- Home

- »

- Next Generation Technologies

- »

-

UAE Artificial Intelligence Market Size, Industry Report, 2030GVR Report cover

![UAE Artificial Intelligence Market Size, Share & Trends Report]()

UAE Artificial Intelligence Market (2024 - 2030) Size, Share & Trends Analysis Report By Solution (Hardware, Software, Services), By Technology (Deep Learning, Machine Learning, NLP), By End-use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-254-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UAE Artificial Intelligence Market Trends

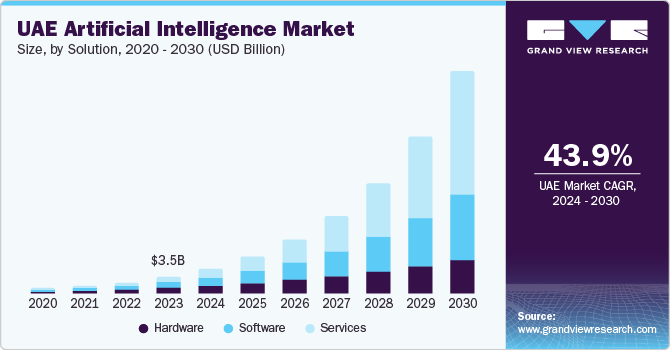

The UAE artificial intelligence market size was valued at USD 3.47 billion in 2023 and is projected to grow at a CAGR of 43.9% between 2024 and 2030. Flourishingartificial intelligence (AI) roadmap and growth of large language models have put the Emirates in a solid position. Moreover, concerted efforts on safety and privacy have culminated in an injection of funds into state-of-the-art AI technologies. The rising penetration of NLP, machine learning and deep learning will augur well the global artificial intelligence market outlook. The growth of smartphones and internet across the region will further the implementation and adoption of AI.

AI technologies hold immense economic potential to bring a paradigm shift in the Middle East’s business landscape. For instance, the emergence of generative AI has spurred the footfall of AI-ChatGPT created by AI can produce data, such as images, audio, videos, code, simulations, texts and 3D objects. The Emirates is likely to ramp up investments in AI research and development as the technology becomes sought-after across the end-use industries.

Incumbent players are expected to harness the value of AI to foster innovation, enhance customer experience and augment competitive advantage. In essence, Dubai has implemented AI-fueled smart traffic control systems that use real-time data from traffic cameras and sensors to minimize traffic congestion, assess traffic patterns, boost transportation efficiency and optimize signal timings.

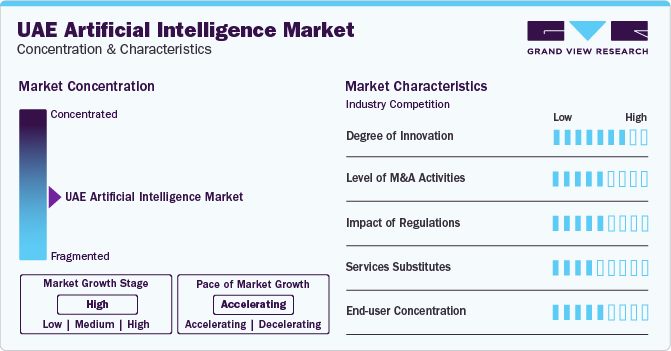

Market Concentration & Characteristics

The market dynamics of AI alludes to an increased focus on innovations in the Middle East region. In May 2023, a Dataiku report found that up to 98% of UAE businesses regard AI to be a major enabler to being more resilient. For instance, the advent of NLP has fueled footprint of virtual assistants and chatbots. Besides, AI-powered software development and medical devices, including smart patient monitoring systems, smart stethoscopes and robotic surgeons.

Mergers and acquisitions activities could be pronounced as companies rev up investments in AI initiatives. The Dataiku report found that almost three in four UAE companies and organizations have either increased or maintained their investment in AI initiatives. As stakeholders strive to make AI more accessible to business users and foster automation, M&A initiatives could hold prominence in the ensuing period.

UAE has prioritized AI regulations amidst ethical considerations regarding data governance, transparency and data privacy. The Emirates has formed the UAE AI and Blockchain Council to recommend policies to create an AI-friendly ecosystem. Although there are no specific laws and regulations (for AI), Digital Dubai rolled out an Ethical AI Toolkit for AI systems to be transparent, fair, safe, understandable and accountable.

At a time when AI has witnessed tremendous traction in the Middle East, the level of substitutes could be moderate. Specifically, expert systems, automation, and rule-based systems could witness gradual growth in the near term. However, the UAE will continue to inject funds into AI technologies to spearhead technology adoption in the region. Stakeholders are expected to boost its AI initiatives to gain a substantial competitive advantage.

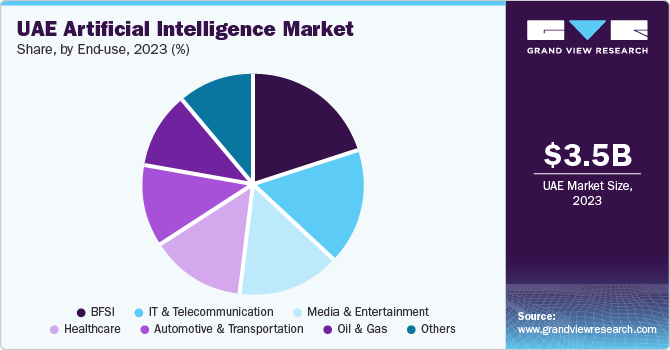

End-users, such as BFSI, automotive & transportation, healthcare, oil & gas, media & entertainment, and IT & telecommunication, are poised to exhibit heightened demand for AI tools and technologies. To illustrate, the hospitality sector in Dubai attracts millions of tourists annually, prompting industry leaders to invest in personalized experiences through predictive analysis. AI-powered chatbots, for instance, can boost customer experience and offer customized recommendations.

Solution Insights

The software segment spearheaded the UAE AI market in 2023, accounting for 35.9% of revenue share. The growth outlook is partly attributed to the innate ability to extract data, provide real-time insights, and help in decision-making. Notably, software deployment (powered by cloud) and pre-trained models have added a fillip to the business outlook. For instance, in August 2023, the UAE rolled out Arabic AI software as the country ramps up the adoption of generative AI.

The services segment will exhibit considerable growth on the back of surging investments in professional services, including training & education and designing & testing. Moreover, managed services and deployment of AI services will gain ground, prompting stakeholders to inject funds into the portfolio. Market companies are poised to count on predictive maintenance, planning and forecasting.

Technology Insights

The deep learning segment will grow against the backdrop of rising footprint of videos and images and robust government policies. In 2023, an international team of 25 computer scientists put the finishing touches on a deep learning algorithm (before sending it to be trained on 4,000 computer chips) at an AI research lab in Abu Dhabi. Additionally, autonomous vehicles have gained ground with deep neural networks gaining ground for road mapping and object detection.

The machine learning segment will grow in light of the penetration of machine learning models and ML’s behavioral analytics tools. UAE is expected to augment AI investments and propel its ML portfolio. In February 2024, UAE announced pouring USD 500 million to accentuate research and development into AI and other emerging technologies. With the Middle Eastern giant robustly embracing AI and ML technologies, several sectors, including healthcare and finance, are poised to bank on the state-of-the-art technology.

End-use Insights

The BFSI segment is likely to exhibit heightened demand for AI on the heels of soaring demand for fraud analysis, smart portfolio management, algorithmic trading and customer profiling. Businesses in the region are adopting emergent technologies to foster security, productivity and efficiency. AI has become a good talking point for the banks and financial sectors to boost customer experience and boost security measures.

The media & entertainment segment is likely to depict a notable rise, partly due to the demand for AI-integrated media & entertainment software and solutions. The trend for content personalization has fueled the demand for AI. The technology has become instrumental in real-time marketing intelligence, increased revenue, better budget insights and enhanced services. Besides, as the world shifts from digital journalism to AI-powered algorithmic journalism, UAE media houses could foster AI strategies to attract a new target audience on social media and attract young newsreaders.

Key UAE Artificial Intelligence Company Insights

Some of the leading players operating in the market include IBM, Google LLC, Amazon, Advanced Micro Devices and Baidu, Inc. They are likely to focus on organic and inorganic strategies to underpin their strategies in the regional landscape.-

In March 2024, The IBM Global AI Adoption Index 2023 found that 65% of IT professionals in the UAE have expedited AI rollout over the past 24 months. The study revealed that 42% of companies have already deployed it in their business operations.

-

In May 2023, Google joined forces with UAE organizations to underpin AI research and sustainability initiatives. The tech behemoth is expected to extend support in the form of machine learning, data analytics and cloud computing resources.

-

In March 2023, Microsoft bolstered its UAE’s G42 partnership with the inclusion of AI tools, cloud for the country’s public sector and some other industries.

Some emerging companies are slated to expand their portfolios to bolster their value propositions. Some of the prevailing dynamics are delineated below:

-

In March 2024, Abu Dhabi announced setting up a technology investment firm and infusing USD 100 billion in Assets under management in AI and semiconductors.

-

In February 2024, CAI Concierge AI reportedly raised an undisclosed investment round to foray into the Dubai market. The startup expects it will help expand its UAE footprint and provide AI-powered tools to boost productivity and streamline workflows.

Key UAE Artificial Intelligence Companies:

- Omdena Inc.

- Microsoft

- Google LLC

- IBM

- Intel Corporation

- Yanzo

- Digital Energy

- Gleac

- CAI Concierge AI

Recent Developments

-

In February 2024, Cleveland Clinic Abu Dhabi exhorted that it had embraced multiple systems fueled by AI to improve its complex care offerings. The company is integrating AI into its operation to help diagnose and treat stroke.

-

In May 2023, Amazon Web Services (AWS) collaborated with the Emirates Group to provide a 3D interactive experience to create a “truly immersive environment.” Reports suggest virtual training, 3D virtual hubs, simulated experiences and gamified environments are in the offing.

UAE Artificial Intelligence Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.22 billion

Revenue forecast in 2030

USD 46.33 billion

Growth rate

CAGR of 43.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, technology, end-use

Key companies profiled

Omdena Inc.; Microsoft; Google LLC; IBM; Intel Corporation; Digital Energy; Gleac; Yanzo; CAI Concierge AI

Customization Scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UAE Artificial Intelligence Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the UAE artificial intelligence market on the basis of solution, technology and end-use:

-

Solution Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Hardware

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Deep Learning

-

Machine Learning

-

Natural Language Processing (NLP)

-

Machine Vision

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Media & Entertainment

-

BFSI

-

IT & Telecommunication

-

Healthcare

-

Automotive & Transportation

-

Oil & Gas

-

Others

-

Frequently Asked Questions About This Report

b. The UAE artificial intelligence market size was estimated at USD 3.47 billion in 2023 and is expected to reach USD 5.22 billion in 2024.

b. The UAE artificial intelligence market is expected to grow at a compound annual growth rate of 43.9% from 2024 to 2030 to reach USD 46.33 billion by 2030.

b. The software segment dominated the UAE AI market with a share of 35.9% in 2023. This is attributable to the innate ability to extract data, provide real-time insights, and help in decision-making.

b. Some key players operating in the UAE AI market include Omdena Inc., Microsoft, Google LLC, IBM, Intel Corporation, Digital Energy, Gleac, Yanzo, CAI Concierge AI

b. Key factors that are driving the market growth include rising penetration of NLP, machine learning, and deep learning, and rising penetration of NLP, machine learning and deep learning .

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.