- Home

- »

- Clinical Diagnostics

- »

-

U.S. Assisted Reproductive Technology Market, Industry Report 2030GVR Report cover

![U.S. Assisted Reproductive Technology Market Size, Share & Trends Report]()

U.S. Assisted Reproductive Technology Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (In-Vitro Fertilization (IVF), Artificial Insemination), By End-use (Fertility Clinics & Other Facilities, Hospitals & Other Settings), And Segment Forecasts

- Report ID: GVR-4-68040-273-5

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

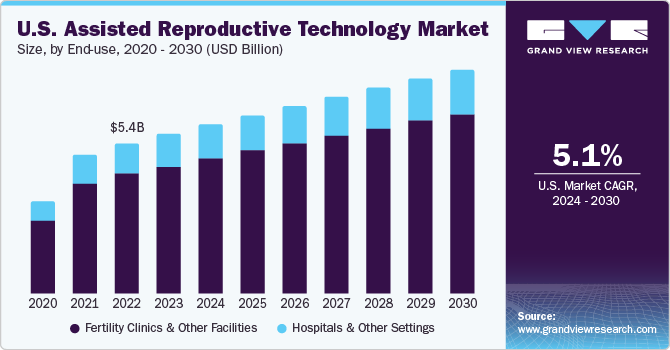

The U.S. assisted reproductive technology market size was valued at USD 5.76 billion in 2023 and is expected to grow at CAGR of 5.1% from 2024 to 2030. With increase in age, fertility declines and there are high chances of abnormalities and other fertility-related health conditions. Increasing cases of infertility paired with improving success rates of IVF and artificial insemination are expected to drive industry growth during the forecast period.

The fertility rate in the U.S. has been decreasing over the years. According to data from the Centers for Disease Control and Prevention (CDC), the birth rate in the country significantly declined from 2007 to 2022, dropping from 14.3 births per 1000 people to 11.1 births. Factors contributing to this decline include the delay in pregnancy and lifestyle changes.

Furthermore, the increasing disposable income of the population is resulting in a high adoption rate of assisted reproductive technology (ART). The growth is also attributed to the large number of medical institutions offering ART-based services. According to the CDC, more than 4 million births are performed using IVF in the U.S. each year. The government is undertaking various initiatives to remove the stigma and hesitation around ART, raising public awareness through advertising and policies, which are likely to propel global assisted reproductive technology market growth.

In over 14 states, including New York, Rhode Island, Texas, Ohio, and Montana, state governments have mandated health insurance coverage for infertility treatments, fueling the market for ART treatments. Artificial insemination increases the chances of pregnancy by boosting the gamete density at the site of fertilization. With the legalization of gay marriages in the U.S., the demand for artificial insemination has increased, as it helps both gay and lesbian couples to conceive, thus driving market growth.

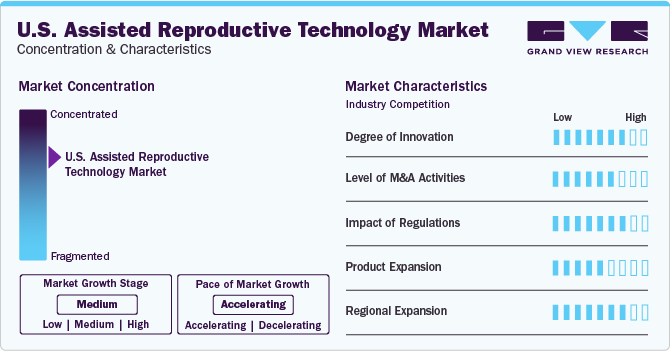

Market Concentration & Characteristics

Standardization of procedures through automation, regulatory reforms, and government funding for egg/sperm storage are some of the contributing factors for growth of the market. Advanced innovations, including Primo Vision Tim-Lapse Embryo Monitoring System by Vitrolife; sperm preparation media & catheters by Irvine Scientific; in-vitro tubes & dishes by Thermo Fischer; three unique technologies Gavi, Geri, & Gems by Genea Biomedx; Eeva test (noninvasive system) by Merck; and a range of fertility treatments by Boston IVF are opening new growth avenues for the market.

The U.S. assisted reproductive technology market is characterized by a high level of M&A activities undertaken by leading players. This is due to factors including the increasing focus on enhancing companies' portfolio and the need to consolidate in a rapidly growing market. Several players in the market are undertaking this strategy to strengthen their portfolio. For instance, in February 2021, The Cooper Companies, Inc. and Virtus Health formed a multi-year strategic partnership to promote fertility care through innovation, digitization, & development.

This industry is regulated by statutory provisions, regulations, or professional guidelines implemented by state professional licensing bodies. For IVF, the authorities are inclined to regulate the market for devices, to increase patient safety and reduce the risk of malpractices. Hence, improving quality of service further enhances the success rate of treatment. As per government regulations, donor identity is kept confidential. Hence, increase in egg and sperm donation creates opportunity for various couples seeking IVF treatment.

Advancements in IVF, including cryopreservation of excess embryos and sperm, Preimplantation Genetic Diagnosis (PGD) with the aid of chromosomal screening, and others are opportunistic for the market demand. Moreover, the number of successful IVF cycles is anticipated to increase at a significant pace during the upcoming years.

Companies such as CooperSurgical, Inc., Vitrolife AB, and Cryolab Ltd., among others have a strong presence in the U.S. market. However, these companies are also focusing on market expansion in European and Asian countries. In December 2021, Fujifilm opened a new production site in Tilburg, Netherlands. The facility offers state-of-the-art life science manufacturing and connects facilities in Japan & the U.S. to increase the cell culture media production capacity of the company and serve as a hub for European & global markets.

Type Insights

The In-vitro Fertilization (IVF) segment accounted for the highest revenue share of 91.7% in 2023. The higher success rates associated with IVF compared to artificial insemination make it the preferred choice of treatment for infertility. The success rates of IVF depend on the age; younger patients have higher success rates compared to the older patients. The frozen non-donor procedure is used when the woman is releasing healthy eggs and undergoing ART due to male infertility or fallopian tube malformation.

Artificial insemination is anticipated to witness fastest growth rate during the forecast period. Artificial insemination is intended for minor fertility conditions and is usually done for same-sex couples or single women. The success rate for artificial insemination varies with the age. As per the Human Fertilization and Embryology Authority (HFEA), success rates for artificial insemination per individual cycle is around 15.8% for women aged below 35 years, 11% for females aged 35 to 39 years, and 4.7% for females aged 40 to 42 years. In addition, more than 50% of the females undergoing intrauterine insemination conceive a child over the first 6 cycles.

End-use Insights

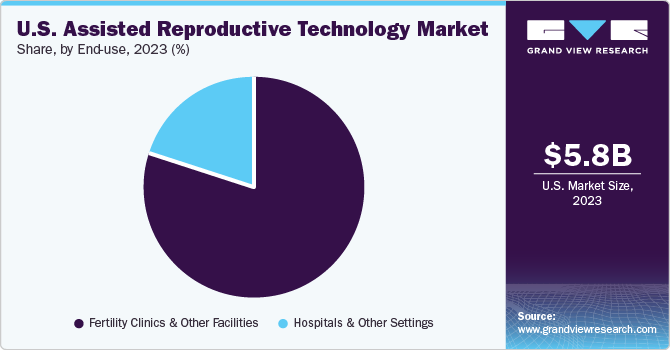

The fertility clinics & other facilities end-use segment dominated the market in 2023 and accounted for a share of 80% of the overall revenue. The segment is projected to expand further at the fastest growth rate, maintaining its forefront position in the industry throughout the forecast period. The high share and rapid growth can be attributed to a rise in the number of infertility cases and the need for a specialized place to perform assisted reproductive procedures.

Fertility clinics are the most preferred setting for physicians and surgeons and the only option for treating complex fertility conditions due to the presence of experts at the centers. Furthermore, invasive methods such as intrauterine insemination and intratubal insemination are performed in fertility clinics. Factors including cost-effectiveness, specialization, expertise in the area, and customized treatment are anticipated to propel the segment growth during the forecast period.

Key U.S. Assisted Reproductive Technology Company Insights

Companies are contributing to the market growth through the implementation of diverse strategies, including introducing new products, investing in R&D, and expanding their product portfolios. For instance, in January 2021, CooperSurgical acquired Embryo Options, a prominent player in cryo-storage software solutions for fertility clinics. Embryo Options platform was intended to aid the patients by giving access to its online resources to provide knowledge about stored specimens for future ART treatment cycles.

Key U.S. Assisted Reproductive Technology Companies:

- Cosmos Biomedical Ltd.

- Microm U.K. Ltd.

- CooperSurgical Inc.

- FUJIFILM Irvine Scientific

- Cryolab Ltd.

- Vitrolife AB

- European Sperm Bank

- Bloom IVF Centre

- Merck KGaA

- Ferring B.V.

Recent Developments

-

In August 2023, Reproductive Medicine Associates (RMA) acquired Conceptions Reproductive Associates of Colorado. RMA added Colorado to its network of 25 fertility centers in New Jersey, Texas, Florida, California, Pennsylvania, and Washington.

-

In March 2022, FUJIFILM Irvine Scientific completed the acquisition of Shenandoah Biotechnology, a major recombinant protein manufacturer. The terms of the deal were not disclosed.

-

In January 2022, Future Fertility raised over USD 6 million in Series A funding to accelerate the expansion of its artificial intelligence-based IVF products. While many other companies involved in fertility have focused on embryos, Future Fertility is the first company to offer noninvasive egg testing to patients through a fertility clinic.

-

In July 2021, Hamilton Throne Ltd. Global provider of ART research acquired IVFTECH ApS (IVFtech) and its associated firm, K4 Technology ApS. IVFtech is dedicated to providing laminar flow workstations and huge-capacity incubators for the ART with the aid of its associated firm, K4. The transaction was worth USD 8 million.

U.S. Assisted Reproductive Technology Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.10 billion

Revenue forecast in 2030

USD 8.08 billion

Growth Rate

CAGR of 5.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use

Country scope

U.S.

Key companies profiled

Cosmos Biomedical Ltd.; Microm U.K. Ltd.; CooperSurgical Inc.; FUJIFILM Irvine Scientific; Cryolab Ltd.; Vitrolife AB; European Sperm Bank; Bloom IVF Centre; Merck KGaA; Ferring B.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Assisted Reproductive Technology Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. assisted reproductive technology market based on type and end-use:

-

Type (Revenue in USD Million, 2018 - 2030)

-

In-vitro Fertilization (IVF)

-

Fresh Donor

-

Frozen Donor

-

Fresh Non-donor

-

Frozen Non-donor

-

-

Artificial Insemination

-

Intrauterine Insemination

-

Intracervical Insemination

-

Intravaginal Insemination

-

Intratubal Insemination

-

-

-

End-use (Revenue in USD Million, 2018 - 2030)

-

Fertility Clinics & Other Facilities

-

Hospitals & Other Settings

-

Frequently Asked Questions About This Report

b. The U.S. assisted reproductive technology market is expected to grow at a compound annual growth rate of 4.79% from 2024 to 2030 to reach USD 8.08 billion by 2030.

b. In Vitro Fertilization (IVF) segment dominated the U.S. assisted reproductive technology market with a share of 91.66% in 2023. This is attributable to favorable reimbursement policies and the introduction of new technology.

b. Some key players operating in the U.S. assisted reproductive technology market include California Cryobank, Parallabs, OvaScience, Anecova, Origio, Microm Ltd., Merck KGaA, Cooper Surgical, Inc, Ferring Pharmaceuticals, Irvine Scientific and Hamilton Throne Ltd.

b. Key factors that are driving the U.S. assisted reproductive technology market growth include the increasing number of infertility cases due to obesity, growing stress, and pollution, increasing number of smokers, fertility threatening treatments such as chemotherapy, and favorable regulatory framework.

b. The U.S. assisted reproductive technology market size was estimated at USD 5.76 billion in 2023 and is expected to reach USD 6.10 billion in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.