- Home

- »

- Pharmaceuticals

- »

-

U.S. Asthma Therapeutics Market, Industry Report, 2033GVR Report cover

![U.S. Asthma Therapeutics Market Size, Share & Trends Report]()

U.S. Asthma Therapeutics Market (2025 - 2033) Size, Share & Trends Analysis Report By Drug Class (Anti-inflammatory, Bronchodilators), By Device Type (Inhalers, Nebulizers), By Route of Administration (Oral, Inhaled), By Product, And Segment Forecasts

- Report ID: GVR-4-68040-778-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2025 - 2033

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

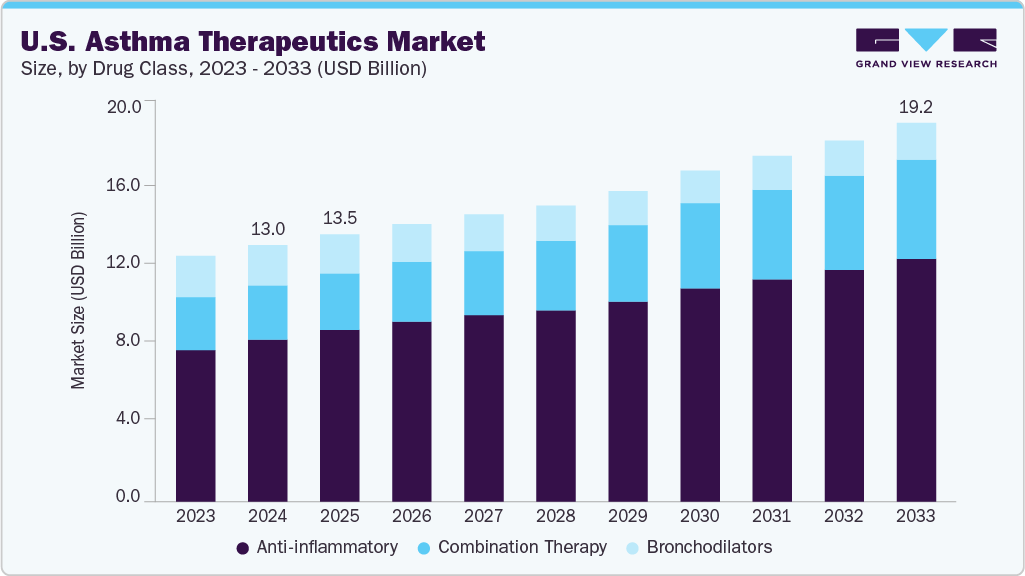

The U.S. asthma therapeutics market size was estimated at USD 13.00 billion in 2024 and is projected to reach USD 19.20 billion by 2033, growing at a CAGR of 4.5% from 2025 to 2033. The rising number of asthma patients in the U.S. has led to a growing demand for effective therapies, including some of the most advanced and promising treatment options.

Key Market Trends & Insights

- By drug class, the anti-inflammatories segment held the highest market share of 63.2% in 2024.

- Based on device type, the nebulizer device segment is expected to register the highest CAGR from 2025 to 2033.

- By product, the metered dose segment held the highest market share in 2024.

- The oral route of administration is the fastest-growing segment during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 13.00 Billion

- 2033 Projected Market Size: USD 19.20 Billion

- CAGR (2025-2033): 4.5%

The U.S. asthma therapeutics market is experiencing steady growth, driven by a rising number of asthma cases. According to the American Lung Association, over 25 million people in the U.S. are living with asthma, and approximately 5-10% of them have severe asthma, highlighting the urgent need for more effective and targeted treatment options.Although various therapies are available, many patients continue to experience frequent asthma attacks, highlighting the limitations of current medications. In response, pharmaceutical companies invest in developing advanced therapies that offer targeted and more effective solutions.In February 2023, Amgen and AstraZeneca announced that the U.S. FDA approved TEZSPIRE for patients aged 12 years and older suffering from severe asthma. It has been approved for self-administration in the U.S. with a new prefilled pen. The product is also approved in the U.S., Japan, the EU, and other countries.

The increasing emphasis on precision medicine and patient-specific treatment plans is notably transforming asthma care markedly in the U.S. There is increasing interest in biomarkers and genetic profiling to effectively guide therapy decisions as healthcare shifts toward a more individualized approach. The changing scenario lets doctors spot the true sources of asthma for each patient and then choose the treatments that have the greatest effect. In addition, artificial intelligence and data analytics are being integrated into clinical practice. This integration improves diagnostic accuracy in addition to monitoring treatment. These particular clinical and technological advancements are not only enhancing therapeutic outcomes. Still, they are also creating new opportunities for pharmaceutical innovation, positioning the U.S. asthma therapeutics market for sustained, innovation-driven growth.

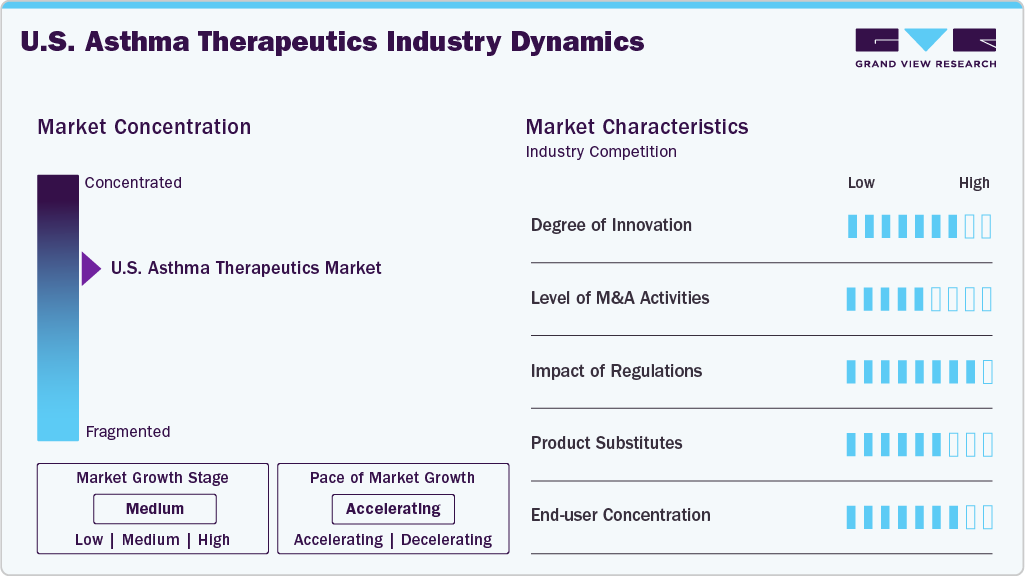

Market Concentration and Characteristics

The U.S. asthma therapeutics market exhibits moderate-to-high concentration, dominated by a few key pharmaceutical players, including AstraZeneca, Teva Pharmaceuticals, Sanofi, Regeneron, and GlaxoSmithKline (GSK). These companies maintain significant market share due to established product portfolios, exclusive biologics, and continuous inhaled and systemic therapy innovation.

Product substitution threats are moderate. While alternatives such as oral corticosteroids, leukotriene inhibitors, and bronchodilators exist, advanced inhalation therapies and biologics dominate due to their targeted action and superior outcomes. Smart inhalers and biologics also face limited external substitutes owing to their specificity and technological integration.

Regional expansion within the U.S. is driven by increased access to healthcare infrastructure, the rising prevalence of asthma in both urban and rural populations, and the growing presence of retail pharmacies and digital health platforms.

Drug Class Insights

The anti-inflammatory segment led the market and accounted for a revenue share of 63.2% in 2024, primarily due to the introduction of cost-effective and advanced biologics for treating severe asthma. The segment's growth is further fueled by strategic collaborations among pharmaceutical companies, research institutions, and healthcare organizations, which are accelerating research and development in novel anti-inflammatory therapies.

The combination therapy segment is expected to register the fastest CAGR from 2025 to 2033.Combination therapy plays a vital role in asthma treatment by targeting two fundamental aspects of the disease: airway inflammation and bronchoconstriction. This approach typically involves a combination of an inhaled corticosteroid (ICS) to reduce inflammation and a long-acting beta-agonist (LABA) to relax airway muscles. Combination inhaler therapy, particularly single-inhaler regimens such as budesonide/formoterol and mometasone/formoterol, is widely used and endorsed under the SMART (Single Maintenance and Reliever Therapy) protocol.

Device Type Insights

The inhalers segment accounted for the largest revenue share in 2024. Inhalers are essential for asthma management, delivering medication directly to the lungs for rapid and targeted relief. They are commonly used to administer bronchodilators and corticosteroids, helping to relax airway muscles, reduce inflammation, and prevent or control asthma symptoms. Inhalers come in various forms, including metered-dose inhalers (MDIs), dry powder inhalers (DPIs), and soft mist inhalers, each designed to meet different patient needs and preferences. Their portability, ease of use, and ability to provide immediate relief make them a preferred option for daily maintenance and emergency treatment.

The nebulizer segment is expected to register the fastest CAGR from 2025 to 2033.One key factor driving the growth of the nebulizer market is their ease of use, which makes them especially suitable for young children, elderly individuals, and patients with severe asthma who may find inhaler techniques challenging. The growing adoption of nebulizers in home healthcare settings and emergency care also contributes to market expansion, as these devices offer enhanced comfort, the ability to deliver larger medication doses, and improved therapeutic outcomes.

Product Insights

Based on product, the metered dose segment held the largest market share of 44.8% in 2024. Metered-dose inhalers (MDIs) are commonly prescribed for inhalation therapy and are among the most frequently used devices for managing asthma and other respiratory conditions. They deliver a precise, pre-measured dose of medication in aerosol form with each actuation, offering fast and effective relief. MDIs are valued for their portability, ease of use, and ability to provide quick symptom control, especially during acute asthma episodes.

The soft mist segment is projected to witness a growth rate from 2025 to 2033.Soft mist inhalers (SMIs) significantly advance inhalation therapy, particularly in treating asthma and chronic respiratory conditions. From a clinical and pharmaceutical research perspective, SMIs are engineered to deliver medication as a slow-moving, fine-particle aerosol, enhancing pulmonary deposition and minimizing oropharyngeal loss. Unlike traditional MDIs that rely on propellant-based actuation, SMIs utilize a spring-driven mechanism to produce a consistent and sustained mist, reducing the need for precise hand-breath coordination.

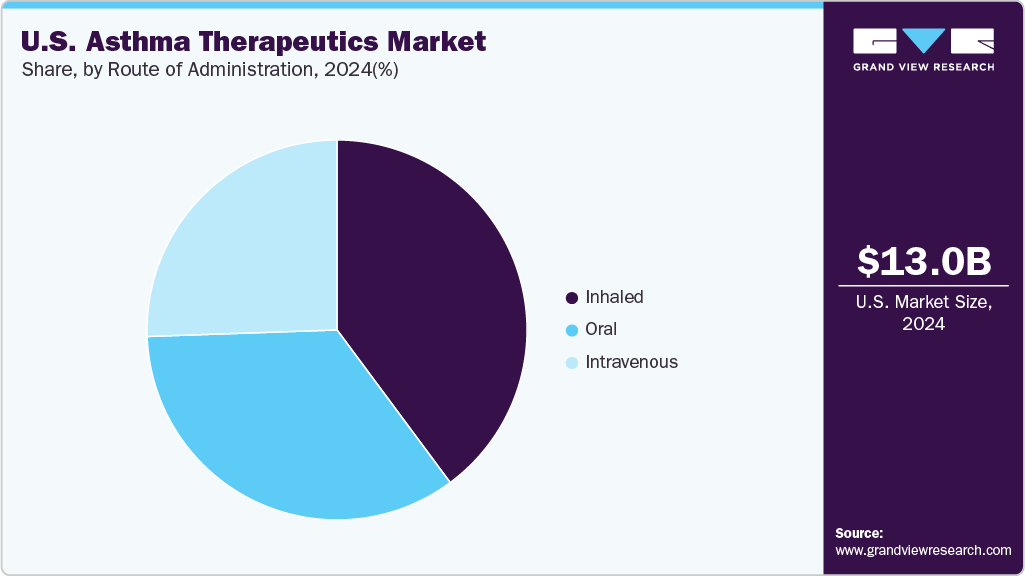

Route of Administration Insights

The inhaled route of administration segment held the largest revenue share of 39.8% in 2024.The route of administration plays a crucial role in the effectiveness and safety of asthma therapies. Among the various options, the inhaled route is the most widely preferred for respiratory conditions, as it enables targeted drug delivery directly to the lungs. This localized approach allows for faster onset of action, improved symptom control, and reduced systemic side effects compared to oral or injectable methods.

The oral segment is projected to witness the highest growth rate from 2025 to 2033. Driven by its convenience and widespread acceptance. Oral medications are taken by mouth and absorbed through the digestive system into the bloodstream. This route is generally well-tolerated and user-friendly, allowing patients to manage their treatment at home without needing specialized tools or medical supervision. Its simplicity, effectiveness, and adaptability make oral therapy a preferred option for patients and healthcare providers in asthma management, contributing to the segment’s projected expansion.

Key U.S. Asthma Therapeutic Market Company Insights

Some key players operating in the market include Teva Pharmaceutical Industries Ltd, GSK plc, Merck & Co., Inc., and others.

Key U.S. Asthma Therapeutics Companies:

- Teva Pharmaceutical Industries Ltd.

- GSK plc

- Merck & Co., Inc.

- F. Hoffmann-La Roche Ltd

- AstraZeneca

- Boehringer Ingelheim International GmbH

- Sanofi.

- Koninklijke Philips N.V.

- Covis Pharma

- Pfizer

- Regeneron

- Amgen

Recent Developments

-

In January 2025, Kinaset Therapeutics, an inhaled therapeutics developer, announced that it received FDA clearance for its Investigational New Drug (IND) application associated with frevecitinib (KN-002), an inhaled dry powder pan-JAK inhibitor targeting JAK1, JAK2, JAK3, and TYK2.

-

In January 2024, AstraZeneca announced the commercial availability of its FDA-approved AIRSUPRA in the U.S. The product is offered by prescription for treating or preventing asthma symptoms and to help prevent sudden breathing issues/ asthma attacks in people 18 years and above.

U.S. Asthma Therapeutic Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.55 billion

Revenue forecast in 2033

USD 19.20 billion

Growth rate

CAGR of 4.5% from 2025 to 2033

Historical period

2021 - 2023

Actual data

2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug class, device type, product, route of administration

Regional scope

U.S.

Key companies profiled

Teva Pharmaceutical Industries Ltd.; GSK plc; Merck & Co., Inc.; F. Hoffmann-La Roche Ltd; AstraZeneca; Boehringer Ingelheim International GmbH; Sanofi.; Koninklijke Philips N.V.; Covis Pharma; Pfizer; Regeneron; Amgen

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Asthma Therapeutics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. asthma therapeutics market report based on drug class, device type, product, route of administration.

-

Drug Class Outlook (Revenue, USD Billion, 2021 - 2033)

-

Anti- inflammatory

-

Bronchodilators

-

Combination therapy

-

-

Device Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Inhalers

-

Nebulizers

-

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Dry Powder

-

Metered Dose

-

Soft Mist

-

-

Route of Administration Outlook (Revenue, USD Billion, 2021 - 2033)

-

Oral

-

Inhaled

-

Intravenous

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.