- Home

- »

- Homecare & Decor

- »

-

U.S. Adjustable Bed Frames Market, Industry Report, 2033GVR Report cover

![U.S. Adjustable Bed Frames Market Size, Share & Trends Report]()

U.S. Adjustable Bed Frames Market (2025 - 2033) Size, Share & Trends Analysis Report By Frame Type (Single Frame, Split Frame), By Size (Full Size, King Size, Queen Size), By End Use, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-630-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

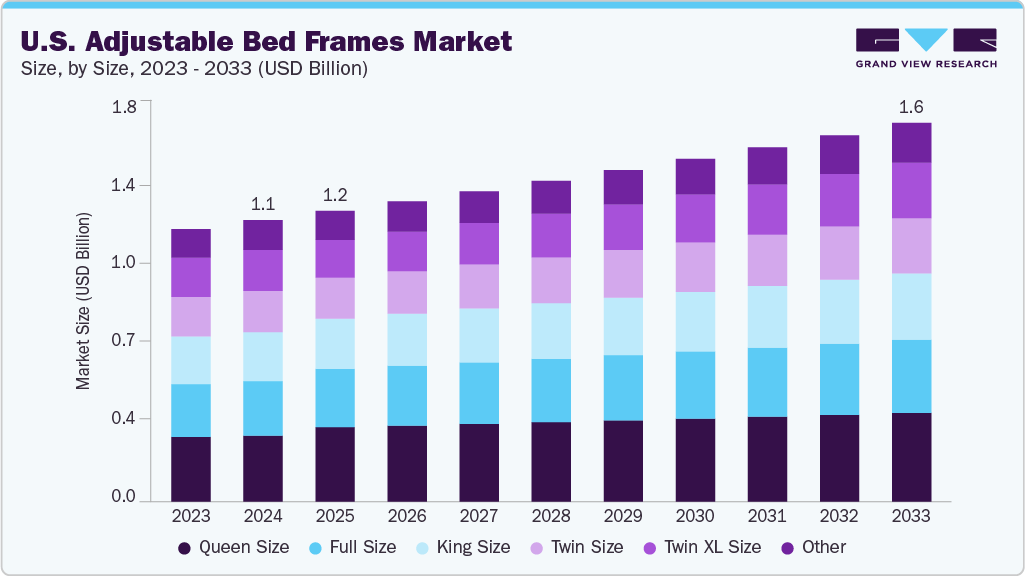

The U.S. adjustable bed frames market size was estimated at USD 1,199.4 million in 2024 and is expected to expand at a CAGR of 3.4% from 2025 to 2033. The market is expanding due to population growth, new housing construction, and increased demand for furniture. This growth is further fueled by rising disposable incomes and a preference for smart, multi-functional bed frames that enhance interior aesthetics in residential and hospitality sectors.

Numerous people in the United States suffer from several sleep disorders. According to the National Library of Medicine, 23% of Americans experienced difficulty sleeping by 2022. Irregular sleeping habits have a variety of negative impacts. Insomnia is one of numerous sleeping issues that people in the United States experience, and it can severely impair a person's lifestyle. Adjustable bed frames meet home and business purposes, with various features that improve the user’s experience. The adjustable bed frames industry is driven by rising demand for more comfort, particularly in developed markets.

One of the key driving forces behind the U.S. smart home industry is the growing need for energy-efficient and low-carbon emission solutions. Furthermore, in the United States, the rising prevalence of chronic sleep deprivation has a substantial influence on people's quality of life. Numerous clinical studies have revealed a range of causes, including jet lag, respiratory issues, and disruptions caused by mattress discomfort owing to durability and stiffness. As a result, customers are investing extensively in high-quality sleeping solutions, boosting the adjustable bed frames industry.

As the number of individuals aged 65 and above continues to rise, many consumers seek comfort-oriented furniture catering to their health and mobility needs. Adjustable bed frames allow users to elevate their head and legs, alleviating common age-related ailments such as arthritis, acid reflux, poor circulation, and back pain. This demographic shift has fueled increased adoption in residential and assisted living facilities, further driving the growth of the adjustable bed frames industry.

Manufacturers have responded with designs that combine ergonomic functionality with aesthetic appeal, making adjustable beds more mainstream. Medicare policies and private insurance plans that cover durable medical equipment have also encouraged demand, especially when prescribed by healthcare professionals. The push toward aging-in-place models further underscores the relevance of adjustable beds, as older adults invest in furniture that supports long-term health and quality of life within their homes.

Consumer Surveys & Insights

Adjustable bed frames allow customers to customize their sleeping experience manually or automatically adjust their bed's height, inclination, or geometry. While common in hospitals and more common in hotels, domestic users have made up the vast bulk of purchases in recent years. Adjustable bed frames and bed bases are increasingly being integrated into smart homes across the U.S., particularly as the smart home ecosystem continues to expand and evolve. Adjustable bed frames are becoming more popular across smart homes due to their compatibility with other smart technologies and growing consumer interest in health, comfort, and convenience.

The generational adoption of smart home technology in the U.S. offers important insights into the market’s future. As smart homes become more prevalent, the demand for compatible smart furniture, such as adjustable bed frames, is expected to grow unevenly across age groups due to varying interest levels and technological engagement.

Millennials, who currently show the highest inclination toward smart technology adoption (44%), represent a crucial demographic for the future of the adjustable bed market. Though adjustable beds have traditionally been associated with older adults and medical needs, Millennials are redefining their use, emphasizing comfort, convenience, and connectivity. Their openness to integrating smart devices makes them early adopters of app-controlled adjustable bed frames, especially as they continue forming households and upgrading their living spaces.

Gen X is another key demographic. With 90% having already adopted at least one smart device and 33% owning smart home devices, they are in a prime position to incorporate smart adjustable beds into their homes. This group often balances wellness, aging concerns, and tech interests, making them potential brand customers.

While Baby Boomers and the Silent Generation currently show lower adoption rates, 39% and 33% respectively, their growing focus on health and aging in place is driving demand for comfortable, medically supportive sleeping solutions. However, only 24% of individuals aged 55+ show significant interest in smart home technology, which may slow adoption unless manufacturers prioritize ease-of-use and offer compelling health-related benefits.

Frame Type Insights

The adjustable single bed frames accounted for the largest share of 67.13% in 2024. Single adjustable frames cater to consumers seeking relief from medical conditions such as sleep apnea, acid reflux, chronic back pain, and poor circulation. Elevating the head or feet, often available in mid-range models, helps alleviate these common ailments, boosting demand among health-conscious buyers. This is driving the demand for adjustable single bed frames in the U.S. adjustable bed frames industry.

The adjustable split bed frames category is expected to grow at the fastest CAGR of 4.1% from 2025 to 2033. Split frames enable independent adjustment on each side, crucial for couples with differing sleep preferences or health needs. Each side's ability to move separately boosts demand exponentially in co-sleeping households. Initially premium, the split-base design has been increasingly featured in mid-price models, thus reaching new categories of buyers in the U.S. adjustable bed frames industry. Entry-level split‑frame offerings spread the appeal of individualized comfort at more accessible price points.

Size Insights

The Queen-size adjustable bed frames held the largest share of 23.44% in 2024, driven by their optimal balance of space and compatibility. Consumer preference leans toward products that offer generous dimensions without overwhelming interior spaces. The dimensions of queen-size beds offer ample room for dual-side customization, which is ideal for couples with different comfort needs while providing full-body support. Their functional design appeals to the elderly and those recovering from surgery or mobility limitations. These trends are fueling rapid growth in the U.S. adjustable bed frames industry.

The Twin XL size category is expected to grow at the fastest CAGR of 4.9% from 2025 to 2033, driven by increasing demand in college dorms, studio apartments, and healthcare setups. Increased demand in student housing and smart dormitory initiatives has pushed Twin XL bases toward features like posture support, cooling layers, and app-enabled adjustability. Retailers and dormitory suppliers are adopting innovative, multi-use designs (foldable, under-bed storage, split configurations), satisfying comfort and convenience needs. These trends fuel rapid growth in this segment of the market.

Distribution Channel Insights

Adjustable bed frames distributed through home improvement stores accounted for a revenue share of 34.35% of the overall U.S. adjustable bed frames industry in 2024. The influence of wellness-focused social media content, sleep tracking devices, and lifestyle influences has amplified consumer interest in investing in premium bedding solutions. Retailers like Tempur-Pedic and Sleep Number, among others, report increased sales of adjustable frames, particularly during promotions tied to sleep wellness campaigns. This has accelerated the adoption of adjustable bed frames through offline channels like home improvement stores, specialty stores, etc., further driving market growth.

Adjustable bed frames distributed through the online/e-commerce channel are expected to grow at a CAGR of 4.7% from 2025 to 2033. E-commerce retailers such as Amazon, Wayfair, and Walmart contribute most to online sales of adjustable bed frames, launching new items and forming relationships with other online adjustable bed frame businesses. Online adjustable bed frame providers offer many trial nights, years of warranty, in-home delivery, and setup. As a result, the adjustable bed frame industry relies heavily on online purchasing.

According to the survey, the U.S. has the highest level of internet purchasing of any country. People continue to search online for the greatest offers and rates. Adjustable bed frames range in characteristics due to technological advancements in manufacturing and transportation. This trend is driving the purchase of adjustable bed frames through online channels, further driving market growth.

End Use Insights

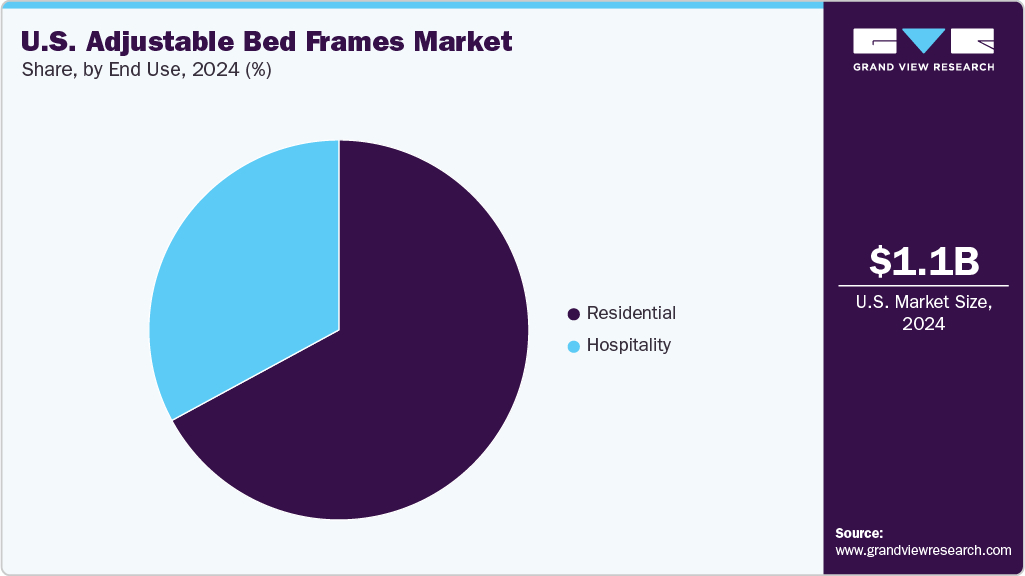

Adjustable bed frames used at residential properties accounted for 68.29% of the overall U.S. adjustable bed frames industry in 2024. Rising consumer demand for personalized comfort and wellness is fueling residential adoption. An aging population, coupled with increasing awareness of sleep-related health issues such as back pain, arthritis, and sleep apnea, encourages investments in adjustable beds at home. Moreover, shifts in lifestyle, like remote work and greater focus on home improvements, have led households to prioritize sleep quality. This has increased the demand for adjustable bed frames across the residential sector, further driving the growth of the U.S. industry.

The hospitality industry is expected to grow at the fastest CAGR of 4.9% from 2025 to 2033. The hospitality sector is embracing adjustable bed frames at the fastest rate, driven by hotels’ need to elevate guest experience and stand out in a competitive market. Post‑pandemic recovery in travel has prompted upscale and boutique properties to renovate with premium sleep solutions. Adjustable beds offer guests enhanced comfort with customizable sleep positions and relief from travel fatigue and mobility issues. This has increased the demand for adjustable bed frames across the hospitality sector, further driving the market growth.

Key U.S. Adjustable Bed Frames Company Insights

The U.S. market is highly competitive, characterized by a blend of established industry giants and emerging innovators. Dominant players such as Tempur Sealy International, Sleep Number Corporation, and Serta Simmons Bedding lead the market. These companies leverage strategies like mergers and acquisitions, product diversification, and expansion into sustainable offerings to maintain their competitive edge in the adjustable bed frames industry.

The U.S. market is witnessing the rise of direct-to-consumer brands, which capitalize on e-commerce platforms and offer customization options to cater to evolving consumer preferences. This dynamic landscape reflects a continuous push towards innovation, sustainability, and responsiveness to consumer trends, ensuring the U.S. market remains vibrant and competitive.

-

Tempur Sealy International is a leading global manufacturer and distributor of bedding products. It is best known for its premium memory foam and hybrid mattresses under the Tempur-Pedic, Sealy, and Stearns & Foster brands. Headquartered in Lexington, Kentucky, the company has built a strong reputation for innovation, comfort, and sleep science. Tempur Sealy also manufactures a range of adjustable bed bases designed to complement its mattress lines, offering customizable sleep positions, massage features, and smart technology integration.

-

Serta Simmons Bedding, LLC (SSB), headquartered in Doraville, Georgia, is one of North America's largest bedding manufacturers. It is known for its trusted brands, such as Serta, Beautyrest, Simmons, and Tuft & Needle. The company produces various mattresses and sleep systems, including adjustable bed frames designed to enhance comfort and health through ergonomic features.

Key U.S. Adjustable Bed Frames Companies:

- Tempur Sealy International

- Sleep Number Corporation

- Reverie (Ascion, LLC)

- Serta Simmons Bedding

- Leggett & Platt

- Ergomotion

- Nectar (Resident Home, LLC)

- Electropedic

- Rize Home

- Denver Mattress

Recent Developments

-

In January 2025, Serta Simmons Bedding launched an adjustable base line under Base Logic. The line supports the Beautyrest and Serta brands and includes four base models.

-

In January 2024, Tempur Sealy’s new second-generation ActiveBreeze Smart Bed, launched at Las Vegas Market, marks the first model to integrate Sleeptracker‑AI fully. It offers personalized climate control with a dual‑zone ActiveAir system that adjusts temperatures to a 30°F range per side and includes active warming and cooling programs.

-

In April 2023, Sleep Number Corporation, a wellness technology leader, announced the launch of its next-gen Sleep Number smart beds and Lifestyle Furniture. Sold separately but optimally used together.

-

In December 2022, Ergomotion, the global leader of state-of-the-art adjustable bed bases and wellness-technology sleep solutions, announced the launch of its new Bed Diagnostic feature, available for select Ergomotion-manufactured adjustable bases.

U.S. Adjustable Bed Frames Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 1,238.9 million

Revenue forecast in 2033

USD 1,614.8 million

Growth rate (revenue)

CAGR of 3.4% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Frame type, size, end use, distribution channel

Key companies profiled

Tempur Sealy International; Sleep Number Corporation; Reverie (Ascion, LLC); Serta Simmons Bedding; Leggett & Platt; Ergomotion; Nectar (Resident Home, LLC.); Electropedic; Rize Home; Denver Mattress

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Adjustable Bed Frames Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global U.S. adjustable bed frames market based on frame type, size, end use, and distribution channel:

-

Frame Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Single Frame

-

Split Frame

-

-

Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Full Size

-

King Size

-

Queen Size

-

Twin XL Size

-

Twin Size

-

Others

-

-

End-Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Hospitality

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Home Improvement Stores

-

Specialty Store

-

Online/E-commerce

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. adjustable bed frames market was estimated at USD 1,199.4 million in 2024 and is expected to reach USD 1,238.9 million in 2025.

b. The U.S. adjustable bed frames market is expected to grow at a compound annual growth rate of 3.4% from 2025 to 2033 to reach USD 1,614.8 million by 2033.

b. The adjustable single bed frames accounted for the largest share of 67.13% of U.S. adjustable bed frames market in 2024. Single adjustable frames cater to consumers seeking relief from medical conditions such as sleep apnea, acid reflux, chronic back pain, and poor circulation.

b. Key players in the U.S. adjustable bed frames market are Tempur Sealy International, Sleep Number Corporation, Reverie (Ascion, LLC), Serta Simmons Bedding, Leggett & Platt, Ergomotion, Nectar (Resident Home, LLC.), Electropedic, Rize Home, and Denver Mattress.

b. Key factors that are driving the U.S. adjustable bed frames market growth include increase in the construction of new privately owned housing units, rising demand for furniture and furnishing products such as adjustable bed frames, increasing adoption of smart adjustable bed frames, and growing demand for multi-functional adjustable bed frames.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.