- Home

- »

- Clothing, Footwear & Accessories

- »

-

UK Lifestyle Sneakers Market Size & Share Report, 2030GVR Report cover

![UK Lifestyle Sneakers Market Size, Share & Trends Report]()

UK Lifestyle Sneakers Market Size, Share & Trends Analysis Report By Product Type (Low-Top Sneakers, High-Top Sneakers), By Price Band, By End-user, By Distribution Channel, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-103-3

- Number of Report Pages: 128

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

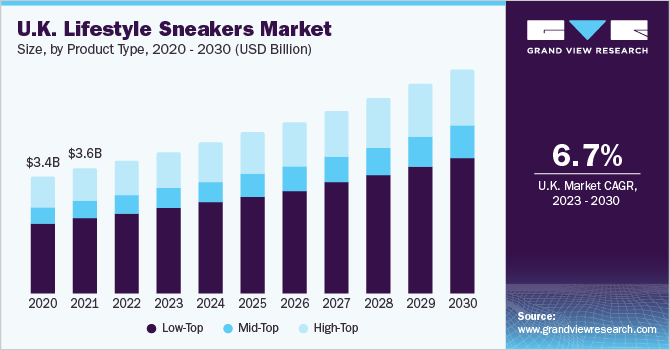

The UK lifestyle sneakers market size was estimated at USD 3.86 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.7% from 2023 to 2030. The key factors driving this market’s growth include increasing enthusiasm and passion for sneakers, especially among collectors, a thriving e-commerce retail industry, and the surge of athleisure culture.The inclination toward fashionable and branded sneakers is growing among all age groups, and the rising disposable incomes are supporting the demand for more comfortable yet innovative sneakers, accelerating market growth. The proliferation of online platforms across the globe is another major driver for the market.

The coming years are anticipated to bring significant growth in e-commerce retail sales due to an increase in consumer spending, a growing population, and increasing access to the Internet. In addition, the introduction of mobile shopping apps and the availability of convenient payment gateways are fueling the growth of the online retail industry. Sales through social media apps such as Facebook and Instagram have also been notable in recent years. Moreover, many consumers buy sneakers online and then pick them up at a retail location or other collection points. This is an extremely convenient shopping option and has been gaining popularity across the UK.

Over the last few years, increasing internet penetration and the emergence of non-banking players in the payment sector have facilitated the growth of online shopping in the UK Many footwear retailers are venturing into online retail as an increasing number of consumers show a preference for virtual marketplaces to purchase products. Additionally, a large number of footwear vendors are listing their products on popular third-party sites like Amazon. This enhances the visibility of these products, further boosting the sales of lifestyle sneakers.

There is increasing enthusiasm and passion for sneakers, especially among collectors, in the UK Sneaker culture is also a growing phenomenon in the region, which is a significant factor driving the growth of the lifestyle sneakers industry. Sneaker brands and high-profile fashion designers, athletes, and celebrities have been known to collaborate on numerous occasions, creating an aura of exclusivity and hype around new sneaker releases. These products are also often limited-edition, which adds to the attraction and drives sneaker collectors to spend more money.

Sustainability is an up-and-coming trend in the overall footwear market and the same is expected to be noted in the lifestyle sneakers market in the UK. Brands such as ROMBAUT, VEJA, and Good News London are capitalizing on the growing trend of vegan and sustainable lifestyle sneakers made from materials like microfibers, polyurethane (PU), and cotton. Many companies are also adopting Gore-Tex, a vegan lightweight, windproof, waterproof, and breathable membrane. For instance, Adidas AG offers Gore-Tex lifestyle sneakers.

Moreover, some companies manufacture sneakers from recyclable materials. For instance, Good News London offers lifestyle sneakers with recycled rubber soles and recycled eco-lifted footbeds. Its Oatmeal Venus Sneakers consist of an upper made from BANATEX, which is derived from banana plants, and a vegan-coated fabric called vegea, which is made from the discarded skins, seeds, and stalks of grapes during wine production.

Product Type Insights

The low-top sneakers segment dominated the market and held the largest share of over 60% in 2022 and is expected to continue leading over the forecast period. Low-top sneakers are a popular footwear style characterized by their low-cut design that sits below the ankle. They offer a casual and versatile option that can be paired with a variety of outfits. Low-top sneakers come in numerous designs, materials, and colors, catering to different tastes and preferences. Low-top lifestyle sneakers are a popular category of casual footwear that blends style, comfort, and versatility. Some of the brands catering to low-top sneakers are Nike, Puma, Tommy Hilfiger, and Sketchers, among others. Chunky soles in low-top sneakers are one of the most popular styles in the product.

The mid-top sneakers segment is expected to grow at a CAGR of 7.0% from 2023 to 2030. Mid-top sneakers are a footwear style that falls between low-top sneakers and high-top sneakers in terms of height. They typically cover the ankle partially, providing a bit more support and coverage compared to low tops while still maintaining a casual and versatile look. Mid-tops are suitable for various occasions and outfits. They can be paired with jeans, chinos, or even shorts for a stylish and casual look. Some of the popular mid-top lifestyle sneaker brands are Converse, Fila, Adidas, and ASICS, among others. Hybrid mid-top sneakers that combine elements of different sneaker styles are in trend. Brands are experimenting with blending athletic, lifestyle, and even hiking or outdoor influences, resulting in unique and versatile designs that cater to a wide range of tastes.

Price Band Insights

The sneaker segment priced less than £50 (USD ~60) dominated the market and held a share of over 37% in 2022 and is projected to remain the leading segment over the forecast period. In the UK, the category of lifestyle sneakers priced below £50 offers affordable options for budget-conscious consumers. Brands like Primark, F&F, and George at Asda provide stylish and inexpensive sneakers in this price range. These sneakers often feature basic designs with simple colorways and minimal branding, catering to individuals who prioritize affordability and practicality.

The sneaker segment priced between £50 to £100 (~60 to USD ~125) is expected to grow with a CAGR of 7.2% from 2023 to 2030. Lifestyle sneakers available in the £50 to £100 category in the UK offer a balance between affordability and quality. Brands like Adidas, Nike, New Balance, and Vans present a wide range of options within this category. Sneakers in this price range often feature more recognizable brand names, popular models, and diverse designs. These sneakers incorporate advanced technology and cushioning systems to enhance comfort and performance. Retailers like JD Sports, Foot Locker, and Schuh regularly feature sales and discounts on sneakers within this price range, allowing customers to find stylish options at more affordable prices.

End-user Insights

The men sneaker segment dominated the market and held a share of over 55% in 2022. It is expected to remain the leading segment over the forecast period. Men in the UK purchase lifestyle sneakers because they combine style and comfort. A large number of brands offer lifestyle sneakers for men, including Adidas, New Balance, Puma, and Vans. These shoes come in high-top, mid-top, and low-top options and in classic designs, sporty influences, and streetwear aesthetics. Men tend to prefer versatile, neutral-tone sneakers that can be paired with different outfits and for various occasions.

The women sneakers segment is expected to grow at a CAGR of 7.0% over the forecast period. Women's lifestyle sneakers in the UK reflect diverse fashion preferences and styles. Brands such as Converse, Reebok, Sketchers, and Adidas offer an extensive selection of sneakers tailored to women's tastes. These shoes tend to embrace a mix of casual chic, athleisure, and fashion-forward designs. Popular styles include sleek and minimalistic sneakers, platform sneakers, and retro-inspired models. Women also tend to gravitate toward sneakers that range from neutral tones to vibrant and pastel shades.

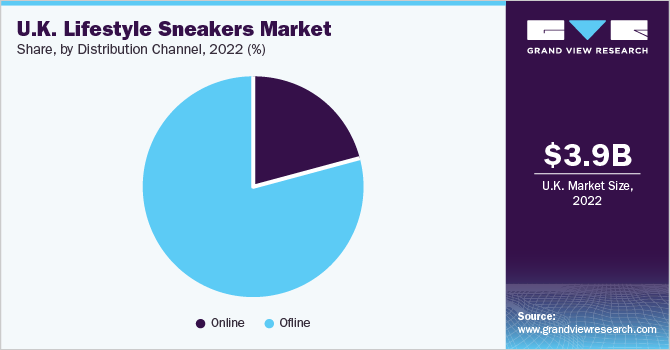

Distribution Channel Insights

The offline distribution channel dominated the market and held a share of over 75% in 2022. Offline distribution channels, including brick-and-mortar stores and specialty sneaker retailers, continue to play a crucial role in the UK lifestyle sneaker industry. Physical stores offer customers the opportunity to try on sneakers, receive personalized assistance from the sales staff, and experience the tactile aspects of shoe shopping. Offline stores often have dedicated sections for men, women, and kids, providing a comprehensive selection. In-store shopping allows customers to access the latest sneaker releases, explore exclusive collaborations, and participate in in-store events or raffles.

The online distribution channel is expected to grow at a CAGR of 8.4% from 2023 to 2030. Online distribution channels play a significant role in the availability and accessibility of lifestyle sneakers in the UK. Online shopping provides convenience, a vast selection, and the ability to compare prices and styles easily. Customers can explore a multitude of brands, including Nike, Adidas, Puma, Reebok, and New Balance. In September 2022, Puma became the first sneaker brand to collaborate with the online marketplace Secret Sales to sell its sneakers in the UK market. This partnership was beneficial for both brands as it brought new customers to the website and ensured promising profits for Puma.

Key Companies & Market Share Insights

Key players operating in the market are adopting various steps to increase their presence in the market. These steps include strategies such as partnerships, mergers & acquisitions, development & launch of new products, global expansion, redesigning their packaging, and others. Some of the initiatives include:

-

In April 2023, Puma collaborated with Web3 brand 10KTF, owned by Yuga Labs, to release a limited edition collection of NFT sneakers. The 2,000 pairs of the limited edition ‘Grailed PUMA Slipstream’ sneakers are designed by artist Alexander John.

-

In February 2023, Fila partnered with the retailing division of Paramount Global to launch a special-edition footwear collection ‘Fila x Rock’s Modern Life’ inspired by Nickelodeon’s ‘Rocko’s Modern Life’ characters.

-

In January 2023, New Balance launched a UK New Year running campaign, ‘Rewards Come to Those Who Run,’ to inspire runners of all abilities. The campaign took place through a partnership with Strava, an online tracker app, and the runners were inspired to run for 30 km in a month to unlock different prizes.

Some prominent players in the UK lifestyle sneakers market include:

-

Nike, Inc.

-

Adidas AG

-

New Balance

-

Puma SE

-

Vans

-

Converse

-

FILA

-

C. & J. Clark International Limited

-

Grenson Shoes

-

Gola (D Jacobson & Sons Ltd)

UK Lifestyle Sneakers Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.11 billion

Revenue forecast in 2030

USD 6.48 billion

Growth rate

CAGR of 6.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion, volume in thousand pairs, CAGR from 2023 to 2030

Report coverage

Revenue and volume forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product type, price band, end-user, distribution channel

Regional scope

UK

Key companies profiled

Nike, Inc.; Adidas AG; New Balance; Puma SE; Vans; Converse; FILA; C. & J. Clark International Limited; Grenson Shoes; Gola (D Jacobson & Sons Ltd)

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

UK Lifestyle Sneakers Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the UK lifestyle sneakers market report based on product type, price band, end-user, and distribution channel:

-

Product Type Outlook (Volume, Thousand Pairs; Revenue, USD Billion, 2017 - 2030)

-

Low-Top

-

Mid-Top

-

High-Top

-

-

Price Band Outlook (Volume, Thousand Pairs; Revenue, USD Billion, 2017 - 2030)

-

Online Less than £50 (USD ~60)

-

£50 to £100 (~60 to USD ~125)

-

£100 to £150 (USD ~125 to USD ~200)

-

£150 to £250 (USD ~200 to USD ~300)

-

Above £250 (USD ~300)

-

-

End-user Outlook (Volume, Thousand Pairs; Revenue, USD Billion, 2017 - 2030)

-

Men

-

Women

-

Kids

-

-

Distribution Channel Outlook (Volume, Thousand Pairs; Revenue, USD Billion, 2017 - 2030)

-

Online

-

Offline

-

Multi-Brand Outlets

-

Exclusive Brand Outlets

-

Retail Shops

-

-

Frequently Asked Questions About This Report

b. The UK lifestyle sneakers market size was estimated at USD 3.86 billion in 2022 and is expected to reach USD 4.11 billion in 2023.

b. The UK lifestyle sneakers market is expected to grow at a compounded growth rate of 6.7% from 2023 to 2030 to reach USD 6.48 billion by 2030.

b. The low-Top segment dominated the global UK lifestyle sneakers market with a share of 60.40% in 2022. This is attributed to popular footwear style characterized by their low-cut design that sits below the ankle. They offer a casual and versatile option that can be paired with a variety of outfits. Low-top sneakers come in numerous designs, materials, and colors, catering to different tastes and preferences.

b. Some key players operating in the UK lifestyle sneakers market include Nike Inc., Adidas AG, New Balance, Puma SE, Vans, Converse, FILA, C. & J. Clark International Limited.

b. Key factors that are driving the market growth include increasing enthusiasm and passion for sneakers, especially among collectors, a thriving e-commerce retail industry, and the surge of athleisure culture.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."