- Home

- »

- Consumer F&B

- »

-

UK Kombucha Market Size & Share, Industry Report, 2033GVR Report cover

![UK Kombucha Market Size, Share & Trends Report]()

UK Kombucha Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Conventional Kombucha, Hard Kombucha), By Distribution Channel (On-Trade, Off-Trade), And Segment Forecasts

- Report ID: GVR-4-68040-641-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UK Kombucha Market Summary

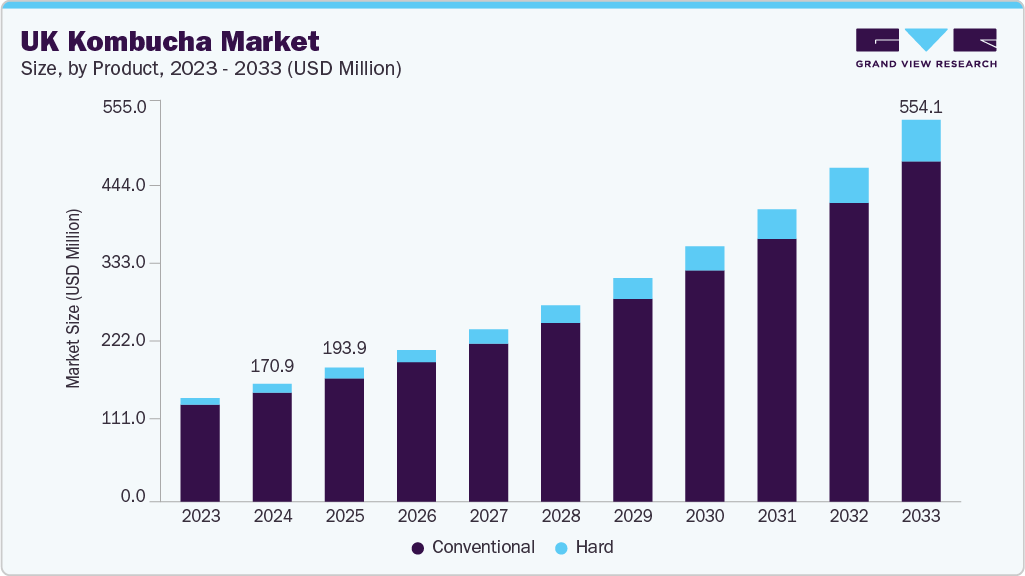

The UK kombucha market size was estimated at USD 170.9 million in 2024 and is projected to reach USD 554.1 million by 2033, growing at a CAGR of 14.0% from 2025 to 2033. The market growth is driven by rising consumer demand for health-conscious, probiotic-rich beverages, fueled by a growing interest in wellness, organic products, and functional drinks.

Key Market Trends & Insights

- The conventional kombucha market in the UK accounted for the largest share of 92.6% in 2024.

- By product, hard kombucha is expected to grow at a CAGR of 18.7% during the forecast period.

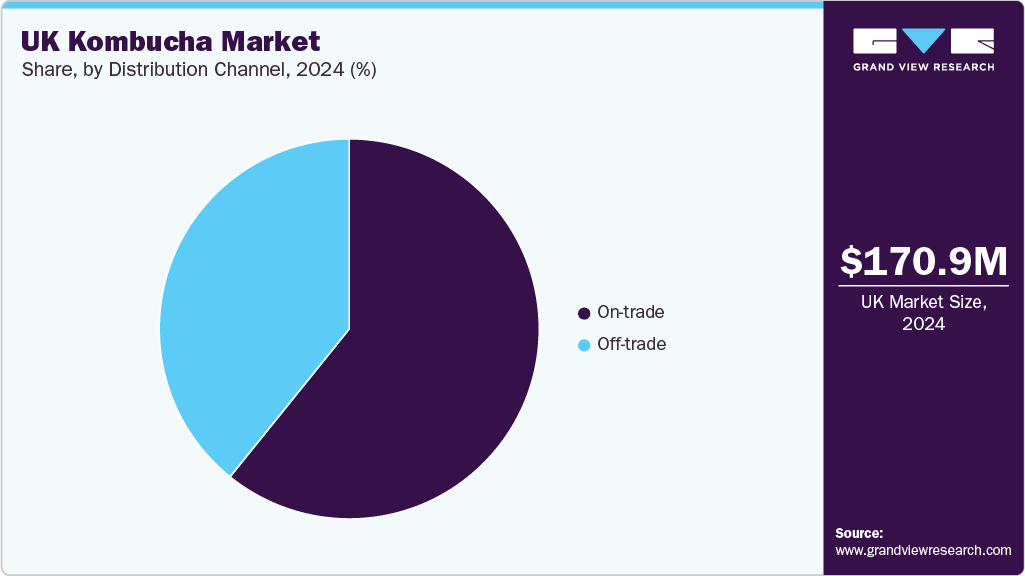

- By distribution channel, the on-trade channel segment led the market and accounted for a share of 60.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 170.9 Million

- 2033 Projected Market Size: USD 554.1 Million

- CAGR (2025-2033): 14.0%

The UK kombucha industry’s growth is bolstered by an increasing shift toward sustainable and eco-friendly products, with consumers seeking beverages that align with their environmental values. Additionally, the rise of the "wellness culture" and the popularity of fermented foods have made kombucha a trendy, mainstream choice among young, health-focused consumers.

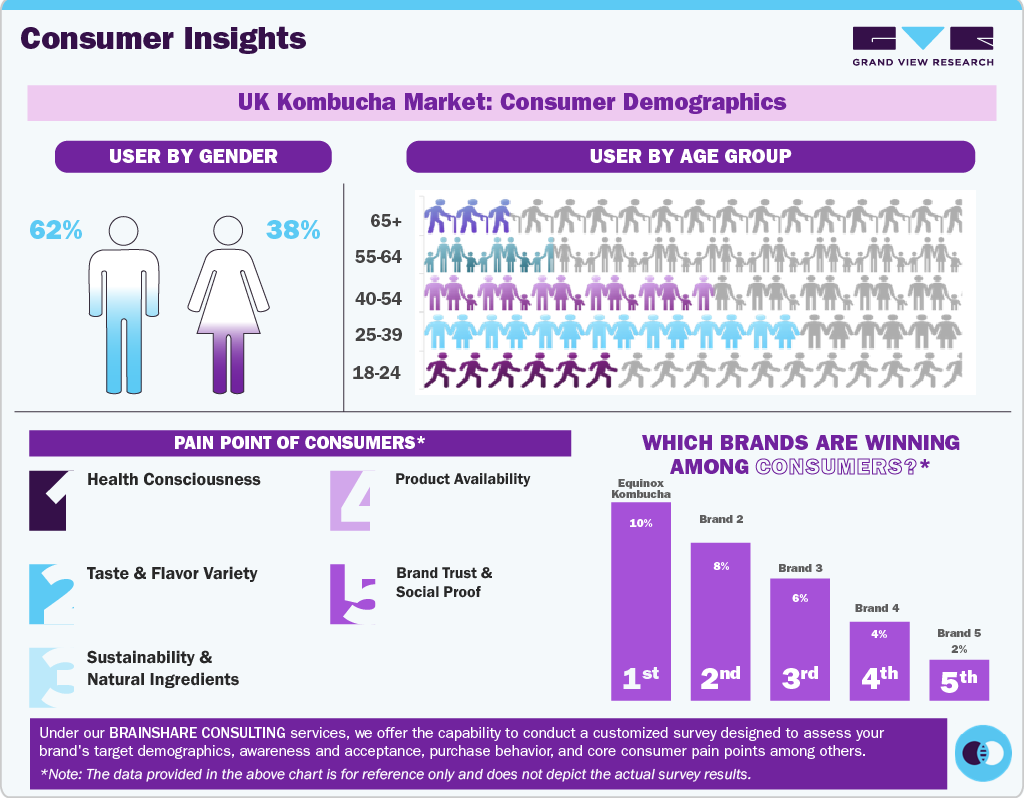

In the UK, kombucha marketing highlights its probiotic-rich content and the associated benefits for gut health, positioning it as a "powerhouse of beneficial probiotics" in a growing fermented drinks category. According to the Bupa data published in August 2023, 1 in 5 adults in the UK suffer from irritable bowel syndrome (IBS). Such health concerns are urging consumers to intake fermented and probiotics-rich food such as kombucha. As the market matures, there’s a clear shift towards brand development and flavor innovation, with emerging trends such as kombucha-based alcoholic drinks and sparkling variants catering to evolving consumer preferences. This reflects the broader interest in functional and unique beverages among UK consumers.

The growth of the UK kombucha market is driven by the increasing popularity of wellness-focused lifestyles, with consumers actively seeking alternatives to sugary sodas and alcoholic beverages. The rise of fitness and mindfulness trends is also fueling demand for functional drinks that support hydration and overall well-being. Additionally, the expanding presence of kombucha in mainstream supermarkets and convenience stores, alongside its growing availability in cafés and restaurants, has enhanced its accessibility. The UK's strong preference for premium, artisanal products further supports the market's expansion, with consumers showing interest in high-quality, locally produced kombucha options. For instance, in March 2025, Lipton introduced kombucha in low-calorie and low-sugar formulation in flavors such as Strawberry & Mint, Raspberry, and Mango Passionfruit.

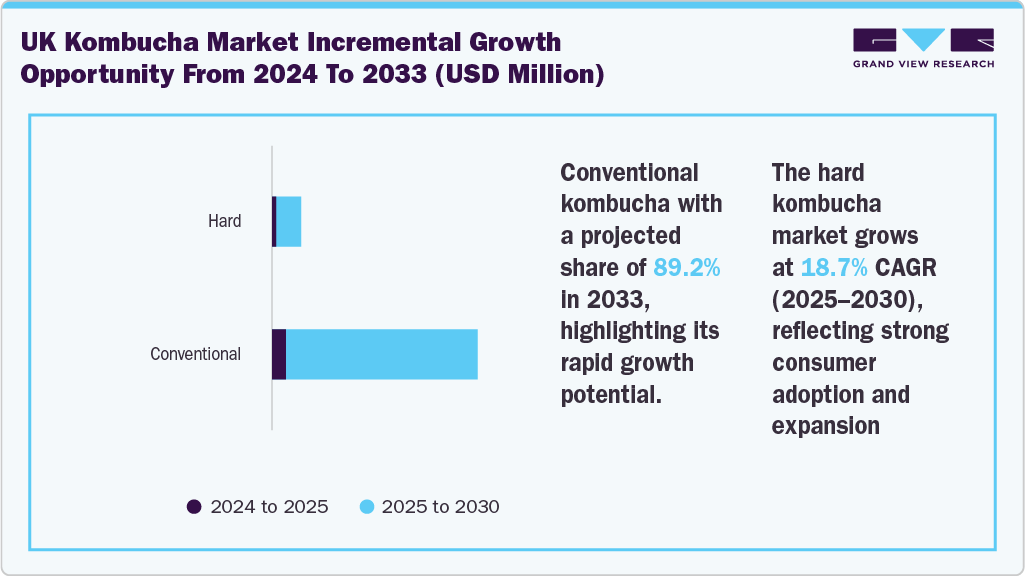

Product Insights

Conventional kombucha accounted for a revenue share of 92.6% in 2024, driven by the UK's growing demand for natural, non-alcoholic functional beverages. Consumers are increasingly seeking gut-friendly products with probiotics, low sugar, and no artificial additives. Health trends, especially among young adults and wellness-focused individuals, support consistent growth. Retail expansion in major supermarkets and health stores boosts their accessibility and visibility. In November 2023, Momo Kombucha and Orbit Beers collaborated to create an alcohol-free hopped kombucha. This innovative beverage combines the probiotic benefits of kombucha with the complex flavors of hops, typically found in craft beers. The collaboration was aimed at offering a unique and healthy alternative to traditional alcoholic drinks, catering to the growing demand for non-alcoholic options. This product is part of a broader trend toward health-conscious consumption, highlighting the evolving preferences in the beverage market.

The hard kombucha market segment is expected to grow at a CAGR of 18.7% from 2025 to 2033. Hard kombucha appeals to health-conscious drinkers looking for a better-for-you alcoholic option. Its natural fermentation and lower-calorie profile resonate with consumers, reducing traditional beer or spirit intake. The rise of craft alcohol trends and experimental flavors also supports its niche appeal. However, availability in pubs and on-trade venues is key to driving broader adoption in the UK. Companies such as The Sierra Nevada Shop offer hard kombucha in the region with 7% ABV, in can packaging in Ginger, Lemon, and Hibiscus variants.

Distribution Channel Insights

The sales through the on-trade distribution channel accounted for a revenue share of 60.2% in 2024. The on-trade channel includes cafes, restaurants, bars, and pubs, where kombucha is served as a premium health or alcohol alternative. Growth here is driven by wellness-focused menus and consumer interest in functional beverages during social occasions. Hard kombucha also sees traction in trendy bars with craft drink offerings. However, its reach is still limited compared to mainstream soft or alcoholic drinks. Happy Kombucha offers a wide range of kombucha beverages in the country through their website and online platforms such as Amazon.

Sales through the off-trade distribution channel are expected to grow by 15.9% during the forecast period. Off-trade refers to retail outlets such as supermarkets, health food stores, and online platforms where kombucha is purchased for home consumption. This channel dominates the UK kombucha market, which is supported by an increasing shelf presence in major chains such as Tesco, Waitrose, and Morrisons. Competitive pricing, flavor variety, and health branding attract repeat purchases. Online health shops and D2C models also play a growing role post-pandemic. For instance, in May 2024, Remedy Drinks introduced kombucha in the UK’s leading supermarket chain- ASDA and offers kombucha flavors such as Wild Berry and Raspberry Lemonade in the store.

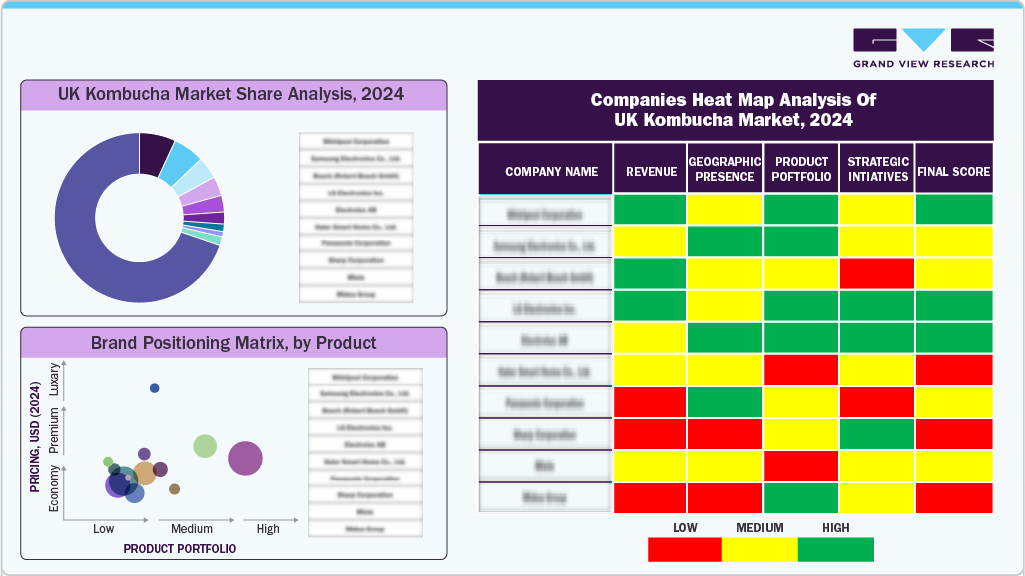

Key UK Kombucha Company Insights

The UK kombucha industry is characterized by a blend of established brands and emerging local players vying for market share. Leading companies have gained strong brand recognition through early market penetration, consistent product quality, and alignment with the growing health and wellness movement.

Key UK Kombucha Companies:

- Happy Kombucha

- Equinox Kombucha

- MOMO Kombucha

- HOLOS Kombucha

- Remedy Drinks

- One Living

- Pret A Manger

- L.A Brewery

- lobros

- GO Kombucha

Recent Developments

-

In March 2025, Lipton introduced kombucha in low-calorie and low-sugar formulation in flavors such as Strawberry & Mint, Raspberry, and Mango Passionfruit.

-

In May 2024, Remedy Drinks introduced kombucha in the UK’s leading supermarket chain, ASDA, and offered kombucha flavors such as Wild Berry and Raspberry Lemonade in the store.

UK Kombucha Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 193.9 million

Revenue forecast in 2033

USD 554.1 million

Growth rate

CAGR of 14.0% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Key companies profiled

Happy Kombucha; Equinox Kombucha; MOMO Kombucha; HOLOS Kombucha; Remedy Drinks; One Living; Pret A Manger; L.A Brewery; lobros; GO Kombucha

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Kombucha Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the UK kombucha market report based on product and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Conventional

-

Hard

-

-

Distribution Channel Outlook (Revenue, USD Million; 2021 - 2033)

-

On-Trade

-

Off-Trade

-

Frequently Asked Questions About This Report

b. The UK kombucha market size was estimated at USD 170.9 million in 2024 and is expected to reach USD 193.9 million in 2025.

b. The UK kombucha market is expected to grow at a compound annual growth rate (CAGR) of 14.0 % from 2025 to 2033 to reach USD 554.1 million by 2033.

b. Conventional kombucha accounted for a revenue share of 92.6% in 2024, driven by health consciousness and demand for natural, functional beverages.

b. Some key players operating in the UK kombucha market include Happy Kombucha, Equinox Kombucha, MOMO Kombucha, Remedy Drinks, One Living, and GO Kombucha.

b. Key factors driving growth in the UK kombucha market include increasing health consciousness among consumers and a growing preference for natural, functional beverages, contributing to the demand for probiotic-rich, low-sugar alternatives that promote gut health.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.