- Home

- »

- Advanced Interior Materials

- »

-

Tray Former Machines Market Size, Industry Report, 2033GVR Report cover

![Tray Former Machines Market Size, Share & Trends Report]()

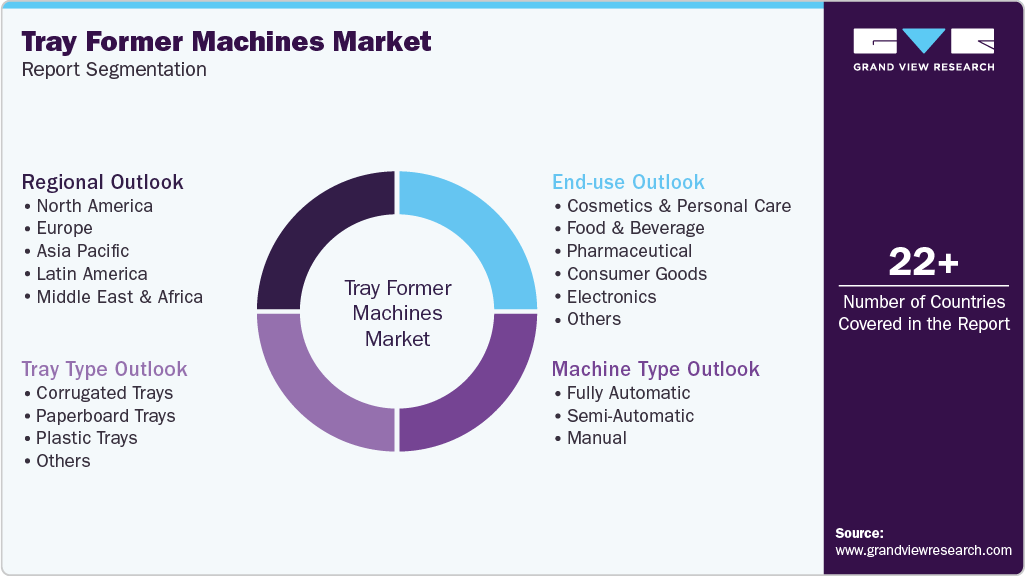

Tray Former Machines Market (2025 - 2033) Size, Share & Trends Analysis Report By Machine Type (Fully Automatic, Semi-Automatic), By Tray Type (Corrugated Trays, Paperboard Trays), By End Use (Pharmaceuticals, Food & Beverage), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-631-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Tray Former Machines Market Summary

The global tray former machines market size was estimated at USD 1,905.9 million in 2024, and is projected to reach USD 2,822.3 million by 2033, growing at a CAGR of 4.7% from 2025 to 2033. The global increase in demand for packaged food and beverages is a key driver for the tray former machines industry.

Key Market Trends & Insights

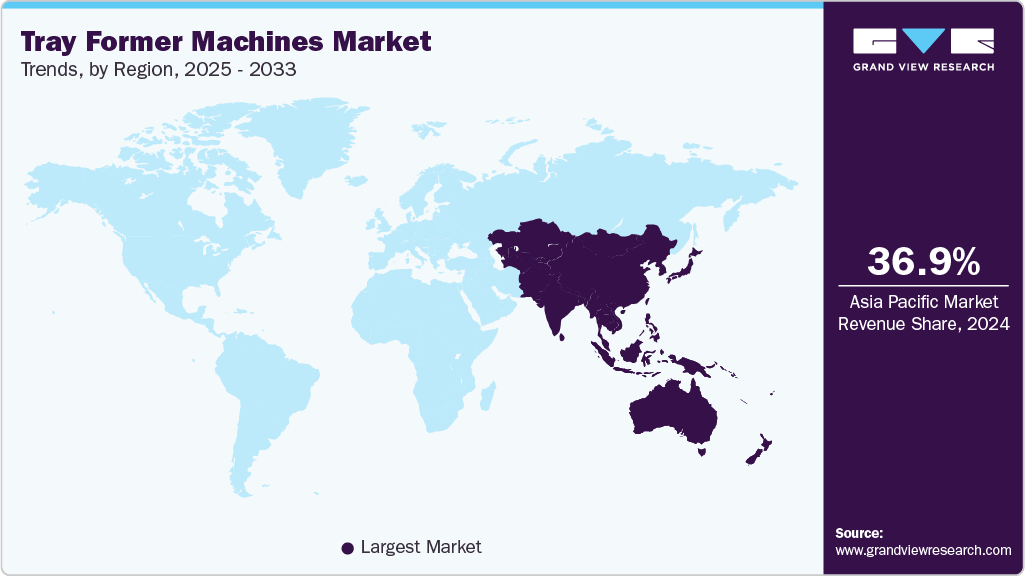

- Asia Pacific dominated the tray former machines market with the largest revenue share of 36.9% in 2024.

- The U.S. tray former market is projected to expand at a CAGR of 4.5% over the forecast period.

- By machine type, the fully automatic segment is expected to grow at a considerable CAGR of 5.0% from 2025 to 2033 in terms of revenue.

- By tray type, the paperboard trays segment is expected to grow at a considerable CAGR of 4.5% from 2025 to 2033 in terms of revenue.

- By end use, the pharmaceuticals segment is expected to grow at a considerable CAGR of 5.7% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 1,905.9 Million

- 2033 Projected Market Size: USD 2,822.3 Million

- CAGR (2025-2033): 4.7%

- Asia Pacific: Largest market in 2024

- Latin America: Fastest growing region

As consumers increasingly prefer ready-to-eat meals and convenience foods, manufacturers are turning to efficient, high-speed packaging solutions to meet this demand. In addition to the growing food sector, the push for automation and improved operational efficiency across industries is fueling the adoption of tray former machines. Companies are increasingly investing in automated packaging systems to enhance productivity, ensure consistent tray quality, and reduce human error. Tray formers offer precise, reliable performance and can be seamlessly integrated into existing production lines, supporting the shift toward smart manufacturing and Industry 4.0 initiatives. This demand for automation is expected to remain a strong growth factor in the global tray former machines industry.

Market Concentration & Characteristics

The global tray former machines industry is fragmented, characterized by the presence of numerous regional and international players. While a few large companies hold significant market share due to their broad product portfolios and global reach, many small and medium-sized manufacturers compete by offering customized or cost-effective solutions tailored to local markets. The diversity in application areas, ranging from food and beverages to pharmaceuticals and industrial packaging, also contributes to the fragmented nature of the market, allowing niche players to thrive alongside larger corporations.

The tray former machines industry exhibits a moderate to high degree of innovation, driven by the demand for faster, more energy-efficient, and automated packaging solutions. Innovations focus on improving machine flexibility to handle various tray sizes, enhancing user interfaces, and integrating smart technologies for predictive maintenance. Sustainability is also influencing innovation, with machines increasingly designed to accommodate eco-friendly materials.

The level of M&A activity in the tray former machines industry is moderate, with strategic acquisitions primarily aimed at expanding technological capabilities and geographic presence. Larger players often acquire smaller firms to access new customer segments, specialized machinery, or innovative packaging technologies. These moves help companies strengthen their market positions and diversify product offerings. However, the fragmented nature of the market limits the frequency of large-scale mergers.

Regulations significantly impact the tray former machines industry, particularly in industries like food, pharmaceuticals, and consumer goods. Manufacturers must comply with strict hygiene, safety, and environmental standards, influencing machine design and material compatibility. In addition, increasing regulatory pressure to reduce plastic use and encourage sustainable packaging is shaping machine capabilities. Compliance with regional standards (e.g., FDA, EU directives) also affects market entry and competitiveness.

Drivers, Opportunities & Restraints

The primary drivers of the tray former machines industry include growing demand for packaged and processed foods, increased automation in manufacturing, and the need for consistent, high-speed packaging solutions. Industries such as food, pharmaceuticals, and logistics rely heavily on efficient packaging lines. Technological advancements have also improved machine reliability and versatility. This combination continues to fuel global market expansion.

Emerging markets present significant growth opportunities due to rising industrialization and urbanization. In addition, the shift toward sustainable and eco-friendly packaging creates demand for machines compatible with recyclable materials. Customization and integration with smart factory systems offer value-added prospects. These trends open new avenues for manufacturers and solution providers.

High initial investment and maintenance costs can be a barrier, especially for small and medium enterprises. Market fragmentation leads to intense competition, limiting profit margins for some players. Technical complexity and the need for skilled operators may hinder adoption in developing regions. Regulatory compliance can also slow down market entry and expansion.

Machine Type Insights

The fully automatic segment led the market with the largest revenue share of 57.20% in 2024, due to its high efficiency, speed, and minimal need for human intervention. They are ideal for large-scale operations that require consistent output and precision. Industries such as food processing and logistics prefer these machines for their ability to reduce labor costs and increase throughput. Their compatibility with advanced automation systems also supports their widespread adoption.

The semi-automatic segment is anticipated to grow at the fastest CAGR during the forecast period, particularly among small to medium-sized enterprises. These machines offer a balance between cost and functionality, making them attractive for operations with lower volume or limited budgets. They provide flexibility and ease of use while still enhancing productivity compared to manual methods. Their lower initial investment makes them suitable for businesses transitioning to automation.

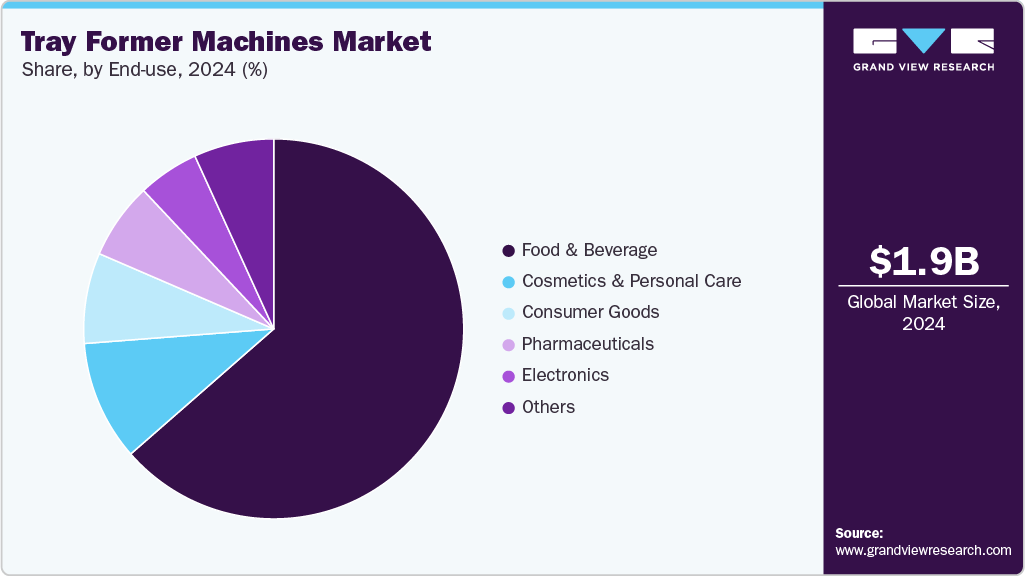

End Use Insights

The food & beverage segment led the market with the largest revenue share of 63.54% in 2024, owing to the high demand for packaged and ready-to-eat products. The need for hygienic, efficient, and reliable packaging solutions to preserve freshness drives widespread adoption. In addition, the diversity of food products requires versatile tray-forming machines. Growing consumer preference for convenience foods further fuels this dominance.

The pharmaceutical segment is anticipated to grow at the fastest CAGR during the forecast period, because of strict regulatory requirements for sterile and tamper-evident packaging. Tray former machines ensure precise and contamination-free packaging of medicines and medical devices. Increasing healthcare demand and the rise of personalized medicine also contribute to rapid market growth. Technological advancements tailored for pharma packaging enhance this expansion.

Tray Type Insights

The corrugated trays segment led the market with the largest revenue share of 56.9% in 2024. Corrugated trays dominate the market because of their excellent strength, durability, and cushioning properties, making them ideal for transporting heavy and fragile goods. Their cost-effectiveness and recyclability further support widespread use across industries like food, electronics, and logistics. The versatility of corrugated material allows for customization in size and design.

The paperboard trays segment is anticipated to grow at the fastest CAGR during the forecast period, due to increasing consumer demand for sustainable and eco-friendly packaging solutions. Their lightweight nature reduces shipping costs and carbon footprint, aligning with environmental regulations and corporate sustainability goals. Advances in paperboard technology have improved durability and moisture resistance. This growing preference for green packaging drives rapid adoption in the food and retail sectors.

Regional Insights

The tray former machines market in North America held a significant share in 2024, due to advanced manufacturing infrastructure and high demand from the food, pharmaceutical, and consumer goods sectors. The region benefits from strong automation adoption and stringent regulatory standards that drive the need for efficient packaging solutions. Innovation and R&D investments by key players also support market growth. In addition, consumer preference for convenience foods boosts demand.

U.S. Tray Former Machines Market Trends

The tray former machines market in the U.S. is expected to grow at the fastest CAGR of 4.5% from 2025 to 2033. The market growth is driven by its advanced manufacturing infrastructure and high demand from the food, pharmaceutical, and consumer goods sectors. The robust food and beverage industry, coupled with a strong emphasis on automation and sustainability, propels the adoption of tray forming machines. Technological advancements and the need for efficient packaging solutions further contribute to the market's growth.

The Mexico tray former machines market is experiencing significant growth, fueled by increased demand for packaging machinery and materials. The country's strategic geographic location, participation in trade agreements like the USMCA, and rising consumption of packaged goods across industries contribute to this growth. Investments in food and beverage sectors, along with a shift towards sustainable and automated packaging solutions, further drive the adoption of tray forming machines.

Europe Tray Former Machines Market Trends

The tray former machines market in Europe holds a significant market share, driven by strict environmental regulations and a strong focus on sustainable packaging. The presence of well-established packaging manufacturers and growing automation trends fuels adoption. Demand from the pharmaceutical and food industries remains robust due to quality and safety standards. The region’s emphasis on reducing plastic use propels innovations in eco-friendly tray forming machines.

The Germany tray former machines market is experiencing steady growth, driven by the country's strong manufacturing sector and emphasis on automation. The food and beverage industry, a significant end-user, requires efficient and sustainable packaging solutions, propelling the demand for tray forming machines. In addition, Germany's commitment to environmental regulations encourages the adoption of eco-friendly packaging technologies.

The tray former machines market in the UK is witnessing notable growth, fueled by increasing demand for packaged goods and advancements in packaging technologies. The pharmaceutical sector's stringent packaging requirements drive the need for precise and reliable tray forming solutions.

Asia Pacific Tray Former Machines Market Trends

Asia Pacific dominated the tray former machines market with the largest revenue share of 36.9% in 2024, owing to rapid industrialization, urbanization, and rising disposable incomes, especially in countries like China and India. The expanding food processing and pharmaceutical sectors fuel demand for efficient packaging machinery. Growing awareness of automation benefits and government initiatives supporting manufacturing modernization further accelerate market growth. The region’s vast consumer base presents significant opportunities.

The tray former machines market in China accounted for the largest market revenue share in Asia Pacific in 2024, driven by its robust manufacturing capabilities and significant demand from the food and beverage industry. The nation's extensive industrial base and emphasis on automation have bolstered the adoption of tray forming technologies. In addition, China's commitment to sustainable packaging solutions has spurred the development and implementation of eco-friendly tray forming machines.

The India tray former machines market is witnessing rapid growth, fueled by increasing urbanization and a burgeoning food processing sector. The rising demand for packaged foods and beverages necessitates efficient and automated packaging solutions. Moreover, India's focus on sustainability and reducing plastic usage aligns with the adoption of recyclable and biodegradable tray forming technologies.

Middle East & Africa Tray Former Machines Market Trends

The tray former machines market in the Middle East and Africa trends are shaped by increasing demand for packaged food and pharmaceuticals amid growing populations and urbanization. Investments in industrial infrastructure and government support for manufacturing diversification are encouraging the adoption of advanced packaging machinery. However, slower automation uptake compared to other regions presents challenges. Rising awareness of sustainability is beginning to influence packaging preferences.

The United Arab Emirates (UAE) tray former machines market is experiencing significant growth, driven by its strategic position as a logistics and manufacturing hub in the Middle East. The establishment of the Khalifa Industrial Zone Abu Dhabi (KIZAD) underscores the UAE's commitment to industrial diversification and foreign investment, providing a conducive environment for packaging machinery.

Latin America Tray Former Machines Market Trends

The tray former machines market in Latin America is anticipated to grow at a significant CAGR during the forecast period, driven by increasing investments in food and beverage manufacturing and expanding pharmaceutical industries. Growing urban populations and rising demand for packaged goods create strong market potential. In addition, improving infrastructure and greater adoption of automation technologies contribute to rapid growth. Local manufacturers are also upgrading capabilities to meet international quality standards.

The Brazil tray former machines market is experiencing significant growth, driven by its status as the largest economy in South America and a rapidly expanding manufacturing sector. The country's vast consumer base, coupled with increasing urbanization and a rising middle class, is fueling the demand for packaged goods, particularly in the food and beverage industry. This surge in demand necessitates efficient and automated packaging solutions, propelling the adoption of tray forming technologies.

Key Tray Former Machines Company Insights

Some of the key players operating in the market include Wayne Automation, Wexxar Packaging, Inc., AFA Systems Inc.

-

Wayne Automation is a prominent player in the packaging machinery industry, known for its expertise in designing and manufacturing high-performance case and tray forming equipment. The company serves major sectors such as food, beverage, and consumer goods with a strong focus on automation and reliability. With decades of experience, it has built a solid reputation for delivering customized packaging solutions. Wayne Automation’s industry presence is marked by innovation and long-standing client relationships across North America.

-

Wexxar Packaging, Inc., a division of ProMach, specializes in case and tray forming, sealing, and packaging solutions, primarily for the food, beverage, and healthcare industries. The company is well regarded for its reliable and flexible machinery that supports both automatic and semi-automatic operations. With a strong footprint in North America and global reach through ProMach’s network, Wexxar emphasizes durability, serviceability, and integration into complex packaging lines. Its solutions cater to both high-volume manufacturers and small-scale operations.

Key Tray Former Machines Companies:

The following are the leading companies in the tray former machines market. These companies collectively hold the largest market share and dictate industry trends.

- Wayne Automation

- Wexxar Packaging, Inc.

- AFA Systems Inc.

- ADCO Manufacturing.

- Combi Packaging Systems, LLC

- Paxiom

- Crown Packaging Corp.

- Sacmi

- DS Smith

- Gietz

- Econcorp

- Boix Maquinaria, S.L.

- Mibox

- Heiber + Schröder Maschinenbau GmbH

- W. H. Leary

Recent Developments

-

In April 2025, EndFlex has unveiled its Vassoyo tray forming machine, engineered specifically for corrugated beverage trays. This advanced equipment features a heavy-duty tubular frame and offers easy changeovers between various tray sizes, enhancing operational flexibility. Equipped with both 1-up and 2-up configurations, it caters to diverse production speeds. An intuitive touchscreen interface provides servicing guides and changeover instructions, streamlining operations and reducing downtime

-

In June 2024, At drupa 2024, Gietz AG demonstrated its advanced tray forming technology, including the HTF 940 model designed for efficient production of two-compartment trays and doggy bags. The machine operated using specially prepared paper blanks from Holmen Iggesund, with printing and die-cutting by PAWI Packaging Schweiz AG, and gluing by W.H. Leary.

Tray Former Machines Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,960.6 million

Revenue forecast in 2033

USD 2,822.3 million

Growth rate

CAGR of 4.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Machine type, tray type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Wayne Automation; Wexxar Packaging, Inc.; AFA Systems Inc.; ADCO Manufacturing.; Combi Packaging Systems, LLC; Paxiom; Crown Packaging Corp.; Sacmi; DS Smith; Gietz; Econcorp; Boix Maquinaria, S.L.; Mibox; Heiber + Schröder Maschinenbau GmbH; W. H. Leary

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tray Former Machines Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global tray former machines market report based on machine type, tray type, end use and region.

-

Machine Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Fully Automatic

-

Semi-Automatic

-

Manual

-

-

Tray Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Corrugated Trays

-

Paperboard Trays

-

Plastic Trays

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Cosmetics & Personal Care

-

Food & Beverage

-

Ready-to-eat meals

-

Meat, poultry & seafood

-

Dairy products

-

Fruits & vegetables

-

Bakery & confectionery

-

Others

-

-

Pharmaceutical

-

Consumer Goods

-

Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global tray former machines market size was estimated at USD 1,905.9 million in 2024 and is expected to be USD 1,960.6 million in 2025.

b. The global tray former machines market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.7% from 2025 to 2033 to reach USD 2,822.3 million by 2033.

b. Corrugated trays segment accounted for a share of 56.9% in 2024. Corrugated trays dominate the market because of their excellent strength, durability, and cushioning properties, making them ideal for transporting heavy and fragile goods. .

b. Some of the key players operating in the global tray former machines market include Wayne Automation; Wexxar Packaging, Inc.; AFA Systems Inc.; ADCO Manufacturing.; Combi Packaging Systems, LLC; Paxiom; Crown Packaging Corp.; Sacmi; DS Smith; Gietz; Econcorp; Boix Maquinaria, S.L.; Mibox; Heiber + Schröder Maschinenbau GmbH; W. H. Leary

b. The global tray former machines market is primarily driven by increasing demand for automated and efficient packaging solutions across food, pharmaceutical, and consumer goods industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.