- Home

- »

- Homecare & Decor

- »

-

U.S. Action Figures Market Size, Industry Report, 2030GVR Report cover

![U.S. Action Figures Market Size, Share & Trends Report]()

U.S. Action Figures Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Superheroes, Movie Characters), By End-user (Up To 8 Years, 9 - 15 Years, 15 Years & Above), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-505-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Action Figures Market Size & Trends

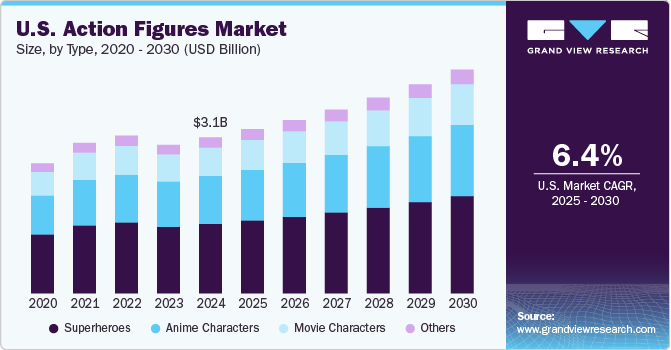

The U.S. action figures market size was valued at USD 3.06 billion in 2024 and is expected to grow at a CAGR of 6.4% from 2025 to 2030. The action figure industry in the country is driven by nostalgia, fandom, and the growing appeal of collectibles. Adults seek connections to cherished childhood memories, while fans engage with detailed figures representing beloved pop culture characters. Innovations in design and craftsmanship have elevated these items to collectible status, attracting enthusiasts and investors alike. In addition, a thriving collector community and the enduring popularity of movies, comics, and gaming fuel market growth.

Adopting action figures as collectibles rather than toys has become a significant trend among adult consumers. Adults, particularly those aged 18 to 49, increasingly view action figures as items of cultural value, artistic expression, or investment. This shift has driven the adoption of premium, highly detailed figures designed specifically for display or collection purposes.

For instance, in November 2024, an article from the Financial Times highlighted the rise of "kidults," adults who are significant contributors to the toy industry, accounting for around 25% of global toy sales. Nostalgia, collectibles, and emotional connections to childhood drive this trend. Companies leverage this demand by creating higher-quality, adult-targeted products like limited-edition action figures and model kits. The growth of this demographic reflects a shift in consumer habits, blending entertainment and nostalgia.

Companies such as Hot Toys and Hasbro’s Black Series have successfully catered to this demand by offering figures with exceptional craftsmanship and limited-edition appeal. For this demographic, the appeal lies in the nostalgic connection to their childhood as well as the thrill of owning exclusive or rare items. This trend has transformed action figures from mass-market toys into coveted collectibles, encouraging a new wave of consumer adoption.

Furthermore, e-commerce and crowdfunding platforms have revolutionized how consumers discover and purchase action figures, driving adoption across various segments. Online shopping has made action figures more accessible to a global audience, allowing consumers to easily purchase figures from niche brands or limited-edition releases. Crowdfunding platforms like Kickstarter and HasLab have also facilitated the creation of unique and highly detailed action figure lines, enabling smaller manufacturers to cater to specific consumer interests. These platforms provide consumers with direct access to innovative products and often involve them in the design and production process, increasing their sense of connection to the brand and encouraging adoption.

Consumer Insights

Children, typically aged 3 to 12 years, form the traditional consumer base for the action figures industry. For this age group, action figures are primarily viewed as toys for imaginative play. Marketing to children often involves leveraging animated TV shows, movies, and video games featuring iconic characters. Popular franchises like Marvel, DC, and Star Wars use cross-media strategies to engage this demographic. Packaging design, affordability, and durability play significant roles in purchasing decisions, with parents being the primary buyers. Trends in this segment also evolve based on the popularity of certain franchises, creating seasonal and cyclical demand.

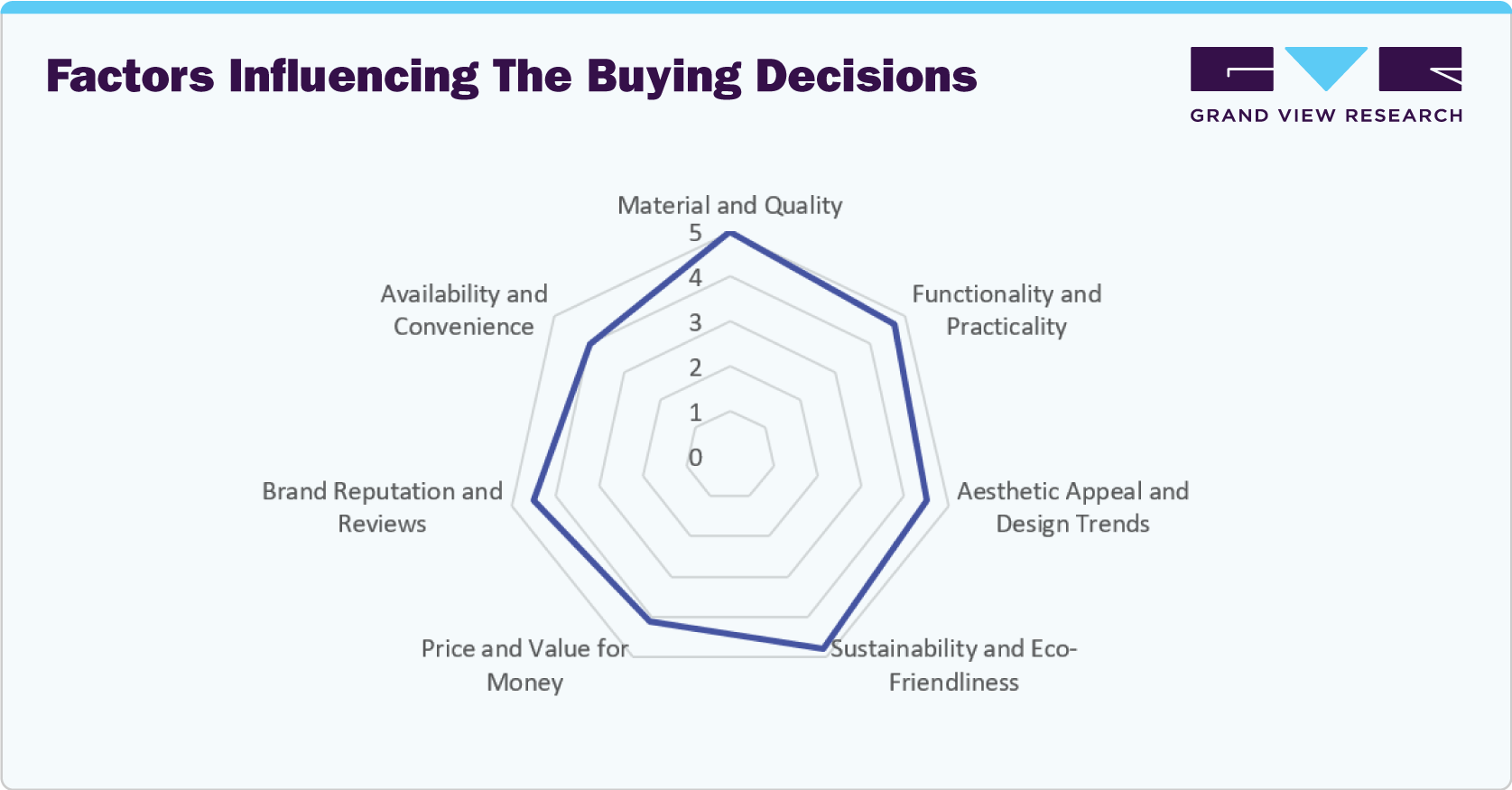

For many, action figures represent more than just toys. They are tangible expressions of their fandom, nostalgia, or admiration for a particular character. Consumers often form deep attachments to characters from TV shows, movies, comics, or video games, and their purchases reflect these personal connections. This is especially true for adults who grew up with certain franchises and seek to reconnect with their childhood through collectible figures. The stronger the emotional connection, the more likely a consumer is to purchase a figure, particularly if it is tied to a beloved character or a rare, limited-edition release.

The quality and craftsmanship of an action figure play a significant role in the buying decision, especially for adult collectors who prioritize intricate details, articulation, and durability. Consumers often assess action figures based on how well they are made, looking at features like the accuracy of facial features, paint applications, and the use of high-quality materials.

Figures that offer excellent attention to detail and realism tend to attract collectors who are willing to pay a premium for items that meet their high standards. Durability and safety are also crucial considerations for children, as parents are concerned about how well the figure will hold up to rough play.

Type Insights

Superhero action figures accounted for a market share of 44.6% in 2024. The growing influence of superhero movies and TV shows drives the growth of superhero action figures. Over the past decade, the Marvel Cinematic Universe (MCU) and DC Extended Universe (DCEU) have experienced massive success, bringing iconic characters like Iron Man, Spider-Man, Batman, and Wonder Woman into mainstream entertainment. This surge in visibility has not only captured the imaginations of moviegoers but also translated into a higher demand for action figures that allow fans to engage with these characters outside of the screen.

The market for anime characters’ action figures is expected to expand at a CAGR of 7.0% from 2025 to 2030. In recent years, anime has seen a surge in visibility through streaming platforms like Netflix, Crunchyroll, and Hulu, making anime more accessible to a broader audience. This has led to an expanding fanbase among younger viewers and older generations who have rediscovered the genre. Anime series such as Attack on Titan, One Piece, Naruto, Demon Slayer, and My Hero Academia have achieved significant mainstream success, with their unique art styles, compelling storytelling, and diverse character development drawing in millions of new fans. As these series gained widespread recognition, the demand for related merchandise, particularly action figures, naturally followed.

For instance, in April 2021, Bandai America announced the launch of a new line of One Piece action figures inspired by the globally popular anime and manga series. These highly detailed figures aimed to appeal to fans and collectors, offering iconic characters with impressive articulation and accessories for display or play. This release reflects the growing popularity of One Piece and Bandai's commitment to catering to its devoted fanbase.

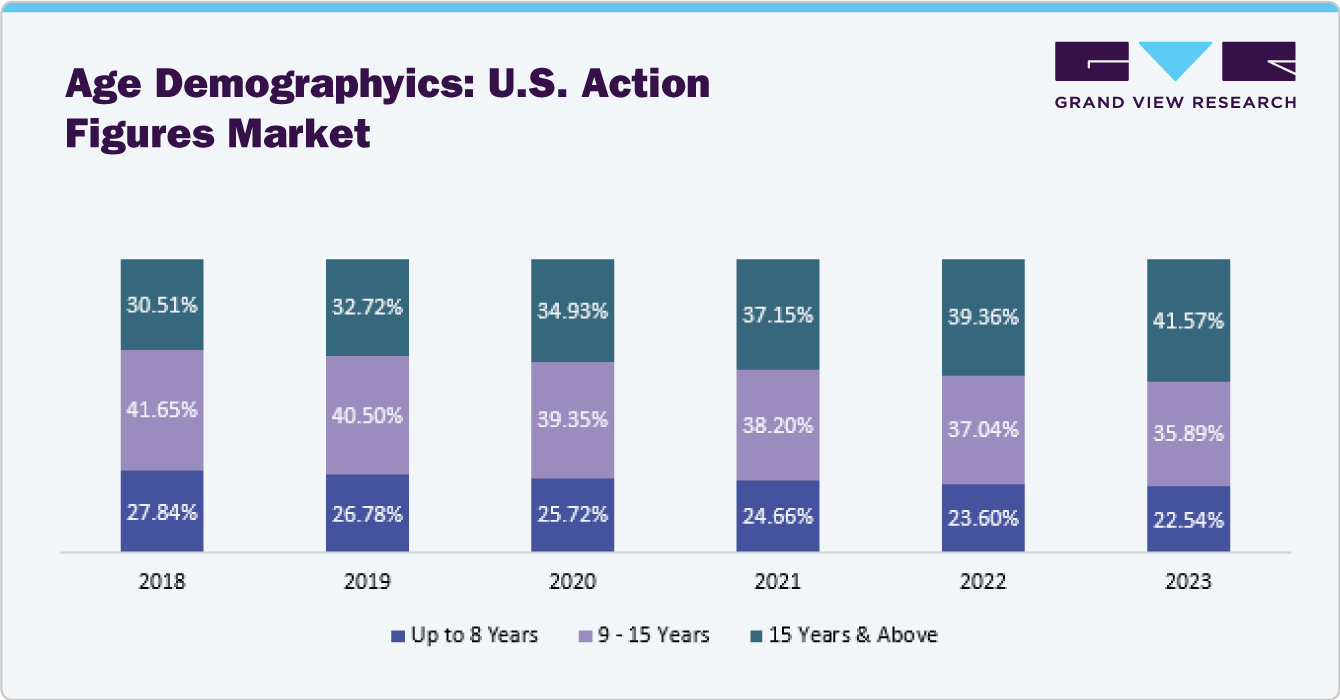

End-user Insights

The 15 years and above age group represented a significant market share, accounting for 43.8% in 2024.Many individuals in this age group grew up with action figures, and as they mature, they continue to purchase figures to relive fond memories or complete their collections. Nostalgia is significant in driving demand as collectors seek to re-acquire figures they may have owned in their youth or expand their collections to include new, limited-edition releases tied to their favorite franchises. In addition to nostalgia, the appeal of action figures as collectibles has become more pronounced among adults. Many manufacturers now produce highly detailed, limited-edition action figures designed specifically for collectors. These figures often come with intricate craftsmanship, special packaging, and features catering to adult collectors seeking authenticity and rarity.

The sales of action figures among the 9 - 15-year-old age group in the U.S. are expected to grow at a CAGR of 6.4% from 2025 to 2030.While younger children may view action figures primarily as toys for play, the 9-15 age group often views them as collectibles and displays of fandom. This shift is partly due to the rising cultural value of collectibles, where figures are often purchased for play and as items to display, share, or trade with others. The intricate detailing and limited-edition releases commonly featured in action figures aimed at this age group add an element of exclusivity and rarity that appeals to collectors and fans. This demographic is also more inclined to participate in fan communities, whether online or in-person, where showcasing action figure collections becomes a source of pride and identity.

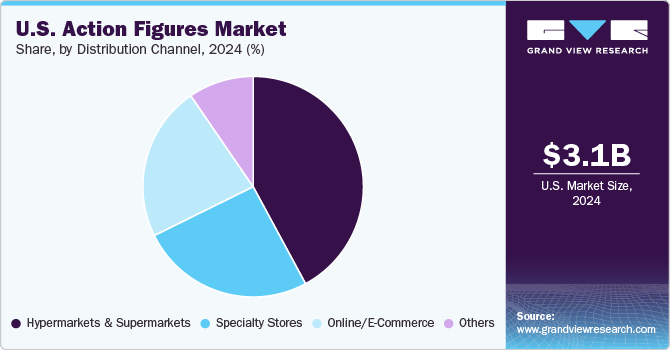

Distribution Channel Insights

Sales through hypermarkets & supermarkets accounted for a share of 42.1% of the U.S. action figures industry in 2024. Many major toy manufacturers have recognized the reach and accessibility of hypermarkets and supermarkets and have expanded their product offerings to include action figures from popular franchises like Marvel, Star Wars, Transformers, and Disney. These franchises have wide appeal across age groups, ensuring that the action figures cater to both children and adult collectors. With these well-known and highly desired products, hypermarkets and supermarkets can attract a broad customer base, increasing foot traffic and stimulating sales. Moreover, promotional efforts and seasonal sales have significantly driven demand through hypermarkets and supermarkets. These stores often offer discounts, bundled deals, and holiday promotions, making action figures more affordable and attractive to buyers.

The online/e-commerce channel is expected to register a CAGR of 7.0% from 2025 to 2030 as increasing convenience, detailed product comparisons, and the rising preference for e-commerce among parents and kids drive demand. The online marketplace provides consumers with a much broader selection of action figures than what is typically available in physical stores. E-commerce platforms, including dedicated toy retailers, general online marketplaces like Amazon, and specialized websites, offer a much wider array of action figures, ranging from popular, mass-produced figures to rare, limited-edition collectibles. For collectors, this diversity is particularly valuable, as it allows them to find and purchase action figures from specific franchises or even rare items that might not be available in local stores. Online platforms provide a level of accessibility to niche products, creating a more comprehensive and personalized shopping experience for consumers who are looking for something unique or specific.

Key U.S. Action Figures Company Insights

The U.S. market is fragmented and characterized by diverse players, from large multinational corporations to smaller regional/local manufacturers. Some leading players in the market are Hasbro, The LEGO Group, Playmates Toys Ltd., and more.

Key U.S. Action Figures Companies:

- Hasbro

- The LEGO Group

- Playmates Toys Ltd.

- JAKKS Pacific, Inc.

- Mattel

- Bandai Namco Holdings Inc.

- Diamond Select Toys

- Good Smile Company, Inc.

- Spin Master

- McFarlane Toys

Recent Developments

-

In May 2024, Hasbro announced the launch of a new collection of Transformers One figures inspired by the upcoming film at Target in the summer. The line included figures like Quintesson High Commander, Ultimate Energon Optimus Prime, and Energon Glow Bumblebee, each with unique features such as transformations and accessories. In addition, the collection offered racing-themed packs, including sets like the Race and Blast 2-Pack and Racing Warrior 3-Pack.

-

In April 2021, Bandai America announced the launch of a new line of One Piece action figures inspired by the globally popular anime and manga series. These highly detailed figures aimed to appeal to fans and collectors, offering iconic characters with impressive articulation and accessories for display or play. This release reflects the growing popularity of One Piece and Bandai's commitment to catering to its devoted fanbase.

U.S. Action Figures Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.22 billion

Revenue forecast in 2030

USD 4.39 billion

Growth rate

CAGR of 6.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-user, distribution channel

Country scope

U.S.

Key companies profiled

Hasbro; The LEGO Group; Playmates Toys Ltd.; JAKKS Pacific, Inc.; Mattel; Bandai Namco Holdings Inc.; Diamond Select Toys; Good Smile Company, Inc.; Spin Master; McFarlane Toys

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Action Figures Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. action figures market report based on type, end-user, and distribution channel:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Superheroes

-

Anime Characters

-

Movie Characters

-

Others

-

-

End User Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 8 Years

-

9 - 15 Years

-

15 Years & Above

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Online/ E-commerce

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. action figures market was estimated at USD 3.06 billion in 2024 and is expected to reach USD 3.22 billion in 2025.

b. The U.S. action figures market is expected to grow at a compound annual growth rate of 6.4% from 2025 to 2030, reaching USD 4.39 billion by 2030.

b. Superheros action figures industry accounted for 44.6% of the market share in 2024. The growing influence of superhero movies and TV shows drives the growth of superhero action figures.

b. Some key players operating in the U.S. action figures market include Hasbro; The LEGO Group; Playmates Toys Ltd.; JAKKS Pacific, Inc.; Mattel; Bandai Namco Holdings Inc.; Diamond Select Toys; Good Smile Company, Inc.; Spin Master; McFarlane Toys

b. Key factors driving the U.S. action figures market growth include rising demand for collectible merchandise, franchise-driven popularity, advancements in design and technology, and expanding consumer demographics across age groups.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.