- Home

- »

- Next Generation Technologies

- »

-

U.S. AI Agents Market Size And Share, Industry Report, 2030GVR Report cover

![U.S. AI Agents Market Size, Share & Trends Report]()

U.S. AI Agents Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Machine Learning, Natural Language Processing), By Agent System, By Type, By Application, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-587-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

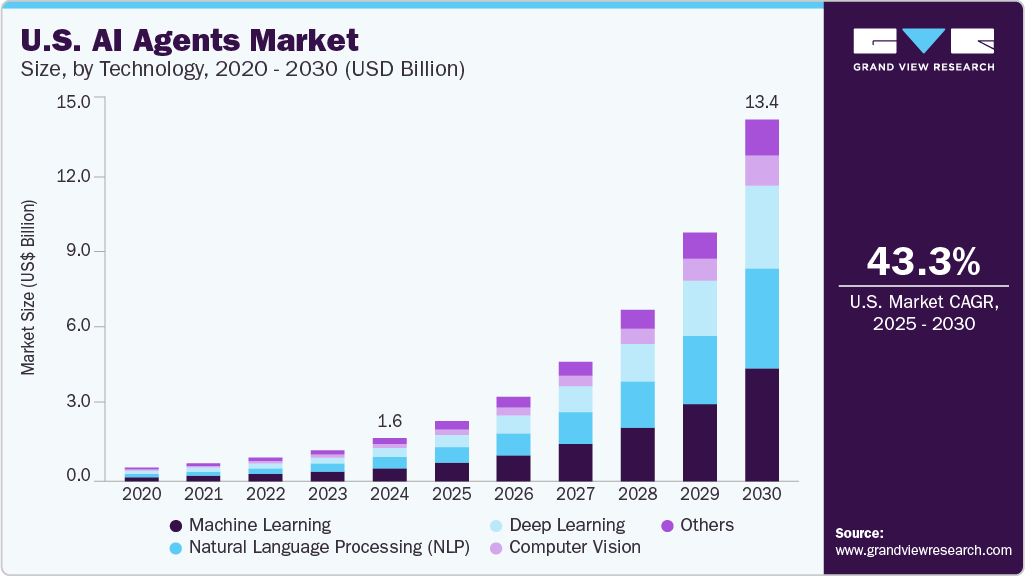

The U.S. AI agents market size was estimated at USD 1,603.0 million in 2024 and is projected to grow at a CAGR of 43.3% from 2025 to 2030. AI agents are increasingly being integrated with cloud platforms. This trend shows the need for scalable and flexible deployment options. Cloud infrastructure enables efficient management of agents across various environments. It also allows seamless integration with enterprise systems and data sources. Continuous updates and maintenance are more easily handled through cloud-based delivery. For instance, in May 2025, IBM Corporation and Amazon Web Services, Inc., a U.S.-based cloud computing company are deepening their collaboration to deliver agentic AI capabilities through integrations such as Amazon Q index with IBM Watson Orchestrate, enabling personalized, enterprise-grade AI solutions. IBM Corporation is also expanding its Granite 3.2 models, governance tools, and automation software across AWS Marketplace to support scalable, trustworthy AI.

AI agent marketplaces are becoming a prominent trend in the evolving AI sector. These platforms provide tools for users to create agents suited to specific functions. They allow for high levels of customization based on industry or task requirements. Users can distribute their agents to others through a shared marketplace. This approach encourages collaboration and the reuse of effective solutions. It also drives faster adoption by simplifying development and deployment processes. For instance, in January 2025, Hippocratic AI, a healthcare technology company, launched its innovative Healthcare AI Agent App Store, enabling clinicians to create customized AI agents for patient care in under 30 minutes. This platform empowers healthcare professionals to address operational challenges while sharing in the revenue generated by their agents. With rigorous safety testing and direct clinician involvement, Hippocratic AI aims to enhance patient outcomes through collaborative AI development.

AI agents are increasingly integrated with Internet of Things (IoT) devices, bringing a new level of automation to various industries. This integration allows AI agents to manage tasks such as adjusting temperatures, monitoring inventory, and controlling equipment. In retail, for example, AI agents work with IoT devices to track stock levels and automatically reorder popular products. In smart homes, they can adjust heating and lighting based on user preferences or external weather conditions. These AI-powered systems not only automate routine tasks but also improve operational efficiency by responding in real-time to changing conditions. As more IoT devices are deployed, the potential for AI agents to optimize workflows grows, making businesses more agile.

Technology Insights

The machine learning segment led the market with the largest revenue share of 30.7% in 2024. This growth was driven by rising adoption across customer support functions, virtual assistant platforms, and data-driven decision-making applications. Organizations increasingly turned to machine learning to improve automation and streamline user interactions. Its ability to analyze large datasets and continuously optimize performance made it essential for intelligent agent development. The segment's prominence highlights its strategic importance in enhancing AI capabilities. As demand for intelligent, adaptive systems grows, machine learning remains central to innovation in this market.

The deep learning segment is anticipated to witness at the fastest CAGR during the forecast period, emerging as the fastest-growing technology area in this space. This expansion is driven by its superior capabilities in handling complex tasks such as natural language processing, image recognition, and speech analysis. The segment benefits from advancements in computational infrastructure, especially the use of high-performance GPUs, which have accelerated model training and deployment. Major players such as Google LLC, Microsoft, and NVIDIA Corporation are investing heavily in this field, while startups are also contributing with novel applications.

Agent System Insights

The single agent systems segment accounted for the largest market revenue share in 2024, due to their simplicity, lower implementation costs, and suitability for tasks that do not require collaboration. These systems operate independently and have been widely adopted in areas such as customer support and task automation. Their reliability, ease of integration, and lower resource requirements have supported rapid deployment across various applications. As a result, Single Agent Systems continue to maintain a strong presence in the current market sector. Their dominance reflects the early-stage maturity of AI deployment, where focused, task-specific solutions are often prioritized.

The multi agent systems segment is expected to grow at the fastest CAGR during the forecast period, driven by increasing demand for intelligent collaboration and decentralized problem-solving. These systems enable multiple agents to work together, making them essential in complex environments such as robotics, autonomous vehicles, and logistics. Advances in communication protocols and distributed computing are enhancing their capabilities and performance. Organizations are increasingly adopting Multi Agent Systems to manage dynamic, real-time scenarios that require flexibility and coordination. As application complexity grows, these systems are gaining traction across multiple sectors.

Type Insights

The ready-to-deploy agents segment accounted for the largest market revenue share in 2024, due to their ease of implementation and faster time-to-value. These pre-configured solutions are widely used in customer service, sales, and internal automation tasks. They allow organizations to adopt AI with minimal technical effort or infrastructure changes. Vendors offer extensive support, templates, and integrations, making these agents attractive to enterprises seeking quick deployment. As a result, Ready-to-Deploy Agents continue to be the preferred choice for businesses prioritizing efficiency and speed.

The build-your-own agents segment is anticipated to grow at the fastest CAGR during the forecast period, it is due to growing in popularity as organizations seek more control and customization in their AI deployments. These agents enable companies to tailor capabilities according to specific workflows, use cases, and industry requirements. The rise of low-code and no-code platforms has made development more accessible to non-technical users. This approach supports long-term scalability and deeper integration with internal systems. As digital maturity increases, Build-Your-Own Agents are gaining traction among enterprises with more complex or evolving needs.

Application Insights

The customer service and virtual assistants segment accounted for the largest market revenue share in 2024, driven by their widespread use in automating support tasks and enhancing user engagement. Businesses across industries have adopted these solutions to handle high volumes of customer interactions efficiently. They offer benefits such as 24/7 availability, reduced response times, and lower operational costs. Integration with CRM platforms and natural language processing tools has further improved their effectiveness. As a result, these use cases remain the most established and commercially mature in the market.

The healthcare segment is anticipated to grow at the fastest CAGR during the forecast period, fueled by increasing demand for automation and personalized care. AI agents are being deployed for appointment scheduling, symptom checking, patient engagement, and administrative support. The sector benefits from advancements in AI-driven diagnostics, clinical decision support, and medical data processing. Regulatory clarity and growing investments in health tech are accelerating adoption. As healthcare organizations strive to improve efficiency and patient outcomes, this segment is expected to expand significantly in the coming years.

End Use Insights

The enterprise sector segment accounted for the largest market revenue share in 2024, benefiting from strong demand for automation, productivity enhancement, and customer engagement across various business functions. Large organizations have widely adopted AI agents for sales, marketing, HR, and IT support to streamline operations and improve decision-making. The availability of ready-to-deploy solutions and integration with enterprise software has accelerated adoption. Enterprises prioritize scalability, security, and compliance, which AI agents increasingly address. This sector remains the primary driver of market growth and innovation.

The industrial segment is expected to grow at the fastest CAGR during the forecast period, as AI agents find new applications in manufacturing, supply chain management, and equipment maintenance. AI agents assist in predictive maintenance, quality control, and real-time monitoring, improving operational efficiency and reducing downtime. Advances in IoT and edge computing have facilitated the deployment of intelligent agents in industrial environments. Growing investment in Industry 4.0 technologies supports this expansion. As industries seek to modernize and optimize production, the role of AI agents in industrial settings is set to increase significantly.

Key U.S. AI Agents Company Insights

Some of the key companies in the U.S. AI Agents industry include Amazon.com, Inc., Cognigy, Google LLC, IBM Corporation, Amelia US LLC and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Microsoft has made significant advancements in AI agents by integrating them into its Azure cloud platform and Microsoft 365 suite. Its AI agents, such as Cortana and conversational AI services, enhance productivity and automate workflows across enterprises. Microsoft focuses on enabling developers to build customized AI agents with tools such as the Bot Framework and Azure Cognitive Services. The company’s continuous investment in large language models and natural language processing strengthens the capabilities of its AI agents.

-

NVIDIA Corporation drives AI agent development through its powerful GPUs and AI computing platforms that accelerate deep learning and neural network training. NVIDIA’s software frameworks, such as CUDA and TensorRT, support efficient AI model deployment, making it easier to build advanced AI agents. The company’s investments in AI research, including conversational AI and reinforcement learning, enable smarter and faster agents.

Key U.S. AI Agents Companies:

- Amazon.com, Inc.

- Cognigy

- Google LLC

- IBM Corporation

- Amelia US LLC

- LivePerson

- Microsoft

- NVIDIA Corporation

- Nuance Communications

- Salesforce, Inc.

Recent Developments

-

In April 2025, Microsoft launched powerful AI agents such as Researcher and Analyst, designed to act as digital colleagues that perform complex workplace tasks using deep reasoning capabilities. These agents, available through a new Agent Store with partners and custom options, aim to transform work by enabling closer collaboration between humans and AI in enterprise environments.

-

In March 2025, NVIDIA Corporation launched the Llama Nemotron AI models to help developers build advanced AI agents for complex tasks with improved accuracy and speed. Major companies such as Microsoft, SAP SE, and Accenture are using these models to enhance their AI solutions

-

In September 2024, Salesforce, Inc., collaborated with NVIDIA Corporation to advance AI agent innovation by combining NVIDIA’s AI platform with Salesforce’s Agentforce, enhancing predictive and generative AI workflows for enterprises. This collaboration aims to deliver more engaging, intelligent customer and employee experiences through AI-powered avatars and optimized AI performance across sales, service, marketing, and IT teams.

U.S. AI Agents Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,229.3 million

Revenue forecast in 2030

USD 13,459.3 million

Growth rate

CAGR of 43.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Technology, agent system, type, application, end use

Country scope

U.S.

Key companies profiled

Amazon.com, Inc.; Cognigy; Google LLC; IBM Corporation; Amelia US LLC; LivePerson; Microsoft; NVIDIA Corporation; Nuance Communications; Salesforce, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. AI Agents Market Report Segmentation

This report offers revenue growth forecasts at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. AI agents market report based on technology, agent system, type, application and end use:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Machine Learning

-

Natural Language Processing (NLP)

-

Deep Learning

-

Computer Vision

-

Others

-

- Agent System (Revenue, USD Million, 2018 - 2030)

-

Single Agent Systems

-

Multi Agent Systems

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Ready-to-Deploy Agents

-

Build-Your-Own Agents

-

-

Application (Revenue, USD Million, 2018 - 2030)

-

Customer Service and Virtual Assistants

-

Robotics and Automation

-

Healthcare

-

Financial Services

-

Security and Surveillance

-

Gaming and Entertainment

-

Marketing and sales

-

Human Resources

-

Legal and compliance

-

Others

-

-

End Use (Revenue, USD Million, 2018 - 2030)

-

Consumer

-

Enterprise

-

Industrial

-

Frequently Asked Questions About This Report

b. The U.S. AI agents market size was estimated at USD 1,603.0 million in 2024 and is expected to reach USD 2,229.3 million in 2025.

b. The U.S. AI agents market is expected to grow at a compound annual growth rate of 43.3% from 2025 to 2030 to reach USD 13,459.3 million by 2030.

b. Machine Learning dominated the U.S. AI Agents market with a share of 30.7% in 2024. This is attributable to its widespread use in automating decision-making and enhancing predictive capabilities.

b. Some key players operating in the U.S. AI agents market include Amazon.com, Inc., Cognigy, Google LLC, IBM Corporation, Amelia US LLC, LivePerson, Microsoft, NVIDIA Corporation, Nuance Communications, Salesforce, Inc.

b. Key factors driving the market growth include increasing adoption of intelligent automation, advancements in natural language processing, and rising demand for personalized user experiences.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.