- Home

- »

- Advanced Interior Materials

- »

-

U.S. Abrasives Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Abrasives Market Size, Share & Trends Report]()

U.S. Abrasives Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Coated, Bonded), By Application (Automotive & Transportation, Heavy Machinery, Metal Fabrication), And Segment Forecasts

- Report ID: GVR-4-68040-227-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Abrasives Market Size & Trends

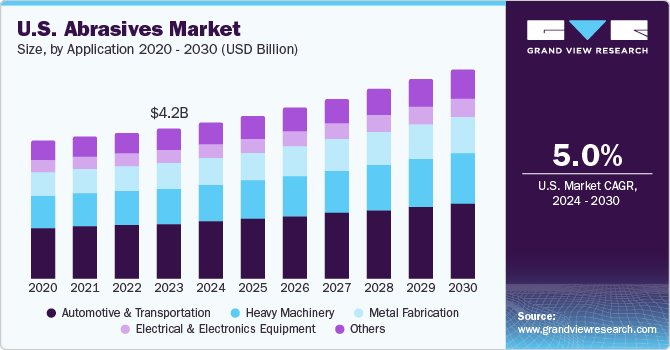

The U.S. abrasives market was valued at USD 4.22 billion in 2023 and is projected to grow at a CAGR of 5.0% from 2024 to 2030. This growth is attributed to the developments in metal fabrication and the electric vehicles (EV) industries. The metal fabrication industry is witnessing tremendous changes backed by economic growth, which in turn, is propelling market growth. The EV industry requires abrasives for modifying the operating parameters and reducing high-performance engine carbon dioxide emissions and component machining.

The U.S. abrasives market is subject to the impact of regulatory frameworks concerning health, environment, and safety concerns, which are related to disposal practices, carbon emissions, and manufacturing processes. For instance, the use of dangerous chemicals and processes, which are subject to strict monitoring by different regulatory authorities, is involved in the production of abrasives.

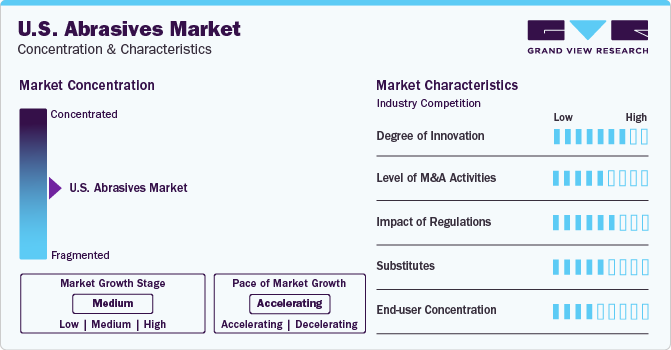

Market Concentration & Characteristics

The abrasives sector has witnessed incremental innovation over the years. Manufacturers continuously improve abrasive materials, coatings, and manufacturing processes. Innovations focus on enhancing abrasive performance, durability, and safety. For instance, advancements in ceramic abrasives and super-abrasives (such as diamond and cubic boron nitride) have contributed to better cutting efficiency and longer tool life.

Regulatory factors significantly influence the market. Environmental regulations drive manufacturers toward sustainable practices and materials. Compliance with safety standards (such as OSHA regulations) impacts product design, labeling, and workplace safety. Tariffs and trade policies also affect the industry, especially when sourcing raw materials globally.

Abrasives face competition from alternative surface finishing methods and materials. Some substitutes include diamond tools (used for precision cutting and grinding), waterjet cutting, and chemical mechanical planarization (used in semiconductor manufacturing).

The market serves diverse end-user industries, including automotive, aerospace, construction, metal fabrication, and electronics. While no single industry dominates, automotive and metal fabrication are significant consumers of abrasives.

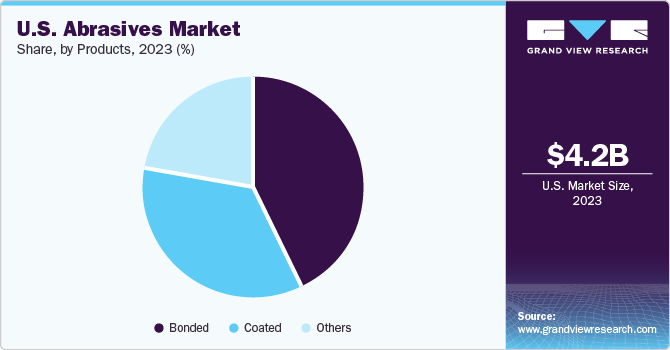

Product Insights

The bonded abrasives dominated the U.S. market in 2023 with more than 43.0% revenue share. This dominance can be attributed to their extensive use in various industries like automotive, aerospace, and medical, for efficient material removal and finishing.

The coated abrasives segment is the fastest-growing, with an estimated CAGR of 5.4% from 2024 to 2030. This growth can be attributed to their adaptability, as they can be easily shaped, cut, and applied to various surfaces. The automotive and woodworking industries extensively use this kind. The popularity of DIY projects and home renovations is also expected to drive the segment growth over the coming years.

Application Insights

The automotive segment dominated the U.S. market in 2023 with more than 36.0% revenue share. This dominance can be attributed to the robust automotive manufacturing industry in the U.S. From bodywork to engine components, abrasives are essential for shaping, finishing, and polishing various auto parts. The need for regular maintenance and repair of vehicles boosts their consumption.

The metal fabrication segment is anticipated to register a CAGR of 5.6% from 2024 to 2030. This growth can be attributed to the construction industry’s shift toward pre-engineered buildings and components, which necessitates precise metal fabrication. Abrasives are vital for cutting, grinding, and shaping metal structures.

Key U.S. Abrasives Company Insights

The U.S. abrasives market exhibits a moderate level of concentration. Several key players dominate the market, but there is also room for smaller and specialized manufacturers. Major companies in the industry include 3M, Saint-Gobain, and CUMI. These players have a significant market share and influence pricing dynamics.

The U.S. abrasives market has experienced moderate merger and acquisition (M&A) activities. Companies seek strategic partnerships to expand their product portfolios and geographic reach. Recent notable M&A deals include acquisitions by major players to consolidate their market position and gain access to new technologies. For instance, acquisition of Michigan-based Acme Abrasives by Tyrolit was a strategic initiative to expand the latter’s product portfolio in steel, foundry, and rail industries.

Key U.S. Abrasives Companies:

- 3M

- Saint-Gobain

- CUMI

- Kingspor Abrasives

- Sia Abrasives Industries

- ARC Abrasives Inc.

- Fujimi Incorporared

- Deerfos

- Robert Bosch GmbH

- SAK Abrasives

Recent Developments

-

In May 2023, Sak Abrasives Inc., acquired Jowitt & Rodgers Co., a Philadelphia-based manufacturer of resin bonded grinding wheels, discs and segments. The acquisition aims at enhancing production of custom-made engineered products in India and the U.S., thus, eventually aiding company’s position in the global bonded abrasives market.

-

In September 2023, Tyrolit acquired Acme Abrasives to expand its portfolio. Acme wheels will be integrated in the grinding and specialty abrasive solutions portfolio of Tyrolit for industrial clients.

-

In December 2023, SurfacePrep acquired Illinois-based Diamond Tool & Abrasives.

U.S. Abrasives Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.38 billion

Revenue forecast in 2030

USD 5.86 billion

Growth rate

CAGR of 5.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application

Key companies profiled

3M, Saint-Gobain, CUMI, Kingspor Abrasives, sia Abrasives Industries, ARC Abrasives Inc., Fujimi Incorporared, Deerfos, Robert Bosch GmbH, SAK Abrasives

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Abrasives Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. abrasives market report based on product and application:

-

Abrasives Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Coated

-

Bonded

-

Others

-

-

Abrasives Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive & Transportation

-

Heavy Machinery

-

Metal Fabrication

-

Electrical & Electronics Equipment

-

Other Applications

-

Frequently Asked Questions About This Report

b. The U.S. abrasives market was valued at USD 4.22 billion in the year 2023 and is expected to reach USD 4.38 billion in 2024.

b. The US abrasives market is expected to grow at a compound annual growth rate of 5.0% from 2024 to 2030 to reach USD 5.86 billion by 2030.

b. The automotive & transportation segment accounted for the largest revenue share of nearly 37.0% in 2023, owing to the increasing production of vehicles.

b. Some of the key players operating in the U.S. abrasives market include 3M, CUMI, Saint-Gobain, Sia Abrasive Industries, SAK Abrasives, Kingspor Abrasives, and ARC Abrasives Inc., among others.

b. The growth of the U.S. abrasives market is attributed to the developments in metal fabrication and the electric vehicles industries. For instance, the electric vehicles require abrasives for modifying the operating parameters and reducing high-performance engine carbon dioxide emissions and component machining.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.