- Home

- »

- Medical Devices

- »

-

UK Wearable Medical Devices Market Size Report, 2030GVR Report cover

![UK Wearable Medical Devices Market Size, Share & Trends Report]()

UK Wearable Medical Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Diagnostic, Therapeutic), By Site, By Grade Type, By Application (Sports & Fitness, Remote Patient Monitoring), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-198-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

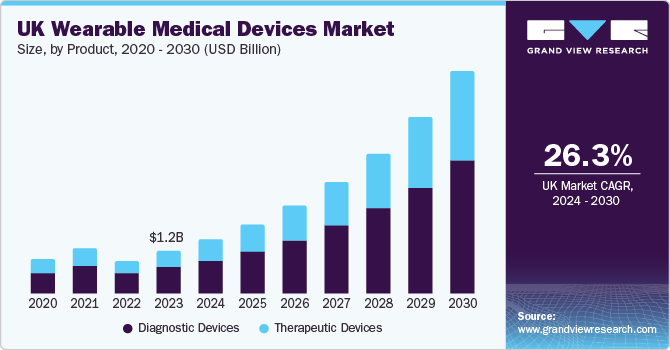

The UK wearable medical devices market size was valued at USD 1.21 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 26.3% from 2024 to 2030. The continuous research and innovation, increase in the usage of remote patient monitoring and home healthcare is anticipated to contribute to the market growth. Moreover, significant opportunities held by technological advancements, mergers and acquisitions, increased focus on fitness and healthy lifestyle contribute to propel the market scope.

Sedentary routines are predicted to contribute to an increase in lifestyle-related diseases including diabetes and hypertension, which demands the need for ongoing physiological parameter monitoring. Healthcare data may be combined with portable medical devices, giving doctors real-time access and provisions of imparting correct treatments and advice. The necessity for individualized monitoring and care is highlighted by the rising death rate from non-communicable illnesses, which is driving up demand for wearable medical technology.

Concerns about the increasing rates of death and the frequency of chronic illnesses are driving healthcare practitioners to prioritize individualized treatment, especially via ongoing remote patient monitoring. Wearable medical devices-which may be worn continuously without interfering with daily activities-are becoming more and more popular due to a large number of benefits. An increase in the demand for these devices is anticipated over the projected period.

Within the cardiovascular device sector, wearable medical technology is becoming increasingly important. These cutting-edge medical innovations, which include smartwatches and continuous monitoring devices, open new possibilities for cardiovascular disease early detection, real-time health tracking, and individualized patient treatment. The use of wearable technology in cardiovascular care represents a revolutionary turn in the direction of preventative healthcare solutions, which will eventually improve patient outcomes and the treatment of diseases.

Furthermore, the development of smaller and powerful sensors and processors has made it possible to create wearable medical devices that are more accurate and affordable. This has led to a proliferation of new devices and applications, many of which are still in the experimental phase but hold great promise for the future of healthcare.

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. As more people become aware of the benefits of wearable medical devices, adoption rates increase. Overall, the high market growth stage for wearable medical devices is characterized by rapid expansion, increasing adoption, expanding product offerings, improving functionality, growing regulatory approval, and increasing competition. These factors are driving significant growth in the market and are likely to continue doing the same over the forecast period.

The UK wearable medical devices market is characterized by a high level of merger and acquisition (M&A) activity by the leading players. For instance, in June 2020, Garmin acquired FirstBeat Analytics, a provider of physiological analytics for health and fitness to expand its share in the corresponding market.

The UK wearable medical devices is highly fragmented, with many different companies creating a varied environment. A competitive climate is created in the market by the large number of firms offering a diverse array of new technologies. The creation of several wearable medical solutions is encouraged by this fragmentation, which is fueled by continuous technical improvements. Consequently, the market is dynamic and diversified, and a wide range of businesses are involved in the growth and development of wearable medical devices.

Quick developments in wearable medical technology have made it possible to develop tools with improved monitoring, diagnosis, and treatment capabilities. The industry is marked by a boom in innovative solutions aimed at revolutionizing patient care and enabling individuals to take charge of their health. These solutions range from smartwatches that measure vital signs to implantable devices that provide real-time health data. This noteworthy level of innovation highlights the industry's dedication to using wearable medical devices that are both smart and accessible to address changing healthcare requirements.

Many market players are proactively broadening their geographic reach to leverage nascent market prospects and satisfy the increasing need for inventive medical technology. This international reach demonstrates the industry's dedication for expanding wearable medical device accessibility, meeting regional healthcare demands, and advancing remote patient monitoring and tailored healthcare solutions globally.

Product Insights

The diagnostic devices segment dominated the market and accounted for a share of 62.0% in 2023 owing to the increase in prevalence of neurological disorders. In addition, increasing public awareness of the ability of neurological wearables to continuously assess cognitive performance during daily activities is expected to contribute to the market growth.

According to a report published in October 2023 by the World Federation of Neurology, neurological disorders are the second leading cause of death and disability in the world. A similar study found that 40% and above world's population currently suffers from neurological diseases, and this burden is expected to almost double by 2050. The top 10 conditions, including stroke, neonatal encephalopathy, migraine, dementia, meningitis, epilepsy, neurological complications, premature birth, neurodegenerative disorders, autism spectrum disorders and Parkinson's disease, account for about 90% of all neurological disorders.

The therapeutic devices segment is anticipated to witness the fastest CAGR during the forecast period. It is anticipated that factors such as the increasing demand of therapeutic devices, the increase in the manufacturing and the demand of intelligent asthma management products, wearable pain reliever devices, and insulin management devices contribute to the market. The market is further segmented into pain management, insulin monitoring, rehabilitation, and respiratory therapy devices, showcasing a wide number of applications.

Site Insights

The clip/strap/bracelet segment dominated the market in 2023 and is expected to register the fastest CAGR during the forecast period. Smart watches are expected to grow in this segment due to their ability to monitor parameters such as mobility, breathing rate and heart rate, as well as functions of Bluetooth and loud connectivity. Moreover, the uses of these bracelets include the measurement of blood pressure, oxygen concentration as well as tracking physical activity and sleep patterns.

Furthermore, clip/strap/bracelet is preferred more as compared to other segments because of its benefits such as its light-weight quality, accessibility, visibility, and monitoring capacities. This growth is attributed to factors such as the advancements in wrist-worn products which offer enjoyable experiences of fitness tracking by monitoring, heart rate, skin temperature, and activity counts. For instance, in March 2019, The University of Kentucky College of Agriculture, Food and Environment launched a mobile fitness app that constituted of a fitness, nutrition tracker and unique features such as a market locator, foodbank locators, workout plans and videos.

The shoe sensors segment is expected to gain a major market share in the UK wearable medical devices market. Shoe sensors have emerged as a promising technology in the field of wearable medical devices. These sensors, when integrated into footwear, can provide valuable health data and insights, contributing to a more comprehensive understanding of an individual's overall well-being. These sensors can track walking patterns and are useful for diagnosing and monitoring conditions such as Parkinson's disease, stroke, and other neurological disorders that affect movement.

Application Insights

The home healthcare segment dominated the market in 2023. Wearable medical devices often come with built-in sensors and connectivity options, allowing healthcare providers to remotely monitor patients' vital signs and health data.This remote monitoring capability enables the patients themselves to keep a close eye on the conditions without having to physically visit hospitals frequently, which is particularly useful for those with limited mobility or living in remote areas.

Moreover, Wearable devices are lightweight, comfortable, and easy to use, making them ideal for home healthcare settings. Patients can wear these devices for extended periods without experiencing discomfort or any sort of inconvenience. These medical devices give patients more control over their health by providing them with valuable insights into their health status and enabling them to make informed decisions about their care. This self-management aspect empowers patients to take an active role in their health journey and can lead to better adherence to treatment plans.

The remote patient monitoring segment is expected to register the fastest CAGR during the forecast period. Wearable devices allow patients to monitor their health and share their data with healthcare providers from the comfort of their homes. This eliminates the need for frequent in-person visits, saving time and effort for both patients and healthcare professionals. For instance, according to the National Library of Medicine, 2023, home healthcare are more likely to be cost saving and same as effective as hospitals. These devices can collect real-time health data, providing healthcare providers with continuous, round-the-clock monitoring. This constant surveillance enables early detection of potential health issues, allowing for timely interventions and better management of chronic conditions.

Grade Type Insights

The consumer grade wearable medical devices segment dominated the market in 2023 pertaining to their user-friendly features and emphasis on tracking personal fitness and health, these gadgets are very well-liked by customers. The market category is driven by convenience, affordability, and growing health consciousness, all of which contribute to its strong success. Consumer-grade wearables are generally more affordable than clinical-grade devices.

The clinical wearable medical devices segment is anticipated to witness the fastest CAGR during the forecast period. The increasing need for monitoring technologies in healthcare settings is the reason for this growth. The high rise of this sector may be attributed to the growing acceptance of these devices for remote healthcare management, continuous patient monitoring, and integration with healthcare systems. The market for clinical-grade wearable medical devices is poised for substantial growth as healthcare providers adopt more cutting-edge technology to meet the changing demands of the sector.

Distribution Channel Insights

The pharmacy segment dominated the market for wearable medical devices in 2023. The reason for this domination is due to the widely accessible pharmacies and provision of customers with an easy way to buy these gadgets. Due to their position as centers of health and wellness and their capacity to offer knowledgeable guidance, pharmacies have a significant revenue share in the market for wearable medical devices.

The online channel segment is anticipated to witness the fastest CAGR over the forecast period. This growth is driven by the increasing consumer preference for online shopping. The convenience, accessibility, and diverse product offerings available through e-commerce platforms fuel this trend.

Key UK Wearable Medical Devices Company Insights

Some of the key players operating in the market include Koninklijke Philips N.V.; Fitbit, Covidien (Medtronic); Omron Corp; Withings; Everist Genomics and Polar Electro.

-

Philips sensing systems are designed and validated to provide accurate readings in the application. Wearable sensing technology uses an optical sensor to track volume variations in blood and track body motion.

-

Everist Genomics and Intelesens Ltd. are some of the other market participants in the UK wearable devices market.

-

Everist Genomics develops and markets Prognostic and diagnostic technologies. The company provides molecular tests based on genes to predict the return of cancer.

Key UK Wearable Medical Devices Companies:

The following are the leading companies in the UK wearable medical devices market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these UK wearable medical devices companies are analyzed to map the supply network.

- Koninklijke Philips N.V.

- Fitbit

- Garmin

- Covidien (Medtronic)

- Omron Corp.

- Withings

- Polar Electro

- Everist Genomics

- Intelesens Ltd.

Recent Developments

-

In September 2023, the UK Government announced the launch of the Innovative Devices Access Pathway (“IDAP”) pilot scheme that aims to improve the access of innovative and transformative medical devices to the patients and meet their needs.

-

In August 2023, Firstkind Ltd developed the geko™ device, a wearable, neuromuscular electrostimulation technology worn outside the knee joint. It is designed to increase blood flow, improve post-surgical stimulation and to help reduce edema.

-

In August 2023, the UK Government announced its plans to indefinitely extend the use of CE marking for the majority of medical devices and in-vitro diagnostic devices.

-

In June 2022, UK MHRA announced new plans to strengthen medical devices’ regulation that is aimed to address inequities in the use of medical devices.

-

In September 2021, Nemaura Medical, Inc., a medical technology company focused on developing and commercializing non-invasive wearable diagnostic devices announced its commercial contract with MySugarWatch DuoPack Limited. This contract was made in the aim of providing CGM and sensors as Duo-Packs that are widely prescribed for people with Type 2 diabetes.

-

In February 2020, UK- based WaveOptics launched the industry’s thinnest and lightest waveguide. This launch was made in the aim to make augmented reality wearables for the mass market to 5G.

UK Wearable Devices Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 6.25 billion

Growth rate

CAGR of 26.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, site, grade type, distribution channel

Country scope

UK

Key companies profiled

Koninklijke Philips N.V.; Fitbit; Garmin; Covidien (Medtronic); Omron Corp.; Withings; Polar Electro; Everist Genomics; Intelesens Ltd.; Firstkind Ltd; WaveOptics.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Wearable Medical Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UK wearable medical devices market report based on product, site, application, grade type, and distribution channel:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Diagnostic Devices

-

Vital Sign Monitor

-

Heart Rate Monitors

-

Activity Monitors

-

Electrocardiographs

-

Pulse Oximeters

-

Spirometers

-

Blood Pressure Monitors

-

Others

-

-

Sleep Monitoring Device

-

Sleep Trackers

-

Wrist Actigraphs

-

Polysomnographs

-

Others

-

-

Electrocardiographs Fetal & Obstetric Devices

-

Neuromonitoring Devices

-

EEG

-

EMG

-

Others

-

-

-

Therapeutic Devices

-

Pain Management Devices

-

Neurostimulation Devices

-

Others

-

-

Insulin Monitoring Devices

-

Insulin Pumps

-

Others

-

Autoinjectors

-

Other Insulin Devices

-

-

-

Rehabiliation Devices

-

Accelerometers

-

Sensing Devices

-

Ultrasound Platform

-

Others

-

-

Respiratory Therapy Devices

-

Ventilators

-

CPAP

-

Portable oxygen concentrators

-

Others

-

-

-

-

Site Outlook (Revenue, USD Billion, 2018 - 2030)

-

Handheld

-

Headband

-

Strap, Clip, Bracelet

-

Shoe Sensors

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sports & Fitness

-

Remote Patient Monitoring

-

Home Healthcare

-

Grade Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consumer-grade Wearable Medical Devices

-

Clinical Wearable Medical Devices

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmacies

-

Online Channels

-

Hypermarkets

-

Frequently Asked Questions About This Report

b. The global UK wearable medical devices market size was estimated at USD 1.21 billion in 2023.

b. The global UK wearable medical devices market is expected to grow at a compound annual growth rate (CAGR) of 26.3% from 2024 to 2030 to reach USD 6.25 billion by 2030.

b. The diagnostic devices dominated the market with the largest market share of 62% in 2023. This high share is attributable to the increase in the prevalence of neurological disorders. In addition, it increases public awareness of the ability of neurological wearables to continuously assess cognitive performance during daily activities.

b. Some of the key players operating in the UK wearable medical devices market include Koninklijke Philips N.V.; Fitbit; Garmin; Covidien (Medtronic); Omron Corp.; Withings; among others.

b. Key factors driving the market growth include an increase in the usage of remote patient monitoring and home healthcare, continuous research and innovation, and technological innovation in technology across the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.