- Home

- »

- Alcohol & Tobacco

- »

-

UK Nicotine Pouches Market Size, Industry Report, 2030GVR Report cover

![UK Nicotine Pouches Market Size, Share & Trend Report]()

UK Nicotine Pouches Market Size, Share & Trend Analysis Report By Product (Tobacco-derived, Synthetic), By Flavor (Original/Unflavored, Flavored), By Strength, By Price Range, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-254-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

UK Nicotine Pouches Market Size & Trends

The UK nicotine pouches market size was estimated at USD 268.4 million in 2023 and is expected to grow at a CAGR of 38.9% from 2024 to 2030. Growing awareness among the U.K. population regarding tobacco-free products will stimulate the demand for nicotine pouches in the country. For example, buynicotinepouches.co.uk is a website based in the U.K, that creates awareness regarding the ill effects of tobacco consumption and works directly with leading tobacco manufacturers to sell the best and fresh products available in the category of tobacco-free oral products. Furthermore, surge in new and next-generation tobacco products such as smokeless tobacco and organic tobacco products is expected to boost market growth over the forecast period.

UK nicotine pouches market accounted for a revenue share of over 10% in global nicotine pouches market for the year 2023.

In a 2020 study titled "Nicotine products relative risk assessment: a systematic review and meta-analysis" Rachel Murkett and her team developed a relative risk hierarchy (RRH) of 13 nicotine products. While combustible tobacco products were at the top of the RRH, with combined risk scores ranging from 40 to 100, products causing the lowest risk with scores of less than 0.25 included non-tobacco pouches, electronic cigarettes, and nicotine replacement therapy. Such studies that indicate the relatively lower risk of nicotine pouches have driven consumption, thereby aiding market growth.

The COVID-19 pandemic had a positive impact on the market. Nicotine pouches are widely accepted by consumers and retailers have predicted significant market expansion for the category of tobacco-free products, majorly due to growing health concerns in light of COVID-19 risk factors. Moreover, the growing penetration of online retailers for such products provided convenience to consumers who wantto shift to safer alternatives to smoking. These factors contributed to the market growth in sales for nicotine pouches in 2020 and are expected to maintain high growth during the forecast period.

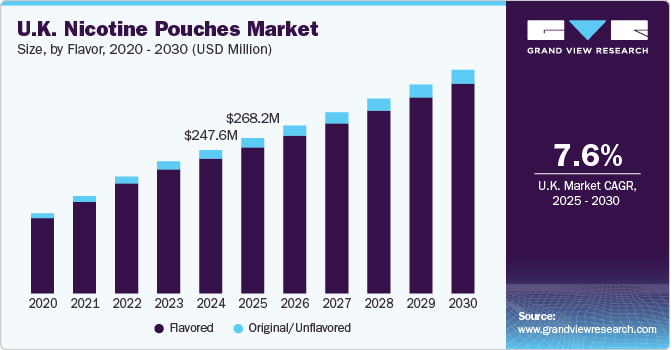

The nicotine pouches market has been witnessing strong growth over the last few years and this trend is expected to continue throughout the forecast period. Nicotine pouches come in various flavors, such as original (unflavored), mint, fruit, coffee, cinnamon, peppermint, black cherry, and citrus. There has been an increase in the consumption of and demand for flavored nicotine pouches in the country.

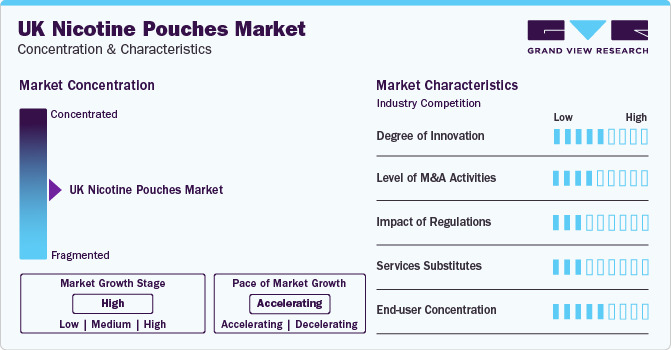

Market Concentration & Characteristics

The UK nicotine pouches industry is characterized by a moderate degree of innovation, with businesses continuously focusing on differentiating themselves through unique experiences and offerings. Companies in the nicotine pouches market use various tactics such as product innovation, and marketing collaborations to entice customers to experience or connect with their brands at social gatherings and events like concerts, bars, nightclubs, and other public venues. Companies mostly entice younger consumers to try tobacco alternatives such as nicotine pouches, thereby increasing consumption.

Market players are expanding their product lines and offering products through their own online portals and local stores. Furthermore, several nicotine pouch manufacturers pass distribution operations to specialized companies that focus on nicotine product distribution and promote numerous non-tobacco products in various markets. They mainly benefit from economies of scale. As these stores offer a major opportunity for large-scale sales, nicotine pouch manufacturers-whether small or large-prefer these channels. These places also offer a large variety of private-label nicotine pouches and numerous promotional offers.

Manufacturers are also collaborating with distribution channel members from convenience stores, hypermarkets & supermarkets, as well as tobacco specialists to efficiently deliver products to end users. Furthermore, supermarkets have started giving nicotine pouches shelf space in the last year or two, leading to the increased presence of nicotine pouches via offline channels.

The end-user concentration is a significant factor in the UK nicotine pouches industry. The market is projected to increase with the growing preference of non-lung-exposed alternatives over tobacco or cigarettes is set to drive the market in coming years.Consumers who have been smoking for a significant duration of their lifetime sometimes develop the need for smoking cessation. However, quitting smoking is a gradual process. Nicotine pouches are highly perceived as a less harmful alternative to factory-made cigarettes. Unlike pre-manufactured cigarettes, the ingredients in nicotine pouches are more visible. Moreover, it has been suggested that pre-made cigarettes might contain poisons or compounds designed to make them burn faster. Users also believed that their frequency of smoking could be reduced if they opt for nicotine pouches as these are less harmful as compared to other tobacco products. These factors have led to an aversion to pre-made cigarettes to a certain extent, consequently increasing the popularity of nicotine pouches.

Product Type Insights

UK tobacco-derived nicotine pouches market accounted for the revenue share of 98.3% in 2023 owing to high demand for nicotine products coupled with increased public awareness campaigns encouraging people to quit smoking. According to Japan Tobacco International U.K., the 100% tobacco-free nicotine pouch category has witnessed rapid growth and showed no signs of slowdown.

The synthetic nicotine pouches market is expected to grow at a CAGR of 42.3% over the forecast period.the adult population's growing preference for tobacco-free smoking products has increased demand for synthetic nicotine pouches in the U.K. The country-wide strategic initiatives have boosted the market for synthetic or tobacco-free products in the country. For example, Action on Smoking and Health (ASH) is a public health charity set up by the Royal College of Physicians to end the harm caused by tobacco.

Flavor Insights

The flavored nicotine pouches market accounted for a revenue share of 90.18% in 2023.Nicotine pouches come in many varieties, from those with lower nicotine levels to those with higher levels. They also come in different flavors, including mint, coffee, lemon, and berry. In the U.K., youth are drawn to fruit and mint flavorings in pouches and gums. Manufacturers in the market are offering their products on various online platforms, such as e-retailers, company websites, and third-party websites, to meet the needs of a large customer base and to increase product visibility, particularly in the U.K. market. For example, in 2020, according to Japanese Tobacco International, in terms of flavor spit, the U.K. market was 64% methanol and 36% fruit.

The original and unflavored nicotine pouches market is projected to grow at a CAGR of 41.7% over the forecast period. Increased demand for reduced-risk alternatives that are both tobacco-free and smoke-free with a taste of tobacco, is propelling the sales of unflavored/original products.Key players are focusing on introducing new products with unique, original flavors due to high demand. For instance, ON! brands offer an original flavor that provides an alternative to traditional tobacco products. These original-flavored products contain a special blend of nicotine bitartrate dihydrate, microcrystalline cellulose, flavor, sodium carbonates, and binders. Such product offerings are likely to boost segment growth during the forecast period.

Strength Insights

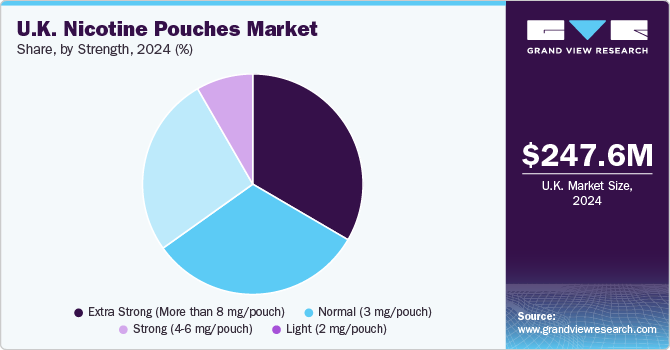

The strong (4-6 mg/pouch) nicotine pouches market accounted for a revenue share of 43.62% in 2023.Numerous factors can influence the effect of a nicotine pouch on individual users. Factors such as individual differences, moisture content, pH levels, and even flavoring can influence the strength of the product. Key brands offer high-strength nicotine pouches due to their growing demand. Some of the products popular for strong strength include LYFT X-Strong Series (16mg/g), Skruf Super White Fresh (26mg/g), and Ace X Cool Mint Slim (20mg/g).

The normal nicotine pouches market is anticipated to grow at a CAGR 34.7% over the forecast period. This segment will gain substantial demand among the millennials and Gen Z in the UK due to manufacturers' consistent focus on appealing marketing strategies and colorful flavors for females and young adults. The U.K. government's focus on raising awareness about quitting tobacco and encouraging the use of using oral tobacco products with lower nicotine concentrations to reduce the potential for addiction in populations in the U.K. has opened up new market opportunities for moderate and normal-strength nicotine pouches.

Distribution Channel

Sales of nicotine pouches through offline channels accounted for a revenue share of 93.00% in 2023. Tobacco-derived and tobacco-free oral products are easily available in and around the U.K. and can be purchased at supermarkets, gas stations, tobacco shops, and cigarette vending machines. Tobacco shops usually stock a variety of oral tobacco products, including nicotine pouches, sachets, chewing gums, and lozenges, which drive the offline segment’s growth.

Sales of nicotine pouches through online channels is projected to grow at a CAGR of 50.5% over the forecast period. Increasing third-party retailer platforms and availability of products directly from brands’ websites are some of the key factors determining segment growth. New entrants in the industry prefer online channels for product distribution. For instance, in March 2021, synthetic nicotine pouch brand NIIN launched the online retail store NIINPouches.com, which would provide consumers with a better user experience, educational information, and a convenient online platform to easily purchase high-quality, 100% tobacco-free products.

Key UK Nicotine Pouches Company Insights

Some of the key players operating in the market include British American Tobacco, Swedish Match AB, and Japan Tobacco International

-

British American Tobacco was founded in 1902 and is headquartered in London, U.K. The company is engaged in manufacturing a wide range of tobaccos, cigarettes, and other nicotine products. British American Tobacco has diversified its business segments into cigarettes and potentially reduced-risk products. It offers products through brand names such as Dunhill, Lucky Strike, Kent, Rothmans, and Pall Mall. The company also sells fine cut tobacco or roll-your-own or make-your-own tobacco.

-

Swedish Match AB was founded in 1915 and is headquartered at Stockholm, Sweden. The company operates as a manufacturer and distributor of various products, including snus, nicotine pouches without tobacco, moist snuff, pouch products (non-nicotine and non-tobacco), cigars, tobacco bits, chew bags, chewing tobacco, matches, and lighters.

Swisher, Philip Morris International, and Tobacco Concept Factory are some of the other participants in the UK nicotine pouches market,

-

Swisher was founded in 1861 and headquartered in Jacksonville, Florida. It is an international lifestyle brand for adult consumers mainly known for its Swisher Sweets Cigars. The company also has a global manufacturing presence in Santiago, Dominican Republic; Esteli, Nicaragua; and Wheeling, West Virginia. The company operates in various product categories including smokeless tobacco products, premium cigars, and even non-tobacco brands among others.

-

Tobacco Concept Factory (TCF) is a Poland-based company that started in 2003, and in 2007 the company started to focus on its brands in e-cigarettes and vaping accessories. In 2019, the company launched its tobacco-free nicotine pouches under the brand ‘77 nicotine pouches’. TCF is one of the leading manufacturers of nicotine pouches in the Polish market.

Key UK Nicotine Pouches Companies:

- British American Tobacco

- Swedish Match AB

- Japan Tobacco International

- Swisher

- Philip Morris International

- Tobacco Concept Factory

- String Free

- Next Generation Labs LLC

- Skruf

- Altria Group, Inc.,

Recent Developments

- In October 2022, British American Tobacco conducted an innovative cross-sectional clinical study of Velo, which is designed to provide new insights into the real-world health impact of its modern oral nicotine pouch product compared to smoking.

UK Nicotine Pouches Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 371.3 million

Revenue forecast in 2030

USD 2,668.6 million

Growth rate

CAGR of 38.9% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, flavor, strength, distribution channel

Country scope

UK

Key companies profiled

British American Tobacco; Swedish Match AB; Japan Tobacco International; Swisher; Philip Morris International; Tobacco Concept Factory; String Free; Next Generation Labs LLC; Skruf; Altria Group, Inc.,

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

UK Nicotine Pouches Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the UK nicotine pouches market report based on product type, flavor, strength, and distribution channel:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Tobacco-derived

-

Synthetic Nicotine

-

-

Flavor Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Original/Unflavored

-

Flavored

-

Mint

-

Fruit

-

Coffee

-

Cinnamon

-

Others

-

-

-

Strength Outlook (Revenue, USD Million, 2018 - 2030)

-

Light

-

Normal

-

Strong

-

Extra strong

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

Frequently Asked Questions About This Report

b. The UK nicotine pouches market size was estimated at USD 268.4 million in 2023 and is expected to reach USD 371.3 million in 2024.

b. The UK nicotine pouches market is expected to grow at a compounded growth rate of 38.9% from 2024 to 2030 to reach USD 2,668.6 million by 2030.

b. UK tobacco-derived nicotine pouches market accounted for the revenue share of 98.3% in 2023 owing to high demand for nicotine products coupled with increased public awareness campaigns encouraging people to quit smoking.

b. Some key players operating in the UK nicotine pouches market include Johnson & Johnson Services, Inc., Kimberly-Clark Corporation, Procter & Gamble, Unilever, Britax, Chicco, Dorel Industries, and Beiersdorf AG.

b. Key factors that are driving the UK nicotine pouches market growth include the growing awareness among the U.K. population regarding tobacco-free products will stimulate the demand for nicotine pouches in the country. For example, buynicotinepouches.co.uk is a website based in the U.K, that creates awareness regarding the ill effects of tobacco consumption and works directly with leading tobacco manufacturers to sell the best and fresh products available in the category of tobacco-free oral products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."