UAE Protein Ingredients Market Summary

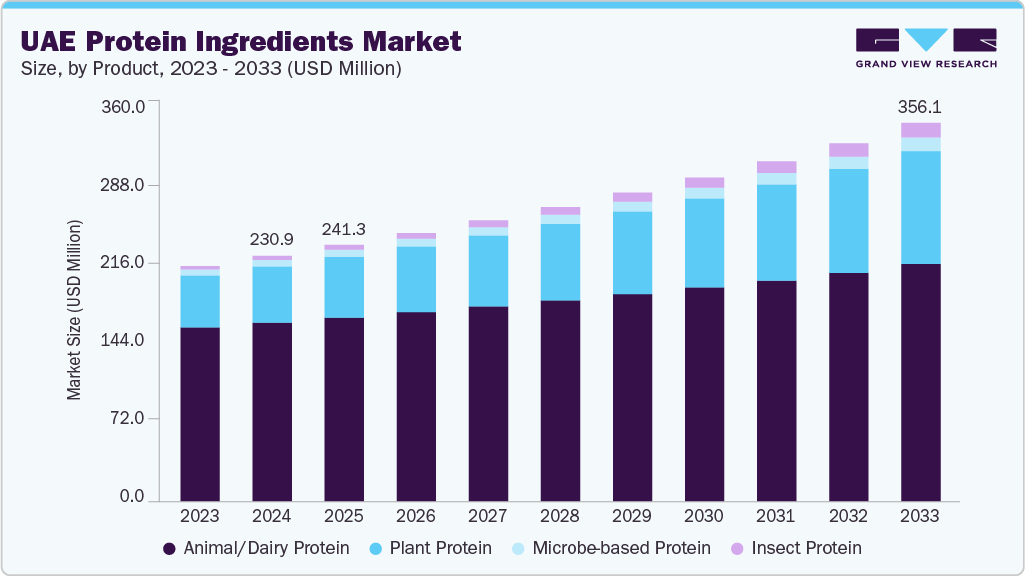

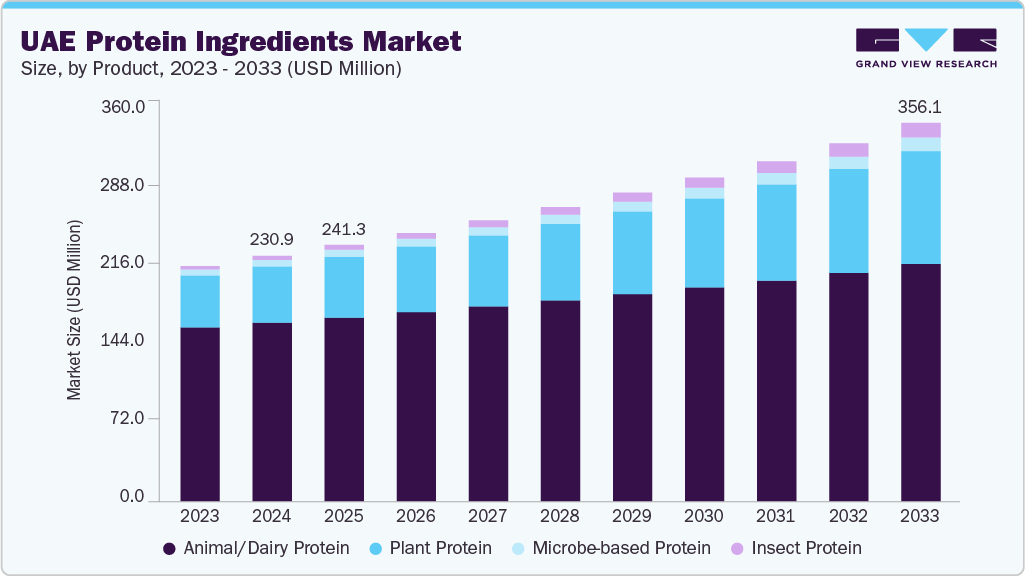

The UAE protein ingredients market size was estimated at USD 230.9 million in 2024 and is projected to reach USD 356.1 million by 2033, growing at a CAGR of 6.7% from 2025 to 2033. The protein ingredient industry in the UAE is growing due to several key drivers, such as increasing health awareness and conscious eating, leading to rising consumption of high-protein and nutritious food options.

Key Market Trends & Insights

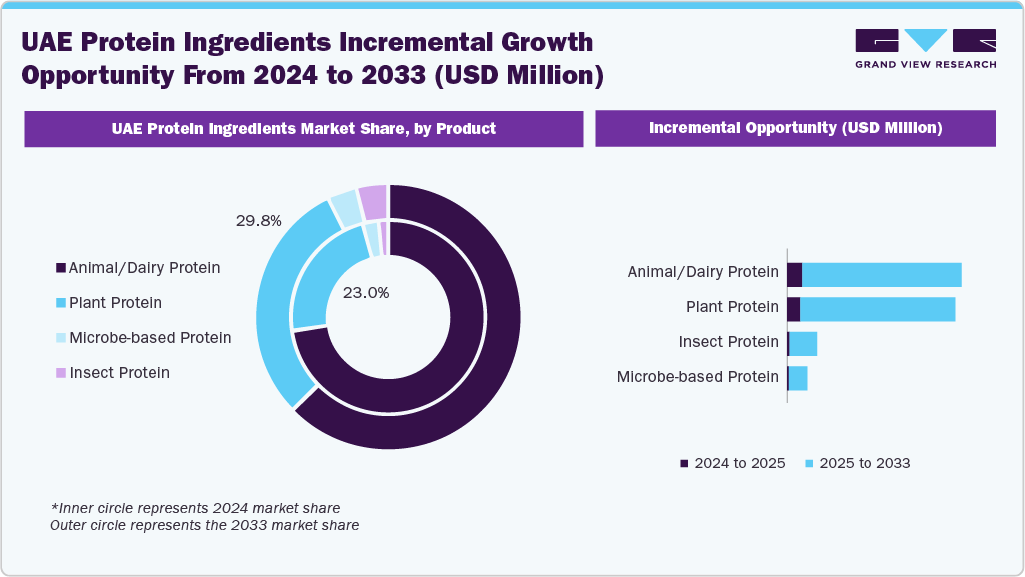

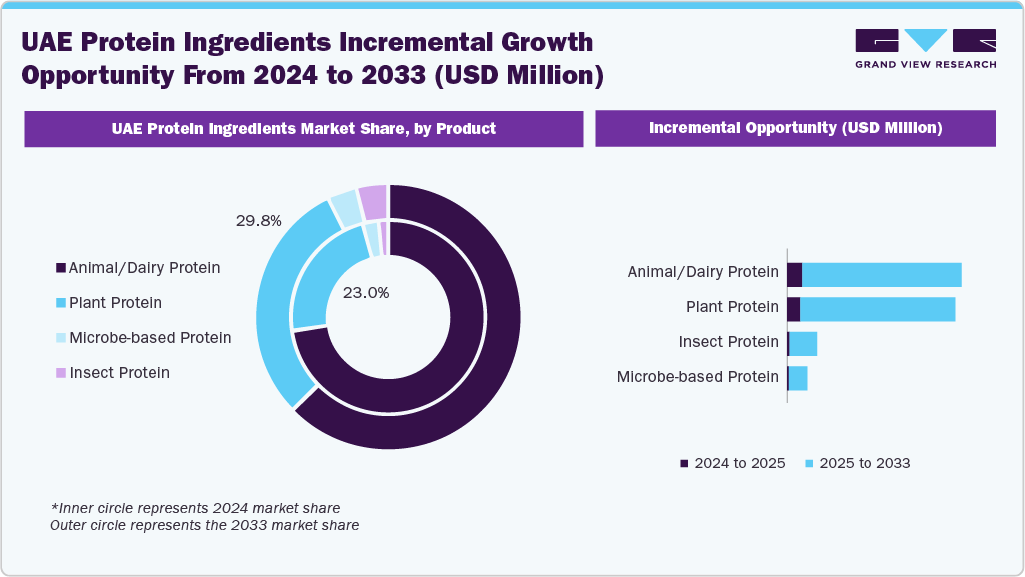

- Based on product, the animal/dairy protein segment held the highest market share of 72.8% in 2024.

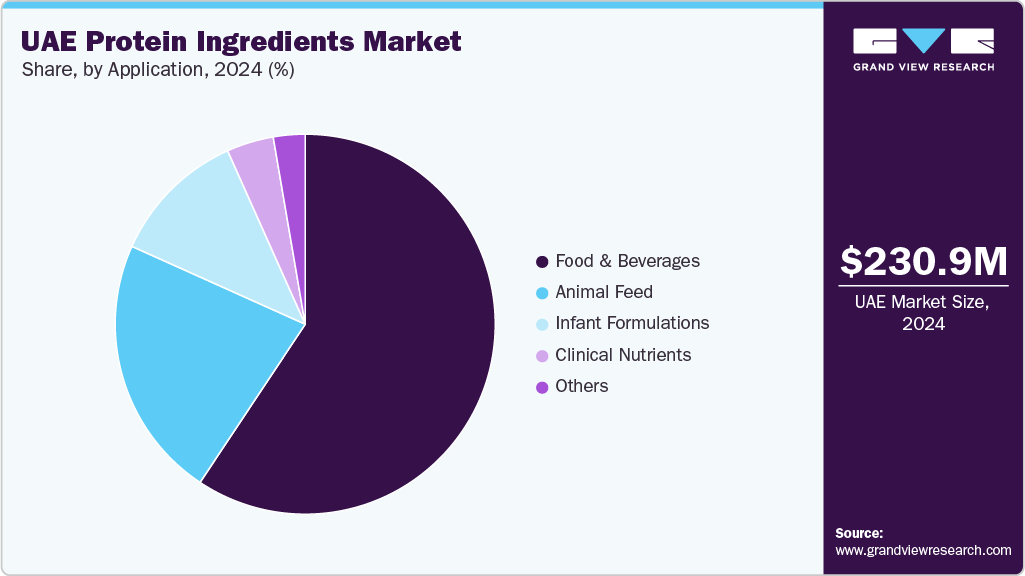

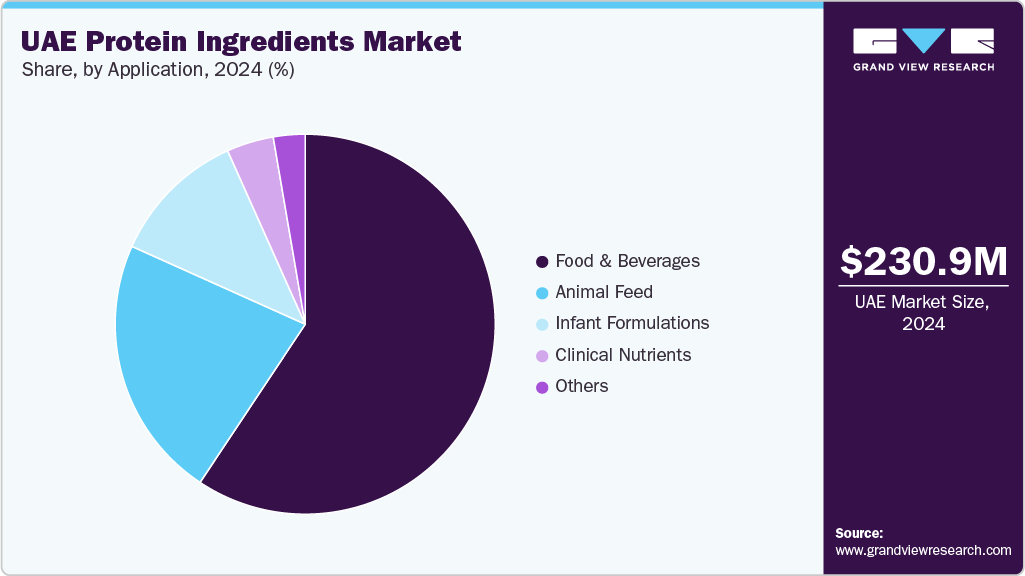

- Based on application, the food & beverages segment held the largest market share of 59.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 230.9 Million

- 2033 Projected Market Size: USD 356.1 Million

- CAGR (2025-2033): 6.7%

The shift toward plant-based diets is also supporting demand for alternative protein sources. The UAE protein ingredients industry is experiencing strong growth, driven by rising health awareness, evolving dietary preferences, and government-led food security initiatives. The rise of fitness culture and interest in sports nutrition is also boosting the need for protein-enriched foods & beverages. Key drivers include the popularity of flexitarian diets, increased interest in fitness & wellness, and a shift toward locally sourced, environmentally friendly ingredients. Convenience, product variety, and wide availability through retail and online platforms are further supporting market growth. Innovation in product formats such as dairy alternatives, protein-enriched snacks, and fortified beverages is also fueling market expansion. The UAE plant-based protein market is expanding due to rising health, sustainability, and ethical food awareness.

Product Insights

The animal/dairy protein dominated the UAE protein ingredients industry and accounted for a share of 72.8% in 2024, driven by growing health consciousness, popularity of high-protein diets, and a strong focus on fitness and wellness. This is further supported by government-led food security initiatives promoting local dairy and poultry production, along with a surge in functional nutrition following the COVID-19 pandemic. The expansion of gyms, sports clubs, and health-focused retail channels has increased the consumption of protein-enriched foods & beverages, particularly among active individuals and professionals. In addition, product innovations such as flavored, fortified, and lactose-free dairy options, combined with high demand from the diverse expatriate population, contribute to sustained growth of this segment.

The insect protein segment is expected to grow at the fastest CAGR of 24.8% from 2025 to 2033. Its minimal environmental impact, high nutritional value, and versatility in human and animal nutrition make it a promising alternative. The country’s growing interest in food-tech innovation and climate-resilient agriculture further supports this shift, alongside increasing health and environmental awareness among consumers.

Application Insights

The food & beverages segment held the largest revenue share of the market in 2024. Protein ingredients are increasingly used in food and beverage applications such as plant-based dairy alternatives, functional snacks, meal replacements, and fortified beverages. These innovations cater to rising health awareness and demand for clean-label products. Pea, soy, and dairy proteins are commonly used for high-protein claims, while insect protein is increasingly used in animal feed and niche foods. Protyze introduced Anytime Clear Whey Protein, a light, refreshing, and easily digestible alternative to traditional whey shakes. Its clear protein drink is water-based, 99% lactose-free, gut-friendly, and contains no added sugar.

The animal feed segment is projected to record the second-fastest CAGR from 2025 to 2033. Increasing domestic meat and dairy consumption is prompting producers to focus on protein-rich feed formulations to improve animal growth rates and product quality. Government initiatives around food security and self-sufficiency are also driving investment in local feed manufacturing. These initiatives are expected to reduce dependence on imports and encourage innovation in protein sources.

Key UAE Protein Ingredients Company Insights

Some of the key companies operating in the UAE protein ingredients market include Protean Ingredients, Circa Biotech, and Mead Johnson & Company, LLC.

Key UAE Protein Ingredients Companies:

- Protean Ingredients

- Circa Biotech

- Mead Johnson & Company, LLC.

Recent Developments

-

In June 2025, the U.S. Grains Council (USGC) announced the first-ever shipment of the U.S. corn fermented protein (CFP) certified under its Corn Sustainability Assurance Protocol (CSAP) to the UAE.

-

In April 2025, agricultural experts developed Saba Sanabel in Sharjah’s Mleiha wheat farm, a new wheat variety with a record-high 19.3% native protein content.

UAE Protein Ingredients Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 241.3 million

|

|

Revenue forecast in 2033

|

USD 356.1 million

|

|

Growth rate

|

CAGR of 6.7% from 2025 to 2033

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2021 - 2023

|

|

Forecast period

|

2025 - 2033

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends.

|

|

Segments covered

|

Product, application

|

|

Key companies profiled

|

Protean Ingredients, Circa Biotech, Mead Johnson & Company, LLC.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

UAE Protein Ingredients Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the UAE protein ingredients market report based on product and application:

-

Product Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Plant Protein

-

Cereals

-

Legumes

-

Soy

-

Soy Protein Concentrates

-

Soy Protein Isolates

-

Textured Soy Protein

-

Hydrolyzed Soy Protein

-

HMEC/HMMA Soy Protein

-

Pea

-

Pea Protein Concentrates

-

Pea Protein Isolates

-

Textured Pea Protein

-

Hydrolyzed Pea Protein

-

HMEC/HMMA Pea Protein

-

Lupine

-

Chickpea

-

Others

-

Roots

-

Ancient Grains

-

Hemp

-

Quinoa

-

Sorghum

-

Amaranth

-

Chia

-

Others

-

Nuts & Seeds

-

Canola

-

Almond

-

Flaxseeds

-

Others

-

Animal/Dairy Protein

-

Egg Protein

-

Milk Protein Concentrates/Isolates Concentrates/Isolates

-

Whey Protein Concentrates

-

Whey Protein Hydrolysates

-

Whey Protein Isolates

-

Gelatin

-

Casein/Caseinates

-

Collagen Peptides

-

Microbe-based Protein

-

Algae

-

Bacteria

-

Yeast

-

Fungi

-

Insect Protein

-

Coleoptera

-

Lepidoptera

-

Hymenoptera

-

Orthoptera

-

Hemiptera

-

Diptera

-

Others

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Food & Beverages

-

Bakery & Confectionary

-

Beverages (Non-Dairy Alternatives)

-

Breakfast Cereals

-

Dairy Alternatives

-

Beverages

-

Cheese

-

Snacks

-

Others

-

Dietary Supplements/Weight Management

-

Meat Alternatives & Extenders

-

Snacks (Non-Dairy Alternatives)

-

Sports Nutrition

-

Others

-

Infant Formulations

-

Clinical Nutrients

-

Animal Feed

-

Others