- Home

- »

- Pharmaceuticals

- »

-

U.S. Astaxanthin Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. Astaxanthin Market Size, Share & Trends Report]()

U.S. Astaxanthin Market (2025 - 2033) Size, Share & Trends Analysis Report By Source (Natural, Synthetic), By Product, By Application (Nutraceuticals, Cosmetics, Aquaculture & Animal Feed, Food), And Segment Forecasts

- Report ID: GVR-4-68040-300-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Astaxanthin Market Size & Trends

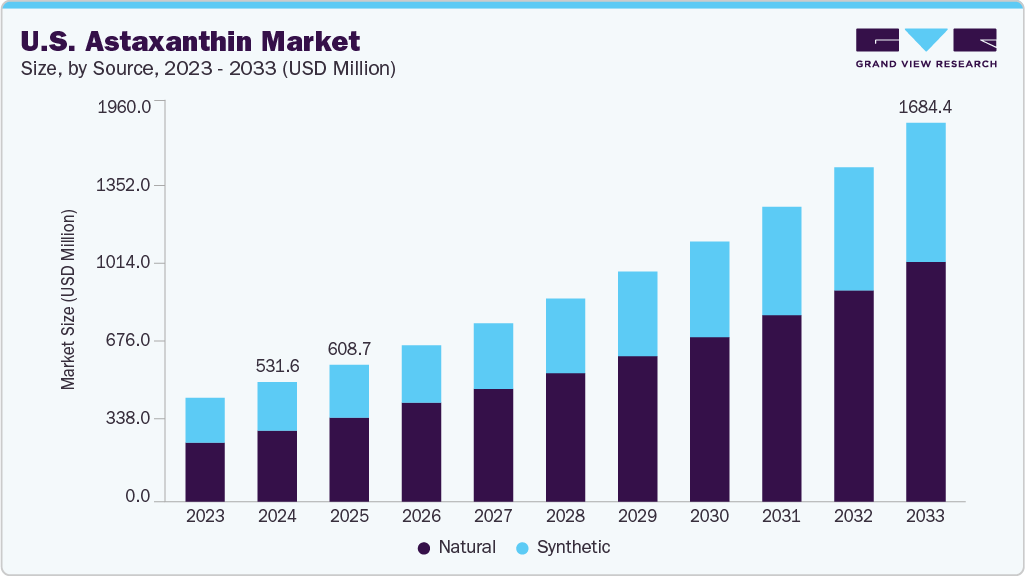

The U.S. Astaxanthin market size was estimated at USD 531.11 million in 2024 and is projected to reach USD 1,684.45 million by 2033, growing at a CAGR of 13.58% from 2025 to 2033, primarily driven by innovations in microencapsulation that enhance bioavailability. Astaxanthin, a potent carotenoid mainly derived from microalgae, krill, and yeast, is valued for its antioxidant qualities that support eye health, skin protection, and immune function. Its market growth is driven by increasing consumer awareness of health and wellness trends, especially in dietary supplements, with the U.S. benefiting from strong agricultural and feed industries, established supply chains, and manufacturing hubs.

Rising disposable incomes and health-conscious consumer behavior further boost demand. Companies are increasingly investing in sustainable sourcing to meet market needs. For instance, in May 2023, BGG World (BGG) and its subsidiary, Algae Health Sciences (AHS), announced the completion of a significant expansion of their state-of-the-art, 100% glass tube photobioreactor microalgae farm. This marks the second major expansion in the last two years and has doubled the capacity of BGG’s flagship AstaZine Natural Astaxanthin line.

Natural astaxanthin is preferred over synthetic versions due to consumer demand for clean-label products free from chemical residues, with the aquaculture sector, especially salmon farming, serving as a key growth driver by using astaxanthin to enhance fish pigmentation and health. Innovations like microencapsulation, adopted by a leading nutraceutical brand, improve product stability and bioavailability, and expand uses in functional foods and cosmetics. In May 2025, the study by Y. Zhang et al. demonstrated an effective method for astaxanthin production using flocculated H. pluvialis cultivated as biofilms in a tri-layer tray photobioreactor. This approach improved biomass harvesting efficiency and enhanced astaxanthin yield, offering a promising commercial-scale production technique. Developing advancements, such as advanced extraction methods and sustainable closed-system microalgae cultivation, improve yield efficiency and lessen environmental impact. New delivery formats, including water-dispersible powders for drinks, cater to changing consumer preferences.

Despite challenges from the high production costs of natural astaxanthin, technological progress is expected to lower costs over time. Strategic partnerships between raw material suppliers and manufacturers to streamline supply chains boost efficiency, while regulatory support for natural ingredients ensures compliance with FDA standards. The rising trend toward plant-based and eco-friendly products will likely increase adoption in the nutraceutical and cosmetic sectors, with projections indicating steady market growth through 2033.

Pipeline Analysis

Research and development in the U.S. astaxanthin market focus on enhancing production efficiency and expanding applications. Companies like Cyanotech Corporation are optimizing microalgae cultivation techniques, with a 2024 study published in Algal Research exploring high-yield Haematococcus pluvialis strains for nutraceuticals. This research aims to reduce production costs, making natural astaxanthin more competitive. Additionally, clinical trials are investigating astaxanthin’s role in reducing inflammation in cardiovascular health. These advancements are poised to broaden market applications in dietary supplements and functional foods, driving growth by addressing consumer demand for high-efficacy, natural antioxidants. Further R&D efforts target innovative delivery systems to improve bioavailability. Investments in bioreactor technology, such as those by Algae Health Sciences, aim to scale sustainable production, as noted in a 2024 Biotechnology Advances article. These developments support applications in aquaculture and nutraceuticals, with potential FDA health claim approvals boosting market expansion. Collaborations with academic institutions, like Oregon State University, are exploring astaxanthin’s benefits in animal feed, further driving innovation and market penetration through 2033.

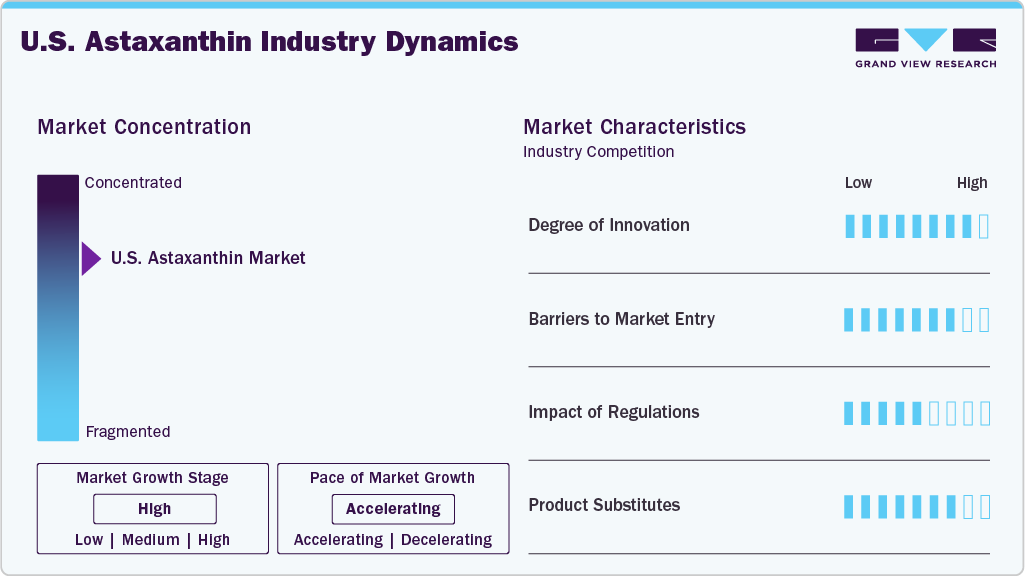

Market Concentration & Characteristics

The U.S. astaxanthin market is moderately concentrated, with key players like Cyanotech, Fuji Chemical, and Algae Health Sciences driving innovation in production and application. Advances in microalgae cultivation and extraction technologies have improved yield efficiency, reducing reliance on synthetic alternatives. For instance, closed-system bioreactors enhance scalability and sustainability, addressing environmental concerns. In January 2025, A comprehensive review updated the understanding of H. pluvialis astaxanthin biosynthesis, including spatiotemporal specificity, transport, esterification, and storage. It highlighted challenges like light-dependent accumulation and high production costs, proposing integrated strategies like strain screening, culture optimization, and stress induction to improve yield and commercialization viability. R&D investments focus on health claims, with clinical trials exploring astaxanthin’s cognitive and cardiovascular health benefits. These innovations strengthen market competitiveness but require significant capital, limiting smaller players’ participation.

High production costs and complex manufacturing processes pose significant barriers to entry in the U.S. astaxanthin market. Natural astaxanthin production, particularly from microalgae, requires advanced bioreactor systems and controlled environments, increasing capital expenditure. Regulatory compliance with FDA standards for dietary supplements and food additives demands rigorous testing, raising costs. Established players benefit from economies of scale and patented technologies, creating challenges for new entrants. Additionally, consumer preference for trusted brands with proven quality limits market access for smaller firms.

The U.S. astaxanthin market operates under stringent FDA regulations, which ensure product safety and efficacy but increase compliance costs. Astaxanthin used in dietary supplements and food must meet Generally Recognized as Safe (GRAS) standards, requiring extensive documentation and testing. The FDA’s decision to revoke FD&C Red No. 3 authorization, effective January 2027 for food and January 2028 for drugs, creates a gap in the market for red colorants. Astaxanthin, a natural red pigment derived from microalgae, yeast, and bacteria, is well-positioned to fill this gap due to its FDA approval as a color additive for animal feed and its safety profile for human consumption. Recent FDA approvals for natural astaxanthin health claims, such as antioxidant benefits, have supported market growth by enhancing consumer trust. However, regulatory scrutiny of synthetic astaxanthin in food applications limits its adoption, favoring natural sources. Compliance with Good Manufacturing Practices (GMP) is mandatory, impacting smaller producers disproportionately. Regulatory support for clean-label products is expected to drive demand for natural astaxanthin through 2033, aligning with consumer trends toward transparency and sustainability.

Product substitutes, such as beta-carotene, lutein, and other carotenoids, pose a moderate threat to the U.S. astaxanthin market. These alternatives offer similar antioxidant benefits at lower costs, appealing to price-sensitive consumers in nutraceuticals and cosmetics. However, astaxanthin’s superior antioxidant potency and proven efficacy in specific applications, like aquaculture for fish pigmentation, provide a competitive edge. Synthetic astaxanthin, while cheaper, faces consumer skepticism due to chemical residue concerns, limiting its substitution potential.

Source Insights

The natural astaxanthin segment, including microalgae, krill/shrimp, yeast, and others, dominated the U.S. astaxanthin market with a revenue share of 59.42% in 2024, driven by consumer preference for clean-label, sustainable products. Microalgae, particularly Haematococcus pluvialis, are being led due to their high astaxanthin content and scalability, with Cyanotech’s BioAstin product achieving strong market penetration in nutraceuticals. For instance, in May 2024, U.S.-based Divi's Nutraceuticals launched AstaBead, a sustainable natural astaxanthin beadlet product, at Vitafoods 2024 in Switzerland. This product was developed in collaboration with Algalif, utilizing Algalif’s Iceland-based production process, powered entirely by renewable energy, emphasizing sustainability and clean-label production. Krill-based astaxanthin gains traction for its bioavailability and omega-3 synergy, while yeast caters to niche feed applications. For instance, in 2022, NextFerm Technologies announced plans to expand production of its vegan protein product, ProteVin, with a USD 10 million investment in a facility located in the Balkan region. Also, in May 2022, Kuehnle Agrosystems announced plans to produce microalgae-based astaxanthin, which is priced competitively with synthetic alternatives.

Synthetic astaxanthin is the fastest-growing source segment in the U.S. astaxanthin market, driven by cost-effectiveness and adoption in animal feed. Furthermore, a study published in 2023 by Elsevier in the journal Aquaculture investigated the effects of Haematococcus pluvialis and synthetic astaxanthin on the growth, immune response, antioxidant capacity, and liver health of Oncorhynchus mykiss in cage culture with flowing fresh water, reducing consumer concerns about residues. Investments in production efficiency and regulatory approvals for feed applications drive growth in price-sensitive markets.

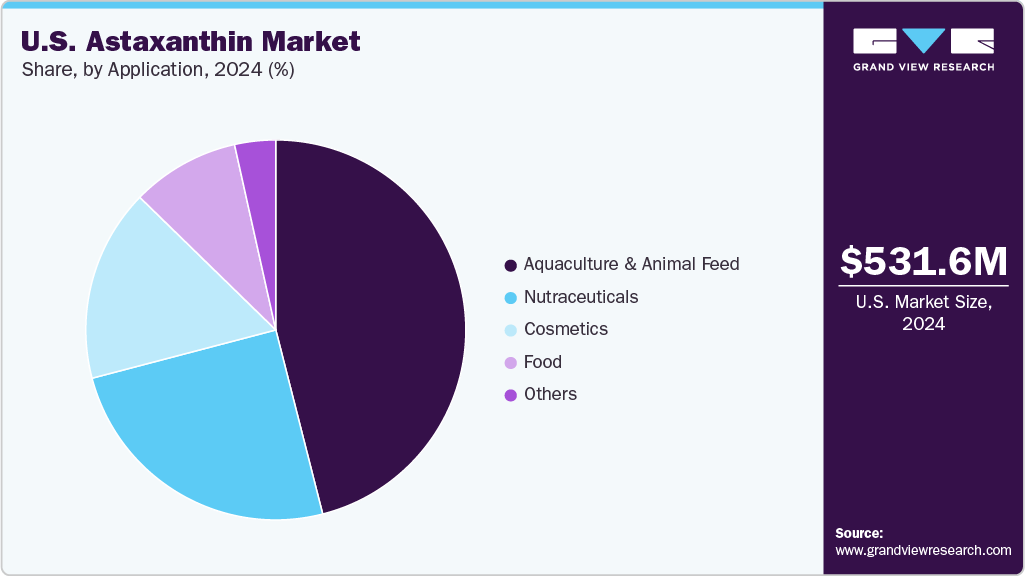

Application Insights

The aquaculture and animal feed segment dominated the U.S. astaxanthin market with a revenue share of 46.03% in 2024, driven by its enhancing fish pigmentation and health, particularly in salmon and shrimp farming. Studies published in March 2025 demonstrate BioAstin’s potent antioxidant, immune-modulating, and anti-inflammatory effects in fish and shrimp, enhancing disease resistance and stress tolerance. Nutraceuticals and cosmetics are significant, with functional foods growing slowly due to formulation challenges.

Nutraceuticals are the fastest-growing application segment, projected to grow through 2030, driven by demand for supplements addressing eye health, skin protection, and immunity. In August 2023, BDI-BioLife Science announced EU approval for astaxanthin for children aged three and above. Known for its antioxidative and anti-inflammatory effects, astaxanthin can now protect children from oxidative damage, especially in the brain and retina. Regulatory approvals and rising retail distribution in the U.S. drive growth, with consumer trends favoring natural antioxidants.

Product Insights

The dried algae meal or biomass segment dominated the U.S. astaxanthin market with a revenue share of 24.97% in 2024, driven by its use in aquaculture for fish pigmentation and health, particularly in salmon farming. Algae Health Sciences’ Algalif brand supplies high-potency dried algae meal, meeting demand for sustainable feed solutions. Softgels, oils, and liquids serve as nutraceuticals and cosmetics, while powders are emerging in functional foods but hold smaller shares due to limited applications.

The softgel product segment is the fastest-growing segment through 2033, fueled by demand for dietary supplements targeting eye and cardiovascular health, which is driving consumer adoption. Regulatory support for clean-label supplements and expanding retail channels, including online platforms, further accelerates soft gel growth, positioning them as a key market driver.

Key U.S. Astaxanthin Company Insights

Key companies in the U.S. astaxanthin market, including Cyanotech, Fuji Chemical, and Algae Health Sciences, focus on sustainable production and product innovation. Cyanotech emphasizes microalgae-based astaxanthin for nutraceuticals, while Fuji Chemical targets cosmetics with high-purity extracts. Strategies include R&D investments in bioavailability. Companies like Valensa International leverage nanoemulsion technologies for liquid formulations, enhancing market penetration in functional foods.

Key U.S. Astaxanthin Companies:

- DSM Nutritional Products

- BASF SE

- Fuji Chemical Industries Co., Ltd.

- BGG World (Beijing Gingko Group)

- Cyanotech Corporation

- Algatech Ltd.

- AstaReal Inc.

- Valensa International

- PIVEG, Inc.

- ENEOS Corporation

Recent Developments

-

In March 2024, Nutrex-Hawaii, Inc., a subsidiary of Cyanotech Corporation, introduced a sugar-free gummy version of its top-selling BioAstin Hawaiian Astaxanthin dietary supplement, delivering 12mg of natural Hawaiian astaxanthin per daily serving. This innovative product is expected to strengthen Cyanotech’s market position by addressing the growing preference for convenient, health-focused supplement formats

-

May 2024: Cyanotech launched Hawaiian Spirulina® gummies to complement their existing Astaxanthin gummy product, expanding their product offerings in the dietary supplement segment.

-

In March 2024, Nutrex-Hawaii, Inc., a subsidiary of Cyanotech Corporation, introduced a sugar-free gummy version of its top-selling BioAstin Hawaiian Astaxanthin dietary supplement. This innovative product features an impressive 12mg of natural Hawaiian astaxanthin per daily serving. This innovative product is likely to strengthen Cyanotech's market position by catering to the growing demand for convenient, health-focused supplements.

U.S. Astaxanthin Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 608.70 million

Revenue forecast in 2033

USD 1,684.45 million

Growth rate

CAGR of 13.58% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Source, product, application

Key companies profiled

DSM Nutritional Products; BASF SE; Fuji Chemical Industries Co., Ltd.; BGG World (Beijing Gingko Group); Cyanotech Corporation; Algatech Ltd.; AstaReal Inc.; Valensa International; PIVEG, Inc.; ENEOS Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Astaxanthin Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. astaxanthin market report based on source, product, and application:

-

Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Natural

-

Yeast

-

Krill/Shrimp

-

Microalgae

-

Others

-

-

Synthetic

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Dried Algae Meal or Biomass

-

Oil

-

Softgel

-

Liquid

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Nutraceuticals

-

Cosmetics

-

Aquaculture & Animal Feed

-

Food

-

Functional Foods & Beverages

-

Other Traditional Food Manufacturing Applications

-

-

Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.