U.S. Acromegaly Treatment Market Summary

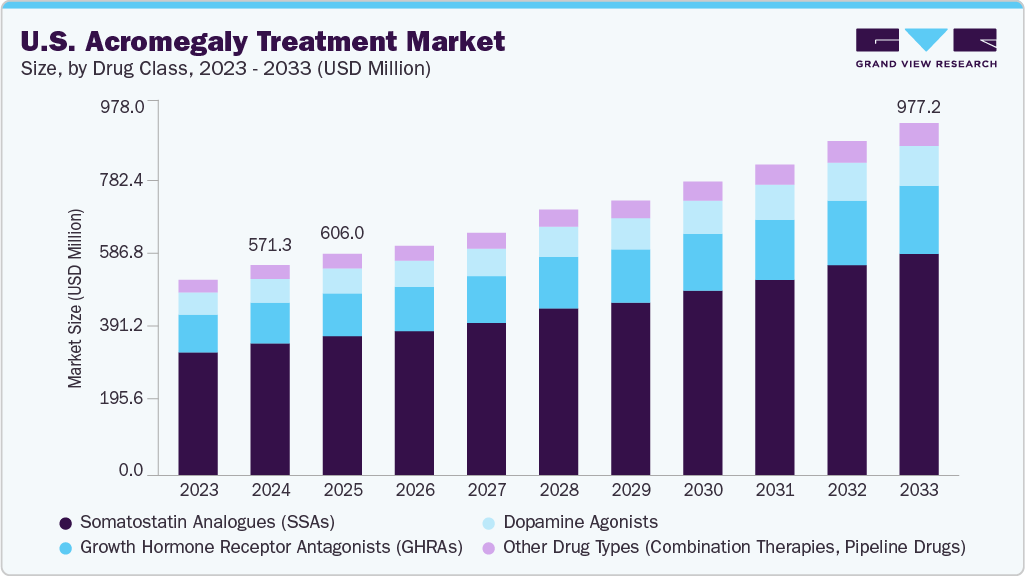

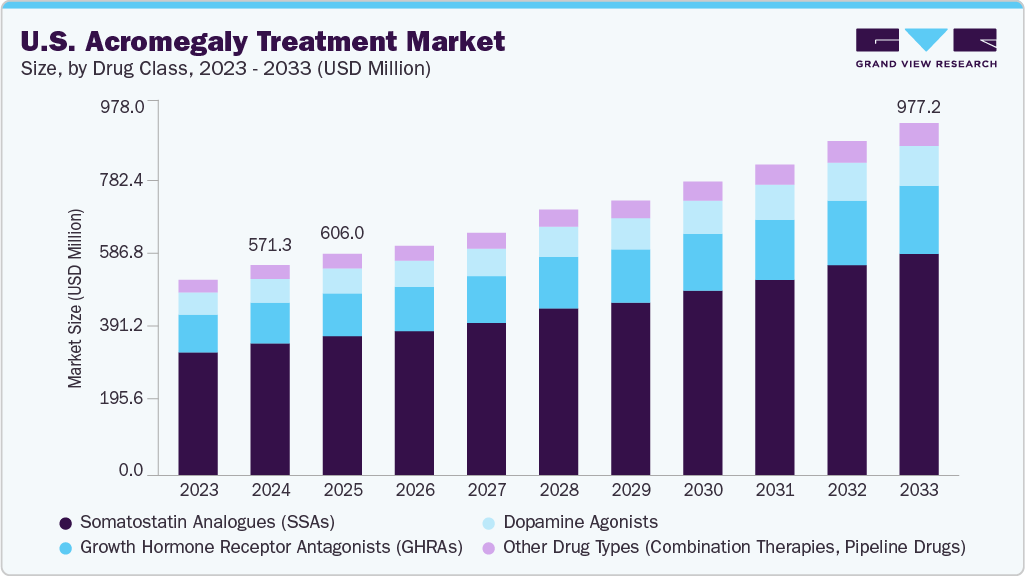

The U.S. acromegaly treatment market size was estimated at USD 571.3 million in 2024 and is projected to reach USD 977.2 million by 2033, growing at a CAGR of 6.2% from 2025 to 2033. This is attributed to the rising prevalence of acromegaly and earlier diagnoses, coupled with advancements in diagnostic tools such as MRI and IGF-1 tests, improved awareness, and a better understanding of the disease’s symptoms.

Key Market Trends & Insights

- By drug class, the somatostatin analogues (SSAs) segment held the highest market share of 65.0% in 2024.

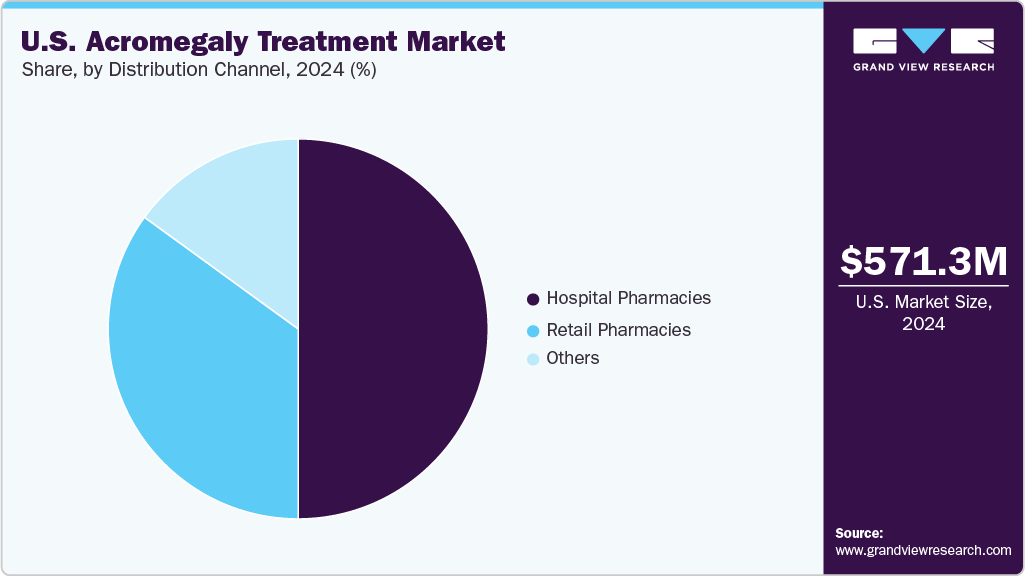

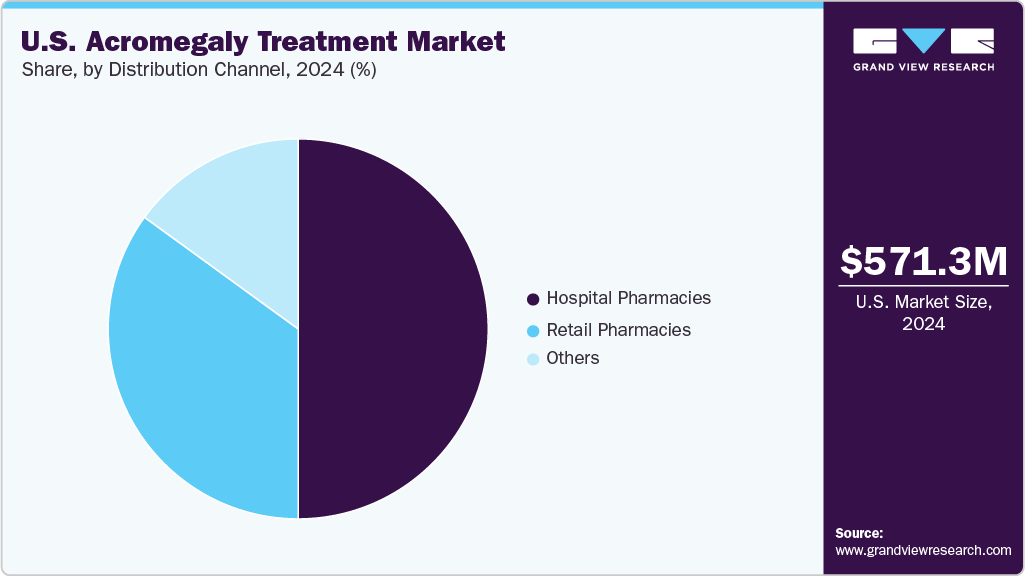

- By distribution channel, the hospital pharmacies segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 571.3 Million

- 2033 Projected Market Size: USD 977.2 Million

- CAGR (2025-2033): 6.2%

Technological advances in diagnostics and the adoption of personalized treatment regimens are expected to help early detection and adherence. Strong healthcare infrastructure, insurance support, and multidisciplinary care teams are further expected to support market expansion.

Moreover, advances in treatment options, including newer somatostatin analogs, growth hormone receptor antagonists, and personalized therapies, offer improved efficacy and fewer side effects. These innovations enhance patient outcomes and expand the treatment pool, fueling market demand and encouraging further investment in research and development.

Drug Class Insights

On the basis of drug class, the somatostatin analogues (SSAs) segment dominated the market with a revenue share of 65.0% in 2024 due to their effectiveness in controlling growth hormone levels and managing symptoms. This segment remains crucial, driven by their proven clinical efficacy and widespread physician trust. Their ability to reduce tumor size and normalize hormone levels has made them the preferred choice for long-term management of acromegaly.

The growth hormone receptor antagonists (GHRAs) segment is expected to register the highest CAGR during the forecast period. The GHRAs segment is gaining momentum in the U.S. acromegaly treatment landscape due to its effectiveness in patients who are unresponsive to somatostatin analogues. Unlike SSAs, GHRAs block growth hormone receptors directly, making them ideal for second-line or adjunct therapy. Rising diagnosis rates and a growing population of SSA-resistant or intolerant patients are expected to drive demand over the forecast period.

Distribution Channel Insights

The hospital pharmacies segment dominated the market in 2024. The segment plays a central role in the U.S. acromegaly treatment market due to its critical role in providing specialized & immediate care. Hospital pharmacies ensure the availability of advanced medications, such as growth hormone receptor antagonists and somatostatin analogs, essential for effective acromegaly management.

The retail pharmacies distribution segment is expected to register significant growth during the forecast period. Retail pharmacies offer services, such as medication management and patient counseling, improving treatment outcomes. In addition, retail pharmacies are increasingly integrating patient support programs and medication adherence tools, making them more capable of managing rare conditions like acromegaly.

Key U.S. Acromegaly Treatment Company Insights

Some of the key players in the U.S. acromegaly treatment market include Novartis AG, Ipsen Pharma, Sun Pharmaceutical Industries Ltd, and Chiasma, Inc.

-

Novartis AG maintains a strong presence in the U.S. acromegaly treatment market, supported by its long-standing expertise in endocrine disorders. The company focuses on therapies that address hormone regulation and tumor control, targeting both first-line and refractory patient populations.

-

Ipsen Pharma plays a prominent role in the U.S. acromegaly treatment market, driven by its focus on endocrine and rare diseases. The company emphasizes patient-centric solutions and continues to invest in improving treatment delivery and accessibility.

Key U.S. Acromegaly Treatment Companies:

- Novartis AG

- Ipsen Pharma

- Sun Pharmaceutical Industries Ltd

- Chiasma, Inc.

- Crinetics Pharmaceuticals

- WOCKHARDT

- Pfizer Inc.

- Ionis Pharmaceuticals, Inc.

- Teva Pharmaceuticals

Recent Developments

- In October 2024, Teva Pharmaceuticals launched the first FDA-approved generic version of Sandostatin LAR Depot, indicated for treating acromegaly & severe diarrhea for carcinoid syndrome.

U.S. Acromegaly Treatment Market Report Scope

|

Report Attribute

|

Details

|

|

Revenue forecast in 2033

|

USD 977.2 million

|

|

Growth rate

|

CAGR of 6.2% from 2025 to 2033

|

|

Actual data

|

2021 - 2024

|

|

Forecast period

|

2025 - 2033

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Drug class, distribution channel

|

|

Key companies profiled

|

Novartis AG; Ipsen Pharma; Sun Pharmaceutical Industries Ltd; Chiasma, Inc.; Crinetics Pharmaceuticals; WOCKHARDT; Pfizer Inc.; Ionis Pharmaceuticals, Inc.; Teva Pharmaceuticals

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Acromegaly Treatment Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. acromegaly treatment market report based on drug class, and distribution channel:

-

Drug Class Outlook (Revenue, USD Million, 2021 - 2033)

-

Somatostatin Analogues (SSAs)

-

Growth Hormone Receptor Antagonists (GHRAs)

-

Dopamine Agonists

-

Other Drug Types (Combination Therapies, Pipeline Drugs)

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Others