- Home

- »

- Medical Devices

- »

-

U.S. Advanced Wound Care OTC Market Size Report, 2033GVR Report cover

![U.S. Advanced Wound Care OTC Market Size, Share & Trends Report]()

U.S. Advanced Wound Care OTC Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Foam Dressings, Hydrocolloids Dressings, Hydrogel Dressings, Honey Dressings), By Application (Acute Wound, Chronic Wound), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-632-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Advanced Wound Care OTC Market Summary

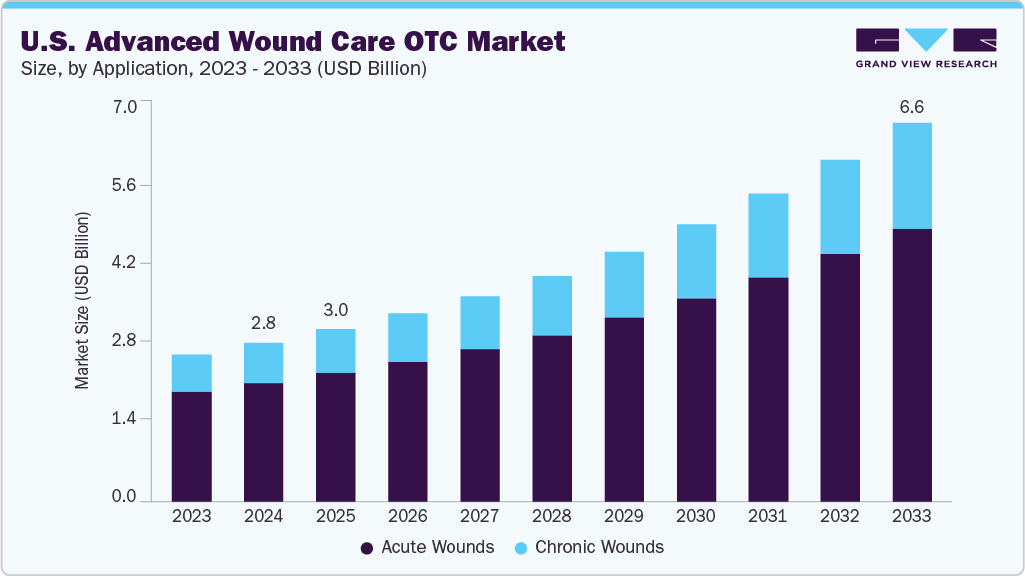

The U.S. advanced wound care OTC market size was estimated at USD 2.77 billion in 2024 and is projected to reach USD 6.61 billion by 2033, growing at a CAGR of 10.33% from 2025 to 2033. The growth is driven by the increasing prevalence of acute wounds, such as surgical wounds, traumatic injuries, and burns, which require effective and immediate wound management solutions.

Key Market Trends & Insights

- Based on product, the foam dressings segment led the market with the largest revenue share of 20.07% in 2024.

- Based on application, the acute wounds segment led the market with the largest revenue share of 74.93% in 2024.

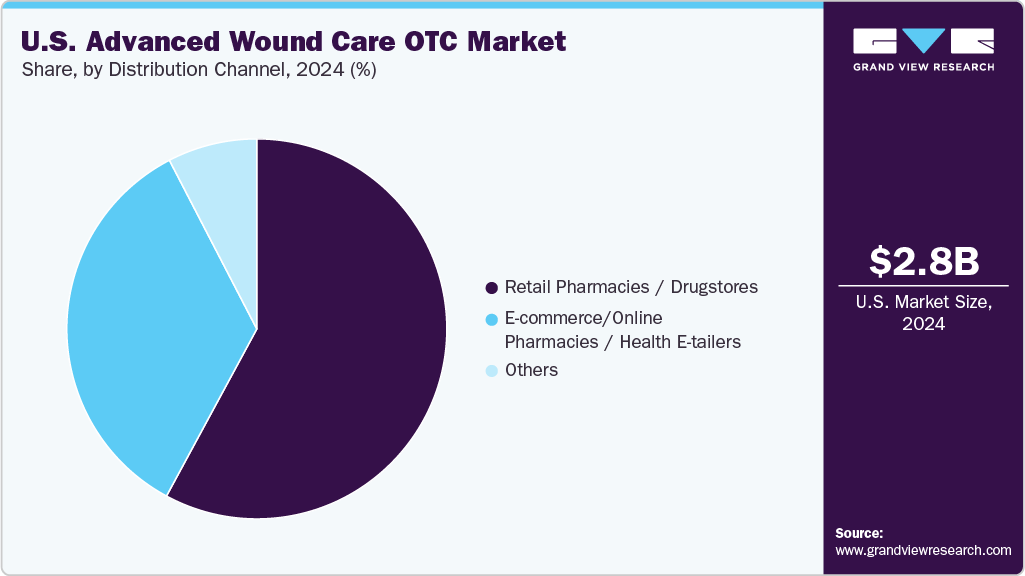

- By distribution channels, the retail pharmacies/drugstores segment led the market with the largest revenue share of 57.46% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.77 Billion

- 2033 Projected Market Size: USD 6.61 Billion

- CAGR (2025-2033): 10.33%

Rising rates of road accidents, sports injuries, and surgical procedures globally have led to a surge in demand for advanced OTC wound care products that promote faster healing and reduce the risk of infection. According to the data published by the Total Family Care Center in April 2025, approximately 11 million individuals in the U.S. experience acute wounds annually, with around 300,000 cases requiring hospital care. In addition, the growing awareness among consumers regarding proper wound care practices and the ease of access to advanced dressings through retail pharmacies and online platforms continue to support market expansion.The high and rising prevalence of diabetes in the U.S. significantly drives the growth of the market. Diabetes is a significant risk factor for the development of chronic wounds, particularly diabetic foot ulcers, which require timely and effective wound management to prevent complications such as infections and amputations. For instance, the Centers for Disease Control and Prevention (CDC) reports that more than 38 million Americans have diabetes (about 1 in 10), and about 90% to 95% of them have type 2 diabetes.

There is an increasing demand for accessible, over-the-counter wound care products that allow individuals to manage minor wounds and prevent them from worsening. Advanced OTC wound care solutions offer diabetic patients a convenient way to treat wounds at home, reducing the need for frequent clinical visits. This growing need for self-care solutions among the diabetic population is a key factor propelling the expansion of the U.S. advanced wound care OTC industry.

Top 15 Percentage of adults who reported ever being told by a health professional that they had diabetes, 2023

Rank

State

Diabetes Prevalence (%)

1

Utah

7.80%

2

Colorado

8.60%

3

Alaska

8.70%

4

Vermont

9.30%

5

Montana

9.40%

6

North Dakota

9.50%

7

Washington

9.60%

8

Idaho

9.80%

8

Massachusetts

9.80%

8

New Hampshire

9.80%

11

Connecticut

9.90%

12

Minnesota

10.50%

12

New Jersey

10.50%

14

Nebraska

10.60%

14

New York

10.60%

15

Wyoming

10.80%

Source:U.S. Department of Health and Human Services, Centers for Disease Control and Prevention, Behavioral Risk Factor Surveillance System, 2023

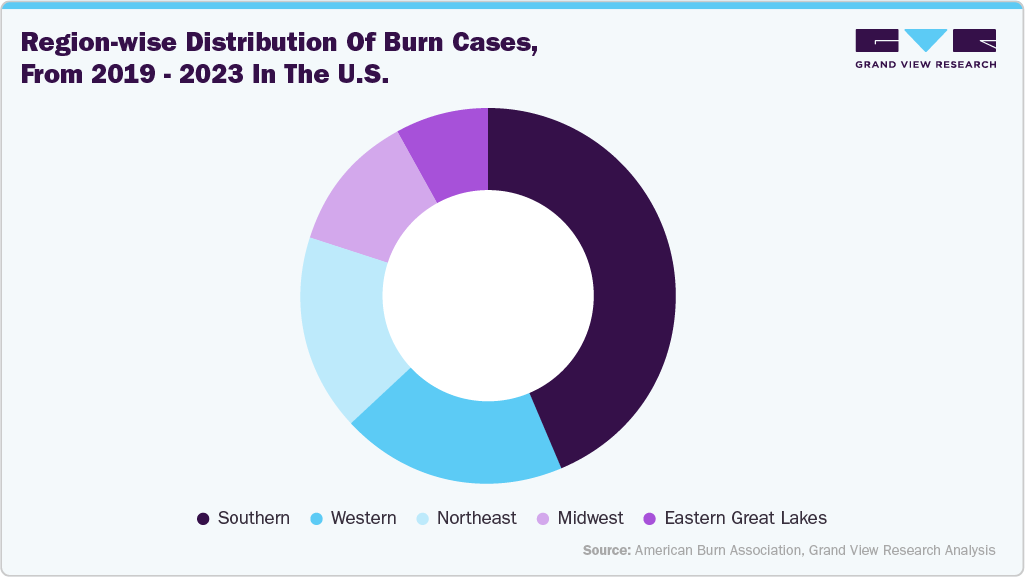

According to the CDC, burn injuries are a leading cause of accidental death and injury in the U.S., with over 398,000 individuals seeking medical care for burns each year. The high incidence of burn injuries in the U.S. significantly contributes to the growth of the advanced wound care OTC market. Burn wounds necessitate specialized care to prevent complications such as infections and scarring, leading to increased demand for advanced wound care products. These products offer benefits like maintaining a moist healing environment and reducing infection risks, making them preferable over traditional dressings. The growing awareness among consumers about effective burn management and the availability of advanced OTC solutions further propel market expansion. The high incidence of burn injuries in the U.S. significantly contributes to the growth of the advanced wound care OTC market. Burn wounds necessitate specialized care to prevent complications such as infections and scarring, leading to increased demand for advanced wound care products. These products offer benefits like maintaining a moist healing environment and reducing infection risks, making them preferable over traditional dressings. The growing awareness among consumers about effective burn management and the availability of advanced OTC solutions further propel market expansion.

The below figure shows the region-wise distribution of burn cases in the U.S. from 2019 to 2023. As illustrated, the Southern region reported the highest burn cases, accounting for 43.7%.

The increasing number of regulatory approvals for OTC advanced wound care products is expected to significantly boost market growth in the forecast years. Recent approvals are expanding consumer access to innovative wound care solutions outside traditional clinical settings. For instance, in April 2024, Vomaris Inc. received FDA clearance for its PowerHeal bioelectric bandage for OTC use. This bandage is designed for treating superficial wounds, such as minor cuts, abrasions, and blisters. It incorporates microcell batteries made from elemental silver and zinc. When activated by a conductive medium-such as wound exudate, saline, or hydrogel-these microcells generate therapeutic microcurrents that accelerate healing and help reduce the risk of infection.

“PowerHeal is proud to bring medical-grade wound care technology directly into the hands of consumers,” said Michael Nagel, President & CEO of Vomaris Innovations, Inc.

Market Concentration & Characteristics

The U.S. advanced wound care OTC industry is in a high-growth phase, with an accelerating pace of expansion. This growth is driven by several key factors, including the increasing prevalence of chronic wounds, a rapidly aging population, a rising volume of surgical procedures, and continuous technological advancements in wound care.

The degree of innovation in the U.S. market is high, driven by advancements in biomaterials, drug delivery systems, and natural healing agents. Manufacturers invest heavily in R&D to develop products that enhance wound healing outcomes while offering convenience and ease of use for at-home care. Innovations include integrating antimicrobial technologies, such as moisture-balancing dressings (such as hydrocolloids, foams, and hydrogels), and smart dressings with pH indicators or temperature sensors to monitor wound conditions. The shift toward natural and bioactive ingredients, such as Manuka honey, aloe vera, and collagen-infused dressings, reflects consumer demand for non-toxic and effective treatment options.

The level of mergers and acquisitions in the U.S. market is moderate, reflecting ongoing efforts by companies to expand product portfolios, enhance technological capabilities, and increase market share. Larger medical device and healthcare companies are actively acquiring or partnering with specialized wound care firms to strengthen their position in the professional and OTC segments. For instance, in October 2024, Mölnlycke Health Care, a leading Swedish MedTech company specializing in wound care, completed its acquisition of P.G.F. Industry Solutions GmbH, an Austrian manufacturer known for its Granudacyn wound cleansing and moisturizing solutions. The acquisition aims to expand Mölnlycke's Granudacyn business and further develop its growing wound care portfolio.

Regulations significantly shape the U.S. market, ensuring product safety, efficacy, and quality. The market is regulated primarily by the U.S. FDA, which classifies wound care products based on their intended use and risk level. Most OTC wound care products, such as dressings, hydrogels, and antimicrobial ointments, are regulated as Class I or Class II medical devices, requiring compliance with 510(k) premarket notification, Good Manufacturing Practices, and labeling standards.

The end user concentration in the U.S. market is significant, with demand distributed across multiple consumer segments rather than being dominated by a single group. Key end users include elderly individuals, diabetic patients, caregivers, athletes, and health-conscious consumers managing minor injuries or chronic wounds at home. Among these, individuals with chronic conditions such as diabetes and venous insufficiency and the aging population represent a significant segment due to their ongoing need for wound care solutions. This demographic requires products that support faster healing, prevent infections, and are easy to apply independently.

Product Insights

The foam dressings segment dominated the market, accounting for a revenue share of 20.07% in 2024 due to their advanced wound management capabilities and broad applicability across various wound types. Foam dressings are highly absorbent, making them particularly effective for managing moderate to heavily exuding wounds such as pressure ulcers, diabetic foot ulcers, and post-surgical wounds. Their structure allows excess exudate retention while maintaining a moist wound environment, which is essential for optimal healing and tissue regeneration. In addition, foam dressings provide thermal insulation and mechanical protection, reducing the risk of further injury or infection. They are designed with non-adherent wound contact layers, which minimize trauma during dressing changes and enhance patient comfort. This feature makes them particularly suitable for elderly patients or individuals with sensitive skin.

The honey dressings segment is expected to grow at the fastest CAGR over the forecast period due to increasing consumer preference for natural, effective, and antimicrobial wound healing solutions. Medical-grade honey, particularly Manuka honey, is known for its broad-spectrum antibacterial properties, ability to promote autolytic debridement, maintain a moist wound environment, and accelerate tissue regeneration. These benefits make honey dressings especially suitable for managing a wide range of wounds, including minor cuts, abrasions, burns, and chronic wounds such as diabetic ulcers. The rise in demand for natural and holistic healing alternatives and growing clinical evidence supporting honey’s efficacy in wound management has led to greater availability of honey-based products in retail pharmacies, online platforms, and health stores.

Application Insights

The acute wounds segment led the market in 2024, accounting for a significant revenue share of 74.93%. The rising incidence of traumatic injuries and surgical interventions worldwide primarily drives this dominance. For instance, data released by the U.S. Department of Transportation in April 2024 reported approximately 40,990 fatalities from road accidents in 2023, highlighting the continued burden of trauma-related hospital admissions. As the global population grows and the rate of accidents and injuries increases, there is a corresponding surge in the demand for effective wound management solutions. Additionally, advancements in advanced wound care products have significantly improved healing outcomes, reduced the risk of complications, and shortened recovery times, making them essential in emergency and acute care settings. These innovations include dressings promoting faster healing, controlling infection, and enhancing patient comfort. Moreover, the growing public awareness of proper wound care and the increasing preference for self-treatment options have led to greater adoption of OTC advanced wound care products.

The chronic wounds segment is expected to grow at the fastest CAGR over the forecast period, driven by the rising prevalence of long-term conditions such as diabetes, obesity, and vascular diseases that contribute to non-healing wounds such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers. As the aging population increases in the U.S. and lifestyle-related chronic diseases become more widespread, the burden of chronic wounds is escalating, creating a sustained demand for effective wound care solutions. Patients and caregivers are turning to over-the-counter advanced wound care products that offer convenience, cost-effectiveness, and ease of use for ongoing wound management at home. Innovations in OTC products-such as antimicrobial dressings, silicone-based products, and moisture-retentive dressings-are making it easier for individuals to manage chronic wounds without frequent clinical intervention. Moreover, increased health literacy and awareness of chronic complications encourage proactive wound care practices. The rising cost of clinical treatments also makes OTC alternatives an attractive option for long-term management, further fueling the growth of this segment.

Distribution Channel Insights

Retail pharmacies and drugstores dominated the market in 2024 due to their widespread accessibility, consumer trust, and ability to offer products directly to end-users. Major pharmacy chains such as CVS Health, Walgreens, and Rite Aid, along with retail giants such as Walmart and Target, serve as primary distribution channels for advanced wound care products, including hydrocolloid dressings, hydrogels, antimicrobial ointments, and silicone-based products. These outlets provide consumers convenient access to wound care solutions without requiring a prescription, aligning with the growing trend toward self-care and at-home treatment. Furthermore, retail pharmacies offer private-label wound care products at competitive prices, enhancing affordability and driving sales. Their integrated digital platforms and in-store pharmacists also help guide purchasing decisions through personalized recommendations and promotions. As a result, retail pharmacies and drugstores account for a significant share of OTC wound care product sales.

The E-commerce/Online Pharmacies/Health E-tailers segment is expected to grow at the fastest CAGR over the forecast period due to shifting consumer preferences toward digital convenience, increased internet penetration, and the growing popularity of health and wellness platforms. Consumers purchase wound care products online for the ease of home delivery, access to a broader product range, and the ability to compare prices and read reviews before making decisions. In addition, online pharmacies and health e-tailers offer subscription-based models, discounts, and auto-refill services that encourage repeat purchases and customer loyalty. Niche players and direct-to-consumer brands leverage online platforms to introduce innovative wound care products and build customer engagement through targeted marketing.

Key U.S. Advanced Wound Care OTC Company Insights

Medline Industries, LP, Coloplast Corp, Mölnlycke Health Care AB, Solventum, Convatec Inc., Smith+Nephew, and B. Braun SE are some of the major players in the U.S. market. The industry players are undertaking several strategic initiatives such as acquisitions, partnerships, and collaborations. Moreover, the launch of novel products is anticipated to boost the competitive rivalry in the U.S. advanced wound care OTC industry.

Key U.S. Advanced Wound Care OTC Companies:

- Smith+Nephew

- Solventum

- 3M

- Medline Industries, LP

- DeRoyal Industries, Inc.

- Sonoma Pharmaceuticals, Inc.

- Cardinal Health

- Remedium Healthcare Products

- Dimora Medical

- Lavior

- Vomaris Innovations, Inc.

- Mölnlycke Health Care AB

- Convatec Group PLC

- Coloplast Group

- B. Braun SE

- PAUL HARTMANN AG

- Beiersdorf

Recent Developments

-

In April 2025, Sonoma Pharmaceuticals, Inc. is known for its patented Microcyn technology, which features stabilized hypochlorous acid. This technology serves a wide range of markets, including wound care, eye, oral, nasal care, dermatology, podiatry, and animal health. The company announced that its hypochlorous acid-based acne products have been registered with the Medicines & Healthcare Products Regulatory Agency (MHRA).

-

In January 2025, Beiersdorf is now introducing a new plaster formulated with advanced hydrocolloid technology. The Second Skin Protection Plaster provides a more professional solution for managing everyday minor wounds. The company is also raising awareness about its benefits through social media, television, and point-of-sale displays.

U.S. Advanced Wound Care OTC Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.01 billion

Revenue forecast in 2033

USD 6.61 billion

Growth rate

CAGR of 10.33% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Product, application, distribution channel

Country Scope

U.S.

Key companies profiled

Smith+Nephew; Solventum; 3M; Medline Industries, LP; DeRoyal Industries, Inc.; Sonoma Pharmaceuticals, Inc.; Cardinal Health; Remedium Healthcare Products; Dimora Medical; Lavior; Vomaris Innovations, Inc.; Mölnlycke Health Care AB; Convatec Group PLC; Coloplast Group; B. Braun SE; PAUL HARTMANN AG; Beiersdorf

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Advanced Wound Care OTC Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. advanced wound care OTC market report based on product, application, and distribution channel.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Foam Dressings

-

Adhesive

-

Non-adhesive Foam Dressings

-

-

Film Dressings

-

Hydrocolloids

-

Hydrogel Dressings

-

Honey Dressings

-

Greasy Gauzes

-

Non-Woven Post Operative Dressings

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers (Stage 1, Stage 2, Stage 3, Stage 4, and Deep Tissue Injury included)

-

Venous Leg Ulcers

-

Other Chronic Wounds

-

-

Acute Wounds

-

Surgical & Traumatic Wounds (skin tears included)

-

Burns

-

1st degree burns

-

2nd degree burns

-

3rd degree burns

-

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Retail Pharmacies / Drugstores

-

E-commerce/Online Pharmacies / Health E-tailers

-

Others

-

Frequently Asked Questions About This Report

b. The global U.S. advanced wound care OTC market size was estimated at USD 2.77 billion in 2024.

b. The global U.S. advanced wound care OTC market is expected to grow at a compound annual growth rate of 10.3% from 2025 to 2033 to reach USD 6.61 billion by 2033.

b. Foam dressings dominated the U.S. advanced wound care OTC market with a share of 20.7% in 2024 due to their high absorbency, comfort, and ability to maintain a moist wound environment, which promotes faster healing.

b. Key players in the U.S. advanced wound care OTC market include Smith+Nephew, Solventum, 3M, Medline Industries, LP, DeRoyal Industries, Inc., Sonoma Pharmaceuticals, Inc., Cardinal Health, Remedium Healthcare Products, Dimora Medical, Lavior, Vomaris Innovations, Inc., Mölnlycke Health Care AB, Convatec Group PLC, Coloplast Group, B. Braun SE, PAUL HARTMANN AG, and Beiersdorf.

b. The U.S. advanced wound care OTC market is primarily driven by the rising prevalence of chronic conditions such as diabetes and obesity, which lead to an increase in minor wounds and ulcers that are often managed at home. The growing elderly population, more prone to skin injuries and slow healing, further fuels demand for accessible wound care solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.