- Home

- »

- Healthcare IT

- »

-

U.S. AI In Oncology Market Size, Share, Growth, Report, 2030GVR Report cover

![U.S. AI In Oncology Market Size, Share & Trends Report]()

U.S. AI In Oncology Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Software Solutions, Hardware), By Cancer Type (Breast Cancer, Lung Cancer), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-197-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

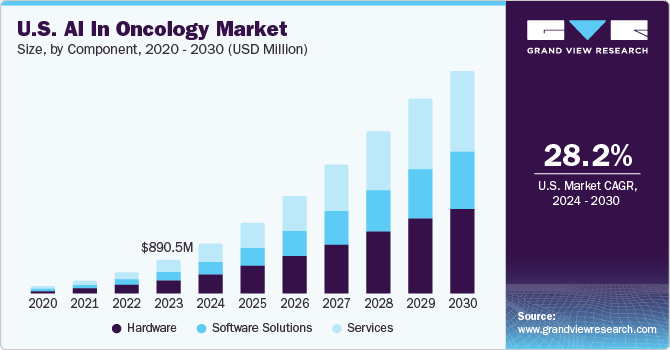

The U.S. AI in oncology market size was estimated at USD 890.5 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 28.25% from 2024 to 2030. The market growth is attributed to an increasing prevalence of cancer, technological advancement in AI-based diagnostic techniques, rapidly improving healthcare infrastructure, and an increasing demand for early and accurate diagnosis of cancer. The rising initiatives undertaken by public and private organizations to invest in R&D for the introduction of novel technologies are further anticipated to fuel market growth. For instance, in October 2022, Vara raised funding of USD 4.4 million to introduce an AI-enabled breast cancer screening platform for millions of women.

According to the National Institutes of Health (NIH) estimates of 2023, approximately 2.0 million individuals in the U.S. are diagnosed with cancer annually. Breast cancer was the most diagnosed cancer, with an estimated 297,790 cases in women and 2,800 cases in men. Among men, prostate cancer was the most frequently diagnosed, and overall, it was the second-most common diagnosis, with an anticipated 288,300 cases. The estimated number of new cases of lung and bronchus cancer made it the third-most diagnosed. The total count of new cases for this type of cancer was 238,340. Such increasing cancer cases will generate large amounts of data, thereby boosting the demand for AI.

The COVID-19 pandemic had a positive impact on market growth as it significantly drove demand for AI utilization in oncology as restrictions on movement were imposed in hospitals and homecare settings. Due to lockdown and travel restrictions, patients’ diagnosis, care, and treatment were some of the major challenges due to which, the need to develop products that can help in providing solutions in remote locations at an early stage significantly increased. Furthermore, due to a shortage of medical professionals, the use of AI has grown even more to provide better results to patients.

Market Concentration & Characteristics

One of the key factors responsible for overall market growth is the increasing prevalence of cancer. According to WHO, cancer is the leading cause of death worldwide accounting for the death of nearly one in every six individuals accounting for 10 million of the population. The majority of cancer deaths occur due to lung cancer which accounted for 2.21 million cases and 1.80 million deaths in 2020. The rising prevalence of cancer and shortages of healthcare professionals are propelling the adoption of AI to meet the rising demand for novel solutions to provide efficient and accurate diagnosis and treatment.

Technological advancements and the incorporation of AI in applications, such as classification, detection, segmentation, characterization, and monitoring, are fueling market growth. Government and private interest in applications of AI in oncology is enhancing the diagnostic and therapeutic scenario of providing efficient oncological solutions. For instance, in January 2024, the U.S. FDA approved the first AI medical device, DermaSensor, to detect skin cancer. This technology is designed to offer primary care physicians a real-time, non-invasive tool to detect all common skin cancers, melanoma, basal cell carcinoma, and squamous cell carcinoma.

Companies are undertaking mergers and acquisitions, partnerships, and collaboration majorly for geographic expansion and broadening product/technology portfolios. Several key players are acquiring smaller players to strengthen their market positions. This strategy enables companies to increase their capabilities, expand product portfolios, and improve competencies. ConcertAI acquired CancerLinQ, previously a subsidiary of the American Society of Clinical Oncology (ASCO). Concurrently, ASCO has entered into a multiyear cooperation agreement with CancerLinQ. The new partnership seeks to build on CancerLinQ’s original mission, launched by ASCO in 2013, to improve cancer care and expedite clinical research. The venture will leverage real-world data, analytics, next-generation AI, and other advanced technologies to enhance and expand CancerLinQ’s capabilities.

Companies are developing AI solutions for specific cancer types and their treatment in different stages, thus offering more precise modes of treatment. The integration of AI in oncology with Electronic Health Records (EHR) and imaging systems plays a crucial role in product expansion. Moreover, companies are accelerating innovations in the scalability and accessibility of information and building trust, which will result in market growth. For instance, Philips launched an AI-powered imaging and reporting tool for prostate cancer detection, whereas Illumina introduced Connected Insights software to tertiary analysis in oncology and rare diseases.

U.S. economies are laying down stringent regulations for the development & adoption of AI. For instance, in May 2021, the U.S. government initiated AI.gov, a dedicated website aimed at soliciting ideas regarding the development, application, and regulation of AI under the administration of President Joe Biden. Similarly, in January 2020, the U.S. reviewed and reformed AI applications. The guidelines were on the lines of public trust & participation, scientific integrity, risk management, benefits & cost analysis, fairness & unbiased modules, disclosure & transparency, and interagency coordination.

The increasing prevalence of cancer globally creates a demand for AI-based solutions. The growing healthcare infrastructure, cost-effectiveness & efficiency, and government initiatives are the major reasons for the geographic expansion of the market. For instance, IBM Watson Health expanded its AI-powered oncology solutions like Watson for Drug Discovery to regions like China and Europe. In October 2023, Roche partnered with Amazon Web Services and Ibex Medical Analytics to accelerate the adoption of Ibex’s AI-powered decision support tools to improve cancer diagnoses. Similarly, in July 2023, Massive Bio partnered with CureMatch to increase access to precision oncology treatments and cancer clinical trials through the AI platforms.

Component Insights

Based on components, hardware dominated the market with a revenue share of 39.4% in 2023 and is anticipated to continue its dominance over the forecast period. AI hardware refers to physical components and systems tailored to meet the computational demands of AI algorithms. Medical linear accelerators, crucial in oncology for radiotherapy, fall within this scope. For example, Varian's Ethos therapy, an AI-powered adaptive radiotherapy treatment system with a linear accelerator, obtained regulatory clearances in 2019 and 2020. Ethos therapy enhances radiotherapy by providing adaptive treatments within a 15-minute time slot. The growing demand for AI-powered diagnostic solutions in automated detection systems is expected to support the delivery of improved diagnostic precision while interpreting medical images of a patient.

In addition, the growing demand for hardware platforms with high computing power to operate AI-based software contributes to segment growth. The software solutions segment is anticipated to witness the fastest CAGR from 2024 to 2030. The increasing adoption of AI software solutions by healthcare providers and payers operating in oncology is one of the major factors fueling the segment growth. Software solutions are highly effective at predicting various types of cancer, including brain, breast, liver, lung, and prostate cancer. They offer better accuracy compared to clinicians. Hence, numerous key players are focusing on developing & launching new tools and platforms, increasing the competition in the market.

Cancer Type Insights

Based on cancer type, the others segment held the largest revenue share of 25.4% in 2023 and is anticipated to grow at a lucrative CAGR from 2024 to 2030. The dominance of this segment is attributed to increasing prevalence of kidney cancer. According to the Global Cancer Observatory, kidney cancer is among the top 10 types of cancer. Some of the causes for this cancer type include inherited syndromes, high blood pressure, obesity, smoking, old age, long-term dialysis, and a family history of kidney cancer. Common diagnosing techniques include blood tests and imaging procedures, such as CT, Magnetic Resonance Imaging (MRI), and ultrasound. In addition, various awareness programs undertaken by public & private organizations to improve awareness about kidney cancer are expected to support market growth.

The prostate cancer segment is expected to register the fastest CAGR from 2024 to 2030. Prostate cancer generally affects 13 out of every 100 men in the U.S., according to the data published by the CDC. Moreover, according to the National Cancer Institute, in 2023, approximately 288,300 new prostate cancer cases were diagnosed. Some of the risk factors for prostate cancer include age, family history of prostate cancer, diet, smoking, obesity, chemical exposure, and vasectomy. Obesity has a substantial impact on men suffering from advanced & aggressive (fast-growing) prostate cancer. According to certain studies, obesity is also linked with higher chances of death.

Application Insights

Based on application, the diagnostics segment dominated the market with a revenue share of 37.5% in 2023. Cancer diagnostics is an essential starting point for designing relevant therapeutic strategies and clinical management, and its AI-based advancement makes it more efficient and effective. Furthermore, early cancer diagnosis and AI are rapidly developing fields with significant convergence areas. Diagnosing cancer at an initial stage increases the possibility of delivering effective treatment in multiple tumor groups. Hence, several companies are developing approaches for early diagnosis that include screening patients at risk with no symptoms & appropriately and rapidly investigating those who do.

The research & development segment is expected to register the fastest CAGR from 2024 to 2030 owing to the modern pharmaceutical companies that are increasingly adopting AI to accelerate and improve various aspects of clinical development. The potential of AI extends to aiding pharmaceutical corporations in introducing medications to the market. AI currently exceeds its gene-sequencing capabilities as it undergoes training to anticipate drug effectiveness and potential adverse reactions. Furthermore, according to a report published by IDTechEx in 2021, several key companies, such as Turbine AI, Relay Therapeutics, and Erasca, are focusing on developing cancer therapies. Moreover, the report showed that oncology held a major focus for AI drug discovery companies constituting 45%.

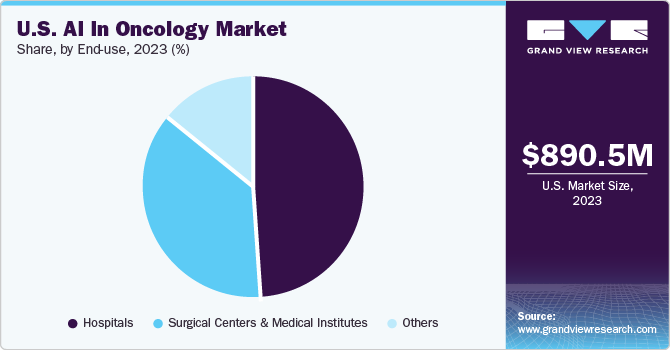

End-use Insights

The hospitals segment dominated the market with a revenue share of 48.7% in 2023owing to the rising demand for AI applications to revolutionize medicine and advance research, diagnostics, & cancer treatment. Furthermore, the growing adoption of AI in pathology solutions, especially for cancer diagnostics, is a major market driver. The hospitals segment is expected to grow at the fastest CAGR from 2024 to 2030 due to the rising adoption of AI-powered solutions.

A rising number of companies entering the market to cater to cancer care in hospitals, and positive responses from patients, are expected to boost the market during the forecast period. According to the AI Multiple reports, approximately 12 million individuals in the U.S. are misdiagnosed, of which 44% are misdiagnosed with cancer. The most misdiagnosed cancers are breast cancer, prostate cancer, and thyroid cancer. Hence, integrating AI-powered algorithms in cancer therapy is anticipated to flourish in the hospital segment over the upcoming decade.

Key U.S. AI In Oncology Company Insights

The industry is marked by the presence of major players, developing digital infrastructure, favorable government initiatives, and increasing application scope of AI in oncology. Furthermore, increasing adoption of AI in cancer diagnosis and growing investments in AI healthcare startups are anticipated to propel industry growth. In addition, initiatives undertaken by various research institutes to advance AI applications in the oncology field contribute to market growth. For example, in January 2024, Penn Medicine researchers introduced Inferring Super-Resolution Tissue Architecture (iStar) designed to assist clinicians in diagnosing and treating cancers that might otherwise go undetected.

Key players are adopting new product development, partnership, and merger & acquisition strategies to increase their market share. Companies, such as Azra AI; IBM; Siemens Healthcare GmbH; Intel Corporation; and others, dominate the market. These key players have been developing novel technologies to cater to different end-use applications. For instance, in January 2023, Massive Bio announced the plans to adopt AI use in oncology with the development and launch of a drug-matching product in 2023.

Key U.S. AI In Oncology Companies:

The following are the leading companies in the U.S. AI in oncology market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these U.S. AI in oncology companies are analyzed to map the supply network.

- Azra AI

- iCAD, Inc.

- IBM

- Siemens Healthcare GmbH

- Intel Corporation

- GE HealthCare

- NVIDIA Corporation

- Digital Diagnostics Inc.

- ConcertAI

- Median Technologies

- PathAI

Recent Developments

-

In November 2021, Kheiron Medical Technologies received FDA clearance to introduce its Mia IQ software in the U.S. The software, powered by AI & Machine Learning (ML), is designed to identify potential discrepancies in breast positioning & compression and retrospectively review mammograms

-

In November 2021, the company integrated TeraRecon as a ConcertAI company, integrating electronic health records, genomic datasets, and medical imaging data into one network of AI-powered workflow. This integration made ConcertAI one of the first unified AI-powered SaaS companies in the U.S.

-

In June 2021, ConcertAI collaborated with the U.S. FDA to broaden the usage of real-world data in regulatory decision-making. The U.S. FDA would utilize real-world evidence data in assessing the safety of drugs post-approval

-

In June 2023, iCAD, Inc. signed a strategic multiyear commercial agreement with Radiology Partners, one of the largest radiology practices in the U.S. This will allow iCAD to leverage Radiology Partners’ clinical expertise, AI platform, and scale to expand access to the Company’s Breast AI Suite to millions of patients and their physicians

U.S. AI In Oncology Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 5.9 billion

Growth rate

CAGR of 28.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, cancer type, application, end-use

Country scope

U.S.

Key companies profiled

Azra AI; iCAD, Inc.; IBM; Siemens Healthcare GmbH; Intel Corporation; GE HealthCare; NVIDIA Corporation; Digital Diagnostics Inc.; ConcertAI; Median Technologies; PathAI

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. AI in Oncology Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. AI in oncology market report based on component, cancer type, application, and end-use:

-

Component Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Software Solutions

-

Hardware

-

Services

-

-

Cancer Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Breast Cancer

-

Lung Cancer

-

Prostate Cancer

-

Colorectal Cancer

-

Brain Tumor

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostics

-

Radiation Therapy

-

Research & Development

-

Chemotherapy

-

Immunotherapy

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Surgical Centers & Medical Institutes

-

Others

-

Frequently Asked Questions About This Report

b. Hardware dominated the artificial intelligence in oncology market with a revenue share of 39.4% in 2023 and is anticipated to continue its dominance over the forecast period.

b. Market players such as Azra AI; IBM; Siemens Healthcare GmbH; Intel Corporation; and others dominate the market. These key players have been developing novel technologies for different end-use applications.

b. The market growth is attributed to an increasing prevalence of cancer, technological advancement in AI based diagnostic techniques, rapidly improving healthcare infrastructure, and an increasing demand for early and accurate diagnosis of cancer.

b. The U.S. AI in Oncology market is estimated at USD 890.5 mllion in 2023 and is expected to reach USD 1.3 billion in 2024.

b. The U.S. AI in Oncology market is expected to grow at a CAGR of 28.2% from 2024 to 2030 to reach USD 5.9 billion in 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.