- Home

- »

- Next Generation Technologies

- »

-

U.S. Additive Manufacturing Market Size, Share Report, 2030GVR Report cover

![U.S. Additive Manufacturing Market Size, Share & Trends Report]()

U.S. Additive Manufacturing Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Printer Type (Desktop, Industrial), By Technology, By Software, By Application, By Vertical, By Material, And Segment Forecasts

- Report ID: GVR-4-68039-937-3

- Number of Report Pages: 249

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

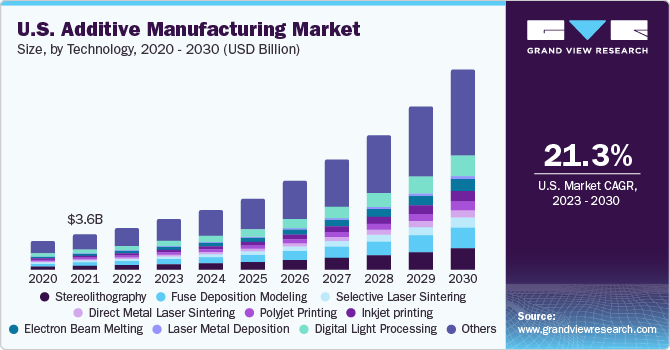

The U.S. additive manufacturing market size was estimated at USD 3.56 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 21.3% from 2023 to 2030. The assertive research & development in three-dimensional (3D) printing and increasing demand for rapid prototyping & iterative design processes from various industry verticals, particularly healthcare, automotive, and aerospace & defense, are expected to drive market's growth. Moreover, the U.S. government recognizes the strategic importance of additive manufacturing (AM). Initiatives like America Makes, and the National Additive Manufacturing Innovation Institute aim to advance research and development in the field.

Additive manufacturing encompasses the incremental deposition of material, layer by layer, to create an object. This process is guided by specialized software and executed using a 3D printer, all based on a three-dimensional digital design file. Additive manufacturing allows the creation of intricate and lightweight structures that were previously difficult or impossible to manufacture. Thus, additive manufacturing profoundly impacts innovation, customization, sustainability, and supply chain resilience across various industries in the U.S. It fosters economic growth, job creation, and research opportunities while enabling the production of complex and lightweight structures.

Additive manufacturing enables manufacturers in terms of prototyping, designing the structure and end products, modeling, and time to market. As a result, the production expenses have been reduced considerably, and the manufacturers are in a position to offer better products at reasonable prices. As a result of these benefits, the demand for 3D printers is expected to trigger more in the coming years. In the U.S., 3D printers are helping to develop complex machinery and parts easily; mass customization, improved speed to market, and waste reduction are the key factors because the market is moving ahead with incredible speed. The industry is likely driven by increasing attempts by various end-use sectors to include 3D printers as mainstream manufacturing equipment. In addition, the availability of 3D printers in various sizes and capacities is projected to propel market expansion.

However, the prevalent misconceptions with respect to the prototyping processes held by small and medium-scale manufacturers are hindering the adoption of additive manufacturing. Design-focused companies, particularly small and medium-sized enterprises, often contemplate whether investments in prototyping are sound financial decisions rather than fully appreciating the advantages of prototyping. Many of these businesses commonly perceive prototyping as an expensive preliminary step preceding actual manufacturing. Such perceptions regarding prototyping, coupled with the need for more specialized knowledge and a looming shortage of standard process controls, are expected to hinder market growth.

The outbreak of the COVID-19 pandemic has significantly impacted the overall U.S. economy and, subsequently, the additive manufacturing industry. Furthermore, due to the outbreak, the situation deteriorated in the U.S. The complete lockdown due to the pandemic affected the production of additive manufacturing printers. On the other hand, the pandemic disrupted global supply chains, leading to shortages of traditional manufacturing components and equipment. Additive manufacturing's ability to quickly produce parts on-demand helped fill supply gaps, especially for critical medical equipment like ventilator parts and face shields. Moreover, the pandemic highlighted the need for agile and localized manufacturing. Many businesses began exploring and adopting AM technologies to reduce reliance on distant suppliers and enable fast response to changing demands.

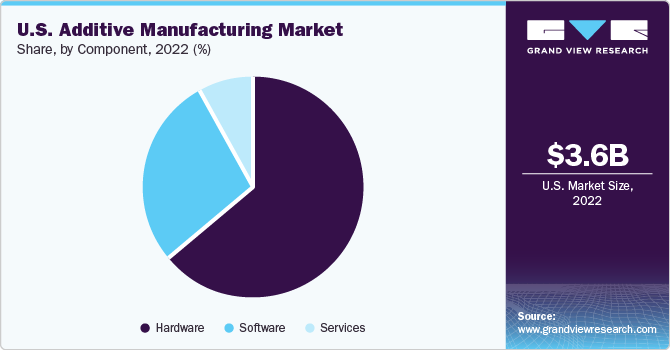

Component Insights

Based on components, the market has been further segmented into hardware, software, and services. The hardware segment led the market and accounted for a revenue share of more than 64.1% in 2022. The hardware segment has benefitted significantly from the growing necessity of rapid prototyping and advanced manufacturing practices. The expansion of the hardware segment can be primarily attributed to several factors, including swift industrialization, rising adoption of consumer electronic devices, the development of civil infrastructure, accelerated urbanization, and the optimization of labor expenses.

Technological proliferation, growing penetration of rapid 3D printing processes, such as rapid prototyping, and increasing applications across various industry verticals are the factors likely to propel the demand for various AM components. This technology enables the step-by-step production of 3D objects, interconnected through a system that utilizes relevant digital files. Aircraft production indirectly relies on mass 3D printing. 3D printing is faster and cheaper because it is well-equipped to create complex parts. It is often used as a master pattern for urethane casting of large aircraft parts. 3D printed designs are initially used to integrate multiple components into a fluid assembly. Thus, the use of additive 3D printing hardware technologies and 3D printing software in various industrial sectors is expected to boost the growth of the market.

Printer Type Insights

Based on the printer type, the market has been further segmented into industrial and desktop 3D printers. The industrial printer section led the market and accounted for more than 69% revenue share in 2022. The higher share of industrial printers can be attributed to the extensive adoption of industrial printers in industries, such as automotive, electronics, aerospace & defense, and healthcare. Prototyping, designing, and tooling are some of the most common industrial applications across these industry verticals. The widespread embrace of additive manufacturing in prototyping, design, and tooling is fueling increased demand within the industrial sector. Consequently, the industrial printers segment is anticipated to maintain its dominance throughout the forecast period.

On the contrary, the utilization of desktop 3D printers was initially confined to hobbyists and small enterprises. However, their application has now expanded to encompass household and domestic functions. In addition, within the education sector, which encompasses schools, educational institutions, and universities, desktop printers are increasingly employed for technical training and research endeavors. Furthermore, small businesses are notably adopting desktop printers and broadening their operational scope to include additive manufacturing and associated services. A noteworthy trend in this regard is the emergence of 'fabshops,' gaining popularity in the United States.

These fabshops provide on-demand additive manufacturing services, producing parts and components based on customers' specifications and designs. Consequently, the demand for desktop printers is poised for substantial growth in the foreseeable future. Due to the numerous applications of 3D printers over traditional production processes, 3D printing has exploded in popularity over the last decade. High flexibility, rapid prototyping, publishing, minor loss, fast design and manufacturing, ease of access, and cost and time effectiveness are just a few of the benefits of the production process. Personal, professional, and industrial printing are all possible with these printers. These printers may be programmed to indefinitely print any piece or component, reducing material costs to ensure little or no waste.

Technology Insights

Based on technology, the market has been further segmented into stereolithography, fuse deposition modeling (FDM), direct metal laser sintering (DMLS), selective laser sintering (SLS), inkjet, polyjet, laser metal deposition, electron beam melting (EBM), digital light processing, laminated object manufacturing, and others. Stereolithography segment accounted for the largest share of more than 11.3% in 2022. At present, the stereolithography technology holds the largest share as it happens to be one of the oldest and most conventional printing technologies. While the benefits and operational simplicity of stereolithography technology are promoting its adoption, progress in alternative technologies and R&D initiatives by industry experts and researchers are creating avenues for a range of other efficient and dependable technologies.

FDM also accounts for a considerable revenue share of nearly 10.2% in 2022, owing to extensive technology adoption across various 3DP processes. DLP, EBM, inkjet printing, and DMLS are also expected to witness a growing adoption over the forecast period, as these technologies are applicable in specialized additive manufacturing processes. The growing demand for numerous components & systems from aerospace & defense, automotive, and healthcare verticals would open opportunities for adopting these technologies.

The technology of 3D printing has developed over the period. Various types of 3D printers are used in multiple industries, including direct metal laser sintering, Stereolithography (SLA), Selective laser sintering (SLS), Carbon DLS, Carbon DLS, and Multi Jet Fusion (MJF). The defense industries in the U.S. are using these technologies extensively for various purposes, such as 3D printing being used for anything from fighter aircraft replacement parts to concrete dormitories for isolated outposts. The U.S. Marine Corps is exploring the use of concrete 3D printing as a cost-effective and expedited method for constructing structures.

Software Insights

Based on software, the market has been further segmented into design software, inspection software, printer software, and scanning software. The design software segment accounted for the largest share of 34.4% in 2022 and is expected to maintain its dominance over the forecast period. Design software is used to construct the object's designs to be printed, particularly in automotive, aerospace & defense, and construction & engineering verticals. It acts as a bridge between the objects to be printed and the printer's hardware. Demand for scanning software is estimated to grow due to the trend of scanning objects and storing scanned documents. This ability to store the scanned images of objects irrespective of their size or dimensions for 3D printing of these objects whenever necessary is expected to drive segment growth.

The segment is also expected to witness rapid growth and generate considerable revenues owing to the rising adoption of scanners. The scanning software segment is projected to grow at the highest CAGR of 21.8% from 2023 to 2030. 3D printing is a complicated process requiring various software to function correctly. As scanning the part that needs to be printed should be accurate up to the millimeter of its size, this software plays a vital role. Various software, such as design, inspection, printer, and scanning, help in solid modeling that generates a lightweight and manifold model. The U.S. is one of the leading creators of the software for additive manufacturing. Software like Tinkercad, Blender, BRL-CAD, DesignSpark Mechanical, and Wings3D are used in defense, automation, and construction industries.

Application Insights

Based on application, the market has been further segmented into prototyping, tooling, and functional parts. The prototyping segment led the market and accounted for a revenue share of more than 52.8% in 2022. In particular, the automotive and aerospace & defense industries leverage prototyping to precisely design & develop parts, components, and intricate systems. This approach allows manufacturers to achieve heightened precision & produce reliable end products. Consequently, the prototyping segment is well-positioned to uphold its market leadership throughout the forecasted duration. Functional components include compact joints and various metallic hardware connecting different parts. Precision and accurate sizing are of utmost importance when engineering machinery and systems.

Thus, the functional application segment is expected to register a CAGR of 21.8% from 2023 to 2030, driven by the rising demand for design & fabrication of these crucial parts. The U.S. is one of the prominent countries to use 3D printing extensively. 3D printing is used in various places, such as education, prototyping & manufacturing, and medicines. The U.S. is utilizing 3D printing in space and the aviation sector as well. For instance, in March 2023, a 3D-printed rocket called Relativity Space Terran 1 was launched from Cape Canaveral Space Force Station in Florida. Terran 1 boasted nine engines crafted through additive manufacturing techniques, utilizing an innovative copper alloy designed to withstand extreme temperatures, representing a technology pivotal for augmenting capabilities and cost-effectiveness in the aerospace sector.

Vertical Insights

Based on verticals, the market has been further segmented into separate verticals for desktop and industrial additive manufacturing. The desktop additive manufacturing vertical comprises educational purposes, fashion & jewelry, objects, dental, food, and others. The verticals considered for industrial 3DP comprise automotive, aerospace & defense, healthcare, consumer electronics, industrial, power & energy, and others. The aerospace & defense, healthcare, and automotive verticals are anticipated to contribute significantly toward the growth of the U.S. industrial additive manufacturing owing to the active adoption of technology in various production processes associated with these verticals. In the healthcare sector, additive manufacturing plays a pivotal role in advancing the development of artificial tissues and muscles that closely mimic natural human tissue, offering promising solutions for replacement surgeries.

These capabilities are poised to stimulate the adoption of 3D printing across the healthcare industry, making a substantial contribution to the growth of the industrial segment. Conversely, the dental, fashion & jewelry, and food sectors are forecasted to make significant contributions to the expansion of the U.S. desktop additive manufacturing market in the foreseeable future. The dental field held a dominant position in 2021 and is projected to maintain its leadership in this segment. Furthermore, the utilization of additive manufacturing in the production of imitation jewelry, miniatures, artistic creations, as well as clothing and apparel, is steadily gaining traction. The automotive industry has witnessed a significant uptick in the adoption of 3D printing technology.

With the growing demand for high-performance vehicles, traditional manufacturing methods struggle to meet the scale & precision required for producing automotive parts & components. Thus, many companies are turning to 3D printing for the fabrication of these parts. For instance, in 2020, Ford introduced its Ford Mustang Shelby GT500 sports car, which incorporates 3D-printed elements, including body components, brake pad brackets, and brake lines, contributing to enhanced aerodynamic stability & accelerated manufacturing processes. In February 2022, Stratasys Ltd., a renowned provider of polymer 3D printing solutions, entered into a partnership with Radford, a global automotive company, to produce approximately 500 3D-printed parts for the Lotus Type 62-2 coach built sports car launch. The integration of 3D printing technology has afforded the manufacturer greater design flexibility, enabling the creation of customized styles & features that align with customer expectations.

Material Insights

Based on material, the market has been further segmented into polymer, metal, and ceramic. The metal segment accounted for the largest revenue share in 2022 and is anticipated to maintain its lead during the forecast period. The segment is also expected to register the highest CAGR of 26.4% from 2023 to 2030. Metal 3D printing offers numerous advantages, including design flexibility, sustainability benefits, and the ability to create complex and customized parts. As these advantages become more widely recognized and accessible, the industry is expected to see continued growth across various sectors.

The ceramic material segment is also expected to grow considerably. Since additive 3D printing using ceramic material is fairly new, the growing focus on R&D in AM technologies like FDM and inkjet printing has increased interest in ceramic additive manufacturing. The adoption of AM processes enables manufacturers to produce intricate and delicate components with enhanced ease and precision. Moreover, production expenditures are being reduced significantly owing to the improved material efficiency and advantages provided by this technology. As such, the benefits of additive 3D printing are achieving significant attention from the numerous players of industry verticals.

Key Companies & Market Share Insights

The market has a fragmented competitive landscape featuring various global and regional players. Leading industry players are adopting strategies, such as partnerships, collaborations, mergers & acquisitions, and agreements, to survive the highly competitive environment and enhance their business footprints. For instance, in March 2022, GE Additive announced a partnership with Orchid. Orchid manufactures orthopedic implants and instruments. Under the partnership, Orchid will buy GE Additive's EBM Spectra L systems, AP&C metal powders, service agreements, and GE Additive's AddWorks consultancy services under the agreement. The partnership will help Orchid adopt additive manufacturing in its manufacturing process.

Key U.S. Additive Manufacturing Companies:

- 3D Systems, Inc.

- Stratasys Ltd.

- Arcam AB

- GE Additive

- HP Inc.

- Materialise NV

- Proto Labs, Inc.

- EnvisionTEC, Inc.

U.S. Additive Manufacturing Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 16.48 billion

Growth rate

CAGR of 21.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Component, printer type, technology, software, application, vertical, material

Country scope

U.S.

Key companies profiled

EnvisionTEC, Inc.; 3D Systems, Inc.; GE Additive; Autodesk Inc.; Made In Space; Prodways Americas; Solidscape, Inc.; Sciaky, Inc.; 3D Printer Works; Airwolf 3D Printers; AON3D; Ultimaker BV

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Additive Manufacturing Market Report Segmentation

The report forecasts revenue growth at the country level and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. additive manufacturing market report based on component, printer type, technology, software, application, vertical, and material:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Printer Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Desktop 3D Printer

-

Industrial 3D Printer

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Stereolithography

-

Fuse Deposition Modelling (FDM)

-

Selective Laser Sintering (SLS)

-

Direct Metal Laser Sintering (DMLS)

-

Polyjet Printing

-

Inkjet printing

-

Electron Beam Melting (EBM)

-

Laser Metal Deposition

-

Digital Light Processing

-

Laminated Object Manufacturing

-

Others

-

-

Software Outlook (Revenue, USD Million, 2017 - 2030)

-

Design Software

-

Inspection Software

-

Printer Software

-

Scanning Software

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Prototyping

-

Tooling

-

Functional Parts

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Industrial Additive Manufacturing

-

Automotive

-

Aerospace & Defense

-

Healthcare

-

Consumer Electronics

-

Power & Energy

-

Others

-

-

Desktop Additive Manufacturing

-

Educational Purpose

-

Fashion & Jewelry

-

Objects

-

Dental

-

Food

-

Others

-

-

-

Material Outlook (Revenue, USD Million, 2017 - 2030)

-

Polymer

-

Metal

-

Ceramic

-

Frequently Asked Questions About This Report

b. The U.S. additive manufacturing market size was estimated at USD 3.56 billion in 2022 and is expected to reach USD 4.26 billion in 2023.

b. The U.S. additive manufacturing market is expected to grow at a compound annual growth rate of 21.3% from 2023 to 2030 to reach USD 16.48 billion by 2030.

b. The Hardware segment led the U.S. additive manufacturing market and accounted for more than 64.15% share of the global revenue in 2022.

b. Some key players operating in the additive manufacturing market include EnvisionTec, Inc., 3D Systems, Inc., GE Additive, Autodesk Inc., Made In Space, and Solidscape, Inc

b. Key factors that are driving the additive manufacturing market growth include the assertive research & development in three-dimensional printing and the increasing demand for prototyping applications from various industry verticals, particularly healthcare, automotive, and aerospace & defense

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.