- Home

- »

- Medical Devices

- »

-

U.S. Adjustable Compression Wraps Market Report, 2033GVR Report cover

![U.S. Adjustable Compression Wraps Market Size, Share & Trends Report]()

U.S. Adjustable Compression Wraps Market (2026 - 2033) Size, Share & Trends Analysis Report By Indication & Pathology (Venous Leg Ulcers, Lymphedema, Chronic Venous Insufficiency), By End Use, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-839-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Adjustable Compression Wraps Market Summary

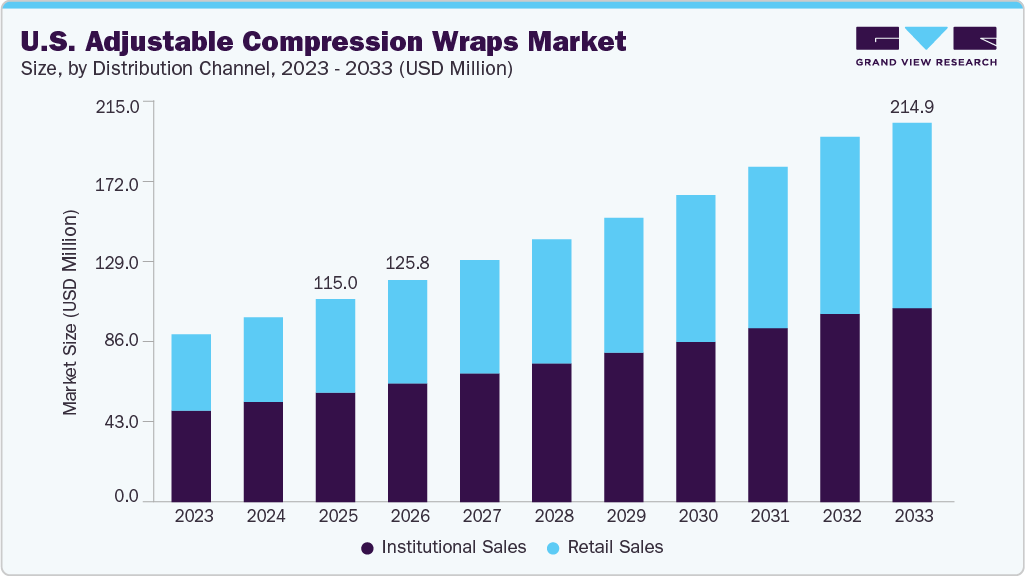

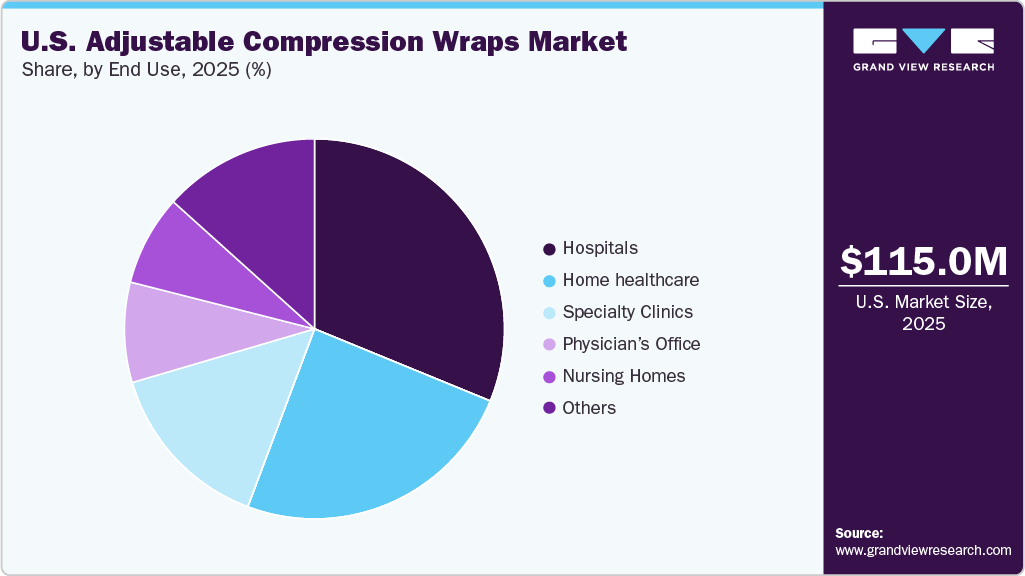

The U.S. adjustable compression wraps market size was estimated at USD 115.02 million in 2025 and is projected to reach USD 214.90 million by 2033, growing at a CAGR of 7.95% from 2026 to 2033. This growth is driven by the rising prevalence of chronic venous disorders and lymphedema, an aging population, and increasing adoption of compression therapy for post-surgical care and wound management.

Key Market Trends & Insights

- By indication & pathology, the Venous Leg Ulcers (VLU) segment led the market with the largest revenue share in 2025.

- By distribution channel, the institutional sales segment led the market with the largest revenue share in 2025.

- By end use, the hospital segment led the market with the largest revenue in 2025.

Market Size & Forecast

- 2025 Market Size: USD 115.02 Million

- 2033 Market Size: USD 214.90 Million

- CAGR (2026-2033): 7.95%

The shift toward home healthcare, growing preference for easy-to-use and adjustable compression solutions, and expanding use in sports, pregnancy-related edema, and preventive care further support market expansion.

Venous leg ulcers drive the U.S. market, as compression therapy is a key component of VLU treatment and long-term management. VLU is a common complication of chronic venous insufficiency, particularly among the aging population and individuals with obesity, diabetes, or reduced mobility, leading to a large and growing patient pool. Adjustable compression wraps are preferred over traditional bandages as they provide consistent, controlled compression, are easier to apply, and support better patient adherence during prolonged treatment periods.

Prevalence and Recurrence Rate of VLU in the U.S. (2023)

Country

Population Group

Prevalence

Recurrence Rate (3 Months)

Recurrence Rate (12 Months)

Recurrence Rate (3 Years)

U.S.

People aged 65 and above

4%

22%

57%

78%

Source: Wiley Online Library

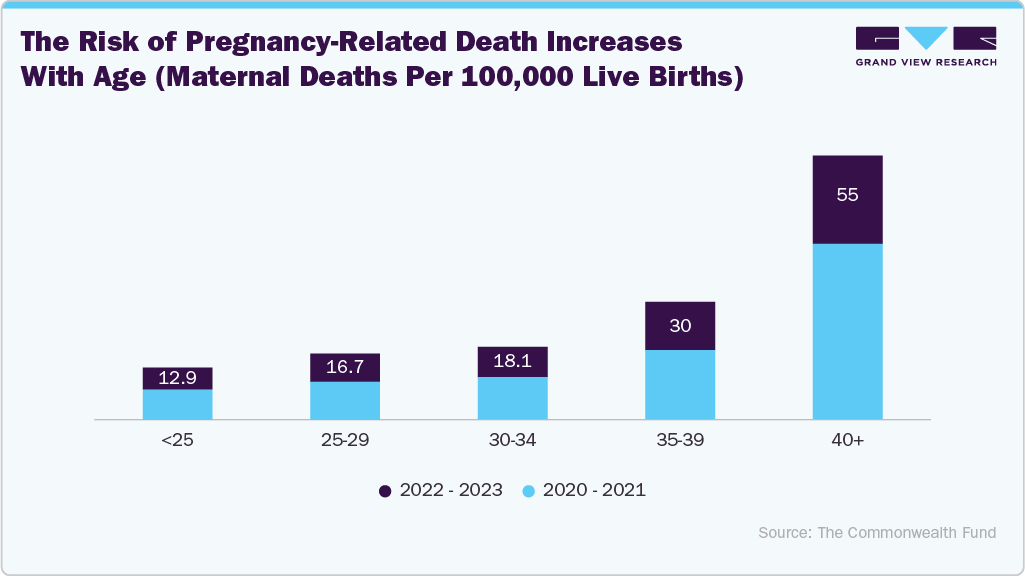

Pregnancy drives the market due to the high prevalence of pregnancy-related circulatory issues such as leg swelling, edema, varicose veins, and increased risk of venous insufficiency. Hormonal changes, weight gain, and increased pressure on the lower extremities during pregnancy lead healthcare providers to recommend compression therapy to improve blood circulation and reduce discomfort. Adjustable compression wraps are particularly suitable for pregnant women, as they offer flexible sizing and adjustable pressure to accommodate the body's changes throughout different stages of pregnancy. The growing awareness of maternal health, preventive care, and non-invasive management options, along with recommendations from obstetricians and midwives, is increasing the adoption of compression wraps during and after pregnancy, thereby contributing to market growth.

Sports and recreational injuries drive the market by increasing demand for supportive and recovery-focused compression solutions among athletes and physically active individuals. Muscle strains, ligament sprains, joint injuries, and soft-tissue swelling are common in sports and fitness activities. Adjustable compression wraps are widely used to reduce edema, enhance blood circulation, and promote faster recovery. Their ease of application, reusability, and ability to provide customizable compression make them particularly attractive for use during training, post-injury rehabilitation, and preventive support. In addition, growing participation in fitness, outdoor sports, and recreational activities, along with rising awareness of injury prevention and recovery management, is expanding the adoption of adjustable compression wraps beyond clinical settings into sports medicine clinics, gyms, and retail channels, thereby contributing significantly to market growth. According to the National Safety Council, following a record low number of sports and recreational injuries reported in 2020, injuries increased by 20% in 2021, 12% in 2022, 2% in 2023, and 17% in 2024.

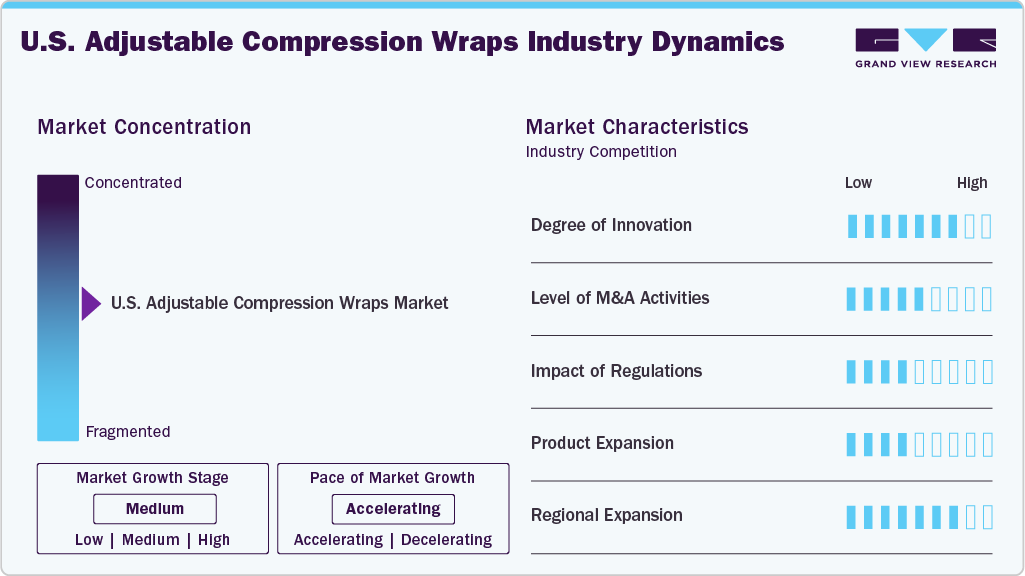

Market Concentration & Characteristics

The U.S. adjustable compression wraps industry growth stage is significant, and the pace of the market growth is accelerating.

The U.S. adjustable compression wraps industry is characterized by a moderate to high degree of innovation, driven by continuous improvements in product design, materials, and usability. Manufacturers are focusing on lightweight, breathable fabrics, improved fastening systems, and enhanced pressure-adjustment mechanisms to improve patient comfort and compliance. Some players are also integrating digital features, such as pressure indicators and smart monitoring, to support accurate compression and long-term therapy management, particularly in home healthcare settings.

Regulatory requirements have a significant influence on the market, as adjustable compression wraps are regulated as medical devices by the U.S. FDA. Manufacturers must comply with stringent quality, safety, and labeling standards, which can increase development costs and lengthen approval timelines. However, these regulations also help ensure product reliability and clinical effectiveness, strengthening physician confidence and encouraging adoption in hospitals and other institutional settings.

Product expansion remains a key growth strategy, with companies broadening their portfolios to address various clinical indications, including venous leg ulcers, lymphedema, and post-surgical edema. Manufacturers are launching wraps in multiple sizes, compression levels, and limb-specific designs to cater to the diverse needs of patients. Expansion into consumer-oriented and home-use products, along with wider distribution through retail and e-commerce channels, is further enhancing market reach and supporting market growth.

Indication & Pathology Insights

Venous leg ulcers dominate the U.S. market in 2025. Compression therapy is the standard and most effective first-line treatment for managing VLU and preventing recurrence. VLU is caused by chronic venous insufficiency, a highly prevalent condition among the aging population and patients with obesity, diabetes, and limited mobility. Adjustable compression wraps are widely preferred in VLU management as they provide sustained, controllable compression, are easier to apply than traditional bandages, and support long-term use in both clinical and home-care settings. In addition, VLU requires long and repeated treatment over months, leading to continuous product demand and replacement cycles. Strong clinical guidelines recommending compression therapy, high recurrence rates of VLU, and frequent treatment in hospitals, wound care centers, and home healthcare environments drive higher utilization of adjustable compression wraps for VLU.

The lymphedema segment is expected to grow at the fastest CAGR in the U.S. market due to the rising prevalence and improved diagnosis of primary and secondary lymphedema, particularly among cancer survivors and the aging population. Lymphedema is a chronic, lifelong condition that requires continuous and long-term compression therapy, making adjustable compression wraps highly suitable because they allow patients to adjust pressure levels as swelling fluctuates easily. In addition, the shift toward home-based care and self-management has increased the adoption of user-friendly compression solutions that reduce dependence on clinical visits. Ongoing product innovations focused on comfort, durability, and ease of use further support patient compliance, accelerating demand growth for adjustable compression wraps in lymphedema management compared to other indications.

Distribution Channel Insights

Institutional sales dominate the market in 2025. Hospitals, clinics, rehabilitation centers, and long-term care facilities are the primary prescribers and users of compression therapy products. These institutions treat large volumes of patients with venous disorders, lymphedema, post-surgical edema, and immobility-related complications, leading to consistent and high demand. Institutional buyers procure adjustable compression wraps in bulk through centralized purchasing contracts and group purchasing organizations (GPOs), which significantly increases sales volumes compared to individual consumer purchases. In addition, physician recommendations, standardized clinical protocols, and favorable reimbursement when products are prescribed in medical settings further strengthen institutional purchasing. The presence of trained healthcare professionals to ensure correct application and patient compliance also encourages institutions to prefer adjustable compression wraps, supporting the dominance of institutional sales channels in the market.

The retail sales segment is expected to grow at the fastest CAGR from 2026 to 2033, due to increasing consumer preference for convenient and direct access to healthcare products. The expansion of e-commerce platforms, pharmacies, and medical supply stores has made adjustable compression wraps more readily available to a broader population, eliminating the need for hospital visits. In addition, rising awareness of preventive healthcare, fitness recovery, and self-care is encouraging consumers to purchase compression wraps for non-clinical uses such as travel, sports, and daily comfort. Growing digital awareness, competitive pricing, and the convenience of home delivery further support the rapid adoption of retail.

End Use Insights

The hospital segment dominates the U.S. market in 2025. Hospitals are primarily the main point of care for patients with venous disorders, lymphedema, post-surgical edema, and immobility-related complications. Compression therapy is routinely integrated into hospital treatment protocols for surgical recovery, wound management, and the prevention of deep vein thrombosis (DVT), resulting in consistent and high utilization rates of the product. Hospitals also handle large patient volumes and procure compression wraps in bulk through institutional purchasing systems, which significantly increases their overall market share. In addition, physician-led prescribing, better reimbursement coverage for clinically used compression products, and access to trained healthcare professionals further support the widespread adoption of adjustable compression wraps in hospital settings compared to outpatient clinics or home-care environments.

The home healthcare segment is expected to grow at the fastest CAGR from 2026 to 2033, due to the increasing shift toward at-home treatment and self-management of chronic conditions such as lymphedema, venous insufficiency, and post-surgical edema. Patients and caregivers prefer home-based care for its convenience, comfort, and lower overall healthcare costs compared to repeated hospital or clinic visits. In addition, adjustable compression wraps are specifically designed for easy application and pressure adjustment, making them well-suited for non-clinical settings. The rising geriatric population, expansion of telehealth and remote patient monitoring, and efforts by healthcare systems to reduce hospital readmissions further support the rapid adoption of compression therapy in home care settings.

Key U.S. Adjustable Compression Wraps Company Insights

The industry players are undertaking several strategic initiatives such as acquisitions, partnerships, and collaborations. Moreover, the launch of novel products is anticipated to boost the competitive rivalry in the U.S. market.

Key U.S. Adjustable Compression Wraps Companies:

- SIGVARIS

- L&R Group

- Julius Zorn GmbH

- Solventum

- Essity Aktiebolag

- medi USA

- Sun Scientific

- Cardinal Health

Recent Developments

-

In September 2025, Cardinal Health announced the opening of its newest distribution center in Fort Worth, Texas, dedicated exclusively to its at-Home Solutions business, a leading provider of medical supplies serving over 6 million people across the U.S. each year. The company also revealed plans to break ground on another at-Home Solutions distribution center in Sacramento, California, later this fiscal year.

-

In October 2024, SIGVARIS GROUP Britain announced a new addition to its Let’s Measure Together series, focusing on inelastic compression wraps. As these wraps gain popularity for managing lower limb conditions, ensuring a proper fit is essential to achieve maximum therapeutic effectiveness.

U.S. Adjustable Compression Wraps Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 125.80 million

Revenue forecast in 2033

USD 214.90 million

Growth rate

CAGR of 7.95% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Indication & pathology, distribution channel, end use

Regional scope

U.S.

Key companies profiled

SIGVARIS; L&R Group; Julius Zorn GmbH; Solventum; Essity Aktiebolag; medi USA; Sun Scientific; Cardinal Health

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to the country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Adjustable Compression Wraps Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. adjustable compression wraps market report based on indication & pathology, end use, and distribution channel:

-

Indication & Pathology Outlook (Revenue, USD Million, 2021 - 2033)

-

Venous Leg Ulcers (VLU)

-

Lymphedema

-

Deep Vein Thrombosis (DVT) / Post‐thrombotic syndrome

-

Chronic Venous Insufficiency

-

Class 1

-

Class 2

-

Class 3

-

Class 4

-

Class 5

-

Class 6

-

-

Post-operative Edema

-

Pregnancy-related Edema

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Specialty Clinics

-

Home healthcare

-

Physician’s Office

-

Nursing Homes

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Institutional Sales

-

Retail Sales

-

Frequently Asked Questions About This Report

b. The U.S. adjustable compression wraps market size was valued at USD 115.02 million in 2025.

b. The global U.S. adjustable compression wraps market is expected to grow at a compound annual growth rate of 7.95% from 2026 to 2033 to reach USD 214.90 million by 2033.

b. By indication & pathology, the Venous Leg Ulcers (VLU) segment led the market, accounting for the largest revenue share in 2025.

b. Some key players operating in the U.S. adjustable compression wraps market include SIGVARIS, L&R Group, Julius Zorn GmbH, Solventum, Essity Aktiebolag, medi USA, Sun Scientific, and Cardinal Health

b. Key factors driving market growth include the rising prevalence of chronic venous disorders and lymphedema, an aging population, and the increasing adoption of compression therapy for post-surgical care and wound management.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.