- Home

- »

- Next Generation Technologies

- »

-

Transparent Display Market Size, Industry Report, 2033GVR Report cover

![Transparent Display Market Size, Share & Trends Report]()

Transparent Display Market (2026 - 2033) Size, Share & Trends Analysis Report By Resolution (Ultra HD, Full HD, HD, 4K And Above), By Display Size (Small & Medium, Large), By Technology, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-860-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Transparent Display Market Summary

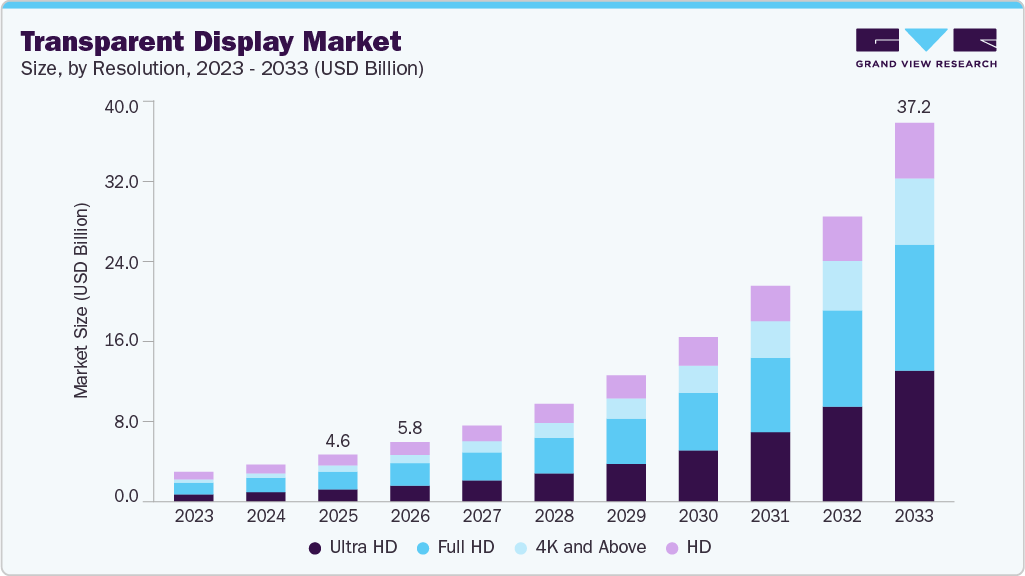

The global transparent display market size was valued at USD 4,598.0 million in 2025 and is projected to reach USD 37,204.2 million by 2033, growing at a CAGR of 30.3% from 2026 to 2033. The growth is driven by the rising demand for next-generation display solutions that enable immersive visual communication.

Key Market Trends & Insights

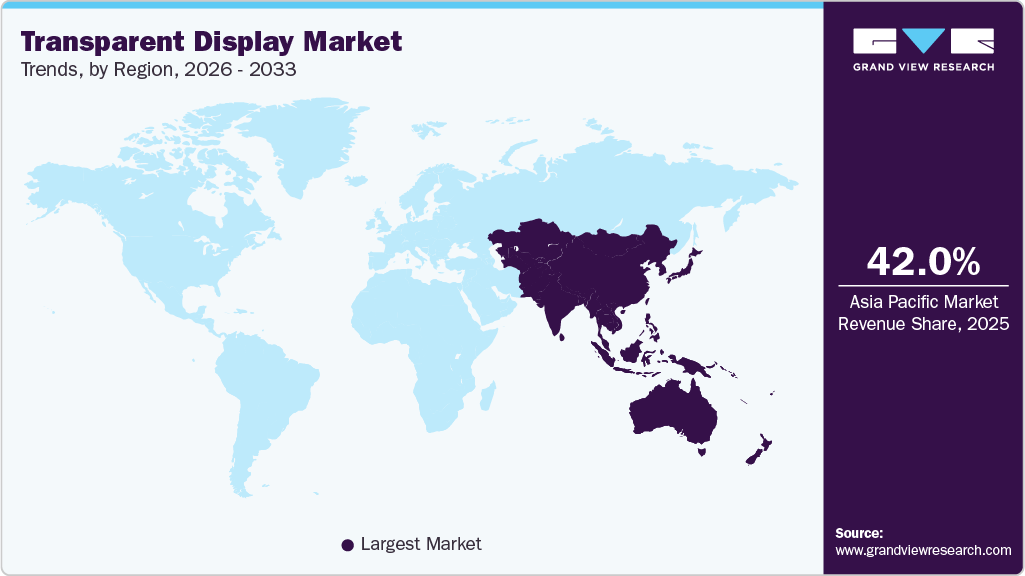

- The Asia Pacific transparent display market accounted for the largest revenue share of over 42% in 2025.

- Based on resolution, the full HD segment held the highest market share of over 38% in 2025.

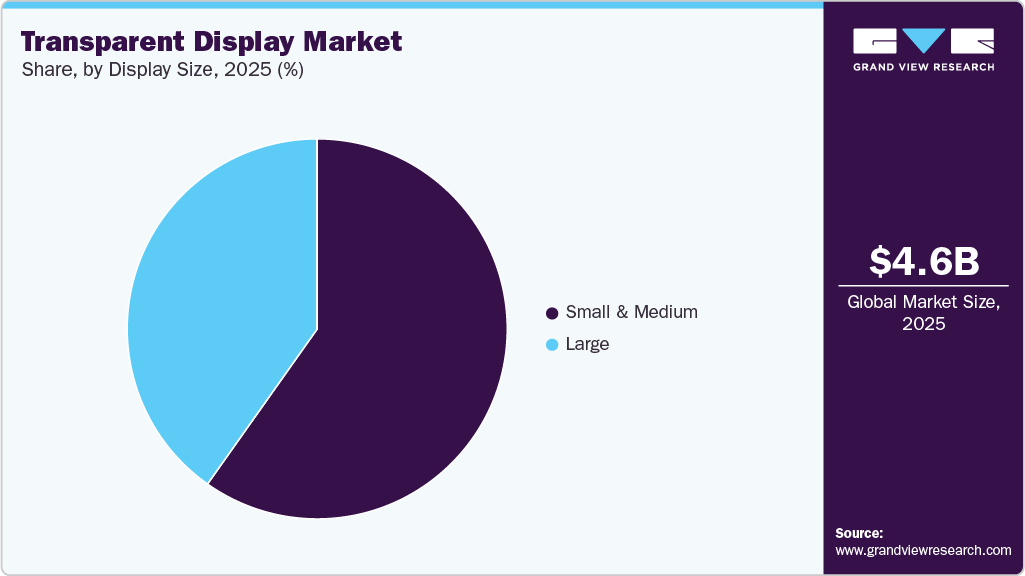

- Based on display size, the small & medium segment accounted for the largest revenue share of over 59% in 2025.

- Based on technology, the LCD segment held the largest market share of over 42% in 2025.

- Based on end use, the retail segment accounted for the highest market share of over 29% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 4,598.0 Million

- 2033 Projected Market Size: USD 37,204.2 Million

- CAGR (2026-2033): 30.3%

- Asia Pacific: Largest market in 2025

Technological advancements in OLED- and micro-LED-based transparent panels, improvements in pixel density and brightness, and integration with IoT-enabled smart glass systems are enabling wider commercial adoption, further accelerating the growth of the transparent display industry.The increasing adoption of next-generation display technologies, such as OLED-based transparent panels, micro-LED transparent screens, and smart glass-integrated digital signage, is expected to enhance visual engagement, improve space utilization, and deliver a premium user experience. The growing emphasis on immersive retail experiences, futuristic automotive cockpit designs, and smart building infrastructure, along with rising demand for interactive storefront advertising and advanced head-up display systems, is accelerating enterprise investments in advanced transparent displays, thereby contributing to the sustained expansion of the industry.

The rapid integration of automotive-grade transparent display systems, including AR head-up displays (HUDs), transparent dashboard panels, and windshield-projected interfaces, is creating substantial growth opportunities for the transparent display market. These innovations enable real-time navigation overlays, driver-assistance visualization, and enhanced cockpit user experiences while maintaining visibility and safety compliance. This trend is accelerating demand for high-brightness, high-transparency OLED and micro-LED displays that support durability, sunlight readability, and seamless integration into next-generation vehicle interiors.

Additionally, government initiatives worldwide are significant drivers fueling the growth of the transparent display industry. Public investments supporting smart city infrastructure, intelligent transportation systems, and digital public signage modernization are encouraging the adoption of advanced transparent display solutions across airports, metro stations, government buildings, and tourism hubs. Government-backed programs focused on energy-efficient building upgrades and smart commercial architecture are also lowering the financial barriers for deploying transparent OLED and smart glass-integrated displays, thereby propelling the expansion of the industry.

Moreover, leading display manufacturers and technology providers are actively strengthening their market position by expanding their production capabilities and commercial deployment partnerships. Companies are forming strategic collaborations with retail chains, luxury brands, smart glass manufacturers, and digital signage integrators to scale transparent displays for storefront advertising, interactive product showcases, and premium indoor commercial environments. The emphasis on improved transparency ratios, better contrast performance, longer operational lifetimes, and scalable manufacturing yields is further increasing the attractiveness of modern transparent displays, thereby supporting sustained market expansion.

Resolution Insights

The full HD segment accounted for the largest revenue share of over 38% in 2025, driven by the strong demand for cost-effective transparent display deployments across retail storefronts, commercial digital signage, museums, and indoor advertising environments. Full HD resolution remains highly preferred for high-volume installations where buyers prioritize affordable panel sourcing, stable image clarity, lower power consumption, and compatibility with existing content ecosystems. These factors reflect the continued focus on scalable rollout and faster adoption of entry-level transparent OLED solutions within the full HD segment.

The ultra HD segment is expected to register the fastest CAGR of over 35% from 2026 to 2033. This growth is attributed to the rising emphasis on premium visual experiences, increasing adoption of AR-enabled automotive head-up displays, and the growing demand for high-resolution transparent panels. The integration of micro-LED and advanced transparent OLED technologies, along with improvements in brightness, pixel density, and optical transparency, is enabling sharper content rendering even under high ambient light conditions, thereby accelerating the adoption of ultra HD transparent displays across high-end commercial and automotive applications.

Technology Insights

The LCD segment accounted for the largest market share in 2025, driven by its strong cost advantage, mature manufacturing ecosystem, and widespread availability of transparent LCD modules. Transparent LCD technology remains highly preferred for large-scale deployments where buyers prioritize lower procurement costs, stable supply chains, and standardized integration with existing signage systems. The growing demand for budget-efficient transparent display installations across malls, transportation hubs, and indoor advertising environments is further strengthening adoption, thereby sustaining the leadership of the LCD segment in the industry.

The micro-LED segment is expected to witness the fastest CAGR from 2026 to 2033. This growth is primarily driven by the increasing demand for ultra-high brightness, superior contrast, and burn-in resistance, which are critical for transparent display applications. The rapid advancements in micro-LED manufacturing yield improvements in pixel-level control, and the rising commercialization of modular transparent micro-LED panels. The increasing focus on high-performance transparent displays capable of delivering vivid content without compromising transparency is further fueling growth in the micro-LED segment in the industry.

End Use Insights

The retail segment accounted for the largest market share in 2025, driven by the growing demand for high-impact storefront advertising, rising adoption of digital-out-of-home (DOOH) media, and the increasing shift toward experiential retail formats. Retailers and luxury brands are increasingly deploying transparent displays in shop windows, in-store glass showcases, smart shelves, and product demonstration zones to enhance customer attention. The strong expansion of omnichannel retail strategies and rising investments in interactive merchandising are further increasing demand, thereby sustaining the leadership of the retail segment in the market.

The automotive segment is expected to register the fastest CAGR from 2026 to 2033. This growth is primarily driven by the rapid adoption of advanced driver-assistance systems (ADAS), increasing demand for augmented reality head-up displays (AR-HUDs), and the rising shift toward software-defined vehicles. The growing production of electric vehicles, increasing consumer preference for premium cockpit features, and continuous advancements in high-brightness transparent technologies are accelerating adoption, thereby supporting the strong growth of the segment in the industry.

Display Size Insights

The small & medium segment accounted for the largest market share in 2025, driven by the rising adoption of transparent displays in automotive head-up displays (HUDs), instrument clusters, smart rearview mirrors, and compact in-cabin information panels. The increasing deployment of transparent displays in retail point-of-sale counters, smart vending machines, and interactive product showcases is further strengthening demand. These factors reflect the continued focus on high-volume, standardized installations and cost-efficient production of transparent panels, thereby sustaining the leadership of the small & medium segment in the transparent display industry.

The large segment is expected to witness the fastest CAGR from 2026 to 2033. This growth is primarily driven by the expanding use of large transparent displays in storefront window advertising, glass wall digital signage, luxury brand flagship stores, museums, and high-footfall public infrastructure such as airports and metro stations. The increasing availability of modular large transparent panels, improvements in sunlight readability, and advancements in glass bonding and structural integration are further fueling growth in the industry.

Regional Insights

North America transparent display market accounted for a revenue share of over 25% in 2025, fueled by the region’s strong adoption of premium digital signage, high penetration of advanced retail visualization technologies, and the presence of major display innovators accelerating the commercialization of transparent OLED solutions. The rapid modernization of smart retail storefronts, airports, and high-end commercial infrastructure is driving demand for transparent displays. North America remains a global innovation hub for micro-LED development, AR-enabled display interfaces, and AI-powered interactive retail experiences, which are expected to redefine transparent display capabilities.

U.S. Transparent Display Market Trends

The transparent display market in the U.S. accounted for the largest regional share of over 79% in 2025, driven by the rapid deployment of digital-out-of-home (DOOH) advertising, strong investments in automotive HUD systems, and increasing adoption of smart glass and interactive display solutions. The U.S. focus on advanced driver-assistance systems (ADAS), next-generation cockpit digitization, and luxury vehicle personalization is accelerating demand for transparent displays. The country’s strong ecosystem of technology vendors, system integrators, and commercial display manufacturers is supporting the faster rollout of high-brightness transparent OLED and micro-LED products.

Europe Transparent Display Market Trends

The transparent display market in Europe is expected to grow at a CAGR of over 28% from 2026 to 2033. In Europe, the market is driven by rising adoption of energy-efficient smart building solutions, the expansion of high-end retail and luxury storefront modernization, and strong investments in interactive public information systems. The region’s emphasis on sustainability, architectural innovation, and premium customer experiences is encouraging the integration of transparent displays into glass façades, retail windows, and smart transportation hubs. Europe’s strong automotive manufacturing base is supporting demand for transparent displays in next-generation cockpit and HUD applications.

The UK transparent display market is expected to grow at a significant rate in the coming years. This expansion is supported by the U.K.’s strong growth in digital-out-of-home advertising and rising demand for immersive in-store product experiences across fashion, electronics, and luxury segments. The rapid adoption of interactive window displays, combined with the strong commercialization of retail technology in London and other metropolitan hubs, is encouraging brands to deploy transparent display-based storefront engagement solutions, thereby supporting sustained market growth in the country.

The transparent display market in Germany is rapidly expanding, driven by the country’s strong leadership in automotive engineering and rising adoption of AR head-up displays. Germany’s advanced manufacturing ecosystem and strong presence of automotive OEMs and Tier-1 suppliers are accelerating the integration of transparent displays into windshields, dashboards, and passenger infotainment systems. The growing modernization of smart factories and transportation infrastructure is increasing demand for high-durability transparent displays, reinforcing Germany’s position as a key growth market for the industry.

Asia-Pacific Transparent Display Market Trends

The transparent display market in Asia-Pacific is expected to register the highest CAGR of over 33% from 2026 to 2033, fueled by the rapid expansion of consumer electronics manufacturing, rising investments in smart city projects, and strong adoption of digital signage. The region’s dominance in display panel production, combined with aggressive innovation in OLED, micro-LED, and advanced glass technologies, is enabling faster commercialization and cost reduction. These factors are positioning Asia-Pacific as the fastest-growing market for transparent displays.

The Japan transparent display market is gaining momentum, driven by strong demand for premium consumer electronics, rapid adoption of transparent displays in high-end retail and brand showrooms, and increasing integration of AR-enabled visualization technologies in smart commercial environments. Japan’s focus on innovation-driven retail experiences, combined with strong adoption of advanced automotive cockpit systems, is supporting demand for transparent OLED displays with high clarity and durability. The increasing use of transparent displays in public venues, exhibitions, and smart transportation hubs is further strengthening long-term market growth in the country

The transparent display market in China is witnessing robust expansion, supported by the country’s dominance in display panel manufacturing, rapid rollout of smart retail ecosystems, and large-scale deployment of DOOH advertising infrastructure. China’s strong investments in micro-LED commercialization, high-volume OLED production, and smart glass integration are accelerating product availability and reducing cost barriers. The growing demand for transparent displays in shopping malls, metro stations, automotive applications, and interactive brand experiences is driving widespread adoption of transparent display solutions across the country.

Key Transparent Display Companies Insights

Some of the key players operating in the market are LG DISPLAY CO., LTD., and Samsung Electronics Co., Ltd., among others.

-

LG DISPLAY CO., LTD. is a global company in advanced display technologies, specializing in transparent OLED and next-generation panel solutions that enable high transparency, vivid color reproduction, and integration into smart retail, automotive HUD, and commercial signage applications. With extensive R&D in micro-LED and transparent display optics, the company drives innovation in immersive customer engagement, premium storefront experiences, and connected smart environments, reinforcing its position as a core supplier in the transparent display industry.

-

Samsung Electronics Co., Ltd. is a major innovator in transparent display technologies, offering transparent OLED, transparent LED, and advanced smart signage solutions for automotive, retail, and experiential display markets. Samsung’s transparent displays are integrated into smart glass applications, advanced head-up displays, and retail digital window systems that enhance visual interaction and brand storytelling while maintaining see-through clarity. The company’s strong ecosystem of hardware, software, and display intelligence — including AI-enabled content management and sensor integration — supports scalable deployment of transparent display solutions across global commercial and automotive segments.

Pro Display Ltd. and Kent Optronics, Inc. are some of the emerging participants in the transparent display market.

-

Pro Display Ltd. is a specialist in transparent display modules and integrated systems designed for luxury retail, experiential marketing, and architectural showcase applications. Pro Display focuses on transparent OLED and high-performance transparent LCD technologies that blend digital content with physical environments, enabling brands to deliver immersive product visualization without obstructing the underlying space. With customizable form factors, interactive touch integration, and design-centric deployment approaches, Pro Display is gaining traction among premium retailers and creative agencies seeking differentiated transparent display experiences.

-

Kent Optronics, Inc. is an emerging transparent display technology provider offering transparent OLED and interactive transparent panel solutions targeted at niche commercial and industrial applications. Kent Optronics emphasizes modular transparent screens, high transparency ratios, and enhanced optical performance to support digital signage, augmented visual interfaces, and integrated display solutions for smart buildings and vertical markets. The company’s focus on flexible integration, rapid prototyping, and tailored transparent display configurations positions it as a growing innovator within the transparent display ecosystem.

Key Transparent Display Companies:

The following key companies have been profiled for this study on the transparent display market.

- LG DISPLAY CO., LTD.

- Samsung Electronics Co., Ltd.

- BOE Technology Group Co., Ltd.

- Panasonic Corporation

- Planar Systems, Inc.

- Pro Display Ltd.

- Crystal Display Systems Ltd.

- Universal Display Corporation

- Kent Optronics, Inc.

- Nexnovo.

Recent Developments

-

In January 2026, LG DISPLAY CO., LTD. announced that it is making transparent OLED technology a core growth pillar for 2026, with plans to significantly increase panel transparency and target next-generation automotive displays and XR (extended reality) applications. This strategic focus highlights LG’s commitment to advancing transparent OLED performance for use in immersive vehicle cockpits and wearable displays, further solidifying its leadership in the transparent display market.

-

In March 2025, Samsung Electronics Co., Ltd. announced a supply of transparent OLED panels for a global automotive OEM’s digital cockpit program, signaling accelerated commercialization of transparent displays in next-generation vehicle interiors focused on heads-up and cabin information systems. This development places Samsung Display as a growing supplier of automotive-grade transparent panels.

-

In March 2025, BOE Technology Group Co., Ltd. announced a strategic partnership with Visionox to co-develop and mass-produce transparent flexible OLED panels aimed at automotive heads-up displays and high-end retail signage, indicating collaborative momentum to scale transparent OLED production and widen its application scope. This partnership supports BOE’s evolution in transparent display technology adoption.

Transparent Display Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 5,835.6 million

Revenue forecast in 2033

USD 37,204.2 million

Growth rate

CAGR of 30.3% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Resolution, display size, technology, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

LG DISPLAY CO., LTD.; Samsung Electronics Co., Ltd.; BOE Technology Group Co., Ltd.; Panasonic Corporation; Planar Systems, Inc.; Pro Display Ltd.; Crystal Display Systems Ltd; Universal Display Corporation; Kent Optronics, Inc.; Nexnovo.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Transparent Display Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global transparent display market report based on resolution, display size, technology, end use, and region:

-

Resolution Outlook (Revenue, USD Million, 2021 - 2033)

-

Ultra HD

-

Full HD

-

HD

-

4K and Above

-

-

Display Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Small & Medium

-

Large

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

LCD

-

OLED

-

Micro-LED

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Consumer Electronics

-

Healthcare

-

Automotive

-

Aerospace and Defense

-

Industrial & Manufacturing

-

Retail

-

Others

-

-

Transparent Display Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global transparent display market size was estimated at USD 4,598.0 million in 2025 and is expected to reach USD 5,835.6 million in 2026

b. The global transparent display market is expected to grow at a compound annual growth rate of 30.3% from 2026 to 2033 to reach USD 37,204.2 million by 2033

b. The full HD segment accounted for the largest market share of over 38% in 2025, driven by the strong demand for cost-effective transparent display deployments across retail storefronts, commercial digital signage, museums, and indoor advertising environments. Full HD resolution remains highly preferred for high-volume installations where buyers prioritize affordable panel sourcing, stable image clarity, lower power consumption, and compatibility with existing content ecosystems. These factors reflect the continued focus on scalable rollout and faster adoption of entry-level transparent OLED solutions within the full HD segment.

b. Some key players operating in the transparent display market include LG DISPLAY CO., LTD., Samsung Electronics Co., Ltd., BOE Technology Group Co., Ltd., Panasonic Corporation, Planar Systems, Inc., Pro Display Ltd., Crystal Display Systems Ltd, Universal Display Corporation, Kent Optronics, Inc., Nexnovo.

b. The market growth is driven by the rising demand for next-generation display solutions that enable immersive visual communication. Technological advancements in OLED- and micro-LED-based transparent panels, improvements in pixel density and brightness, and integration with IoT-enabled smart glass systems are enabling wider commercial adoption, further accelerating the growth of the transparent display industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.