- Home

- »

- Clothing, Footwear & Accessories

- »

-

UAE Jewelry Market Size And Share, Industry Report, 2033GVR Report cover

![UAE Jewelry Market Size, Share & Trends Report]()

UAE Jewelry Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Necklace, Ring, Earring, Bracelet), By Material (Platinum, Gold, Diamond), By Distribution Channel (Offline Retail Stores, Online Retail Stores), By End Use (Men, Women), And Segment Forecasts

- Report ID: GVR-4-68040-640-5

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UAE Jewelry Market Summary

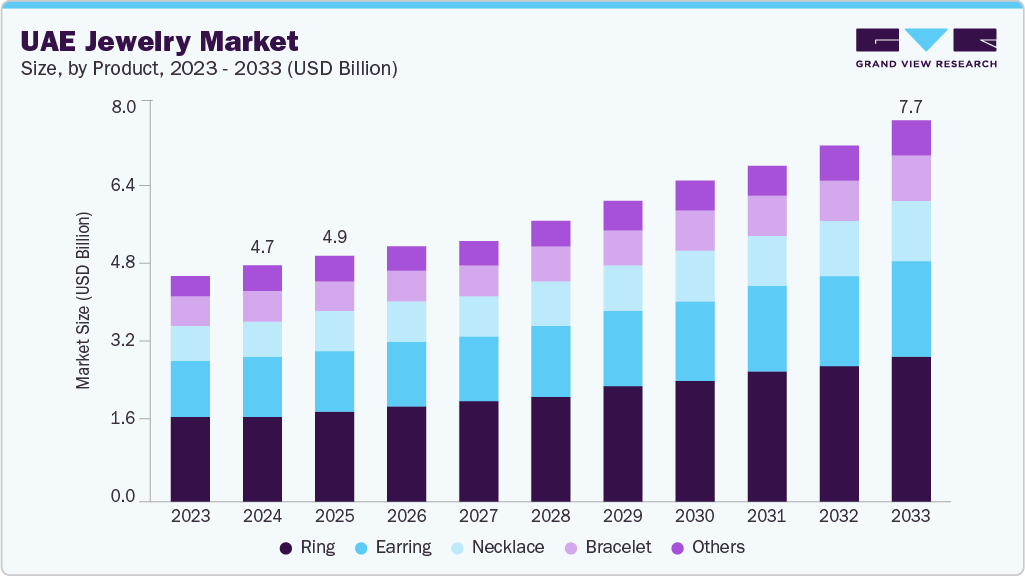

The UAE jewelry market size was estimated at USD 4.66 billion in 2024, and is projected to reach USD 7.65 billion by 2033, growing at a CAGR of 5.8% from 2025 to 2033. The market is driven by rising disposable income, luxury tourism, and increasing demand for gold and diamond investments.

Key Market Trends & Insights

- The ring market held the largest revenue share of 37.4% in 2024.

- By material, the gold jewelry segment held the largest share of 58.5% in 2024.

- The diamond segment in the UAE is expected to grow significantly at a CAGR of 6.4% during the forecast period.

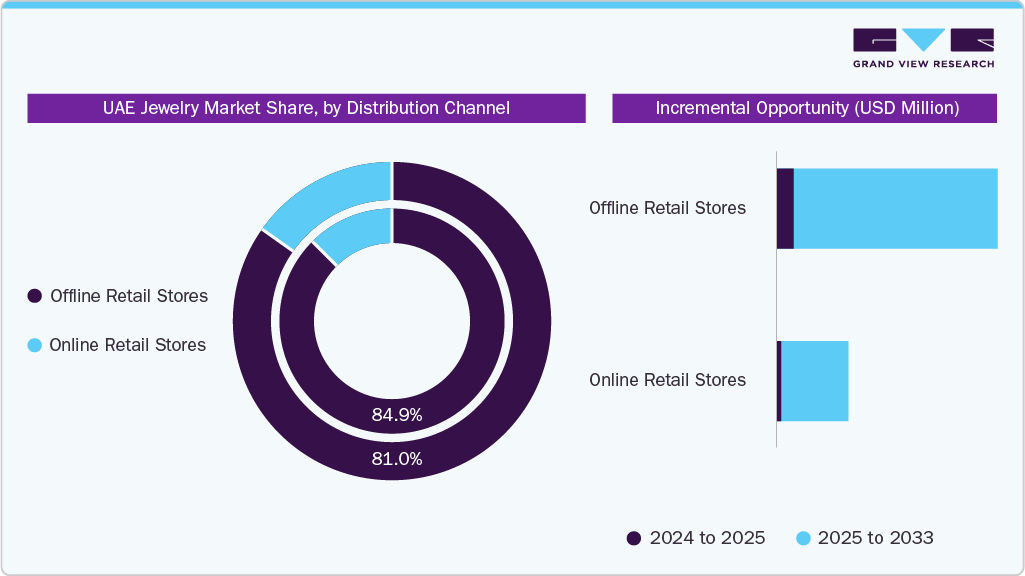

- By distribution channel, the offline retail stores segment held the largest share of 84.9% in 2024.

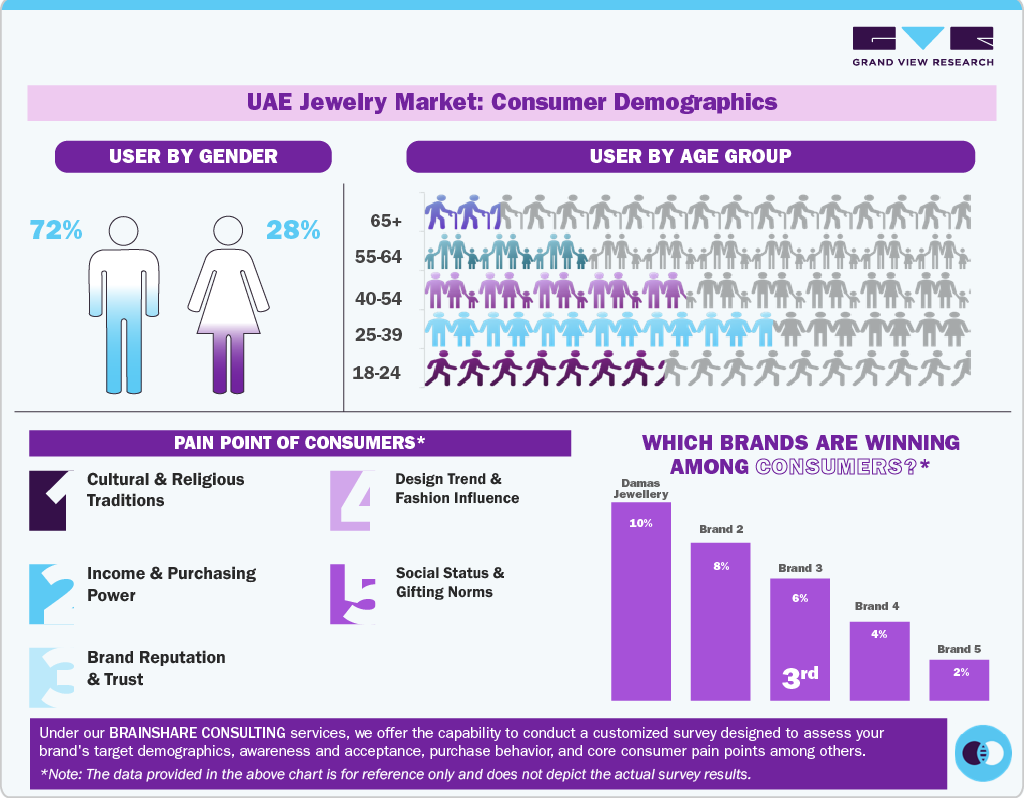

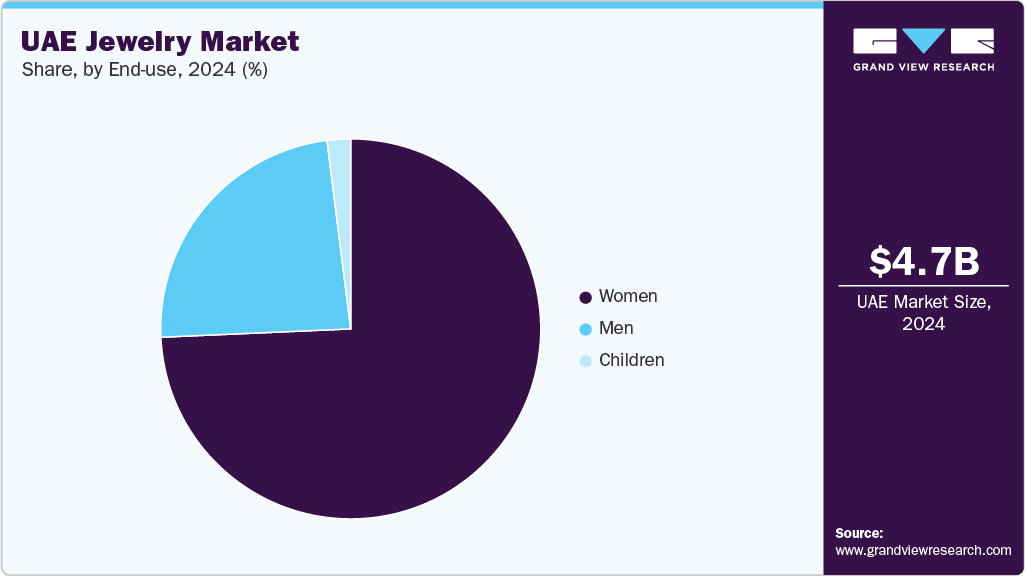

- By end use, women segment held the largest share of 74.3% of the UAE Jewelry Market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.66 Billion

- 2033 Projected Market Size: USD 7.65 Billion

- CAGR (2025-2033): 5.8%

The UAE jewelry industry is propelled by a strong preference for luxury goods among affluent consumers and tourists, especially from neighboring countries. Growing urbanization and exposure to global fashion trends boost demand for contemporary designs. In addition, favorable government policies and tax benefits attract both retailers and buyers. The rising popularity of online jewelry sales also expands market reach and accessibility.

The UAE jewelry industry benefits from its strategic position as a global trade hub, attracting international brands and buyers. Increasing awareness of branded and certified jewelry enhances consumer trust and demand. Cultural significance and gifting traditions further fuel purchases throughout the year. Moreover, advancements in craftsmanship and customization options appeal to a diverse customer base.

Product Insights

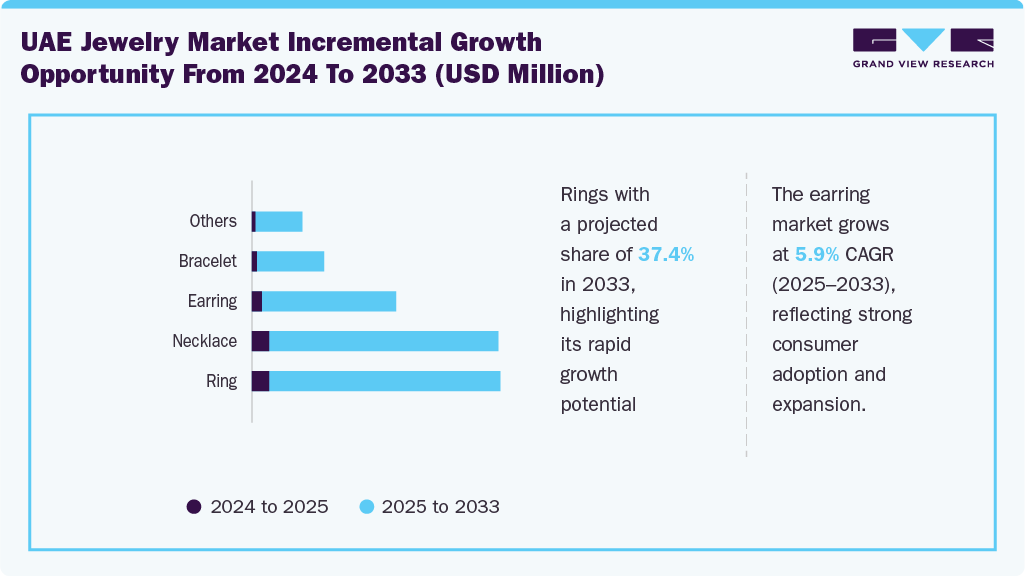

The UAE rings segment accounted for the largest share of 37.4% of the revenue in 2024. The demand for rings in the UAE is driven by their cultural and emotional significance, especially in engagement and wedding traditions. A growing preference for personalized and designer rings has led to increased demand for bespoke and branded collections. The influence of social media trends and celebrity endorsements further stimulates interest in unique ring styles. In addition, affluent consumers seek rings as status symbols and investment pieces, supporting demand for high-quality materials like diamonds and platinum.

The UAE earring segment is projected to grow significantly at a CAGR of 5.9% from 2025 to 2033. Earrings enjoy strong popularity in the UAE due to their everyday wearability and their role in completing fashion-forward looks. A wide variety of styles, from traditional to contemporary, caters to diverse ethnic groups and fashion tastes. Seasonal collections and limited-edition designs create a sense of exclusivity, attracting repeat purchases. The increasing presence of women in the workforce also drives demand for elegant yet versatile earring designs suitable for both professional and social settings.

Material Insights

The UAE gold jewelry segment accounted for the largest share of 58.5% of the revenue in 2024. Gold remains a favored material in the UAE due to its deep-rooted cultural and religious value, often associated with prosperity and celebration. According to the data published in August 2024, consumer demand for gold in the UAE is globally the highest, followed by Saudi Arabia. Moreover, the absence of value-added tax (VAT) on investment-grade gold and the country's reputation for purity assurance attract both local and international buyers. According to the data published in February 2025, if gold is 99% pure, the VAT is exempted. Competitive pricing driven by low import duties enhances gold's accessibility. Furthermore, gold's liquidity and role as a financial hedge increase its appeal among wealth-conscious consumers.

The UAE diamond jewelry segment is expected to grow at the fastest CAGR of 6.4% during the forecast period. Diamonds are increasingly popular in the UAE, driven by a shift toward luxury lifestyle choices and a desire for exclusivity. Moreover, the UAE also exports diamonds, and according to the OEC (The Observatory of Economic Complexity) data published in 2023, the UAE exported USD 11.4 billion diamonds, making the country the 3rd largest exporter of diamonds globally. The rise of high-net-worth individuals and luxury tourists supports strong demand for premium, certified stones. Dubai’s status as a global diamond trading center ensures wide availability and competitive pricing. In addition, innovation in diamond cuts and settings appeals to consumers seeking modern, standout jewelry pieces.

Distribution Channel Insights

The jewelry sales through the offline retail stores accounted for the largest share of around 84.9% of the UAE revenue in 2024. Offline jewelry retail thrives in the UAE due to consumer preference for physically inspecting high-value items like gold and diamonds. Iconic locations such as Dubai Gold Souk and luxury malls provide an immersive shopping experience, enhancing buyer confidence. Personalized service, in-store customization, and instant authenticity verification attract both residents and tourists. In addition, offline outlets often serve as cultural and social landmarks, encouraging footfall and brand loyalty. According to the Gem and Jewelry Export Promotion Council (GJEPC) data published in January 2023, Indian jewelry brand Tanishq, part of the Tata Group, has inaugurated its seventh boutique store in the UAE. The store showcases a diverse collection featuring 18-carat and 22-carat gold, along with diamonds, solitaires, and a variety of other finely crafted pieces.

The jewelry sales through the offline retail stores are projected to grow at the fastest CAGR of 8.5% from 2025 to 2033. Online jewelry sales are rapidly growing in the UAE, driven by digital-savvy consumers seeking convenience and variety. E-commerce platforms offer competitive pricing, virtual try-on tools, and wider access to international designs. The integration of secure payment systems and transparent return policies builds consumer trust. Furthermore, social media marketing and influencer collaborations are key in driving traffic and conversions for online jewelry retailers.

End Use Insights

The UAE women jewelry segment accounted for the largest share of around 74.3% of the revenue in 2024. Women remain the dominant consumer group, driven by strong cultural traditions of gifting and self-adornment. The rise of financially independent women has increased demand for premium, statement pieces. Evolving fashion preferences fuel interest in both traditional and modern designs suited for various occasions. In addition, targeted marketing campaigns and female-centric collections enhance engagement and brand loyalty.

The men’s jewelry segment is projected to grow at the fastest CAGR of 5.3% from 2025 to 2033. Men’s jewelry consumption in the UAE is growing steadily, influenced by changing fashion norms and rising interest in luxury accessories. Demand is especially strong for items such as rings, cufflinks, chains, and watches that reflect personal style and status. The increase in male-focused jewelry lines and customization options appeals to a more style-conscious male demographic. Moreover, cultural practices and occasions like weddings and festivals contribute to sustained demand among men. Companies such as Tanishq offer jewelry pieces for men, such as chains, rings, and bracelets.

Key UAE Jewelry Company Insights

The UAE jewelry industry is characterized by a blend of established brands and emerging local players vying for market share. Leading companies have gained strong brand recognition through early market penetration, consistent product quality, and alignment with the growing health and wellness movement.

Key UAE Jewelry Companies:

- Titan Company Limited

- Gafla

- Malabar Gold & Diamonds Limited

- Damas Jewellery

- Liali Jewellery

- Pure Gold Jewellers

- Taiba Jewellery

- Amwaj Jewellery

- Al Romaizan Gold & Jewellery

- Cara Jewellers

Recent Developments

-

In December 2024, Indian jewelry brand Tanishq, part of the Tata Group, launched its largest flagship boutique in the Dubai Gold Souk Extension, spanning 5,000 sq ft and showcasing over 10,000 meticulously crafted pieces, from everyday elegance to bespoke bridal collections.

-

In September 2022, Etika Jewels, based in Dubai, launched in the UAE, offering modern designs crafted from ethical lab-grown diamonds and gemstones. The brand emphasizes conscious luxury, featuring eco-friendly packaging and vegan leather boxes, aiming to provide accessible, mindful alternatives to traditional diamond jewelry.

UAE Jewelry Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 4.9 billion

Revenue Forecast in 2033

USD 7.6 billion

Growth rate (Revenue)

CAGR of 5.8% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative (Revenue) units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, distribution channel, end use

Regional Scope

UAE

Key companies profiled

Titan Company Limited; Gafla; Malabar Gold & Diamonds Limited; Damas Jewellery; Liali Jewellery; Pure Gold Jewellers; Taiba Jewellery; Amwaj Jewellery; Al Romaizan Gold & Jewellery; Cara Jewellers

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UAE Jewelry Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021-2033. For this study, Grand View Research has segmented the UAE jewelry market report based on product, material, distribution channel, end use, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Necklace

-

Ring

-

Earring

-

Bracelet

-

Others

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Platinum

-

Gold

-

Diamond

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline Retail Stores

-

Supermarkets & Hypermarkets

-

Jewelry Stores

-

-

Online Retail Stores

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Men

-

Women

-

Children

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

UAE

-

Frequently Asked Questions About This Report

b. The UAE jewelry market size was estimated at USD 4.66 billion in 2024 and is expected to reach USD 4.9 billion in 2025.

b. The UAE jewelry market is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2025 to 2033 to reach USD 7.65 billion by 2033.

b. The ring market accounted for a revenue share of 37.4% in 2024, driven by high disposable income, strong tourism, and cultural affinity for gold and luxury jewelry, which drives the UAE ring market.

b. Some key players operating in the UAE jewelry market include Titan Company Limited, Gafla, Malabar Gold & Diamonds Limited, Damas Jewellery, Liali Jewellery, Pure Gold Jewellers.

b. The UAE jewelry market is fueled by booming tourism and high disposable incomes, with tax‑free shopping and world‑class retail infrastructure drawing in global buyers. Additionally, strong cultural affinity and a diverse expatriate population drive demand for both traditional gold and emerging trends like lab‑grown diamonds, customization, and ethical sourcing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.