- Home

- »

- Next Generation Technologies

- »

-

U.S. Advanced Driver Assistance System Market Report, 2030GVR Report cover

![U.S. Advanced Driver Assistance System Market Size, Share & Trends Report]()

U.S. Advanced Driver Assistance System Market (2024 - 2030) Size, Share & Trends Analysis Report By Solution (Adaptive Cruise Control, Blind Spot Detection), By Component, By Vehicle, And Segment Forecasts

- Report ID: GVR-4-68040-272-9

- Number of Report Pages: 103

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

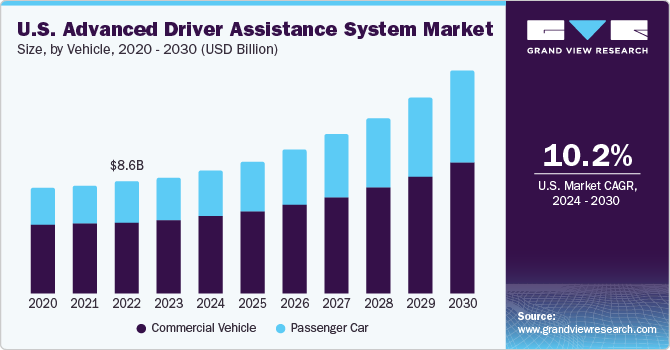

The U.S. advanced driver assistance system market size was valued at USD 8.93 billion in 2023 and is anticipated to grow at a CAGR of 10.2% from 2024 to 2030. The increasing number of road accidents in the United States due to human errors, traffic issues, and vehicle problems have created an urgent need for technologies that can avoid or minimize such occurrences. As a result, automotive companies have partnered with electronics and semiconductor firms to develop advanced driver assistance systems (ADAS), which are now becoming common in both passenger and commercial vehicles. The U.S. government has been making substantial investments in the autonomous vehicle space to help improve traffic management and lower the risk of mishaps. For instance, the U.S. Department of Transportation (DOT) allocated a funding of USD 94 million via the Strengthening Mobility and Revolutionizing Transportation (SMART) Grant Program. This would allow local and state governments to improve transportation systems and technologies, ensuring healthy growth of the industry.

The United States accounted for a revenue share of 27.77% in the global advanced driver assistance system market in 2023. The increasing preference for EVs among consumers has created a major opportunity for the automotive industry. Autonomous EVs are driven by a complex network of sensors, cameras, radar systems, and advanced AI-based algorithms, which help them navigate and make real-time decisions on the road without any direct human intervention. In the U.S., major automakers are investing aggressively in the development of autonomous EVs that can ensure rider safety and comfort. For instance, in September 2023, Mercedes-Benz Group AG announced its entry in the autonomous driving space with the launch of its DRIVE PILOT system, available on the 2024 Mercedes-Benz S-Class and EQS sedans. DRIVE PILOT is a Level 3 automated driving system developed by Mercedes-Benz and is the first such system to receive approval in the country. Through this integration, the car can handle certain driving tasks on its own under specific conditions, without needing driver input. Similar advances are expected by other companies in the near future, highlighting the potential of the EV segment as a leading adopter of ADAS.

The growing demand for advanced parking assistance features have expedited market growth in the United States. This demand can be attributed to the increasing number of accidents due to driver errors while parking. As per an article by Transline Industries published in November 2023, 20% of vehicle accidents occur in parking lots, with around 60,000 people reported to be injured in such accidents. As a result, automotive electronics manufacturers are looking for ways to improve parking safety and convenience. For instance, in March 2022, Bosch and Mercedes-Benz displayed the automated valet parking technology at the InterContinental Los Angeles Downtown to provide a more convenient and comfortable driving experience to vehicle owners. In a more recent development, in March 2023, Tesla, Inc. announced the addition of a new vision park assist feature in its updated software for non-FSD Beta vehicles. The updated software version features support for cameras to measure distances to any object and offers valuable parking assistance to users.

The Society of Automotive Engineers (SAE) has defined the six levels of autonomous driving, which provide a clear structure for regulators, manufacturers, and consumers to categorize autonomy of vehicles. These levels range from Level 0 to Level 5, where the former means no automation, while Level 5 represents full automation (no human intervention required at any stage). Commercial fleet providers are teaming up with technological leaders to realize the development of higher autonomy vehicles. For instance, in March 2024, Plus, a Silicon Valley-based provider of autonomous driving software, announced a collaboration with TRATON Group for the global deployment of Level 4 autonomous trucks, with public road testing already in progress. The emerging trend of autonomous vehicles in the ride-hailing segment presents another attractive avenue for industry growth. In March 2024, Waymo announced that it would immediately initiate its Level 4 autonomous services for consumers in Los Angeles, with Austin (Texas) expected to receive this service later in 2024. The company has been testing this system in Los Angeles since October 2022.

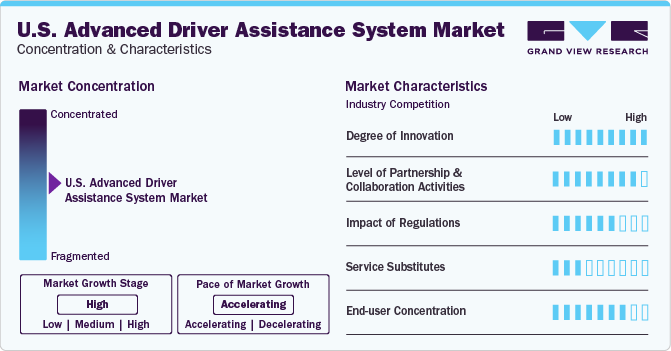

Market Concentration & Characteristics

The market growth stage is high, and pace of growth is accelerating. The market is witnessing various innovations that aim to improve vehicular and road safety. Vehicles are becoming increasingly digital due to the rising adoption of technologies such as IoT, machine learning, and sensor networks, to facilitate predictive maintenance and real-time monitoring. Machine learning algorithms can analyze data from sensors and cameras to identify patterns and improve the accuracy of Advanced Driver Assistance System (ADAS) features. For example, machine learning can be used to improve the accuracy of lane departure warning systems or adaptive cruise control. The rapid proliferation of 5G technology is also expected to improve efficiency of these systems in the coming years.

There is a strong competition present in the market, with major companies such as Continental, Robert Bosch, and Denso competing with regional companies and emerging players. Currently, the primary focus is on leveraging advances in chip manufacturing and automotive electronics to develop driver assistance solutions. For instance, in March 2023, Infineon Technologies AG announced the development of a platform for automotive customers with the support of Apex.AI, Inc., a California-based company developing safety-certified software for autonomous and mobility applications. This collaboration involved the integration of Infineon’s AURIX TC3X microcontroller and Apex.AI’s software development kit (SDK) to integrate safety-critical automotive features in upcoming vehicles.

Automotive manufacturers are focusing on passenger safety by adopting advanced technologies such as ADAS to reduce the number of traffic-related accidents and enhance occupant comfort. In the U.S., the National Highway Traffic Safety Administration (NHTSA) is responsible for bringing in regulations and guidelines that are to be followed by companies to ensure safety of their systems. In April 2023, the body created a more accessible web-based reporting system for AV operators and manufacturers to report crashes. Also, in 2023, the Federal Motor Carrier Safety Administration requested public comments on a regulatory framework for commercial motor vehicles with Level 4 and Level 5 automated driving systems. This would necessitate more stringent accident reporting requirements on commercial vehicles under these categories.

The threat of substitutes for advanced driver assistance systems is expected to remain low in the future. While there are a few alternatives to ADAS, such as defensive driving courses and other safety technologies, these do not ensure the same level of safety as ADAS provides. As ADAS technologies become more advanced and comprehensive, they are beginning to offer a range of safety features that go beyond what current alternatives can provide as advanced assistance as ADAS.

The integration of ADAS brings a wealth of benefits to drivers and vehicle occupants, which is expected to have a positive impact on the demand for these solutions. Private vehicle owners, as well as fleet operators, have been leading adopters of driver assistance technologies. ADAS ensures security for drivers, enhances driving experiences, mitigates human errors, provides comfort and convenience, and reduces driver fatigue. It also positively impacts the environment by reducing emissions, improving fuel efficiency, and optimizing traffic flow. However, there are also stringent rules and guidelines that need to be followed by vehicle operators to ensure that they remain aware while driving and also regularly monitor features such as lane departure warning and tire pressure monitoring, to ensure an incident-free and smooth experience.

Component Insights

In terms of component, the sensors segment accounted for the largest revenue share of 33.20% in the U.S. market for ADAS in 2023. Sensors are a vital component of modern vehicles, forming the basis of various technologies that make driving safer and more efficient. Sensors can detect and monitor various aspects of the road, including obstacles, the presence of other vehicles, pedestrians, and road conditions. This information provides drivers with precise and timely feedback through ADAS solutions. The development and integration of advanced sensors are expected to play a crucial role in the evolution of automotive technology. The implementation of Sensor Fusion, which combines inputs from LiDAR, RADAR, and ultrasonic sensors, helps in offsetting individual drawbacks of each sensor while leveraging their advantages, aiding autonomous vehicles to optimally interpret driving conditions. These advances are expected to boost industry expansion.

The processor segment is expected to advance at the second-fastest CAGR during the forecast period. The increasing adoption of ADAS among automakers in the country is driving the demand for processors, as they are a critical component in any vehicle. ADAS requires substantial computing power that is provided by microprocessors, with the automotive sector utilizing microprocessors for machine learning and image processing tasks, among other complex algorithms. Many automotive manufacturers integrate efficient processors for ADAS, such as NVIDIA Drive, Texas Instruments TDA, Mobileye EyeQ, and Renesas R-Car. In January 2024, Ambarella, a California-based semiconductor design company, introduced the CV3-AD635 and CV3-AD655 systems-on-chip, fabricated in Samsung’s cutting-edge 5nm automotive process technology. These SoCs form part of the company’s CV3-AD automotive AI domain controller portfolio for ADAS solutions, developed for passenger vehicles.

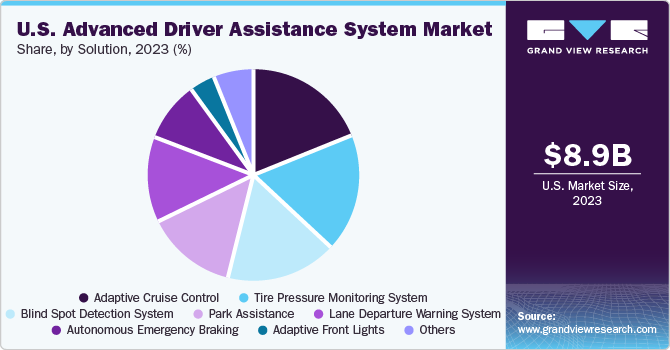

Solution Insights

Based on solution, adaptive cruise control (ACC) was the leading market segment, in terms of revenue, in 2023. ACC solutions utilize sensors and computer algorithms to automatically maintain a safe distance between a vehicle and the one in front of it. They enable automatic adjustments to car speed, which help in preventing road accidents. According to the NHTSA, there were an estimated 42,795 fatalities due to motor vehicle traffic crashes in 2022 in the U.S., highlighting the need for improving road safety and vehicular safety. Automotive manufacturers are accordingly implementing modifications and improvements in driver safety features such as adaptive cruise control to enhance user comfort and vehicle performance, which has helped in shaping segment expansion.

Meanwhile, the blind spot detection (BSD) system segment is anticipated to advance at the fastest CAGR during the projection period. The BSD system is an innovative technology that employs sensors to detect other vehicles in a driver's blind spot, which is a crucial area on the vehicle’s side that may not be visible through side mirrors or the rear window. The NHTSA states that over 800,000 blind spot accidents occur in the U.S. annually, showcasing the need for vehicular solutions that can alert drivers about these areas and prevent such mishaps. A survey conducted by Consumer Reports in 2022 found that 82% of the respondents stated that it was very important for them that their next truck or car came equipped with a blind spot warning feature. Another report by the Insurance Institute for Highway Safety (IIHS) and the Highway Loss Data Institute (HLDI) published in 2019 showed that this system led to a reduction in injury-causing lane-change crashes by 23%. Consequently, American manufacturers are focusing on integration of this system in their future vehicles.

Vehicle Insights

The commercial vehicle segment held the largest share in the U.S. advanced driver assistance system market in 2023. Commercial vehicles such as trucks, vans, and buses are witnessing steady sales in the country, owing to rising population and industrialization. These vehicles are increasingly being equipped with advanced driver assistance systems to improve their efficiency and safety on roads. Commercial vehicles utilize ADAS features such as forward collision warning, blind spot monitoring, lane departure warning, rear-view camera, pedestrian detection, and automatic emergency braking, while also offering a range of safety solutions. As per the National Highway Traffic Safety Administration (NHTSA), highway autopilot and fully automated safety features are expected to handle complete driving tasks from 2025 onwards in the U.S. As a result, the demand for ADAS is expected to remain strong in this area.

On the other hand, the passenger cars segment is projected to witness the fastest growth rate through 2030. There has been a steady increase in the number of consumers demanding the integration of driver assistance solutions in their vehicles, which has encouraged market expansion. According to a survey by the American Automobile Association (AAA) in January 2023, 6 out of 10 respondents stated that they would ‘definitely’ or ‘probably’ want their next vehicle to have ADAS. The growing appeal of vehicles with advanced features and an increasing consumer base of hybrid and electric vehicles are major factors compelling manufacturers to introduce such technologies. As per the law firm Morgan Lewis, in the coming years, automakers are expected to introduce various innovative technologies in Level 2 and Level 3 ADAS to reduce accident risks and improve rider safety. Such developments are expected to advance industry growth during the forecast period.

Key U.S. Advanced Driver Assistance System Company Insights

The United States has a well-established technological base and expertise in advanced driver assistance systems, leading to strong competition among leading companies in this area. As solution providers aim to establish their dominance in the industry, strategies such as mergers & acquisitions, new product launches, collaborations, and investments in research & development activities have become vital to enhance their potential. The use of innovative materials that can act as a base for advanced functions, as well as stringent regulatory scenarios in the country, help ensure the consistency and quality of ADAS components.

Leading names are focused on introducing novel products in the U.S. market that aim to improve driver and rider convenience. For instance, in August 2022, Garmin International, Inc., the Kansas-based subsidiary of Garmin Ltd., introduced the Garmin RVcam 795 and DriveCam 76 all-in-one navigators, each equipped with a built-in, HD dash cam. Features of these models include a 1080p HD video recording capability, a premium 7-inch display, and a wide 140-degree FOV to capture an expansive view of the path ahead. The camera integration helps increase driver awareness through real-time notifications concerning lane departure and forward collisions. Such initiatives are expected to aid market expansion during the forecast period.

Key U.S. Advanced Driver Assistance System Companies:

- Altera Corporation (Intel Corporation)

- Autoliv Inc.

- Continental AG

- DENSO CORPORATION

- Garmin Ltd.

- Infineon Technologies AG

- Magna International Inc.

- Robert Bosch GmbH

- Valeo SA

- ZF Friedrichshafen AG

Recent Developments

-

In March 2024, Concept Reply, a leading IoT solution provider, announced the launch of an innovative AI-based offering to improve the efficiency and safety of autonomous vehicles, via a collaboration with Intel. This novel solution is based on the CARLA platform, which is designed for simulating complex sensor functionalities such as LiDAR, GPS, and accelerometers, enabling precise simulations of different driving scenarios, such as changing weather conditions and night-time driving

-

In January 2024, Magna unveiled a breath and camera-based safety technology that has been designed to address road safety by combating impaired driving. The company collaborated with air and gas sensing specialist company Senseair to develop an infrared sensor technology. This system, embedded in the cockpit, would be used to detect driver intoxication, distraction, and drowsiness via pupillary signals, thus helping determine whether the person is fit to drive the vehicle. The solution aims to lower the number of traffic-related deaths in the U.S.

-

In January 2024, Valeo announced that it would be partnering with Applied Intuition, a U.S.-based vehicle software supplier, to offer a digital twin platform for ADAS sensor simulation. Applied Intuition’s ‘Spectral’ sensor simulation product would be leveraged as part of the deal to provide digital twins, helping OEMs to develop more precise simulations compared to traditional techniques. This is ultimately expected to aid manufacturers in the faster market launch of reliable and safe ADAS features

-

In January 2023, ZF launched the ‘Smart Camera 6’, the company’s next-generation camera, aimed at accelerating the advancements in highway and urban automated driving and safety systems. The device features over 4-times greater image resolution (8-megapixels) in comparison to the previous generation, a wide 120-degree field of view, and higher processing capabilities to enable advanced functionalities

U.S. Advanced Driver Assistance System Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 17.05 billion

Growth rate

CAGR of 10.2% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, component, vehicle

Key companies profiled

Altera Corporation (Intel Corporation); Autoliv Inc.; DENSO CORPORATION; Continental AG; Garmin Ltd.; Infineon Technologies AG; Magna International Inc.; Robert Bosch GmbH; Valeo SA; ZF Friedrichshafen AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Advanced Driver Assistance System Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. advanced driver assistance system market report based on solution, component, and vehicle:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Adaptive Cruise Control (ACC)

-

Blind Spot Detection (BSD) System

-

Park Assistance

-

Lane Departure Warning System (LDWS)

-

Tire Pressure Monitoring System (TPMS)

-

Autonomous Emergency Braking (AEB)

-

Adaptive Front Lights (AFL)

-

Others

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Processor

-

Sensors

-

RADAR

-

LiDAR

-

Ultrasonic

-

Others

-

-

Software

-

Others

-

-

Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Car

-

Commercial Vehicle

-

Light Commercial Vehicle

-

Heavy Commercial Vehicle

-

-

Frequently Asked Questions About This Report

b. The U.S. advanced driver assistance system market size was estimated at USD 8.93 billion in 2023 and is expected to reach USD 9.49 billion in 2024.

b. The U.S. advanced driver assistance system market is expected to grow at a compound annual growth rate of 10.2% from 2024 to 2030 to reach USD 17.05 billion by 2030

b. the sensors segment accounted for the largest revenue share of 33.20% in the U.S. market for ADAS in 2023. The implementation of Sensor Fusion, which combines inputs from LiDAR, RADAR, and ultrasonic sensors, helps in offsetting individual drawbacks of each sensor while leveraging their advantages, aiding autonomous vehicles to optimally interpret driving conditions. These advances are expected to boost industry expansion.

b. Some of the companies operating in the U.S. ADAS market include Altera Corporation (Intel Corporation); Autoliv Inc.; DENSO CORPORATION; Continental AG; Garmin Ltd.; Infineon Technologies AG; Magna International Inc.; Robert Bosch GmbH; Valeo SA; ZF Friedrichshafen AG

b. The increasing number of road accidents in the U.S. due to human errors, traffic issues, and vehicle problems have created an urgent need for technologies that can avoid or minimize such occurrences. As a result, automotive companies have partnered with electronics and semiconductor firms to develop advanced driver assistance systems (ADAS), which are now becoming common in both passenger and commercial vehicles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.