- Home

- »

- Homecare & Decor

- »

-

UK Kitchenware Market Size & Share, Industry Report, 2033GVR Report cover

![UK Kitchenware Market Size, Share & Trends Report]()

UK Kitchenware Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Cookware, Bakeware), By Application (Residential, Commercial), By Distribution Channel (Specialty Stores, Online Retail), And Segment Forecasts

- Report ID: GVR-4-68040-680-5

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

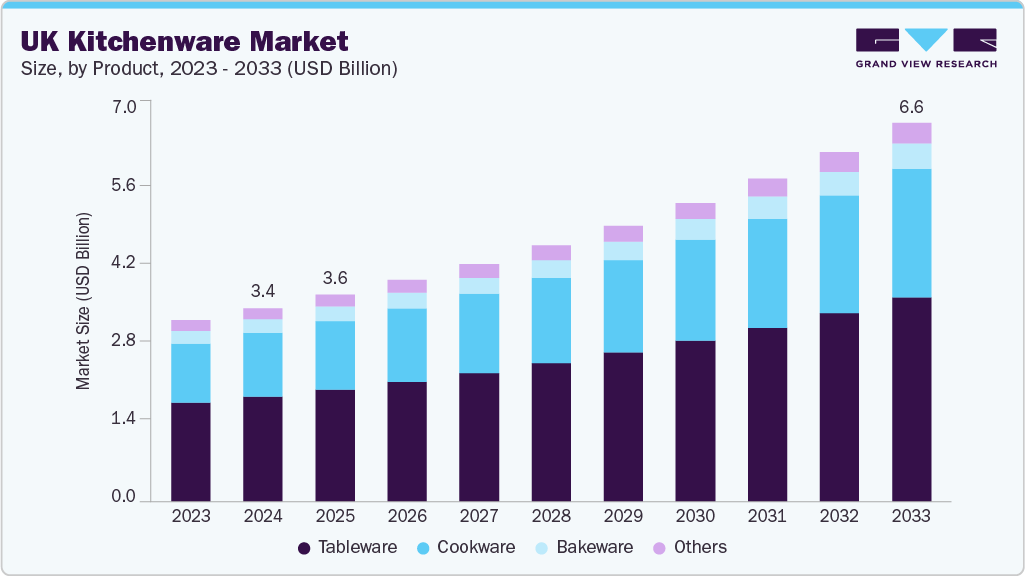

The UK kitchenware market size was estimated at USD 3,375.9 million in 2024 and is expected to grow at a CAGR of 7.8% in the forecast period from 2025 to 2033. A major trend shaping the market is the increasing popularity of home cooking and experimentation with new ingredients. According to a recent survey, 51% of UK consumers are experimenting with new cooking trends, and this figure rises to 60% among those aged 16-34. This surge in culinary curiosity has led to a rise in scratch cooking, further driving demand for kitchen essentials such as cookware, utensils, chopping boards, and bakeware.

This behavioral shift, amplified by food-related social media content, cooking tutorials, and health consciousness, prompts consumers to invest in higher-quality, aesthetically appealing, and multifunctional kitchenware. Sustainability is another powerful driver reshaping the UK kitchenware industry. Eco-conscious consumers actively seek durable, reusable, and sustainable alternatives to traditional materials, such as bamboo utensils, glass storage containers, and stainless-steel straws. Government regulations aimed at reducing single-use plastics and carbon emissions are also accelerating the adoption of sustainable kitchenware, making it a mainstream rather than a niche preference.

Digitalization and changing retail dynamics are further contributing to market growth. E-commerce continues to expand, driven by consumers' preference for convenience, product variety, and online-exclusive deals. According to the Office for National Statistics, online household goods sales accounted for nearly 30% of all homeware purchases in 2023. This shift is particularly impactful for kitchenware, as it allows brands to showcase innovations like smart kitchen gadgets, ergonomic tools, and compact storage solutions that cater to urban lifestyles.

Consumer Insights & Surveys

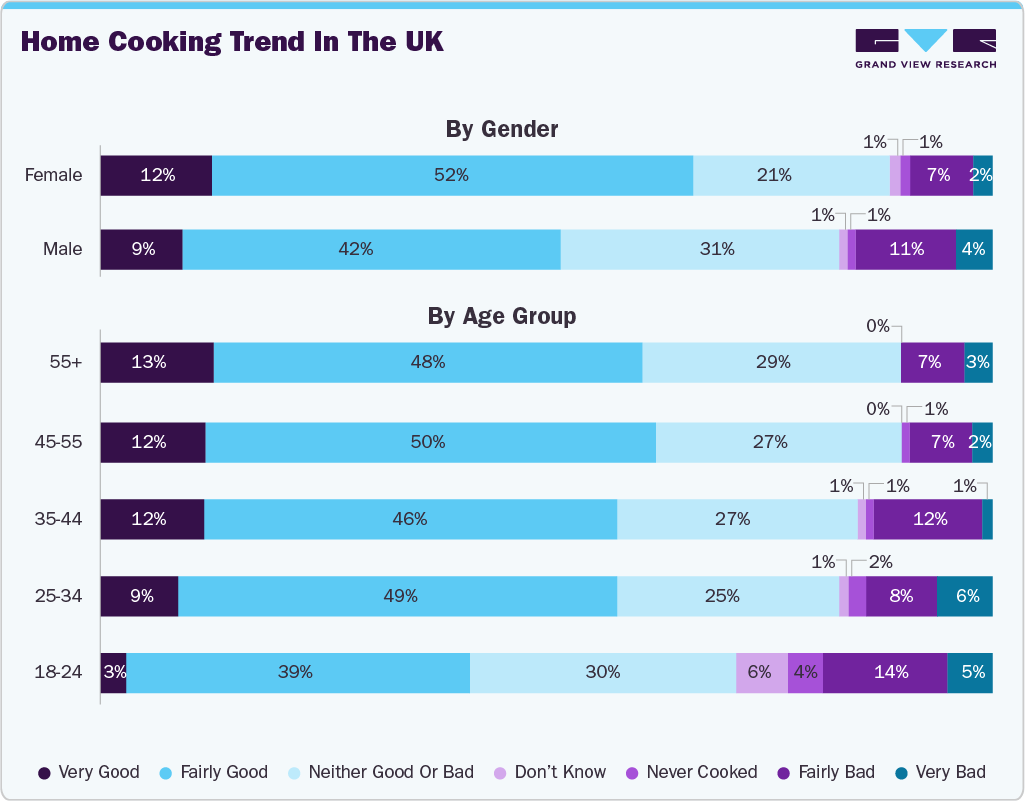

Consumer preferences in the UK kitchenware industry are deeply influenced by generational behaviors, gender roles, and changing lifestyle patterns. Cooking confidence varies across age groups in the country. According to the Survey data published by YouGov, 58% of Britons consider themselves either "very good" (11%) or "fairly good" (47%) at cooking. Notably, women report higher confidence, with 64% rating themselves positively, compared to 51% of men. This suggests a stronger inclination among women toward investing in quality kitchenware.

Among age groups, the consumer between 18-24 years of age stands out, with 39% claiming to be "very good" at cooking, the highest across all age bands. This aligns with growing enthusiasm for home cooking among younger consumers, especially Gen Z and Millennials, who are more open to experimenting with global cuisines and healthier eating habits. Their kitchenware preferences often lean toward trendy, multifunctional, compact tools that suit smaller urban kitchens and contemporary aesthetics.

Home cooking trend in the UK

The young demographic is driving demand for bakeware, air fryers, spiralizers, digital thermometers, and smart kitchen appliances. Influenced by platforms like TikTok and Instagram, they prioritize kitchenware supporting creativity and visual appeal. Eco-consciousness is also high in this group, with increasing preference for reusable, biodegradable, or recycled-material kitchen products. Meanwhile, Gen X and Baby Boomers, who tend to cook out of routine or necessity, favor functionality and durability, often preferring traditional cookware like cast iron pans and high-quality knives.

Product Insights

Tableware accounted for a revenue market share of about 54.28% in 2024 due to a combination of evolving consumer lifestyles, increased frequency of home dining, and a strong emphasis on aesthetics and presentation. As more consumers hosted at home post-pandemic, the demand for elegant, versatile, and functional tableware surged. Social media trends have further fueled this shift, with consumers prioritizing visually appealing dinner sets, serveware, and cutlery to enhance the dining experience.

Furthermore, the rise in online food content and cooking shows inspired people to replicate restaurant-style plating at home. Retailers responded by expanding their premium and designer tableware offerings. For instance, in 2024, Denby launched its "Quartz Rose" collection in the UK, blending handcrafted ceramic artistry with contemporary pastel aesthetics, targeting traditional buyers and younger audiences seeking sophistication. This growing emphasis on style, hosting culture, and quality has firmly positioned tableware as the leading segment in the market.

Demand for cookware is projected to rise at a CAGR of 8.3% from 2025 to 2033 in the UK kitchenware industry. The ongoing trend of home cooking, reinforced by rising food costs and increased health consciousness, encourages consumers to prepare meals from scratch more frequently. As a result, there is growing interest in high-performance, durable, and non-toxic cookware that supports healthy cooking practices. Younger consumers, particularly Millennials and Gen Z, increasingly embrace cooking as a hobby and creative outlet, driving demand for versatile and modern cookware like non-stick pans, induction-compatible pots, and multi-purpose skillets.

Moreover, integrating technology, such as smart cookware that monitors temperature or connects to recipe apps, attracts tech-savvy users. Sustainability is another key factor, with rising demand for eco-friendly cookware from recycled metals or ceramic coatings free from harmful chemicals like PFOA or PTFE.

Application Insights

Kitchenware used for residential applications accounted for the revenue share of about 65.71% in the UK due to the growing trend of home cooking, increased meal preparation frequency, and rising interest in culinary experimentation. Factors such as hybrid work models, inflation-driven dining-out reductions, and social media influence have encouraged consumers to invest more in quality kitchen tools for everyday use. Moreover, the surge in home improvement activities and preference for aesthetically pleasing, multifunctional kitchenware has further boosted residential demand across all age groups.

Kitchenware used for commercial applications is estimated to grow at a CAGR of 8.1% over the forecast period. The expansion of the hospitality, foodservice, and catering industries is primarily driving the market growth across the country. As restaurants, cafés, and hotels increasingly focus on enhancing operational efficiency and dining experiences, there is a rising demand for durable, high-capacity, and professional-grade kitchenware. In addition, the growth of dark kitchens, food delivery services, and gourmet catering businesses is fueling investments in specialized cookware and utensils designed for high-volume, consistent performance in commercial settings.

Distribution Channel Insights

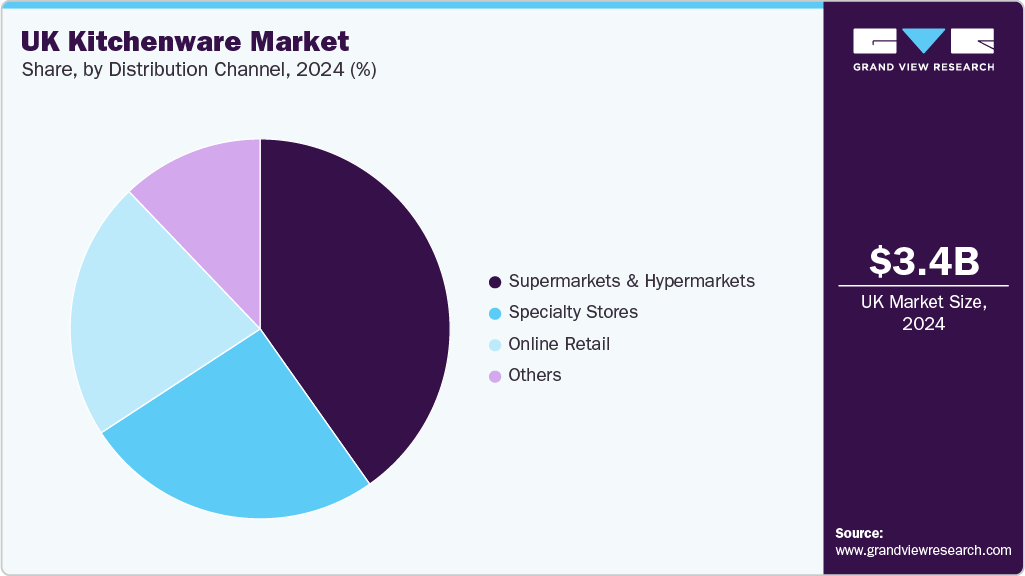

Sale of kitchenware through supermarkets and hypermarkets accounted for a revenue share of about 40.22% in 2024. Consumers often choose supermarkets and hypermarkets for kitchenware purchases due to their convenience, wide product selection, and competitive pricing. These one-stop retail destinations allow shoppers to buy groceries and household items in a single trip, saving time and effort. The ability to see, touch, and compare products in person and assistance from in-store staff add to the appeal of physical retail. These stores cater to diverse budgets by offering everything from basic kitchen tools to premium cookware, often accompanied by seasonal deals, bundle offers, and loyalty rewards.

Sale of kitchenware through online retail is expected to grow at a CAGR of 8.3% from 2025 to 2033. Online shopping allows customers to browse and buy anytime, making it especially appealing for busy individuals or those in remote locations. The availability of multiple brands across various price points, exclusive discounts, flash sales, and festive deals appeals to cost-conscious shoppers. Added benefits such as easy returns, doorstep delivery, and secure payment options have further boosted consumer confidence, particularly in the post-pandemic era. According to a Private Label Manufacturers Association (PLMA) survey, many consumers reported buying kitchenware and cookware online, reflecting a strong and growing preference for digital shopping in this category.

Key UK Kitchenware Company Insights

The market includes a mix of established brands and emerging players. Leading companies are proactively adapting to changing trends in kitchenware and expanding their offerings to maintain and strengthen their market position.

-

Groupe SEB is a global leader in cookware and small household appliances, recognized for its diverse portfolio of over 45 brands, including Tefal, Moulinex, Krups, Rowenta, WMF, All-Clad, and Supor. With operations spanning more than 150 countries, the company sells over 344 million products annually, serving a broad and varied consumer base. Its offerings range from kitchen appliances such as coffee makers and blenders to cookware and home care products like vacuum cleaners, irons, and hair dryers.

-

Meyer International Holdings Limited is a prominent global manufacturer and distributor of cookware and kitchenware, with a strong presence in over 30 countries. Its extensive brand portfolio features well-known names such as Circulon, Anolon, Farberware, Rachael Ray, Ruffoni, and BonJour. Meyer offers various products, including tri-ply stainless steel cookware, nickel-free Japanese steel utensils, pre-seasoned cast iron pans, ceramic-coated cookware, and advanced nonstick solutions.

Key UK Kitchenware Companies:

- Joseph Joseph Ltd.

- Newell Brands

- Groupe SEB

- Meyer International Holdings Limited

- Tramontina

- The Vollrath Company, LLC

- Lifetime Brands

- Hamilton Beach Brands Holding Company

- Cuisinart

- OXO International, Ltd.

Recent Developments

-

In February 2025, Habitat introduced a sleek, design-forward cookware and tabletop collection for Spring/Summer 2025. The line features charcoal, navy, khaki enamel roasters, splatter patterns, and aluminium non-stick pans with wood-effect handles. Aimed at minimalist urban interiors, the range is available at Sainsbury’s, Argos, and Habitat stores.

-

In October 2024, French cookware brand Staub and British design house Buster + Punch unveiled a limited-edition collection titled "Half French, Full English," blending French culinary tradition with London's industrial design aesthetic. The collaboration features Staub's signature cast-iron cocottes and frying pans enhanced with Buster + Punch's distinctive solid metal hardware, including T-bar handles with diamond-cut cross knurling, available in brass or stainless steel finishes. These design elements add visual appeal and improve grip and functionality.

-

In March 2024, IKEA introduced a new collection of emerald green glassware, capturing the season’s popular color trend. Featuring items such as glasses and vases, the jewel-toned range brings a sense of elegance and vibrancy to various home settings. Interior designer Ashley Banbury notes that rich green hues evoke comfort and luxury, aligning with the increasing preference for nature-inspired and sustainable design. This collection combines timeless charm with a playful, vintage-inspired style, making it a fitting choice for minimalist and bold interiors.

UK Kitchenware Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,605.3 million

Revenue forecast in 2033

USD 6,595.2 million

Growth rate (revenue)

CAGR of 7.8% from 2025 to 2033

Actual

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel

Country scope

UK

Key companies profiled

Joseph Joseph Ltd.; Newell Brands; Groupe SEB; Meyer International Holdings Limited; Tramontina; The Vollrath Company, LLC; Lifetime Brands; Hamilton Beach Brands Holding Company; Cuisinart; OXO International, Ltd.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Kitchenware Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the UK kitchenware market report by product, application, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Cookware

-

Pots & Pan

-

Pressure Cooker

-

Microware Cookware

-

-

Bakeware

-

Tins & Trays

-

Cups

-

Molds

-

Pans & Dishes

-

Rolling Pin

-

Others

-

-

Tableware

-

Dinnerware

-

Flatware

-

Stemware

-

-

Others

-

Cooking Racks

-

Cooking Tools

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online Retail

-

Others

-

Frequently Asked Questions About This Report

b. The UK kitchenware market was estimated at USD 3,375.9 million in 2024 and is expected to reach USD 3,605.3 million in 2025.

b. The UK kitchenware market is expected to grow at a compound annual growth rate of 7.8% from 2025 to 2033 to reach USD 6,595.2 million by 2033.

b. Tableware accounted for a revenue share of 54.28% in the UK kitchenware industry in 2024, highlighting its importance in everyday dining and traditional meal presentation. The demand was driven by cultural preferences for aesthetically pleasing, functional pieces used in both home and restaurant settings.

b. Some of the key players in the UK kitchenware market include Joseph Joseph Ltd.; Newell Brands; Groupe SEB; Meyer International Holdings Limited; Tramontina; The Vollrath Company, LLC; Lifetime Brands; Hamilton Beach Brands Holding Company; Cuisinart; OXO International, Ltd.

b. Key factors driving the growth of the UK kitchenware market are the country’s strong culinary heritage, which supports consistent demand for quality and precision tools. Additionally, growing interest in healthy cooking and durable, non-toxic materials is influencing product choices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.