- Home

- »

- Next Generation Technologies

- »

-

U.S. AI Shopping Assistant Market, Industry Report, 2033GVR Report cover

![U.S. AI Shopping Assistant Market Size, Share & Trends Report]()

U.S. AI Shopping Assistant Market (2025 - 2033) Size, Share & Trends Analysis Report By Offering, By Technology (Natural Language Processing (NLP), Machine Learning (ML), Computer Vision), By Type, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-736-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. AI Shopping Assistant Market Summary

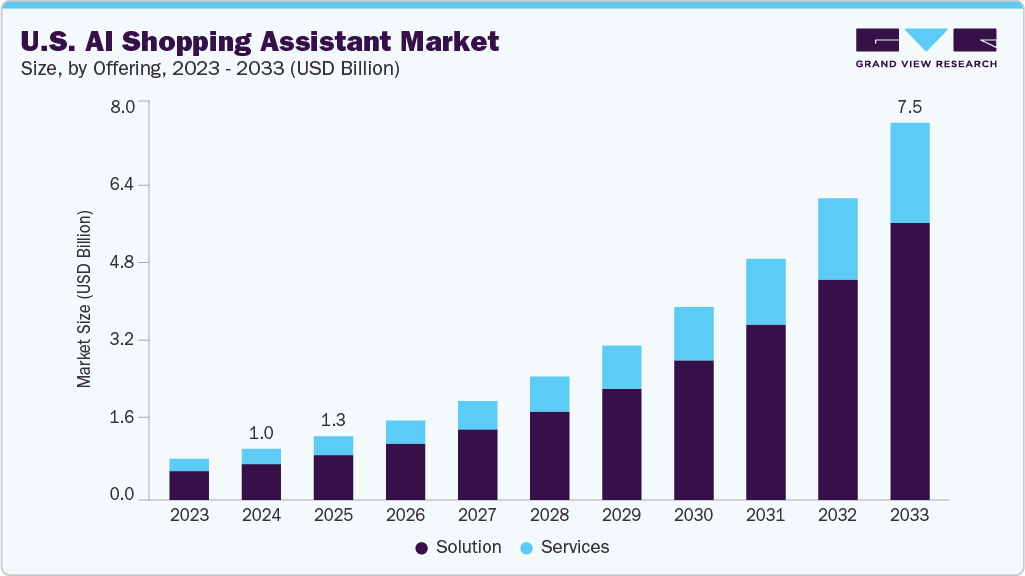

The U.S. AI shopping assistant market size was estimated at USD 1,020.6 million in 2024 and is projected to reach USD 7,548.9 million by 2033, growing at a CAGR of 24.9% from 2025 to 2033. This growth is driven by the increasing demand for personalized, real-time customer engagement across digital retail platforms, powered by advancements in natural language processing and conversational AI.

Key Market Trends & Insights

- By offering, the solution segment led the market, holding the largest revenue share of 70.2% in 2024.

- By technology, the Natural Language Processing (NLP) segment led the market, holding the largest revenue share in 2024.

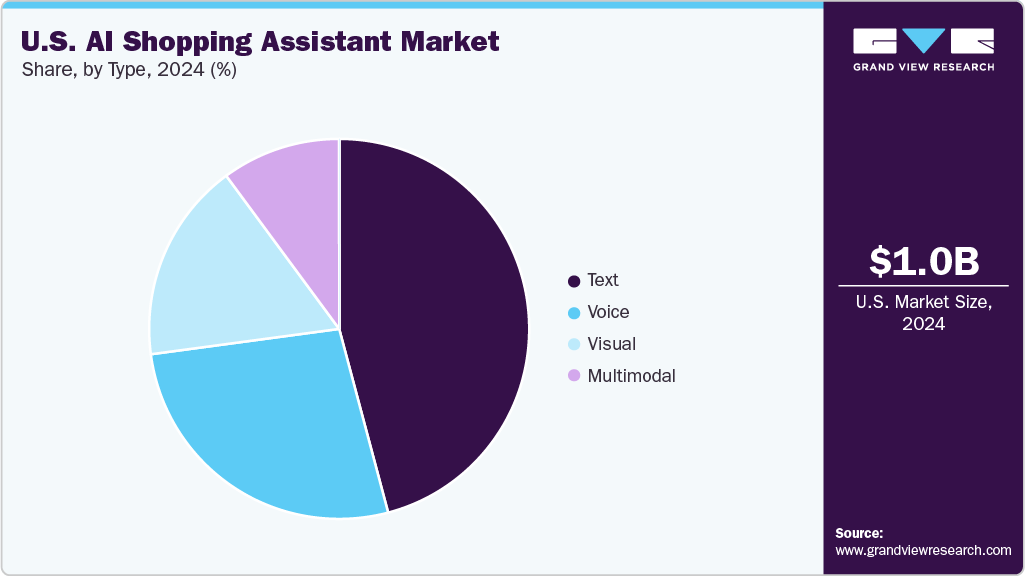

- By type, the text segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,020.6 Million

- 2033 Projected Market Size: USD 7,548.9 Million

- CAGR (2025-2033): 24.9%

The U.S. AI shopping assistant industry is expected to grow significantly in 2024 as retailers increasingly integrate AI assistants into online and brick-and-mortar stores to enhance customer engagement and operational efficiency. High consumer awareness and acceptance of AI technologies encourage adoption across diverse retail formats. The country’s strong technology ecosystem, including leading AI research institutions and startups, accelerates innovation in AI shopping assistants. Retailers leverage AI to personalize marketing, optimize inventory management, and improve customer service, driving growth.

The U.S. market for AI shopping assistants is witnessing strong growth, fueled by the rapid adoption of conversational AI and self-service shopping tools across industries. Retailers and e-commerce platforms in the U.S. are increasingly deploying AI assistants that integrate voice, text, and visual modes to engage customers through websites, mobile apps, and social media. Advances in generative AI and computer vision technologies are further transforming the customer journey, enabling features such as virtual try-ons, smart product discovery, and personalized recommendations that resonate with U.S. consumers’ demand for convenience and customization. Moreover, the integration of AI assistants into social commerce and omnichannel retail strategies is helping U.S. retailers improve customer engagement, retention, and overall loyalty.

Market momentum in the U.S. also depends on continuous technological innovation and investments by major domestic players. For instance, in January 2025, NVIDIA Corporation (U.S.) introduced the NVIDIA AI Blueprint for retail shopping assistants, a generative AI reference framework designed to revolutionize both online and in-store shopping experiences. Built on NVIDIA Omniverse and NVIDIA AI Enterprise platforms, this blueprint provides U.S. developers and retailers with the tools to build AI-powered assistants that enhance human staff support. The scalability of these assistants-capable of handling large volumes of customer interactions 24/7 while delivering tailored solutions-positions them as critical assets for U.S. retailers navigating high competition and customer expectations.

Offering Insights

The growth of solution offerings in AI shopping assistance is accelerating as retailers and technology providers expand beyond basic chatbots to deliver comprehensive, multi-modal platforms. Companies are increasingly integrating voice, text, and visual AI assistants across websites, mobile apps, and social commerce channels to create seamless and personalized shopping journeys. Advanced solutions such as virtual try-ons, intelligent product discovery, and recommendation engines are gaining traction, driven by consumer demand for convenience and tailored experiences. Major players like Amazon, Walmart, Microsoft, and NVIDIA are investing heavily in scalable AI frameworks and generative AI models, fueling innovation across the sector. Additionally, the integration of AI shopping assistants into omnichannel retail strategies supports stronger engagement and higher conversion rates, making solution-driven offerings a central growth pillar in the U.S. market.

The service segment of AI shopping assistance is witnessing strong momentum as enterprises increasingly rely on managed services, consulting, and system integration to deploy and scale AI solutions effectively. Retailers and e-commerce players are seeking customized implementation support, training, and continuous optimization to ensure AI assistants align with their customer engagement strategies. Service providers are also focusing on maintenance, upgrades, and performance monitoring, helping businesses maximize ROI while reducing operational complexities. The rise of cloud-based AI services and API-driven models is further enabling faster adoption, particularly among mid-sized retailers who may lack in-house expertise. With growing investments from U.S. technology firms and specialized service providers, the service segment is becoming a critical enabler of personalization, automation, and long-term scalability in the U.S. AI Shopping Assistant industry.

Technology Insights

The Natural Language Processing (NLP) segment accounted for the largest revenue share of the U.S. AI shopping assistant market in 2024, as it enables AI shopping assistants to understand and engage with customers using natural, conversational language. This capability is fundamental for chatbots, voice assistants, and virtual agents that respond instantly to queries, product recommendations, and support. NLP allows AI systems to interpret intent, context, and sentiment, making interactions more human-like and effective. Its application spans multiple languages and dialects, broadening accessibility and enhancing user experience U.S.ly. Retailers benefit from NLP-driven assistants by reducing response times, increasing customer satisfaction, and lowering support costs. The continuous evolution of Natural Language Processing (NLP) models improves accuracy and expands use cases, solidifying its leadership in the market.

The Computer Vision (CV) segment is expected to grow at the fastest CAGR during the forecast period due to its ability to transform visual product discovery and customer engagement. Major players in this market are significantly contributing towards market expansion. For instance, in September 2025, Amazon launched Lens Live, a real-time visual search feature integrated into the Amazon Shopping app for iOS in the U.S. Users can point their cameras at objects in their environment to instantly see matching or similar products via a swipeable carousel. The feature leverages on-device computer vision models and AWS-backed deep-learning embeddings to deliver fast, accurate results. It also incorporates Amazon’s AI assistant Rufus, providing conversational summaries and suggested questions, all without leaving the camera view.

Type Insights

The text segment accounted for the largest revenue share of the U.S. AI shopping assistant industry in 2024, as it supports various applications, including chatbots on websites, messaging platforms, and in-app assistants. Text interfaces are widely accessible, easy to deploy, and familiar to users, making them a preferred initial type. Moreover, in January 2025, NVIDIA unveiled the NVIDIA AI Blueprint for retail shopping assistants, a generative AI reference workflow built on its AI Enterprise and Omniverse platforms. The blueprint empowers developers to design AI agents that can interpret text and image prompts, support virtual try-ons, and operate alongside human staff delivering personalized, 24/7 shopping experiences that boost shopper engagement, conversion, and operational efficiency. Early access partners, including SoftServe and Dell Technologies, are already deploying the blueprint to accelerate AI innovation in the retail sector.

The multimodal segment is expected to experience the fastest CAGR during the forecast period. Multimodal AI shopping assistants are rapidly gaining traction as they combine voice, text, and visual inputs to deliver more natural and flexible user experiences. This approach aligns with American consumers’ evolving expectations, as they increasingly prefer to switch seamlessly between speaking, typing, and using visual search while shopping online or in stores. Multimodal systems also improve accessibility for U.S. user groups, including individuals with disabilities or those navigating language barriers in a highly diverse population. By supporting advanced shopping tasks such as product comparison, virtual try-ons, and hyper-personalized recommendations, these assistants leverage multiple data streams to enhance accuracy and convenience. In the U.S., retailers adopting multimodal AI assistants such as Amazon’s Lens Live and Walmart’s AI Sparky are already seeing improvements in customer engagement, satisfaction, and loyalty, reinforcing the role of multimodal AI as a critical driver of growth in the American retail landscape.

End Use Insights

The retail & e-commerce segment accounted for the largest revenue share of the U.S. AI shopping assistant market in 2024 due to their early adoption and extensive use of AI shopping assistants to meet increasing consumer demands for personalized and efficient shopping experiences. The competitive nature of this sector drives continuous investment in AI tools that enhance product discovery, reduce cart abandonment, and increase conversion rates. For instance, in November 2024, AWS introduced a generative AI-powered U.S. AI Shopping Assistant for e-commerce, showcased through a demo that guides users to add everything needed for a home project into their cart just by recognizing their intent. Built on a flexible AWS architecture incorporating Amazon Bedrock, CloudFront, Lambda, AppSync, DynamoDB, and OpenSearch Service, the assistant delivers personalized recommendations that reduce decision fatigue and mimic the expert guidance of an in-store associate.

The healthcare segment is expected to grow at the fastest pace as the AI shopping assistant technologies expand beyond retail into patient engagement and healthcare product recommendations. The U.S. healthcare providers and digital health platforms are increasingly leveraging AI assistants to help patients navigate complex healthcare products, schedule appointments, and access personalized health information, thereby improving the overall patient experience. The rapid digitization of healthcare services in the U.S. and the widespread adoption of telemedicine are driving demand for virtual assistants that can deliver timely and accurate support. Moreover, AI-powered shopping assistants are being integrated into U.S. healthcare ecosystems to support medication management, wellness tracking, and tailored product suggestions aligned with individual health profiles, reinforcing their role in enhancing care accessibility and efficiency.

Key U.S. AI Shopping Assistant Company Insights

Some key companies in the U.S. AI shopping assistant industry are Alibaba Group Holding Limited; Shopify Inc.; Amazon.com, Inc.; and Google LLC.

-

Google LLC is a prominent player in AI-driven shopping experiences, leveraging its advanced Gemini AI models. Its AI Mode offers hyper-personalized browsing with visual inspiration, dynamic filtering, and virtual try-on features that allow users to see apparel on themselves using uploaded photos. Google LLC's U.S. AI Shopping Assistant also includes an agentic checkout system that can complete purchases on behalf of users, enhancing convenience and confidence in online shopping. These innovations position Google LLC at the forefront of integrating AI to transform e-commerce and improve customer engagement.

-

Amazon.com, Inc. is a prominent player in the U.S. AI Shopping Assistant market, utilizing advanced AI technologies to power personalized recommendations, virtual assistants, and voice-activated shopping through devices such as Alexa. Its AI capabilities enhance product discovery, streamline the customer journey, and support seamless transactions across its vast e-commerce ecosystem. Amazon.com, Inc.'s continuous innovation in AI-driven shopping tools strengthens its leadership by delivering tailored user experiences, reducing purchase friction, and driving higher customer satisfaction and loyalty.

Key U.S. AI Shopping Assistant Companies:

- Amazon.com, Inc.

- eBay Inc.

- Google LLC

- IBM Corporation

- Meta Platforms, Inc.

- Microsoft

- Salesforce, Inc.

- Shopify Inc.

- Walmart (Sparky)

Recent Developments

-

On March 28, 2025, Amazon introduced two cutting-edge AI assistants-“Interests”, a conversational shopping assistant that uses natural language prompts to surface tailored product recommendations from its vast catalog, and “Health AI”, a generative chatbot designed to offer reliable health information, symptom guidance, and related product suggestions. Both features are currently being piloted with select U.S. customers via the Amazon app and website, signaling Amazon’s drive toward more personalized and interactive experiences in commerce and digital well-being.

-

In July 2025, Amazon.com, Inc. expanded the availability of its AI-powered shopping assistant, Rufus, by launching it on a desktop-based web interface. Initially introduced in India in August 2024 exclusively through mobile apps, this rollout allows users to access Rufus via desktop, enhancing the shopping experience by providing real-time product recommendations, comparisons, and personalized assistance. Rufus leverages Amazon.com, Inc.'s extensive product catalog and information from across the web to help customers make more informed purchase decisions. The assistant remains in beta, with ongoing improvements based on user feedback to refine its responses and capabilities.

-

In June 2025, Google LLC introduced Doppl, an experimental AI-powered shopping assistant that lets users virtually try on clothing and explore various styles through digital or animated representations. Launched for users in the U.S., Doppl leverages advanced computer vision and Machine Learning (ML) technologies to provide an immersive and interactive shopping experience, facilitating more informed fashion choices and reducing the need for physical trials. This initiative reflects Google LLC's ongoing efforts to integrate AI into retail, enhancing personalization and convenience in online shopping.

U.S. AI Shopping Assistant Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,271.8 million

Revenue forecast in 2033

USD 7,548.9 million

Growth rate

CAGR of 24.9% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, technology, type, and end use

Key companies profiled

Adobe Inc.; Amazon.com, Inc.; eBay Inc.; Google LLC; IBM Corporation; Meta Platforms, Inc.; Microsoft; Salesforce, Inc.; Shopify Inc.; Walmart (Sparky)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. AI Shopping Assistant Market Report Segmentation

This report forecasts revenue growth at the U.S. level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. AI shopping assistant market report based on offering, technology, type, and end use:

-

Offering Outlook (Revenue, USD Million, 2021 - 2033)

-

Solution

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Natural Language Processing (NLP)

-

Machine Learning (ML)

-

Computer Vision (CV)

-

Others

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Voice

-

Text

-

Visual

-

Multimodal

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

BFSI

-

Retail & E-Commerce

-

Healthcare

-

Travel & Hospitality

-

Media & Entertainment

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. AI shopping assistant market size was estimated at USD 1,020.6 million in 2024 and is expected to reach USD 1,271.8 million in 2025.

b. The U.S. AI shopping assistant market is expected to grow at a compound annual growth rate of 24.9% from 2025 to 2033 to reach USD 7,548.9 million by 2033.

b. The solution segment accounted to hold largest revenue share of 70.2% in 2024. The growth of solution offerings in AI shopping assistance is accelerating as retailers and technology providers expand beyond basic chatbots to deliver comprehensive, multi-modal platforms.

b. Some key players operating in the U.S. AI shopping assistant market include Adobe Inc.; Amazon.com, Inc.; eBay Inc.; Google LLC; IBM Corporation; Meta Platforms, Inc.; Microsoft; Salesforce, Inc.; Shopify Inc.; Walmart (Sparky)

b. Key factors that are driving the market growth include the retailers increasingly integrate AI assistants into online and brick-and-mortar stores to enhance customer engagement and operational efficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.