- Home

- »

- Homecare & Decor

- »

-

UK Kids Furniture Market Size, Share, Industry Report, 2030GVR Report cover

![UK Kids Furniture Market Size, Share & Trends Report]()

UK Kids Furniture Market Size, Share & Trends Analysis Report By Product (Beds, Cots, & Cribs, Mattresses), By Raw Material (Wood, Polymer, Metal), By Application, By Distribution Channel And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-227-8

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

UK Kids Furniture Market Size & Trends

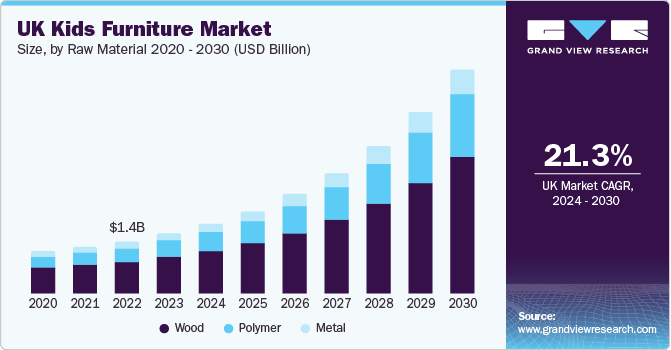

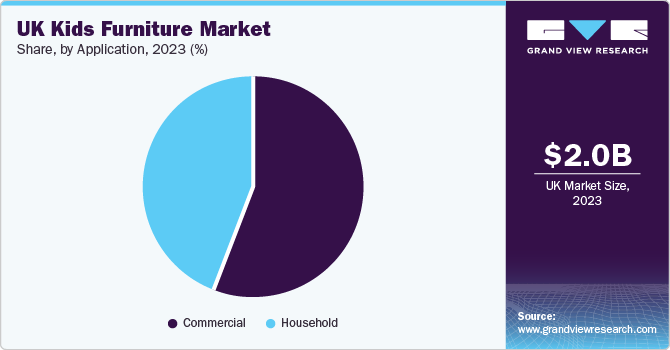

The UK kids furniture market size was estimated at USD 2.01 billion in 2023 and is expected to grow at a CAGR of 21.3% from 2024 to 2030. The growing demand for residential furniture in the country. The market participants in the country have shifted their production to other countries to reduce production cost and increase operational efficiency. Furthermore, the growing trend of housing renovations and an increased demand for residential dwelling, as well as the trend of a separate room for kids, which is favoring the market growth.

UK kids furniture market accounted for the share of 4.00% of the global kids furniture in 2023.

Educational furniture plays an important role in the formation of a dynamic learning environment that is beneficial for the students’ physical health. A constant demand for ergonomically designed products for preventing health problems and providing a comfortable learning environment among teachers & students will support the application growth. The introduction of dynamic and interactive teaching styles including blended learning and flipped classrooms is transforming the industry landscape.

According to World Bank, in 2020, GDP per capita purchasing power parity for U.K. was USD 44,117. The GDP per capita purchasing power parity of U.K. increased from USD 28,000 in 2001 to USD 44,117 in 2020 growing at an average annual rate of 2.48%. This increase in GDP purchasing power parity will likely propel the kids furniture market growth in the country.

This country has strong presence of manufacturers and distributors, which keeps the prices under check. Moreover, the increasing presence of online retailers will drive product sales in the market. For instance, KIDSKRAFT offers a wide range of kids furniture online. The product category includes kids table & chair sets, bookcase & shelves, toy boxes & benches, bin units, and kids desks.

Market players have been incorporating unique features such as 3D prints and theme-based furniture to make kids furniture more attractive to the children. These factors are expected to drive the growth of the market. For instance, Circu Magical Furniture offers numerous theme based beds for children such as Orient Express Bed, Mr. Bunny Bed, Tristen Bed, Dino Bed, Cloud Bed, Bubble Gum Bed, Bun Van Bed, Fantasy Air Balloon Bed, Sky Air Plane Bed, Little Mermaid Bed, Kings & Queens Castle Bed, and Teepee Room Bed. These themes attract and encourage kids to use the furniture in their day-to-day life, which is likely to contribute to the market growth.

Market Concentration & Characteristics

The UK kids furniture industry is characterized by high degree of innovation, with businesses continuously focusing on differentiating themselves through unique experiences and offerings. Market players have been incorporating unique features such as sensory control, intelligent lighting, and noise control to make kids’ furniture more beneficial and attractive for consumers. Such technological advancements enable the growth of the market. For instance, Pillowfort’s Sensory Friendly Activity Chair sold at Target stores encourages sensory exploration and lends enhanced comfort to the kids. It can be pulled right up to a kids’ activity desk, making it an ideal piece of furniture for reading, homework, or enjoying arts and crafts.

The industry is also characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. Social media plays an important role in the growth of the kids furniture industry. Brands collaborate with influencers to promote their product. These influencers are known to post pictures and videos of various furniture items that their kids use in and around the house. A number of millennial parents tend to be heavily influenced by the lifestyles and choices of their favorite and most admired celebrities. This presents players with a significant opportunity to expand their reach and target more customers. Companies are also investing heavily in providing an offline shopping experience to consumers by opening brick-and-mortar stores.

End-user concentration is a significant factor in the UK kids furniture industry. Rising inclination toward the 3D printed furniture trend in the market. Consumers are looking for customized furniture better suited for their individual décor needs and find the perfect solution in 3D printing. This type of material is built quicker than the conventional techniques as the technology is capable of concretizing even the most complex of designs in a shorter time. This efficiency also reduces the wastage of raw materials and hence reduces the overall cost. As a result, this trend is gaining popularity among consumers and manufacturers alike.

Product Insights

The beds, cots, and cribs segment dominated the market with a revenue share of 32.47% in 2023. Healthy sleep plays a quintessential role in the physical and emotional well-being of infants and young children. Sleep is a dynamic developmental process, especially in the first two years, and assists in promoting growth, improving learning, and increasing the attention span of babies. Consequently, there is a significant rise in the demand for kids’ cribs, cots, and beds in the country.

Kids mattresses market is expected to grow at a CAGR of 22.9% from 2024 to 2030. Children tend to need more sleep than adults making mattresses a vital component of kids’ furniture. The best mattresses for growing kids tend to be firm and supportive. These may also have a lower profile than adult mattresses and are usually available in twin, twin XL, and full sizes. These are intended to provide a safe, comfortable sleeping surface, along with all the basic structures such as the core, padding, flame retardant materials, and the covering.

Raw Material Insights

Kids wood furniture market dominated the market with a revenue share of 61.69% in 2023.Increasing focus on quality furniture so as to help create the right ambience in kids’ rooms is increasing the market scope for wood-based furniture products. Wood is a highly popular material as it is environment friendly and it gives an aesthetic appearance to the furniture. According to the Wood Panel Products Federation, 28 percent of the domestically produced wood products are consumed by the U.K. furniture industry, which is similar to the round wood products consumed in the U.K. Similarly, the Timber Trades Federation estimates that 30% of its domestically produced wood is used for furniture production. This shows that wood is widely preferred to produce kids furniture in the country.

Kids polymer furniture market is expected to grow at a CAGR of 22.1% over the forecast period.To make use of recycled plastic bags and other plastic items, manufacturers like Dow work with plastic film recycling companies like Avangard Innovative. Avangard takes previously used low-density polyethylene (LDPE), also known as plastic film, which is used in plastic packaging, bags, and bottles, and turns it into high-quality recycled resin suitable for making new products. Dow then takes the recycled materials and uses its material science technology to enable them to be used in a wide variety of items, such as outdoor furniture. This step is adopted in the country in order to support environmental sustainability and ecology. These factors are expected to boost segment growth over the forecast period.

Application Insights

Usage of kids furniture in household sector dominated the market with a revenue share of more than 67.15% in 2023.The increasing number of constructions has paved the path for quality kids furniture such as beds, cribs, cots, tables, chair, shelves, and wardrobe. According to the Ministry of Housing, Communities & Local Government, it was found that the number of new homes built by June 2019 surged to over 170,000, which is the highest from the past 11 years. Almost 1,73,660 new homes were built in the U.K. in 2019, accounting for the 8% increase from the previous year. This shows that there is an increase in the residential houses in the U.K. which will likely favor the growth of the kids furniture market.

Usage of kids furniture in commercial sector is expected to grow at a CAGR of 20.5% from 2023 to 2030. Several parents continue to work in order to maintain their standard of living and also to provide better education for their children, which implies less quality time for their children. This has increased the number of daycare and crèche facilities in both schools as well as office compounds in the UK. This has resulted in an increased demand for kids’ furniture in commercial spaces like crèche and daycare facilities.

Key UK Kids Furniture Company Insights

Some of the key players operating in the market Circu Magical Furniture, Williams-Sonoma Inc. and BABYLETTO

-

Circu Magical Furniture offers luxury children’s furniture and is headquartered in Rio Tinto, Portugal. The company was established by Portuguese designer André Oliveira in the year 2015. All its furniture pieces are hand-crafted from the finest materials and allow children to live their magical fantasies.

-

Williams-Sonoma Inc., founded in 1956 by Chuck Williams in California, U.S., is a multi-channel specialty retailer of cookware, appliances, and home furnishings. It is headquartered in San Francisco, California, U.S.The company sells kids’ furniture under Pottery Barn Kids brand, which exclusively focuses on the kids’ market. The company offers kid's bedding, furniture, chairs, beanbags, baby furniture, toys, gifts, and home decor products.

Blu Dot, Casa Kids, and Crate and Barrel (Crate & Kids) are some of the other participants in the UK kids furniture market,

-

Blu Dot was founded in 1997 and is headquartered in Minnesota, U.S. The company designs and produces contemporary furniture, with the goal of “bringing good design to as many people as possible.” Blu Dot works with craftspeople from around the world to bring designs to life. A small, family-owned factory in Northern Italy that specializes in metalworking was tasked to manufacture the Hot Mesh collection, which includes a chair, lounge chair, ottoman, stools, and café and bar tables.

-

Casa Kids is a children’s furniture company based in Brooklyn, New York, U.S. It was founded in 1992 by Roberto Gil. The company has embraced a simple approach in its designs — functionality above décor and durability over most everything else. Its furniture is adaptable, for instance, once a child grows out of his or her loft bed, the cabinets underneath can be moved and used as independent pieces.

Key UK Kids Furniture Companies:

- Circu Magical Furniture

- Williams-Sonoma Inc.

- BABYLETTO

- Blu Dot

- Casa Kids

- Crate and Barrel (Crate & Kids)

- Circu Magical Furniture

- Million Dollar Baby Co.

- KidKraft

- Sorelle Furniture

Recent Developments

-

In October, 2023Pottery Barn Kids, a manufacturer of kid’s furniture bedding, décor and accessories acquired Williams-Sonoma Inc.

-

In June 2021, Williams-Sonoma, Inc. announced the return of a partnership with The Trevor Project, the world’s largest suicide prevention and crisis intervention organization for lesbian, gay, bisexual, transgender, queer, and questioning (LGBTQ) young people. The organization provides support to LGBTQ youth through free and confidential crisis services. As part of the partnership, Pottery Barn, Pottery Barn Teen, Mark & Graham, West Elm, and Williams Sonoma will sell exclusive products that benefit the organization.

UK Kids Furniture Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.33 billion

Revenue forecast in 2030

USD 7.45 billion

Growth rate

CAGR of 21.3% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, raw material, application, distribution channel

Country scope

UK

Key companies profiled

Circu Magical Furniture; Williams-Sonoma Inc.; BABYLETTO; Blu Dot; Casa Kids; Crate and Barrel (Crate & Kids); Circu Magical Furniture; Million Dollar Baby Co.; KidKraft; Sorelle Furniture

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, & segment scope.

UK Kids Furniture Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the UK kids furniture market report based on product, raw material, application and distribution channel:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Beds, Cots, & Cribs

-

Table & Chair

-

Cabinets, Dressers, & Chests

-

Mattresses

-

Others

-

-

Raw Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wood

-

Polymer

-

Metal

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial

-

Household

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

Frequently Asked Questions About This Report

b. The UK kids furniture market size was estimated at USD 2.01 billion in 2023 and is expected to reach USD 2.33 billion in 2024.

b. The UK kids furniture market is expected to grow at a compounded growth rate of 21.3% from 2024 to 2030 to reach USD 7.45 billion by 2030.

b. The beds, cots, and cribs segment dominated the market with a revenue share of 32.47% in 2023. Healthy sleep plays a quintessential role in the physical and emotional well-being of infants and young children. Sleep is a dynamic developmental process, especially in the first two years, and assists in promoting growth, improving learning, and increasing the attention span of babies.

b. Some key players operating in the UK kids furniture market include Circu Magical Furniture; Williams-Sonoma Inc.; BABYLETTO; Blu Dot; Casa Kids; Crate and Barrel (Crate & Kids); Circu Magical Furniture; Million Dollar Baby Co.; KidKraft; Sorelle Furniture

b. Key factors that are driving the UK kids furniture market growth include the growing demand for residential furniture in the region. The market participants in the region have shifted their production to other regions/countries to reduce production cost and increase operational efficiency. Furthermore, the growing trend of housing renovations and an increased demand for residential dwelling, as well as the trend of a separate room for kids, which is favoring the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."