- Home

- »

- Animal Health

- »

-

UK Veterinary Medicine Market Size, Industry Report, 2030GVR Report cover

![UK Veterinary Medicine Market Size, Share & Trends Report]()

UK Veterinary Medicine Market Size, Share & Trends Analysis Report By Product (Biologics, Pharmaceutical), By Animal Type, By Route Of Administration, By Distribution Channel, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-422-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

UK Veterinary Medicine Market Trends

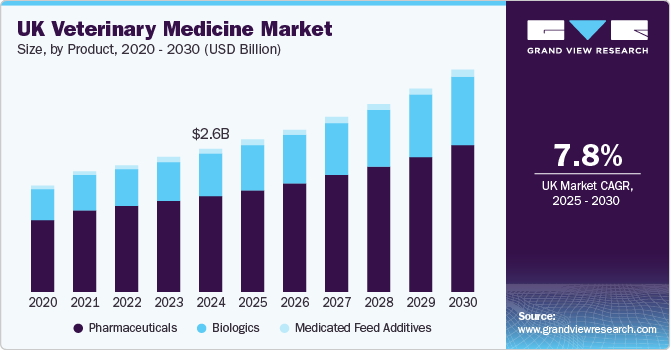

The UK veterinary medicine market size was valued at USD 2.80 billion in 2023 and is projected to grow at a CAGR of 7.6% from 2024 to 2030. This growth can be attributed to the rise in livestock population and increasing pet ownership rates, novel product development in veterinary medicine, and the increasing prevalence of animal diseases. The UK is witnessing a significant rise in pet adoption, thereby increasing the number of pets by each household. According to the PDSA, around 53% of the adults in the country own a pet. This high pet ownership is anticipated to increase the demand for vet medicine over the forecast period.

This growth can also be attributed to the rising incidence of both infectious and non-infectious diseases among pets and livestock, necessitating enhanced veterinary care and innovative treatment solutions. The emergence of diseases such as canine parvovirus and feline leukemia has prompted veterinarians to adopt more proactive health management strategies, including routine vaccinations and preventive care, thereby increasing the consumption of veterinary pharmaceuticals. Moreover, the increasing prevalence of such diseases affecting the country's livestock sector has increased government support for the livestock sector, thereby contributing to the segment growth. For instance, in August 2023, the UK announced phase 2 funding of around USD 11.19 million to revolutionize the country’s livestock sector. Similar funding for phase 1 of around USD 15.81 million was commenced in 2021 to reduce the burden of endemic diseases on animal welfare, health, and productivity.

The rising prevalence of various diseases and other sudden disease outbreaks are increasing the demand for advanced veterinary treatment solutions, leading to the increase in R&D activities to develop novel solutions. For instance, in March 2023, The Biotechnology and Biological Sciences Research Council (BBSRC), which is part of UK Research and Innovation (UKRI), along with the Foreign, Commonwealth and Development Office (FCDO) and the Bill & Melinda Gates Foundation, announced the establishment of a new center at The Pirbright Institute. This center aims to expedite the development of animal vaccines, specifically targeting emerging and urgent infectious diseases. Such initiatives of veterinary medicine development, coupled with increasing pet adoption and rising animal diseases, are driving the market growth.

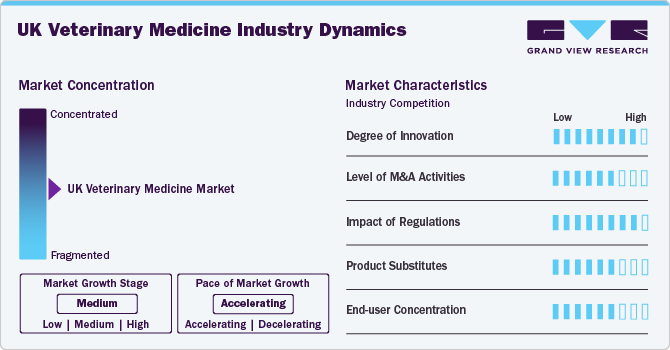

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The UK market is characterized by a high degree of innovation owing to the increasing focus of market players on developing effective and specialized solutions to treat specific conditions. Moreover, the growth opportunities offered by the rising prevalence of animal diseases are further creating opportunities for market players, thereby increasing product innovation. For instance, in October 2023, MSD Animal Health launched Bovilis Nasalgen-C, a new vaccine for calves in the UK aimed at combating bovine coronavirus (BCoV), which significantly contributes to respiratory diseases in cattle.

This vaccine can be administered from birth and helps reduce clinical signs and viral shedding associated with BCoV. Recent studies indicate BCoV's prevalence in respiratory disease outbreaks, highlighting the need for better vaccination practices in the UK cattle sector. The vaccine offers a quick immune response, starting five days post-administration, and can be used alongside other vaccines, providing farmers with an effective tool to manage this costly disease.

The market is witnessing a significant rise in M&A activities, and market players are increasingly trying to enhance their market players using various strategies, including mergers and acquisitions. This strategy allows the market players to increase their product offerings and address different needs of the market, thereby enhancing their market presence. For instance, in June 2023, Swedish private equity firm EQT agreed to acquire UK veterinary drug producer Dechra Pharmaceuticals. The acquisition will allow EQT to strengthen its presence in the pet industry, with Dechra generating 74.6% of its revenue from companion animal products.

The market in the UK is heavily regulated by bodies such as the Veterinary Medicines Directorate (VMD) to ensure the safety, quality, and efficacy of products for animal and human health, as well as environmental protection. The key regulations are the Veterinary Medicines Regulations (VMR) 2013, which inform the requirements for the manufacture, authorization, marketing, distribution, use, and post-authorization surveillance of veterinary medicines.

All veterinary medicines must undergo a rigorous regulatory approval process before being granted a Marketing Authorization (MA) and allowed on the market. After authorization, veterinary medicines remain under ongoing regulatory review, which can include reassessment or renewal of the MA. Moreover, advancements such as Veterinary Medicines (Amendment, etc.) Regulations 2024 further ensure the availability of safe and effective medicine in the country.

When substitutes such as alternative therapies are available, they might not have a larger impact on the veterinary medicine demand owing to the better outcomes offered by the medicines. Furthermore, the development of novel solutions, medicines, and vaccines addressing specific needs and targeting specific diseases in animals is further reducing the threat of substitutes for veterinary medicines.

The market exhibits significant end-user concentration, with various end-users of veterinary medicines such as pet owners, cattle farms and others. These end-users associated with different animal types increase the demand for vet medicine addressing their needs, which significantly contributes to the market growth.

Product Insights

The pharmaceutical segment accounted for the largest revenue share of 67.7% in 2023. The increasing prevalence of diseases in both companion and production animals has heightened the demand for effective veterinary pharmaceuticals. Products such as anti-infectives, anti-inflammatories, and parasiticides are crucial for managing health issues and ensuring animal welfare. Similarly, the advancements in research and development have led to innovative pharmaceutical solutions tailored to specific animal health needs.

Moreover, the increasing demand for pharmaceutical medicine to treat specific health conditions, leading to the increase in market players' focus on developing pharmaceutical products, has further contributed to the segment share. For instance, in February 2024, GNT Pharma partnered with Pfizer CentreOne for the overseas production of its veterinary medication, GedaCure, a chewable tablet designed to treat dogs with cognitive dysfunction syndrome (CDS). Following its success, GNT Pharma plans to launch GedaCure in international markets, having received several purchase requests from 21 countries, including the UK.

The biologics segment is expected to witness the fastest CAGR in the market owing to the increasing awareness among pet owners and livestock farmers about the importance of preventive healthcare. Vaccines play a crucial role in controlling infectious diseases, which can significantly impact animal health and agricultural productivity. This rising emphasis on preventive measures is driving demand for effective vaccines that can safeguard both companion animals and livestock from various diseases.

Similarly, the increasing efforts by the government and companies operating in the market to develop biologics targeting specific health conditions in animals are further anticipated to drive the segment growth. For instance, according to an article published by the Government of the UK in February 2023, the Animal and Plant Health Agency (APHA) announced that the trials for a cattle vaccine and a new bovine tuberculosis skin test have progressed to the next phase. This upcoming phase will assess both the safety of the CattleBCG vaccine and the effectiveness of the Detect Infected among Vaccinated Animals (DIVA) skin test in cattle that are vaccinated. If successful, these trials could pave the way for the implementation of these tools in the near future, enhancing efforts to combat bTB in cattle populations.

Animal Type Insights

The production animal segment dominated the market with the largest revenue share in 2023. The increasing demand for high-quality meat, milk, and other animal products drives farmers to invest in advanced veterinary care to ensure optimal health and productivity of their livestock. Vaccination programs are essential for preventing diseases that can devastate herds and flocks; thus, effective biologics are indispensable.

Moreover, the rise of antibiotic resistance has led to a shift towards preventive measures such as vaccination rather than reliance on antibiotics for treatment. This trend is further supported by regulatory frameworks that emphasize animal welfare and food safety standards. Additionally, advancements in biotechnology have resulted in more effective and targeted biologics that enhance disease resistance and improve overall herd health. As producers seek to maximize yield while minimizing losses from disease outbreaks, the demand for vet medicine for production animals is further anticipated to witness growth.

The companion animals’ segment is expected to witness the fastest CAGR from 2024 to 2030. As pet ownership continues to rise, there is an increasing demand for innovative veterinary care that prioritizes animal health and well-being. Additionally, the growing awareness among pet owners regarding preventive healthcare has spurred investments in biologics aimed at disease prevention rather than just treatment.

Moreover, the increasing access of pet owners to veterinary medicine & pet disease diagnosis owing to the increasing number of veterinary laboratories focused on companion animals is further contributing to the segment growth. For instance, in November 2023, Antech launched the first comprehensive veterinary diagnostics offering in the UK by opening a state-of-the-art reference laboratory in Warwick. This initiative expands Antech's UK lab network, which includes existing facilities at Southfields Veterinary Specialists and Dick White Referrals. Antech aims to enhance pet health outcomes through innovative diagnostics and technology, supporting veterinary teams across the UK.

Route Of Administration Insights

Injectables dominated the market with the largest revenue share in 2023. This can be attributed to several key advantages associated with injectables, particularly with biologics. Injectable medications, including vaccines and monoclonal antibodies, offer significantly faster results, which is critical in treating acute conditions and managing diseases in animals. Moreover, the precision in dosage control inherent in injectables ensures that animals receive the exact amount of medication required, enhancing treatment efficacy. These advantages of injectables over their other alternatives have increased their demand in the market.

Topical is expected to witness the fastest CAGR from 2024 to 2030. Topical administration offers a convenient and effective way to treat skin conditions in animals. With the increasing prevalence of skin infections and allergies in pets, there is a growing demand for topical medications that can provide targeted relief. Products such as spot-on solutions and medicated shampoos have gained popularity due to their ease of application and ability to directly address the affected area. Additionally, the increasing awareness among pet owners about the importance of preventive care has led to a rise in the use of topical parasite control products, thereby driving the segment growth.

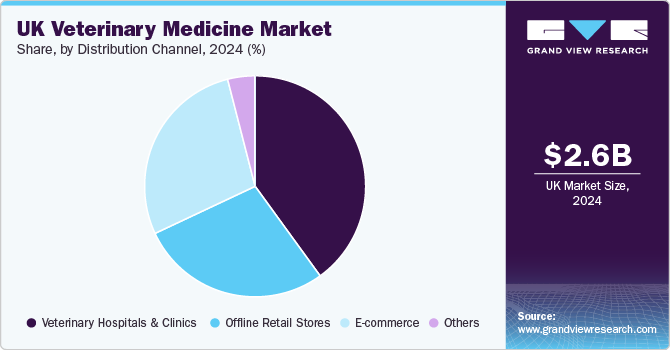

Distribution Channel Insights

The veterinary hospitals and clinics segment dominated the market with the largest share of 40.3% in 2023. Veterinary hospitals serve as primary points for the administration of vet medicines such as biologics, including vaccines and monoclonal antibodies, which are critical for preventing and treating diseases in animals. The increasing awareness of zoonotic diseases has heightened the demand for effective vaccination programs, driving pet owners to seek services from these facilities. Moreover, the integration of advanced technologies in veterinary hospitals enhances their capability to provide comprehensive care, including diagnostics and treatment plans tailored to individual animals, thereby contributing to the segment’s growth.

E-commerce platforms offer a seamless shopping experience, allowing consumers to easily access a broader range of vet medicines such as pharmaceuticals, biologics, and others, which are essential for treating various animal diseases. Additionally, advancements in online shopping, such as user-friendly interfaces and mobile accessibility, further enhance the appeal of e-commerce. The ability to compare products, read reviews, and receive personalized recommendations online is particularly advantageous for pet owners seeking effective medicines for their animals. This advancements in e-commerce coupled with ease of use is expected to drive the segment growth over the forecast period.

Key UK Veterinary Medicine Company Insights

Key players operating in the market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as product launches, partnerships, mergers & acquisitions and expansion activities are playing a key role in propelling market growth.

Key UK Veterinary Medicine Companies:

- Boehringer Ingelheim International GmbH.

- Norbrook

- Merck & Co., Inc.

- Elanco

- Bimeda, Inc.

- Zoetis UK Limited.

- Ceva

- BioZyme, Inc.

- Hill's Pet Nutrition, Inc.

- Decra

Recent Developments

-

In October 2023, Zoetis launched CircoMax, a new vaccine in the UK targeting Porcine Circovirus type 2 (PCV2), which includes protection against genotypes PCV2a, PCV2b, and PCV2d. This vaccine is the only one licensed for these three genotypes, providing broad protection against the evolving PCV2 threat in pig populations. It is a ready-to-use, single-dose vaccine with a duration of immunity of 23 weeks, formulated with MetaStim adjuvant.

-

In April 2021, Boehringer Ingelheim announced the availability of Prevexxion RN, a vaccine for Marek's disease, in the EU and UK. This innovative vaccine is designed to provide enhanced protection against Marek's disease, a viral infection that poses significant risks to poultry. Prevexxion RN utilizes a unique formulation that offers improved efficacy and safety profiles. The vaccine is expected to help poultry farmers better manage the disease, reducing mortality rates and improving overall flock health.

UK Veterinary Medicine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.9 billion

Revenue forecast in 2030

USD 4.6 billion

Growth Rate

CAGR of 7.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Animal type, Route of administration, and Distribution channel

Key companies profiled

Boehringer Ingelheim International GmbH.; Norbrook; Merck & Co., Inc.; Elanco; Bimeda, Inc.; Zoetis UK Limited.; Ceva; BioZyme, Inc.; Hill's Pet Nutrition, Inc.; Decra.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Veterinary Medicine Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UK veterinary medicine market report based on product, animal type, route of administration, and distribution channel.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Biologics

-

Vaccines

-

Modified/ Attenuated Live

-

Inactivated (Killed)

-

Other Vaccines (subunit and DNA vaccines)

-

-

Other Biologics (monoclonal antibodies and regenerative medicine)

-

-

Pharmaceuticals

-

Parasiticides

-

Anti-infectives

-

Anti-inflammatory

-

Analgesics

-

Others (cardiology, neurology, and hormone/fertility pharmaceuticals)

-

-

Medicated Feed Additives

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Production Animals

-

Poultry

-

Pigs

-

Cattle

-

Sheep & Goats

-

Others (aquaculture/fish, mules, camel, etc)

-

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Others (small mammals, birds, rabbits, reptiles, etc)

-

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Injectable

-

Topical

-

Other Routes (intranasal, controlled-release implants, etc)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

E-commerce

-

Offline Retail Stores

-

Others

-

Frequently Asked Questions About This Report

b. The UK veterinary medicine market size was estimated at USD 2.8 billion in 2023 and is expected to reach USD 2.9 billion in 2024.

b. The UK veterinary medicine market is expected to grow at a compound annual growth rate of 7.6% from 2024 to 2030 to reach USD 4.6 billion by 2030.

b. The production animal dominated the animal type segment in 2023. This is attributable to the increasing demand for high-quality meat, milk, and other animal products drives farmers to invest in advanced veterinary care to ensure optimal health and productivity of their livestock.

b. Some key players operating in the UK veterinary medicine market include Boehringer Ingelheim International GmbH.; Norbrook; Merck & Co., Inc.; Elanco; Bimeda, Inc.; Zoetis UK Limited.; Ceva; BioZyme, Inc.; Hill's Pet Nutrition, Inc.; Decra.

b. Key factors that are driving the market growth include the rise in livestock population and increasing pet ownership rates, novel product development in veterinary medicine, and the increasing prevalence of animal diseases.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."