- Home

- »

- Medical Devices

- »

-

UAE Wound Wash Market Size, Share, Industry Report, 2030GVR Report cover

![UAE Wound Wash Market Size, Share & Trends Report]()

UAE Wound Wash Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Antiseptic, Saline Solution), By Product, By Product Form, By Application, By End Use, And Segment Forecasts, Key Companies And Competitive Analysis

- Report ID: GVR-4-68040-575-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UAE Wound Wash Market Size & Trends

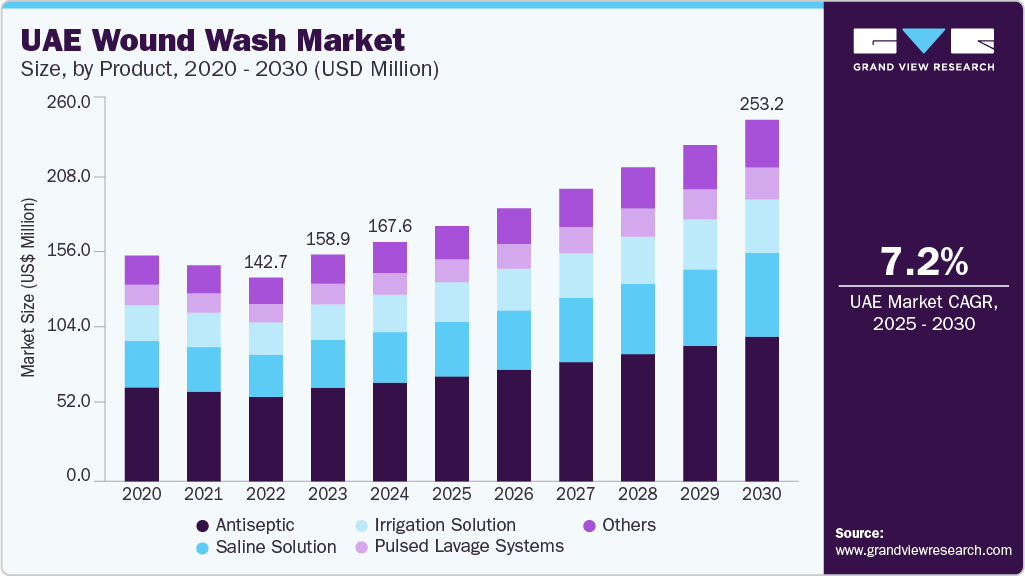

The UAE wound wash market size was estimated at USD 167.63 million in 2024 and is projected to grow at a CAGR of 7.20% from 2025 to 2030. The market growth is driven by the increasing number of surgical procedures performed across the country. The growing aging population and advancements in surgical techniques contribute to a higher demand for effective wound care solutions, including wound wash products. Moreover, the rising prevalence of chronic wounds, such as diabetic foot ulcers and pressure ulcers, is anticipated to propel the market growth in the forecast years. According to the Khalifa University researchers, they have analyzed the prevalence of Type 2 diabetes in the UAE, which projects that by 2031, approximately 1.6 million residents could be living with the disease. The study estimates that diabetes-related healthcare costs could reach USD 3.4 billion by 2031.

Dubai licensed 143 new health facilities in the first quarter of 2023, increasing the total number of healthcare establishments in the emirate to 4,609-an 11.5% rise compared to last year. More clinics, hospitals, and specialty centers mean greater access to medical services across Dubai. This expanded network improves patient access to wound care services, especially for chronic conditions like diabetic foot ulcers and post-surgical wound management, requiring frequent cleaning and irrigation with wound wash products. Each new health facility represents a new consumer of wound care consumables, including wound wash solutions. Routine procedures in inpatient and outpatient settings (e.g., dressing changes, minor surgeries, diabetic wound care) involve wound cleansing, driving demand for sterile wound irrigation products. Some newly licensed facilities likely include specialized services such as diabetic care centers, podiatry clinics, and wound healing units. These centers typically use advanced wound wash and care solutions as part of their treatment protocols, thus accelerating the adoption of high-quality, sterile wound irrigation products.

The aging population in the UAE is expected to drive demand for wound care products, including wound washes, due to the increased prevalence of chronic conditions and age-related health issues. As individuals age, they are more prone to developing wounds such as ulcers, surgical incisions, and pressure sores, which require specialized care and management. Additionally, older adults face complications like diabetes, vascular diseases, and reduced skin elasticity, making wound care essential for faster recovery and prevention of infections. The UAE's healthcare system is adapting to this demographic shift, with a rising emphasis on geriatric care, including wound management. This shift is expected to expand the market for wound washes, integral to cleaning, disinfecting, and promoting healing in various types of wounds. As healthcare providers increasingly focus on elderly care, the demand for effective, easy-to-use, and safe wound care products like wound washes is expected to increase, contributing to the growth of the UAE wound wash industry.

The table below shows the continuous growth of the older population in the UAE, indicating a significant increase in the 60+ age group. This growth in the senior population, among women and men, is expected to drive the demand for healthcare services tailored to this age group, including wound care products, thereby contributing to the growth of the wound wash market in the UAE.

Older Population in UAE by Gender and Year (Age 60+)

Year

Gender

Number (Thousand)

Proportion of Total Population

2020

Women

84

2.80%

2030

Women

237

6.90%

2050

Women

602

15.40%

2020

Men

227

3.30%

2030

Men

760

10.50%

2050

Men

1,454

22.30%

Source: United Nations Population Fund (UNFPA)

With a higher number of traffic accidents, especially those involving injuries such as cuts, abrasions, and deeper lacerations, there is a greater need for effective and efficient wound care solutions to treat trauma patients. Wound washes, which are designed to clean and disinfect wounds to prevent infections, have become an essential part of post-accident medical care. As road accidents increase, hospitals, clinics, emergency medical teams, and even roadside first responders are using more wound washes to clean injuries at the scene or during treatment. Furthermore, the growing number of accidents boosts the demand for wound care products in rehabilitation centers, outpatient clinics, and pharmacies that cater to individuals recovering from road-related injuries. As road accidents often lead to minor and major wounds, high-quality, easy-to-use wound cleaning solutions are critical for effective treatment and faster recovery. In 2023, the UAE experienced a rise in road accidents, with a total of 4,391 accidents, an increase of 11% from the 3,945 accidents reported in 2022.

Market Concentration & Characteristics

The degree of innovation in the UAE wound wash market is significant, with advancements across various aspects of product development and delivery systems. Manufacturers are introducing advanced wound cleansing agents, such as hypochlorous acid and iodine-based solutions, which provide superior antimicrobial effectiveness without damaging healthy tissue. Innovations in pre-moistened wound cleansing wipes have also surged, offering convenience and enhanced properties, including antimicrobial agents or moisturizing ingredients like aloe vera and glycerin.

The impact of regulations on the UAE wound wash industry is significant, as the government imposes stringent guidelines to ensure safety, efficacy, and quality in healthcare products. The regulatory environment influences product development, market access, and consumer confidence. The UAE's regulatory body, the Ministry of Health and Prevention (MOHAP), enforces strict guidelines for approving medical devices and healthcare products, including wound care solutions. These regulations ensure that only safe and effective products are available.

The UAE market for wound wash has experienced significant mergers and acquisitions activity, primarily driven by broader trends in the healthcare sector. While specific M&A transactions within the wound wash segment are limited, the overall healthcare landscape in the UAE has seen increased consolidation and strategic investments. For instance, in January 2024, PureHealth acquired the remaining 25% stake in Sheikh Shakhbout Medical City from Mayo Clinic for approximately USD 150 million. Abdul Latif Jameel Health also acquired a 70% stake in Genpharm, a Dubai-based health solutions company.

The UAE wound wash industry benefits from limited direct competition from substitute products. While there are other ways to clean a wound, like plain soap and water or saline solution, wound washes are preferred by healthcare professionals because they are specifically designed for this purpose and may contain ingredients that promote healing or fight infection.

End user concentration in the UAE wound wash market refers to the extent to which market demand is dominated by specific types of end users, such as hospitals, military and defense institutions, home healthcare providers, and outpatient clinics. However, end user concentration is gradually diversifying. The military and defense sector is expanding its adoption of advanced wound cleansing systems for combat-related injuries, and the home healthcare segment is gaining traction with products like wound cleansing wipes and pre-filled saline solutions due to the rising burden of chronic diseases and aging populations.

Product Insights

The antiseptics segment dominated the market in 2024. Antiseptic solutions, including agents such as Povidone-Iodine and chlorhexidine, are widely utilized in various healthcare settings for their broad-spectrum antimicrobial properties. These are crucial in reducing infection risks and promoting optimal healing outcomes. The UAE's advanced healthcare infrastructure and increasing surgical procedures have further propelled the demand for effective wound cleansing agents. Moreover, the government's continuous investments in healthcare services and the adoption of stringent clinical protocols have facilitated the integration of antiseptic solutions into standard wound care regimens.

The saline solution segment is expected to witness the fastest CAGR over the forecast period, due to its safety, versatility, and cost-effectiveness. Saline solutions, being sterile and isotonic, are gentle on tissues and do not disrupt the natural healing process, making them suitable for various wound types, including acute and chronic wounds. Their non-toxic nature ensures minimal irritation, which is particularly beneficial for patients with sensitive skin or those prone to allergic reactions. Healthcare providers in the UAE are increasingly adopting saline solutions due to their compatibility with various wound care protocols and their effectiveness in cleansing wounds without causing additional trauma. The rising prevalence of chronic conditions such as diabetes, which often lead to complex wound scenarios, further amplifies the demand for reliable and gentle wound cleansing agents like saline solutions..

Product Form Insights

The solutions segment dominated the market in 2024. This segment encompasses a range of products, including saline solutions, antiseptic solutions, hypochlorous acid, and enzymatic solutions. These solutions are widely utilized across various medical settings, such as clinics, hospitals, long-term care homes, and home care environments, due to their efficacy in cleansing wounds, reducing infection risks, and promoting optimal healing outcomes. The dominance of the solutions segment is attributed to its broad applicability in treating diverse wound types, from acute surgical wounds to chronic ulcers, and its compatibility with standard wound care protocols..

The wipes segment is projected to witness the fastest CAGR during the forecast period, driven by their convenience, effectiveness, and alignment with modern healthcare practices. Premoistened and individually packaged, wound cleansing wipes offer a sterile, single-use solution that minimizes the risk of cross-contamination, making them ideal for various settings, including hospitals, clinics, and home care environments. Their ease of use eliminates additional supplies like cotton balls or cleansing solutions, streamlining the wound care process. The increasing prevalence of chronic conditions such as diabetes, which often lead to complex wound scenarios, further amplifies the demand for efficient and gentle wound cleansing options. Wipes infused with antiseptic agents like benzalkonium chloride or Povidone-Iodine cleanses reduce the risk of infection, promoting optimal healing outcomes. Additionally, some wipes incorporate moisturizing ingredients like glycerin or aloe vera, which help maintain a moist wound environment conducive to healing.

Application Insights

The acute wounds segment dominated the market in 2024, owing to the high incidence of surgical and traumatic injuries across the population. Acute wounds, encompassing surgical incisions, lacerations, abrasions, and burns, necessitate immediate and effective wound cleansing to prevent infections and promote optimal healing. The increasing number of surgical procedures and the rising prevalence of trauma cases have significantly contributed to the demand for wound wash products in the region. Hospitals, the primary centers for acute wound treatment, have driven this demand. The widespread use of dispensing cap bottles in hospital settings further underscores the segment's dominance, as this type of packaging is preferred for its ease of use and efficiency in clinical environments. Moreover, the UAE's advanced healthcare infrastructure and the government's continuous investments in healthcare services have facilitated the adoption of advanced wound care solutions, including effective wound cleansing agents.

The chronic wounds segment is anticipated to experience the fastest CAGR in the UAE wound wash industry over the forecast period, driven by several interrelated factors. As per the International Diabetes Federation, there is a high prevalence of diabetes in the UAE, with approximately 12.3% of adults aged 20 to 79 affected. This condition significantly increases the risk of chronic wounds, such as diabetic foot ulcers, which require ongoing and specialized wound care. Additionally, the UAE's rapidly aging population contributes to a higher incidence of chronic wounds, including pressure ulcers and venous leg ulcers, due to age-related factors and decreased mobility. These demographic trends necessitate adopting advanced wound care solutions, including specialized wound cleansers that facilitate effective healing and reduce infection risks. Technological advancements in wound care products, such as pulsed lavage systems and antiseptic solutions, further support this growth by offering efficient and patient-friendly options for chronic wound management.

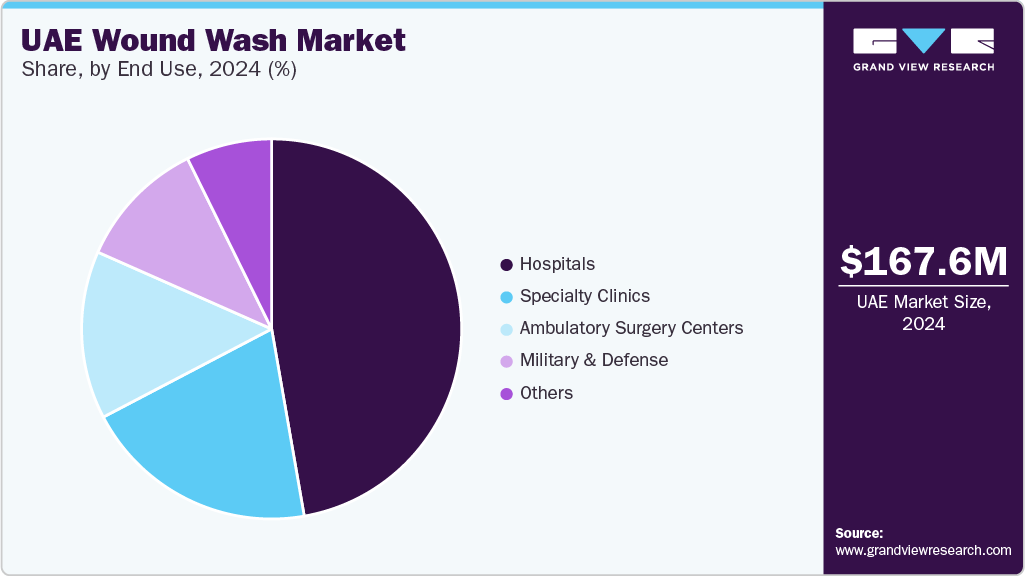

End Use Insights

The hospitals segment dominated the market in 2024. The hospital segment continues to dominate the UAE market for wound wash, driven by the country's advanced healthcare infrastructure, rising surgical procedures, and growing focus on infection prevention and advanced wound care. Hospitals serve as primary centers for acute and chronic wound treatment, requiring a consistent and high-volume supply of wound cleansers to manage a wide range of cases, from trauma and surgical wounds to diabetic ulcers and burns. The increasing prevalence of lifestyle-related conditions, such as diabetes and obesity, further contributes to a surge in chronic wound cases being treated in hospital settings. Moreover, hospitals are adopting and investing in technologically advanced wound cleansing systems, such as pressure irrigation devices and antiseptic-based cleansers, ensuring optimal patient outcomes. The availability of trained healthcare professionals and adherence to stringent clinical protocols also make hospitals key end users of wound wash products.

The military and defense segment is expected to grow at the fastest CAGR over the forecast period. This growth is fueled by the sector's unique requirements for rapid and effective wound management solutions in combat and training environments. The increasing focus on advanced wound care technologies, such as pulsed lavage systems, underscores this trend. These systems offer efficient and thorough wound cleansing and are becoming increasingly integral to military medical protocols. Furthermore, the UAE's strategic investments in healthcare infrastructure and the integration of advanced medical technologies within its defense sector are expected to further accelerate the adoption of specialized wound wash products, positioning the military and defense segment as a key contributor to the market's expansion.

Key UAE Wound Wash Company Insights

Key market players are adopting various strategies such as product launches, approvals, and others to increase their market presence and get a competitive advantage over other market players. These advancements in the UAE wound wash market are anticipated to boost market growth over the forecast period.

Key UAE Wound Wash Companies:

- Atlantis Consumer Healthcare Inc.

- Medline Industries, LP

- B. Braun SE

- Johnson & Johnson Consumer Inc. (Johnson & Johnson)

- Zimmer Biomet

- Urgo Medical North America (URGO Group)

- Coloplast Corp (Coloplast Group)

- Mölnlycke Health Care AB

- Cardinal Health

- Armis Biopharma

- Bravida Medical

- Irrimax Corporation

- BD

- Sanara MedTech Inc.

- Pure&Clean

- Innovacyn, Inc.

Recent Developments

-

In January 2024, Medline Industries, LP acquired United Medco, a national provider specializing in supplemental benefits and member engagement solutions. This strategic move enhances Medline's Health Plans business by expanding its distribution capabilities and broadening its supplemental benefit offerings.

-

In September 2024, Hidramed Solutions Ltd announced a significant development in the UAE wound care market by signing a three-year distribution agreement with Razan Medical & Surgical Equipment Trading LLC. This partnership will enable Razan Medical to distribute HidraWear, a unique, patented, adhesive-free wound dressing solution, across the UAE. In addition, HidraWear has received full regulatory approval from the UAE authorities, which further solidifies its position in the market.

UAE Wound Wash Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 178.86 million

Revenue forecast in 2030

USD 253.22 million

Growth rate

CAGR of 7.20% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue, competitive landscape, growth factors, and trends

Segments covered

Product, product form, application, and end use

Key companies profiled

Atlantis Consumer Healthcare Inc.; Medline Industries, LP; B. Braun SE; Johnson & Johnson Consumer Inc. (Johnson & Johnson); Zimmer Biomet; Urgo Medical North America (URGO Group); Coloplast Corp (Coloplast Group); Mölnlycke Health Care AB; Cardinal Health; Armis Biopharma; Bravida Medical; Irrimax Corporation; BD; Sanara MedTech Inc.; Pure&Clean; Innovacyn, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UAE Wound Wash Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UAE wound wash market report based on product, product form, application, and end use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Antiseptic

-

Povidone Iodine

-

Chlorhexidine

-

Polyhexanide (PHMB)

-

Others

-

-

Saline Solution

-

Irrigation Solution

-

Pulsed Lavage Systems

-

Disposable

-

Reusable

-

Semi Disposable

-

-

Others

-

-

Product Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Solutions

-

Sprays

-

Wipes

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Acute Wounds

-

Surgical & Traumatic Wounds

-

Burns & Lacerations

-

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

Other Chronic Wounds

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Ambulatory Surgery Centers

-

Military & Defense

-

Others

-

Frequently Asked Questions About This Report

b. The UAE wound wash market size was estimated at USD 167.63 million in 2024.

b. The UAE wound wash market is expected to grow at a compound annual growth rate of 7.20% from 2025 to 2030, reaching USD 253.22 million by 2030.

b. The hospital end-use segment dominated the UAE wound wash market with a share of 47.26% in 2024.

b. Some key players operating in the UAE wound wash market include Atlantis Consumer Healthcare Inc., Medline Industries, LP, B. Braun SE, Johnson & Johnson Consumer Inc. (Johnson & Johnson), URGO MEDICAL, Coloplast Corp (Coloplast Group), Mölnlycke Health Care AB, Bravida Medical, BD, Church & Dwight Co., Inc., Beiersdorf, AMERX Health Care Corp., NEILMED PHARMACEUTICALS INC.

b. The growth of the UAE wound wash market is driven by factors such as the rising number of road accidents, an aging population prone to chronic conditions like diabetes, and increased healthcare awareness. The expansion of healthcare facilities and trauma care, alongside the growing prevalence of chronic diseases, boosts demand for wound care products. Regulatory approvals for innovative solutions, like HidraWear, and the influx of medical tourists also contribute to market growth. Additionally, ongoing product innovations in wound care further stimulate demand for effective, patient-friendly wound washes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.