- Home

- »

- Medical Devices

- »

-

UK Condom Market Size And Share, Industry Report, 2030GVR Report cover

![UK Condom Market Size, Share & Trends Report]()

UK Condom Market (2024 - 2030) Size, Share & Trends Analysis Report By Material Type (Latex, Non-latex), By Product (Male Condom, Female Condom), By Distribution Channel (Mass Merchandizers, E-commerce), And Segment Forecasts

- Report ID: GVR-4-68040-279-0

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UK Condom Market Size & Trends

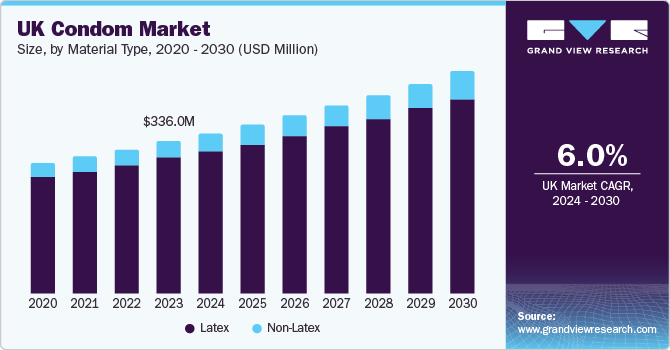

The UK condom market size was estimated at USD 336.05 million in 2023 and is projected to grow at a CAGR of 6.03% from 2024 to 2030. The increasing prevalence of sexually transmitted diseases, increasing number of screenings, and rising awareness among people due to campaigns by the government and key players are expected to drive the market growth in the region.

The market accounted for a 4.0% share of the global condom market. According to the information published by the GOV.UK, as per the sexual health screenings performed by the Sexual Health Services (SHS) for chlamydia, gonorrhea, syphilis, or HIV in 2022, a 13.4% (1,936,455) increase was noted compared to the previous year. There was also an increase of 8.2% in consultation at SHSs. These increasing consultations and rise in screenings suggest an increase in the awareness level regarding sexual health, which is driving the demand for condoms in the country.

The collaborations between different organizations and key players in the market to create awareness regarding different issues and the use of condoms are further expected to drive market growth in the UK. For instance, in June 2023, Superdrug announced its plans to launch its own condoms that would involve lessons regarding consent on the packaging. It is part of the company’s ‘You Before Yes’ campaign launched in collaboration with charities such as Brook, Fumble, UK Says No More, and Switchboard which aims at educating and empowering 18 - 21-year-olds about consent. The launch of such initiatives is further expected to drive market growth.

In addition, the governments in the UK are also engaged in the launch of several campaigns in partnership with charities to promote the use of condoms in the country and prevent the increasing prevalence of STIs. In February 2024, the free condom initiative was launched in Devon and Torbay, which enabled people under 25 in the region to access free condoms, dams, and lubricant from ‘Doink.’ Such initiatives are expected to promote the use of condoms in young-age populations and further drive market growth.

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The condom industry is characterized by a high degree of innovation owing to the increasing launch of different varieties of products and strategies to gain a competitive advantage in the market. For instance, in February 2023, a sexual wellness brand, SexBrand, backed by Uncommon Creative Studio, was launched with its most sustainable condom - SECONDSKIN Condom in the UK, which is made from bio-mimetic lubricated rubber. The company also offers vegan condoms on subscription that are made using sustainable sources of rubber, which is a part of the Regenerative Rubber Initiative.

The UK condom industry is characterized by a low level of merger and acquisition (M&A) activity by the market players. These developments are driven by the increasing emphasis on introducing new and innovative products in the market.

The condom market in the UK is also subject to regulatory scrutiny by different authorities in the country. The Medicines and Healthcare Products Regulatory Agency (MHRA) is authorized to regulate medical devices in the country to ensure their safety and efficacy. Condoms fall in the IIb category of medical devices in the UK. These regulations ensure that condoms meet certain safety and effectiveness standards.

Product expansion is an important factor in the market due to increasing awareness and demand for new and innovative products. In June 2019, Shave Club Cornerstone expanded its sex care product range with the launch of condoms. The company became the UK’s first major shave club to sell condoms by subscription.

Material Type Insights

Latex dominated the market and accounted for a revenue share of 88.9% in 2023. The growth of this segment can be attributed to the availability of latex condoms, their role in preventing the spread of STIs, and the launch of new and innovative products in this category. For instance, in April 2023, Roam introduced a range of inclusive vegan condoms matching skin tones in shades such as Original Latex, Dark Brown, and others.

Non-latex condoms are expected to grow at the fastest CAGR over the forecast period. The increasing awareness regarding the use of condoms and emphasis on product differentiation and innovation are expected to drive the segment growth for this market. In addition, concerns regarding latex allergies are also expected to help in driving the demand for non-latex condoms. According to an article published by SHD Medical in August 2023, approximately one in 1000 people in the UK are affected by latex allergies in the UK.

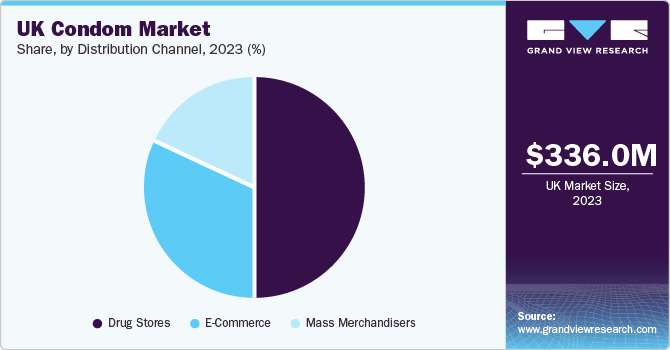

Distribution Channel Insights

Drug stores accounted for the largest market share in 2023. The high share of this segment can be attributed to the accessibility of drug stores and the availability of condoms. In addition, under various schemes of government, pharmacies also provide free condoms to people, which helps in creating awareness regarding both products and drug stores. For instance, in the UK, C-Card holders are eligible to receive free condoms from pharmacies and other shops.

The e-commerce segment is expected to grow at the fastest CAGR over the forecast period. The increasing awareness and usage of the internet and e-commerce platforms due to the convenience and anonymity offered by them and the presence of multiple options are expected to drive the segment growth over the forecast period.

Product Insights

Male condoms accounted for the largest market share in 2023. This growth can be attributed to the increasing product launches, acceptability of male condoms, and efforts by key players to create awareness and promote the use of condoms. For instance, in September 2023, Durex started an initiative to encourage use of condoms based on the survey results of Lovehoney stating that two-thirds of UK singletons rarely use condoms. The company then announced a payment of USD 126.8 (£100) to test their new condoms.

Female condoms are expected to grow at the fastest CAGR over the forecast period. The rising awareness regarding sexual health and empowerment has encouraged organizations to create awareness regarding STIs and their prevention and promote the use of contraceptives, which are expected to drive market growth. According to the information published by the City of Wolverhampton Council in October 2023, Embrace Wolverhampton Sexual Health Service launched a new campaign to create awareness to prevent the spread of sexually transmitted diseases in the country. The organization also provides consultations regarding sexual health and the use of contraceptives for all genders, ages, and orientations.

Key UK Condom Company Insights

Some of the key companies operating in the market include Reckitt Benckiser Group PLC, Roam; SexBrand, and Church & Dwight UK Ltd. The companies are engaged in introducing new product range, launch of campaigns, and partnerships to increase their share in the market.

-

Reckitt Benckiser Group PLC is a global consumer goods company with a presence in different sectors including sexual wellness. Durex is a key sexual wellness brand of the company that offers products such as condoms and personal lubricants.

-

Roam is a sexual wellness company that provides condoms and related products to mainland UK and Northern Ireland. The company offers a diverse range of condoms including ultra-thin condoms, latex-free condoms, and flavored condoms.

Key UK Condom Companies:

- Reckitt Benckiser Group PLC

- Roam

- LifeStyles HealthCare Pte Ltd

- SexBrand

- Karex Berhad

- Church & Dwight UK Ltd

Recent Developments

-

In May 2023, Durex launched an online fitting service for condoms after their survey stated that British men are too embarrassed to buy smaller-size condoms. The initiative is further expected to help create awareness and promote the use of condoms in the country.

-

In May 2022, six veg themed condoms - avocado, onions, artichokes, plums, courgetti, and aubergine were launched in the UK to create awareness regarding safe sex among adults over 65.

UK Condom Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 483.1 million

Revenue forecast in 2030

USD 667.9 million

Growth rate

CAGR of 6.03% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material Type, Product, Distribution Channels

Country scope

UK

Key companies profiled

Reckitt Benckiser Group PLC, Roam; LifeStyles HealthCare Pte Ltd; SexBrand, Karex Berhad,and Church & Dwight UK Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

UK Condom Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UK condom market report based on material type, product, and distribution channel:

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Latex

-

Non-Latex

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Male Condoms

-

Female Condoms

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Mass Merchandisers

-

Drug Stores

-

E-Commerce

-

Frequently Asked Questions About This Report

b. The UK condom market size was valued at USD 336.05 million in 2023 and is expected to reach USD 483.1 million in 2024.

b. The UK condom market is projected to grow at a compound annual growth rate (CAGR) of 6.03% from 2024 to 2030 to reach USD 667.9 million by 2030.

b. Latex dominated the market and accounted for a share of 88.9% in 2023 attributed to the availability of latex condoms, their role in preventing the spread of STIs, and the launch of new and innovative products in this category.

b. Some of the key companies operating in the UK condom market include Reckitt Benckiser Group PLC, Roam; SexBrand, and Church & Dwight UK Ltd.

b. The increasing prevalence of sexually transmitted diseases, increasing number of screenings, rising awareness, and campaigns by government and key players are expected to drive the condom market growth in the UK.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.