U.S. Aortic Valve Replacement Devices Market Summary

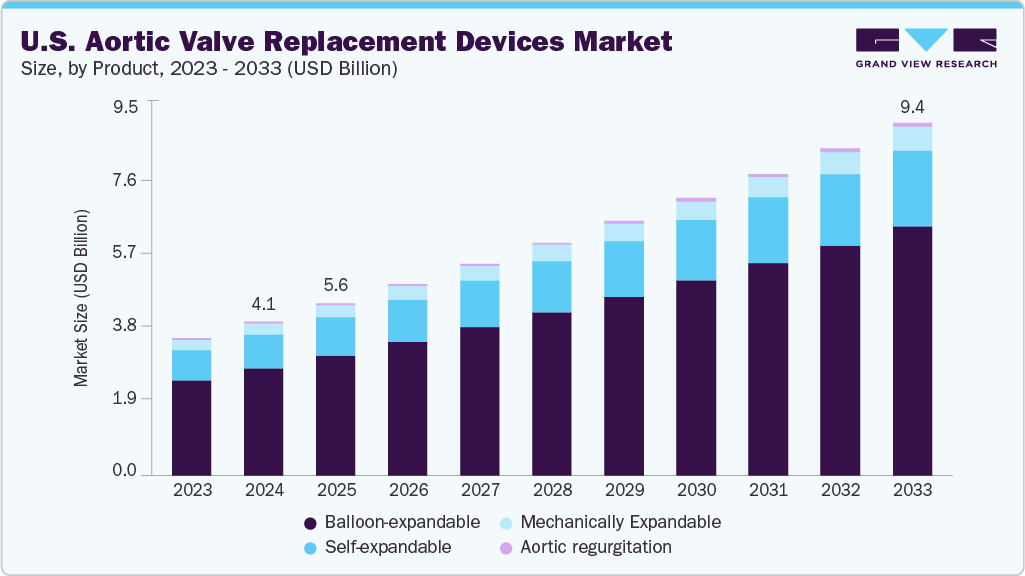

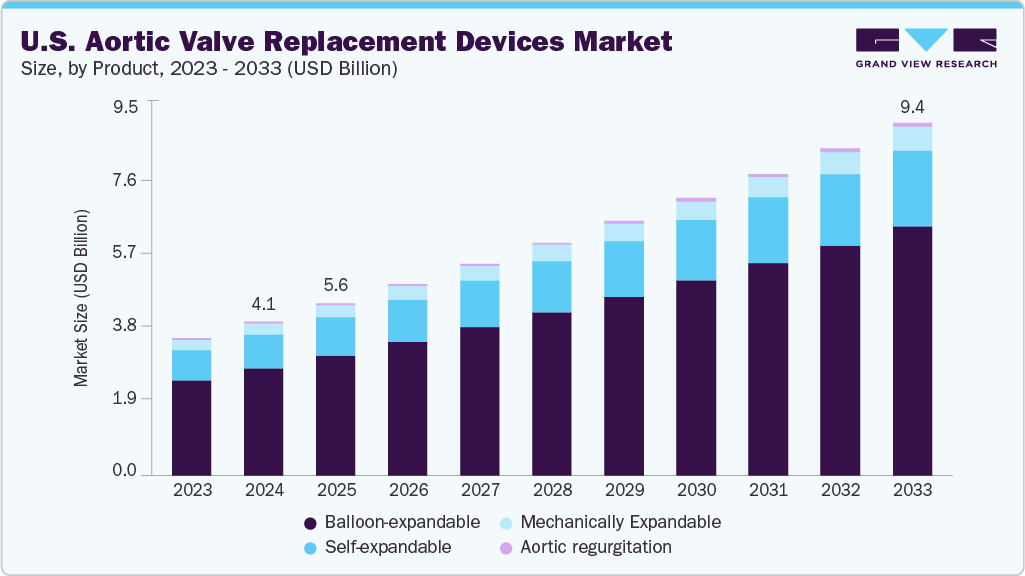

The U.S. aortic valve replacement devices market size was estimated at USD 4.08 billion in 2024 and is projected to reach USD 9.35 billion by 2033, growing at a CAGR of 9.4% from 2025 to 2033. The market is primarily driven by the increasing prevalence of aortic stenosis in an aging population and favorable clinical outcomes from surgical and transcatheter approaches.

Key Market Trends & Insights

- By product, the balloon-expandable segment held the largest market share of 69.5% in 2024.

- Based on leaflet material, the bovine pericardium segment held the largest market share in 2024.

- By frame material, the cobalt-chromium segment held the largest market share of 64.8% in 2024.

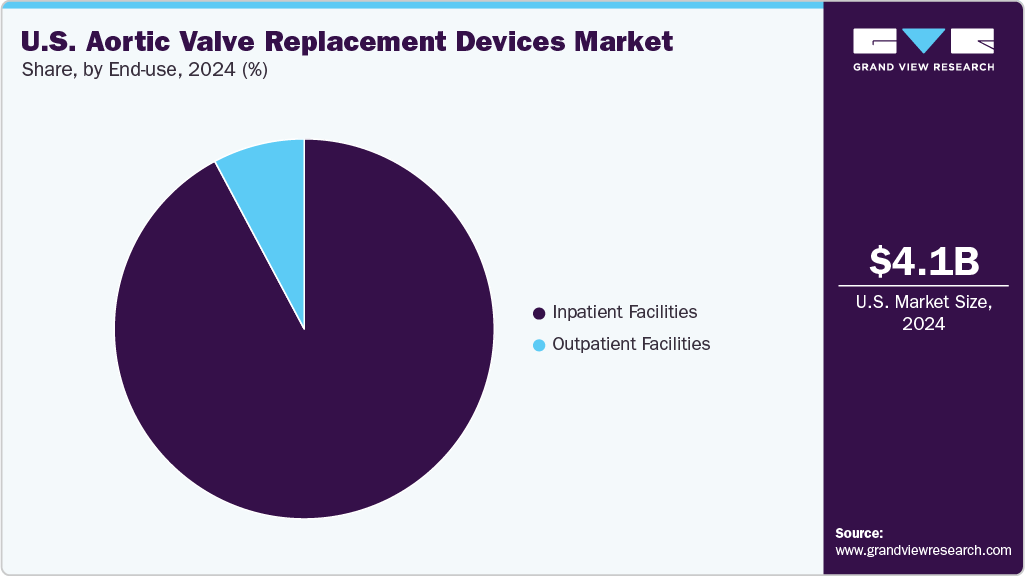

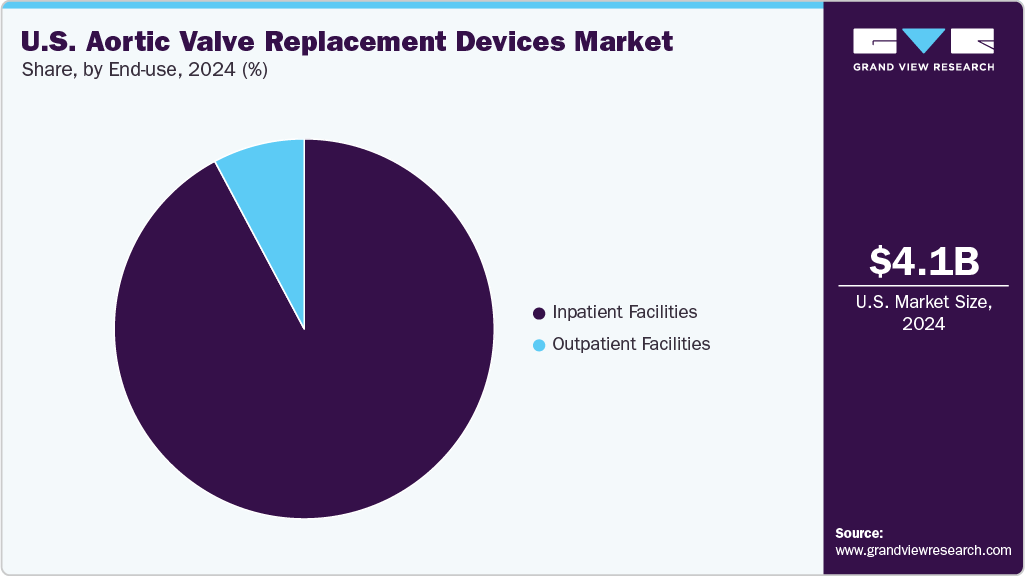

- Based on end use, the inpatient facilities segment held the largest market share of 92.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.08 Billion

- 2033 Projected Market Size: USD 9.35 Billion

- CAGR (2025-2033): 9.4%

With a growing number of patients over age 65, demand for surgical aortic valve replacement (SAVR) and transcatheter aortic valve replacement (TAVR) continues to rise. Clinical outcomes have improved significantly over the past decade, with TAVR gaining wider acceptance due to its less invasive nature and reduced recovery times. As per the article on the Southwestern Medical Center website, approximately 100,000 TAVR procedures are performed annually in the U.S and as of November 2024, the medical centre had performed more than 1,000 transcatheter aortic valve replacement (TAVR) procedures.

Innovation remains a critical driving force within this market, with a strong focus on enhancing device durability and improving delivery systems for less invasive procedures. Manufacturers are continuously investing in research and development to extend the lifespan of prosthetic valves, which is crucial for younger patients who may live longer with their implanted devices.

Merger and acquisition is moderately high, driven by strategic efforts to gain technological advantages or market access. In July 2024, Edwards Lifesciences announced a strategic investment of around USD 1.2 billion to acquire JenaValve Technology and Endotronix, expanding its structural heart portfolio. Acquiring JenaValve Technology enhances Edward’s position in the U.S. aortic valve replacement devices industry, targeting the underserved aortic regurgitation segment. The purchase of Endotronix, following an earlier investment, allows Edwards to enter heart failure management with its FDA-approved Cordella sensor. These strategic moves aim to address unmet patient needs and support long-term growth.

The FDA requires extensive clinical trials and post-market surveillance, which can delay product launches and ensure high safety standards. In May 2025, the FDA approved Edwards Lifesciences Sapien 3 Ultra Resilia TAVR valves for treating asymptomatic severe aortic stenosis (AS).

Product Insights

Based on product, the balloon-expandable segment accounted for the largest revenue share of 69.5% in 2024 and is expected to grow at the fastest CAGR over the forecast period. These valves are known for their precise placement and strong performance in patients with calcified aortic anatomy. Physicians favor them as they have robust clinical data that underpins their efficacy, improving patient outcomes.

The self-expandable segment is expected to grow significantly over the forecast period. This growth is driven by continuous technological advancements that enhance device design, improve deliverability, and aim to address specific anatomical challenges. In January 2023, Abbott received U.S. Food and Drug Administration (FDA) approval for its self-expandable Navitor TAVI system to treat high-risk patients with severe aortic stenosis.

Leaflet Material Insights

Based on leaflet material, bovine pericardium held the largest revenue share of 73.4% in 2024. This is attributed to its biocompatibility and superior mechanical properties. Since it is rich in collagen, it offers the required strength and elasticity for durable bioprosthetic heart valves. Its strong clinical track record enhances its appeal, promoting adoption in valve replacement procedures. Leading manufacturers such as Edwards Lifesciences (SAPIEN 3) and Medtronic (Avalus Ultra bioprosthesis) utilize bovine pericardium in their flagship surgical and transcatheter valves.

The porcine pericardium segment is expected to grow significantly over the forecast period. It offers a thinner profile than bovine pericardium, thereby offering flexibility and larger effective orifice areas, improving hemodynamics.

Frame Material Insights

The cobalt-chromium segment held the largest revenue share, 64.8%, in 2024 and is expected to grow at the fastest CAGR over the forecast period. It exhibits exceptional mechanical properties, including durability, strength, and corrosion resistance, making it ideal for constructing a TAVR device. Its design allows for thinner struts, reducing valve thrombosis risk and improving hemodynamic performance.

The nitinol segment is anticipated to grow at a significant CAGR of about 9.2% from 2025 to 2033. This adoption is driven by nitinol's unique superelastic and shape-memory properties, which are advantageous for self-expanding TAVR systems.

End Use Insights

Based on end use, the inpatient facilities segment held the largest revenue share of 92.2% in 2024. This is attributed to the complexity of surgical aortic valve replacement (SAVR) and transcatheter aortic valve replacement (TAVR) procedures, which typically require advanced infrastructure and post-operative care. As reported by the Cleveland Clinic, approximately 419 SAVR and 699 TAVR procedures were performed in the center in 2023, highlighting the high procedural volume managed within hospital settings.

Outpatient facilities are the fastest-growing segment in the aortic valve replacement devices industry. The shift toward shorter recovery times and reduced hospital stays enables select low-risk and intermediate-risk patients to undergo transcatheter aortic valve replacement (TAVR) procedures in outpatient or same-day discharge settings.

Key U.S. Aortic Valve Replacement Devices Company Insights

Most companies focus on R&D efforts, mergers, acquisitions, collaborations, and partnerships to achieve greater market share.

Key U.S. Aortic Valve Replacement Devices Companies:

- Boston Scientific Corporation

- Artivion, Inc

- Edwards Lifesciences Corporation

- LivaNova PLC

- Medtronic

- Abbott

Recent Developments

- In March 2024, Medtronic received FDA approval for its Evolut FX+ TAVR system, which features larger coronary access windows. This innovation, while maintaining strong valve performance, expands treatment options for severe aortic stenosis patients across all risk categories.

U.S. Aortic Valve Replacement Devices Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 4.56 billion

|

|

Revenue forecast in 2033

|

USD 9.35 billion

|

|

Growth rate

|

CAGR of 9.4% from 2025 to 2033

|

|

Historical Period

|

2021 - 2023

|

|

Actual data

|

2024

|

|

Forecast period

|

2025 - 2033

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, leaflet material, frame material, end use

|

|

Key companies profiled

|

Boston Scientific Corporation; Artivion, Inc; Edwards Lifesciences Corporation; LivaNova PLC; Medtronic; Abbott

|

|

Customization scope

|

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to the country & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Aortic Valve Replacement Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. aortic valve replacement devices market report based on product, leaflet material, frame material, and end use.

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Balloon-expandable

-

Self-expandable

-

Mechanically expandable

-

Aortic regurgitation

-

Leaflet Material Outlook (Revenue, USD Billion, 2021 - 2033)

-

Bovine pericardium

-

Porcine pericardium

-

Frame Material Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cobalt-chromium

-

Nitinol

-

Others

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Inpatient Facilities

-

Outpatient Facilities