- Home

- »

- Clothing, Footwear & Accessories

- »

-

UK Jewelry Market Size And Trends, Industry Report, 2033GVR Report cover

![UK Jewelry Market Size, Share & Trends Report]()

UK Jewelry Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Necklace, Ring, Earring, Bracelet), By Material (Platinum, Gold, Diamond), By Distribution Channel (Offline, Online), By End-use (Men, Women), And Segment Forecasts

- Report ID: GVR-4-68040-654-8

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UK Jewelry Market Summary

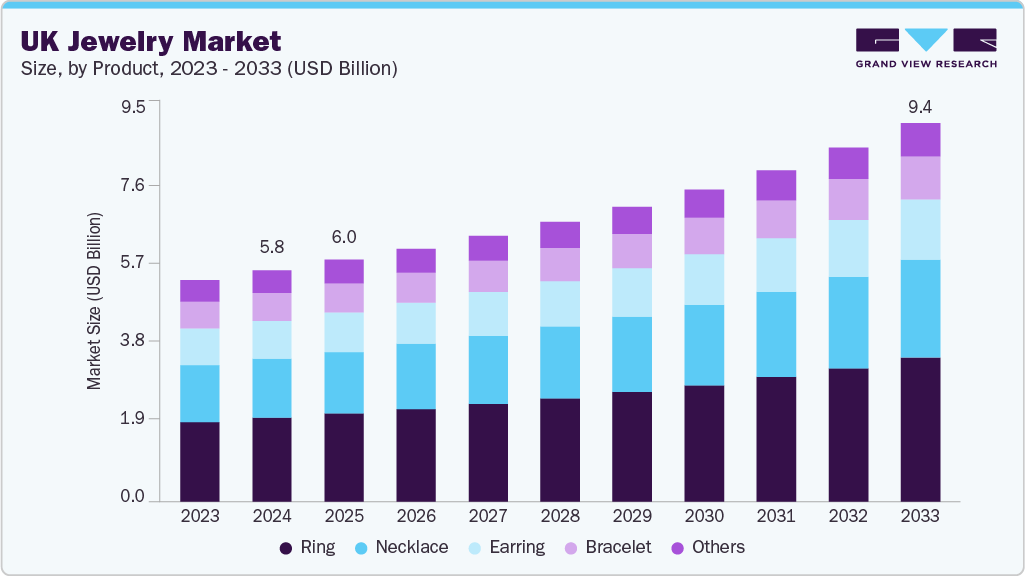

The UK jewelry market size was estimated at USD 5.76 billion in 2024 and is to reach USD 9.41 billion by 2033, growing at a CAGR of 5.7% from 2025 to 2033. The market is driven by a growing preference for long-term value, ethical sourcing, and craftsmanship.

Key Market Trends & Insights

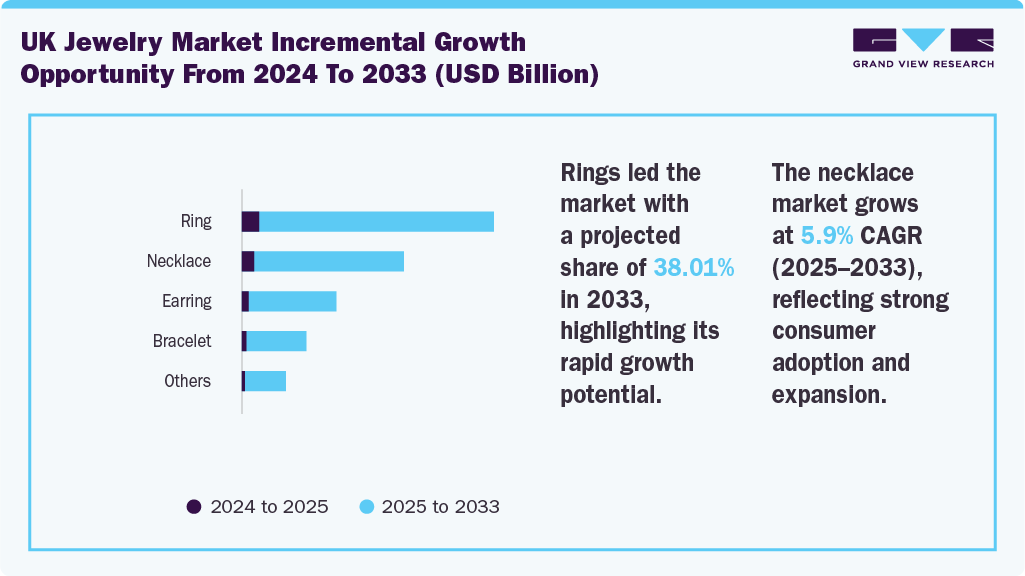

- By product, ring segment led the market with the largest revenue share of 36.26% in 2024.

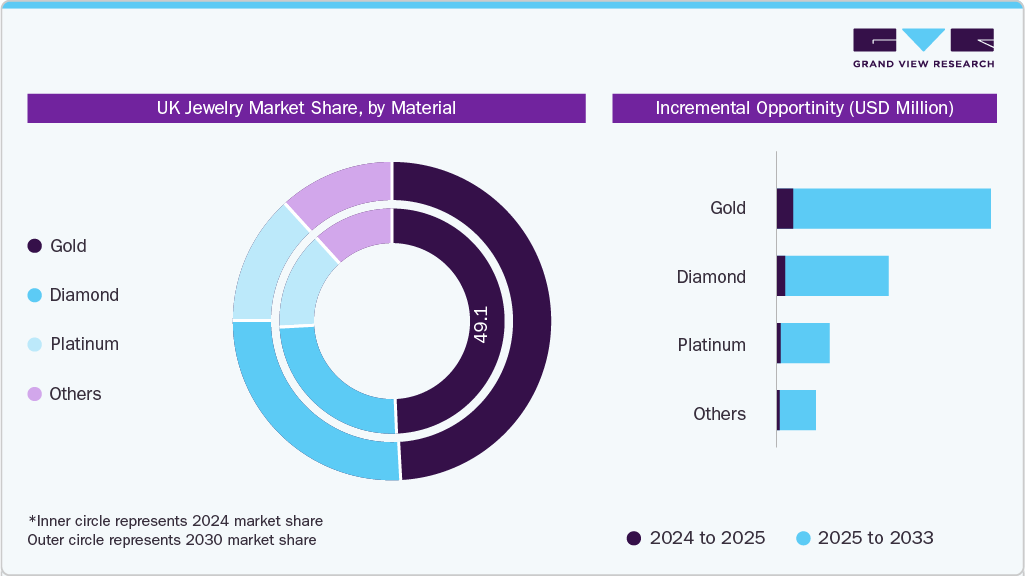

- By material, gold segment led the largest market share of 49% in 2024.

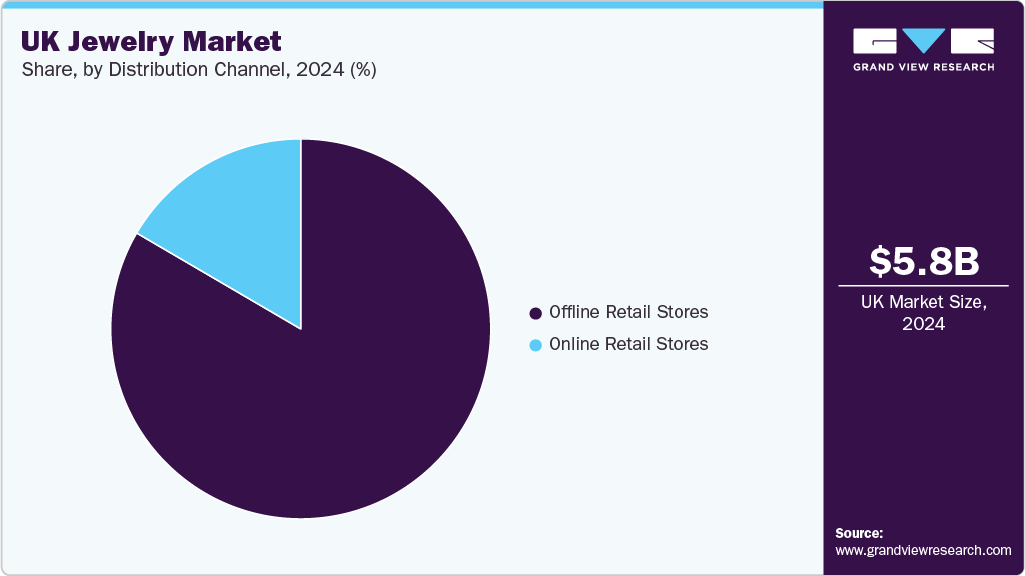

- By distribution channel, the offline sales segment held the largest share of 86.2% in 2024.

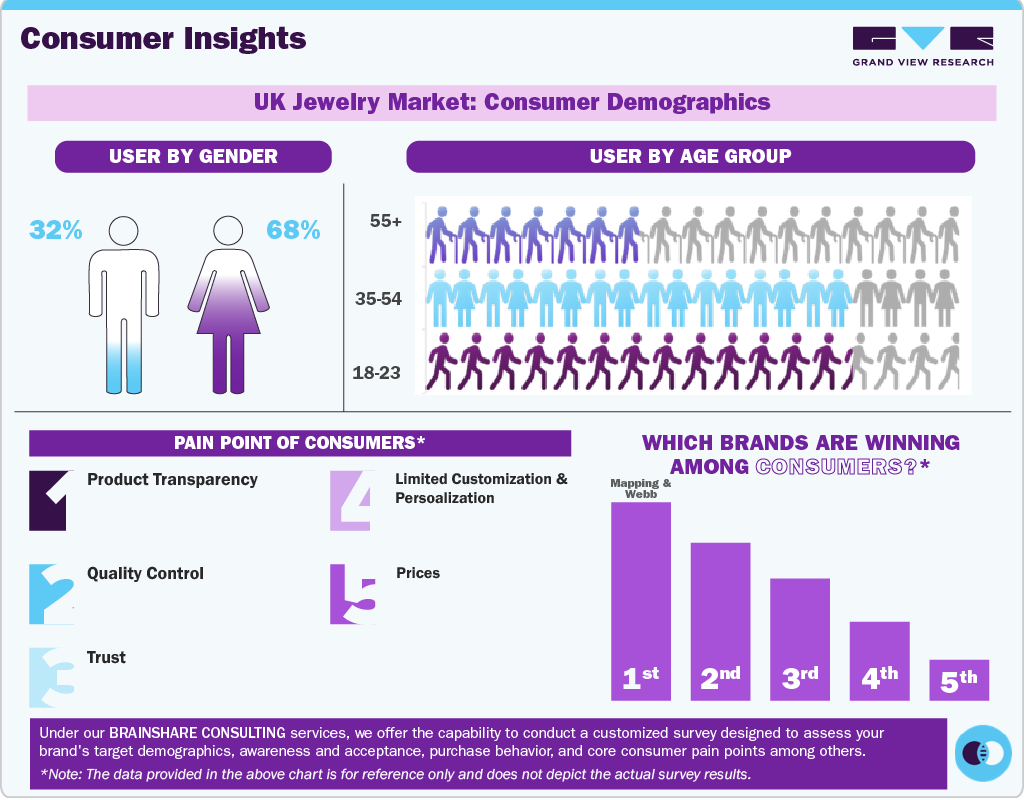

- By end use, women segment dominated the global market, with a share of 69.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.76 Billion

- 2033 Projected Market Size: USD 9.41 Billion

- CAGR (2025-2033): 5.7%

Affluent Millennials and Gen Z consumers are investing in fine jewelry for aesthetics and as a form of financial security. Weddings, anniversaries, and personalized gifting also fuel demand. Lab-grown diamonds are soaring in the UK due to compelling ethical and affordability advantages. Lab-grown diamonds may not be “natural,” but they are indisputably real, sharing the same physical, chemical, and optical properties as mined stones. They are typically 20-40% cheaper than natural diamonds, allowing consumers to purchase larger or higher-quality gems for the same budget while avoiding the environmental and human rights issues associated with mining. Equipped with advanced HPHT and CVD technologies, these diamonds are indistinguishable from mined ones and are produced with a lower carbon footprint.

Investment-oriented fine jewelry is gaining momentum in the UK as consumers turn to tangible assets during economic uncertainty. Gold, platinum, and high-quality gemstones are increasingly seen as adornments and as “wearable wealth” with lasting value. In 2024, fine jewelry outperformed several other luxury assets, with prices rising over 2%. High-purity gold (22K–24K) remains popular for its liquidity and security. At the same time, rare-colored gemstones like Burmese rubies and Kashmir sapphires are being sought after for their collectible and appreciating value. This trend reflects a growing preference for timeless, value-retaining pieces that offer beauty and financial resilience.

Product Insights

Rings emerged as the largest segment in 2024, accounting for a revenue share of 36.3% due to their deep cultural symbolism, broad appeal, and everyday wearability. Traditionally, rings have been central to major life events, particularly engagements and weddings, making them one of the most emotionally significant and consistently purchased types of jewelry. This enduring symbolism drives regular demand across generations. Beyond tradition, rings also have broad consumer appeal; they are unisex and widely accepted as fashion and personal statement pieces. The growing popularity of men’s rings, such as signet rings or minimal bands, has further expanded the market. In addition, rings are uniquely suited for daily and corporate wear due to their subtle elegance and versatility. Unlike larger or more ornate jewelry items, rings can complement casual and formal attire, making them a go-to accessory for professionals and style-conscious consumers.

Rings are highly customizable and ideal for personal gifts and bespoke designs. Features like engravings, birthstones, and initials allow buyers to create meaningful, one-of-a-kind pieces. For instance, Monica Vinader offers free engraving and custom gemstone options, catering to the growing demand for personalized jewelry.

The necklace market is anticipated to witness a CAGR of 5.9% from 2025 to 2033 due to evolving fashion trends, styling flexibility, and strong personalization appeal. The rise of layered necklaces looks often showcased by influencers, has encouraged consumers to purchase multiple pieces for mixing and matching, making necklaces both a fashion statement and a repeat-purchase item. Their versatility allows them to complement various outfits, from casual to formal attire, appealing to diverse style preferences. In addition, personalized options such as name pendants, birthstones, and lockets make necklaces a favored choice for meaningful gifts. For instance, Abbott Lyon, a UK-based brand, has capitalized on this trend by offering a wide range of customizable necklaces that combine style and sentiment, attracting a strong following among Millennials and Gen Z.

Material Insights

Gold jewelry is the largest segment accounting for a share of 49.1% in 2024 due to its strong blend of aesthetic, cultural, and financial value. First and foremost, gold is viewed as both a fashion statement and a long-term investment, especially during economic uncertainty. Its ability to retain or appreciate makes it more appealing than other metals. Gold is also highly versatile and suitable for everyday wear, formal occasions, and traditional events, which broadens its appeal across age groups and cultural backgrounds. In addition, 22K and 24K gold jewelry is particularly popular among South Asian communities in the UK, where gold plays a significant role in weddings and gifting. Brands like Malabar Gold & Diamonds and Tanishq have capitalized on this demand by expanding their presence in UK cities with large diaspora populations.

Diamond jewelry is the fastest growing segment, expected to grow at a CAGR of 6.2% from 2025 to 2033. Traditionally reserved for engagements and luxury gifting, diamonds are now embraced for everyday wear thanks to minimalist designs and rising affordability, particularly through lab-grown options. Younger consumers are increasingly purchasing diamond studs, pendants, and stackable rings not just for special occasions but as self-gifts and fashion statements.

In addition, diamonds carry strong emotional and symbolic value, making them ideal for personal milestones, anniversaries, and custom creations. The UK market has also seen a rise in ethical and sustainable diamond demand, with brands like VRAI and Pandora promoting lab-grown collections that appeal to eco-conscious buyers.

End-use Insights

The women are the largest growing segment accounting for a share of around 69.2% in 2024 in UK, due to a combination of cultural, emotional, and fashion-driven factors. Jewelry is often seen as a form of self-expression, and women frequently buy pieces to complement outfits, celebrate milestones, or mark personal achievements. In addition, many women in the UK purchase jewelry as self-gifts, a trend supported by rising financial independence and shifting attitudes toward personal reward. Jewelry also remains a top choice for gifting occasions like birthdays, anniversaries, and Mother’s Day, where women are typically the recipients.

Men are the fastest growing segment expected to grow at a CAGR of 5.1% from 2025 to 2033, due to shifting fashion norms, improved design offerings, and increased self-expression. Modern men are more open to accessorizing, with rising demand for items like chains, signet rings, bracelets, and earrings often influenced by pop culture, sports icons, and fashion influencers. Brands are responding with sleek, minimalist, and masculine designs that appeal to everyday style and special occasions alike. In addition, changing attitudes around gender and fashion have made jewelry more acceptable and even essential in men's wardrobes.

Distribution Channel Insights

The sales of jewelry through jewelry stores is the largest growing segment, accounting for a share of around 86.8% in 2024. In the UK, consumers prefer buying jewelry from physical stores due to the trust, authenticity, and personalized service they offer. Seeing, touching, and trying on jewelry helps shoppers assess quality and ensures confidence in high-value purchases. In-store experts provide valuable guidance, especially for items like engagement rings or bespoke designs, while services like resizing, repairs, and certification add long-term value. For example, Ernest Jones, one of the UK’s major jewelry retailers, attracts customers with its wide in-store selection, knowledgeable staff, and tailored services that enhance the buying experience and post-purchase support.

Sales of jewelry through online channels are the fastest growing segment, expected to register a CAGR of 8.2% from 2025 to 2033. Online stores allow shoppers to browse and purchase anytime, compare prices easily, and access styles from both global and local brands. Many e-retailers also offer customization tools, virtual try-ons, and detailed product descriptions, making informed choices without visiting a store easier. The rise of free returns, secure payment options, and fast shipping has further boosted confidence in online jewelry shopping. Astley Clarke is a leading online jewelry brand in the UK, known for its stylish, personalized pieces and user-friendly digital platform. The brand offers virtual try-ons, customization tools, and ethically sourced materials like recycled gold and traceable gemstones, making it a popular choice among modern, online-savvy consumers.

Key UK Jewelry Company Insights

Leading players in the UK jewelry industry include Mappin & Webb, Boodle and Dunthorne limited, Graff Diamonds Limited, De Beers Jewellers Ltd, etc. Companies actively invest in innovative design technologies, customization tools, and seamless digital experiences to enhance customer engagement and personalization. In addition, the market is witnessing the entry of major fashion and lifestyle brands, bringing strong branding capabilities and broader consumer reach. As consumer interest in jewelry continues to grow-driven by fashion trends, personalization, and gifting culture-the demand for convenient and accessible purchasing options is rising. These factors position the UK market for substantial growth in the coming years.

Key UK Jewelry Companies:

- Boodle and Dunthorne limited

- Graff Diamonds Limited

- De Beers Jewellers Ltd

- Tiffany & Co.

- Pandora Jewelry, Inc.

- Monica Vinader

- PNG Jewellery

- Signet Trading Limited

- Astley Clarke Ltd

- Mappin & Webb

Recent Developments

-

In May 2025, Boodles partnered with insurer Stanhope to offer 14 days of free worldwide insurance on jewelry purchases up to £500,000, covering loss, theft, accidental damage, and fire. This initiative, now available across all UK boutiques, provides customers immediate protection and peace of mind from the moment of purchase. It also includes an option for extended coverage at a 10% discount. This move strengthens Boodles’ premium positioning by enhancing customer trust, convenience, and overall service experience in the luxury jewelry market.

-

In November 2024, Boodles expanded its flagship store at Victoria Leeds from 1,200 to 2,700 square feet, enhancing its luxury retail presence in the region. The expansion included the launch of" The Rose Garden Suite," a private event space designed for exclusive experiences such as VIP client evenings, champagne receptions, and private dinners. This move reflects a strategy to elevate in-store engagement, deepen customer relationships, and reinforce its positioning as a premium British jeweler, offering exceptional products and personalized service.

-

In July 2023, Mappin & Webb unveiled a redesigned flagship showroom on Davy Gate in York, replacing its smaller Coney Street location. The new 2,300 sq ft open-plan space showcases a blend of contemporary visual identity and historic architecture, featuring dedicated watch and jewelry areas, including a Rolex room, VIP consulting rooms, a bridal section, and a hospitality bar. With soft blush accents, frameless glass display cases, and intelligent lighting, the layout enhances product visibility and client experience, reaffirming Mappin & Webb’s commitment to luxury retail and traditional craftsmanship.

UK Jewelry Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.02 billion

Revenue Forecast in 2033

USD 9.41 billion

Growth rate

CAGR of 5.7% from 2025 to 2033

Actual data

2018 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, distribution channel, end-use

Key companies profiled

Boodle and Dunthorne Limited; Graff Diamonds Limited ; De Beers Jewellers Ltd; Tiffany & Co.; Pandora Jewelry, Inc.; Monica Vinader ; PNG Jewellery; Signet Trading Limited; Astley Clarke Ltd; Mappin & Webb

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Jewelry Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends and opportunities in each sub-segment from 2018 to 2033. For this study, Grand View Research has segmented the UK jewelry market report by product, material, distribution channel, and end-use.

-

Product Outlook (Revenue, USD Billion, 2018 - 2033)

-

Necklace

-

Ring

-

Earring

-

Bracelet

-

Others

-

-

Material Outlook (Revenue, USD Billion, 2018 - 2033)

-

Platinum

-

Gold

-

Diamond

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2033)

-

Offline Retail Stores

-

Supermarkets & Hypermarkets

-

Jewelry Stores

-

-

Online Retail Stores

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2033)

-

Men

-

Women

-

Children

-

Frequently Asked Questions About This Report

b. The UK jewelry market was estimated at USD 5.76 billion in 2024 and is expected to reach USD 6.02 billion in 2025.

b. The UK jewelry market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2033 to reach USD 9.41 billion by 2033.

b. Rings emerged as the largest segment in 2024, accounting for a revenue share of 36.3% due to their deep cultural symbolism, broad appeal, and everyday wearability. Traditionally, rings have been central to major life events, particularly engagements and weddings, making them one of the most emotionally significant and consistently purchased types of jewelry.

b. Some of the key players in the UK jewelry market is - Boodle and Dunthorne limited; Graff Diamonds Limited ; De Beers Jewellers Ltd ; Tiffany & Co. ; Pandora Jewelry, Inc. ; Monica Vinader ; PNG Jewellery ; Signet Trading Limited ; Astley Clarke Ltd; Mappin & Webb.

b. The UK jewelry market is driven by a growing preference for long-term value, ethical sourcing, and craftsmanship. Affluent Millennials and Gen Z consumers are investing in fine jewelry for aesthetics and as a form of financial security. Weddings, anniversaries, and personalized gifting also fuel demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.