance. Translation management systems offer public institutions the ability to manage large-scale translation projects with centralized control, automated workflows, and quality assurance mechanisms, which are essential for handling the volume and complexity of governmental content.

Key Translation Management Systems Company Insights

Some of the key companies operating in the market SAP SE, and Google LLC, among others are some of the leading participants in the translation management systems industry.

-

SAP SE is an enterprise application software and business technology company. SAP offers the SAP Translation Hub, a cloud-based solution designed to streamline and automate the translation process within enterprise applications. This platform enables organizations to efficiently manage multilingual content efficiently, ensuring consistent and accurate translations across various business documents and interfaces. The solution supports a wide range of languages. It is built to scale with the needs of large enterprises, making it a critical tool for businesses operating in diverse linguistic regions.

-

Google LLC is a global technology company specializing in the search engine, advertising services, and a diverse array of products and services spanning cloud computing, hardware, and software. Google provides the Translation Hub, a fully managed, self-service platform designed to streamline and automate the translation of large volumes of content. This enterprise-grade solution enables organizations to translate documents into 135 languages with a single click, utilizing Google's neural machine translation technology. Translation Hub integrates human feedback through a human-in-the-loop approach, allowing for post-editing and refinement of machine-generated translations.

TransPerfect and Acolad Group are some of the emerging market participants in the translation management systems industry.

-

TransPerfect is a privately held American company specialzing in language services and translation-related technologies. GlobalLink is TransPerfect's flagship translation management system, designed to simplify and optimize the management of multilingual content. The platform centralizes the localization process, reducing project management time and costs while improving translation quality and consistency. By automating tasks such as project creation, submission, tracking, approval, review, and delivery, GlobalLink enables organizations to streamline their workflows and accelerate time-to-market for global content.

-

Acolad Group is a global company specializing in content and language solutions. Acolad provides the Acolad Portal, an all-in-one cloud-based platform designed to streamline and automate translation workflows. Acolad Portal serves as a centralized hub for managing multilingual content projects, offering features such as real-time project tracking, budget transparency, and secure data handling with top-tier encryption standards. The platform supports a wide range of file types and integrates seamlessly with various content management systems, enabling organizations to manage complex translation projects efficiently.

Key Translation Management Systems Companies:

The following are the leading companies in the translation management systems market. These companies collectively hold the largest market share and dictate industry trends.

- Acolad Group

- Babylon Software

- Centific

- Google LLC

- LanguageLine Solutions

- Lionbridge

- Localize Corporation

- Microsoft Corporation

- Oracle Corporation

- RWS Group

- SAP SE

- Smartcat

- Transifex

- Translate Plus

- TransPerfect

Recent Developments

- In March 2025, TransPerfect launched an integration of its GlobalLink technology with ServiceNow, an AI-driven platform that offers applications to help customers streamline and automate their workflows. GlobalLink for ServiceNow is TransPerfect’s comprehensive, generative AI-powered solution designed to initiate, automate, manage, track, and complete every aspect of the translation process within the ServiceNow interface. By combining ServiceNow’s workflow automation capabilities with GlobalLink’s translation management expertise, users gain an intuitive and all-encompassing solution for handling global content with minimal IT involvement.

-

In March 2025, TransPerfect acquired Blu Digital Group, which operates as a division within TransPerfect Media. This acquisition allows TransPerfect’s clients to leverage Blu Digital Group’s SaaS products and automation tools. At the same time, Blu Digital Group’s clients will have access to TransPerfect’s wide range of AI-driven and human language services, as well as the GlobalLink global performance platform, including GlobalLink Media.

-

In September 2024, RWS Group signed a strategic collaboration agreement with Amazon Web Services Inc. to develop and launch new solutions powered by generative AI. Through this partnership, RWS and AWS aim to enhance the efficiency of content creation, translation, and delivery for clients. As part of the collaboration, RWS is currently working with Amazon Web Services on 25 new product features and several new proof-of-concept initiatives.

-

In June 2024, Acolad Group signed a strategic partnership with AI language solutions provider DeepL, marking a significant step in its broader strategy to blend human expertise with cutting-edge technology. This collaboration aims to deliver innovative, tailored solutions that address the evolving needs of customers. The company continues to grow its Generative AI (GenAI) portfolio, introducing AI-assisted content creation, quality management tools, AI-driven voice solutions, compliance support, and enhanced machine translation technologies.

Translation Management Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.48 billion

Revenue forecast in 2030

USD 5.47 billion

Growth rate

CAGR of 17.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, business function, content type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Localize Corporation; TransPerfect; Lionbridge; Translate Plus; Microsoft Corporation; Google LLC; Babylon Software; RWS Group; Acolad Group; LanguageLine Solutions; Oracle Corporation; SAP SE; Transifex; Smartcat; Centific

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Translation Management Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the translation management systems market report based on component, business function, content type, application, end use, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Translation Software

-

Localization Software

-

Terminology Management Software

-

Quality Assurance Software

-

Analytics and Reporting

-

Others

-

-

Services

-

Professional Services

-

Managed Services

-

-

Business Function Outlook (Revenue, USD Billion, 2018 - 2030)

-

Finance & Accounting

-

Sales & Marketing

-

Legal

-

Human Resources

-

Others

-

-

Content Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Audio-based Content

-

Text-based Content

-

Video-based Content

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Terminology Management

-

Translation

-

Project Management

-

Quality Assurance

-

Billing & Invoicing Analysis

-

Resource Management

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail and E-commerce

-

Media & Entertainment

-

IT & ITeS

-

Healthcare & Life Sciences

-

BFSI

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global translation management systems market size was estimated at USD 2.10 billion in 2024 and is expected to reach USD 2.40 billion in 2025.

b. The global translation management systems market is expected to grow at a compound annual growth rate of 17.2% from 2025 to 2030 to reach USD 5.47 billion by 2030.

b. The finance & accounting segment dominated the market and accounted for a revenue share of over 41.0% in 2024 in the translation management systems market. The growing trend toward digital transformation in the finance industry is contributing to increased TMS adoption.

b. Some key players operating in the market include Localize Corporation, TransPerfect, Lionbridge, Translate Plus, Microsoft Corporation, Google LLC, Babylon Software, RWS Group, Acolad Group, LanguageLine Solutions, Oracle Corporation, SAP SE, Transifex, Smartcat, Centific

b. Factors such the growth of digital content across platforms and the increasing role of e-learning and digital education is a critical factor contributing to market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.