- Home

- »

- Medical Devices

- »

-

U.S. Anti-acne Dermal Patch Market, Industry Report, 2033GVR Report cover

![U.S. Anti-acne Dermal Patch Market Size, Share & Trends Report]()

U.S. Anti-acne Dermal Patch Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Chemical-based, Herbal-based), By Age Group (10 to 17, 18 to 44, 45 to 64, 65+), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-617-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Anti-acne Dermal Patch Market Trends

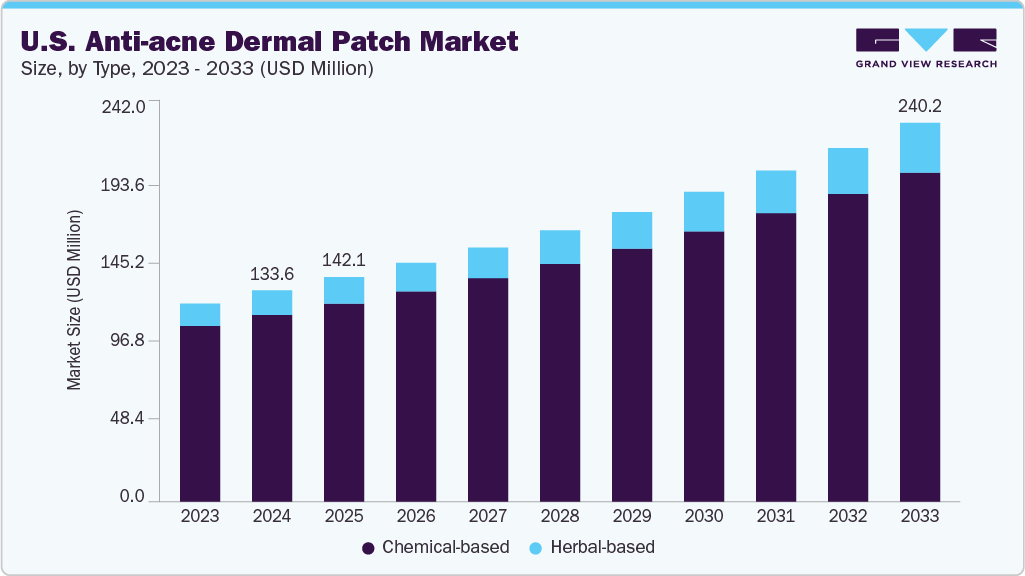

The U.S. anti-acne dermal patch market size was estimated at USD 133.6 million in 2024 and is expected to grow at a CAGR of 6.8% from 2025 to 2033. Diabetes and obesity, which remain at epidemic levels in the U.S., are linked to hormonal imbalances that can trigger acne, thereby contributing to the rising prevalence of acne and increasing the adoption of anti-acne dermal patches. According to the U.S. Pharmacist, major components of the booming U.S. anti-acne market are the extensive marketing of these products, implications of increased self-confidence & clearer skin, and availability of several such products.

According to the American Academy of Dermatology, acne is the most common and prevalent skin condition in the U.S., affecting between 40 million and 50 million individuals. As per a study conducted by JAMA Dermatology, acne is a universal skin disease, affecting 79% to 95% of the adolescent population in westernized societies such as the U.S., and the prevalence of acne increases with age. It also revealed that up to 85% of the U.S. population will be affected by acne vulgaris at some point in their lives.

The growing demand for natural and organic products, along with personalized skincare solutions, is set to drive the U.S. anti-acne dermal patch industry. Consumers are increasingly seeking eco-friendly, chemical-free options that align with sustainability and skin health values. Furthermore, the growing trend of personalized skincare-where products are tailored to individual skin types and concerns-enables more effective solutions, enhancing customer satisfaction. These trends contribute to a shift toward premium, customized, natural anti-acne products, fueling the growth of the U.S. anti-acne derma patch industry.

Type Insights

The chemical-based anti-acne dermal patches held the largest market share of 88.45% in 2024, as these patches are mainly made from hydrocolloid, salicylic acid, hyaluronic acid, and benzoyl peroxide. These pimple patches can be effective on mild breakouts and superficial pimples like small whiteheads & pustules; however, they cannot fight the underlying reason for acne vulgaris. This can be a short-term solution for people suffering from acne.

The herbal-based anti-acne dermal patch segment is anticipated to witness the fastest CAGR of 8.4% during the forecast period. Generally, acne patches are composed of synthetic substances. Natural acne patches do not have any synthetic substances in their composition. They are made from ingredients such as silk and mulberries that can be easily produced. Silk is composed of fibroin and sericin, with fibroin known to accelerate fibroblast growth, promoting faster healing of acne wounds. The rising global demand for herbal-based skincare products valued for their natural healing properties and minimal side effects is a key driver fueling the segment’s growth.

Age Group Insights

The 18 to 44 age group segment held the largest revenue share of 54.74% in 2024. Increasing demand for instant acne treatment and medication is one of the major factors supporting market growth. Furthermore, growing demand for anti-acne dermal patches among the population, especially among the teenage group, owing to its mass marketing across social media platforms, has also boosted its adoption in the past few years. Almost everyone in the age group of 18 to 44 years uses smartphones, implying that they have the highest exposure to social media platforms, which helps raise awareness about healthy skin & recommends effective products. Moreover, this age group is also among the working population, meaning they have high disposable income and a desire to look healthy & young.

The 10 to 17 age group segment is poised to witness considerable growth in the U.S. anti-acne dermal patch market over the forecast period, owing to an increasing number of teenagers adopting acne patches in U.S. High adoption is due to the strong social media marketing of the products that attract a large portion of the teenage population.

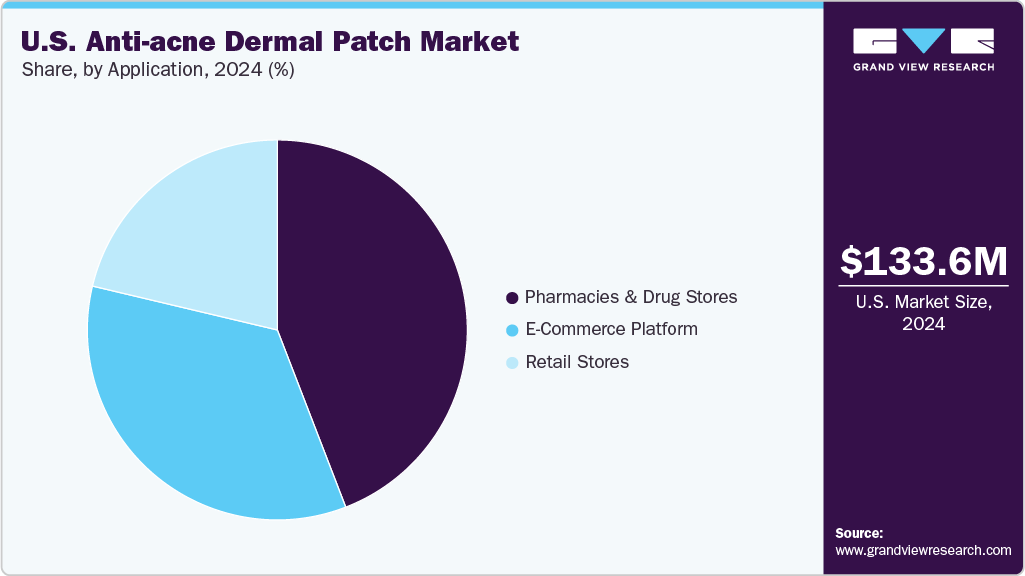

Distribution Channel Insights

The pharmacies and drug stores segment dominated the U.S. anti-acne dermal patch industry and held the highest revenue share of 44.14% in 2024. The major growth drivers include health and beauty stores, which have a wide range of products, including cosmetics, skincare, & perfumes, and these stores are highly accessible, with a few being well-established in the market. The high growth of the segment is mainly attributable to the increasing use of OTC products from drug stores and pharmacies for the self-management of acne.

The E-commerce platform is anticipated to witness the fastest CAGR of 7.4% during the forecast period, as consumers are increasingly opting for e-commerce websites for ordering items of daily requirement as it is convenient, saves a lot of time, and provides favorable discount rates & affordable prices, which are among the major factors boosting the popularity of e-commerce sites among end users.

The e-commerce market is experiencing continuous growth by providing every possible service and comfort to consumers, such as home deliveries, refunds, and discounts. Consumers can compare dozens of products through ratings and reviews on a single platform and make informed decisions.

Key U.S. Anti-acne Dermal Patch Companies:

- ZitSticka

- 3M

- Starface

- Hero Cosmetics

- Sephora USA, Inc.

- Blackbird Skincare

- Peach & Lily

- Amparo Medical Technologies

- Hi-Tech Products

- Peace Out Skincare

U.S. Anti-acne Dermal Patch Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 142.1 million

Revenue forecast in 2033

USD 240.2 million

Growth rate

CAGR of 6.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, age group, distribution channel

Country scope

U.S.

Key companies profiled

ZitSticka, 3M, Starface, Hero Cosmetics, Sephora USA, Inc., Blackbird Skincare, Peach & Lily, Amparo Medical Technologies, Hi-Tech Products, Peace Out Skincare

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Anti-acne Dermal Patch Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. anti-acne dermal patch market report based on type, age group, and distribution channel:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Chemical-based

-

Herbal-based

-

-

Age Group Outlook (Revenue, USD Million, 2021 - 2033)

-

10 to 17

-

18 to 44

-

45 to 64

-

65+

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Retail Stores

-

Pharmacies & Drug Stores

-

E-commerce Platform

-

Frequently Asked Questions About This Report

b. The U.S. anti-acne dermal patch market size was estimated at USD 133.6 million in 2024 and is expected to reach USD 142.1 billion in 2025.

b. The U.S. anti-acne dermal patch market is expected to grow at a compound annual growth rate of 6.8% from 2025 to 2033 to reach USD 240.2 million by 2033.

b. Chemical Based dominated the U.S. anti-acne dermal patch market with a share of 88.5% in 2024 as these patches are majorly made from hydrocolloid, salicylic acid, hyaluronic acid, and benzoyl peroxide. These pimple patches can be effective on mild breakouts and superficial pimples like small whiteheads & pustules.

b. Some of the players operating in this market are ZitSticka, 3M, Starface, Hero Cosmetics, Sephora USA, Inc., Blackbird Skincare, Peach & Lily, Amparo Medical Technologies, Hi-Tech Products, Peace Out Skincare

b. Key factors that are driving the U.S. anti-acne dermal patch market growth include the growing demand for natural and organic products, along with personalized skincare solutions, is set to drive the U.S. anti-acne dermal patch industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.