- Home

- »

- Alcohol & Tobacco

- »

-

U.S. Baijiu Market Size And Share, Industry Report, 2033GVR Report cover

![U.S. Baijiu Market Size, Share & Trends Report]()

U.S. Baijiu Market (2025 - 2033) Size, Share & Trends Analysis Report By Price Point (Economy, Mid-Premium, Super-Premium, Ultra-Premium), By Distribution Channel (On-Trade, Off-Trade), By Price Point - Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-805-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Baijiu Market Summary

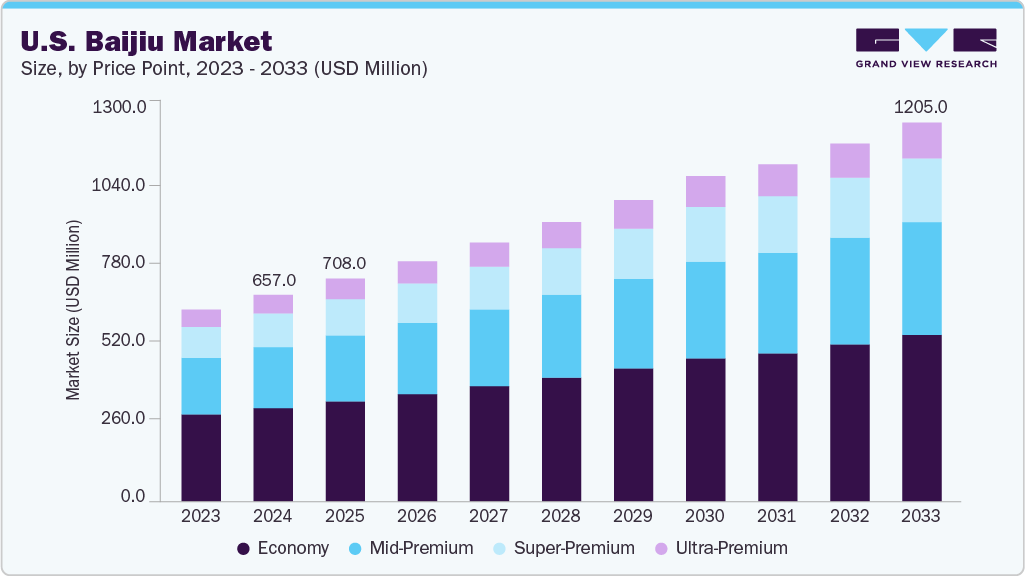

The U.S. baijiu market size was estimated at USD 657.0 million in 2024 and is expected to reach USD 1,205.0 million by 2033, growing at a CAGR of 6.9% from 2025 to 2033. Baijiu’s growing presence in the U.S. is largely driven by rising consumer curiosity toward new and exotic spirits, as well as the efforts of Chinese brands to adapt the drink for Western palates.

Key Market Trends & Insights

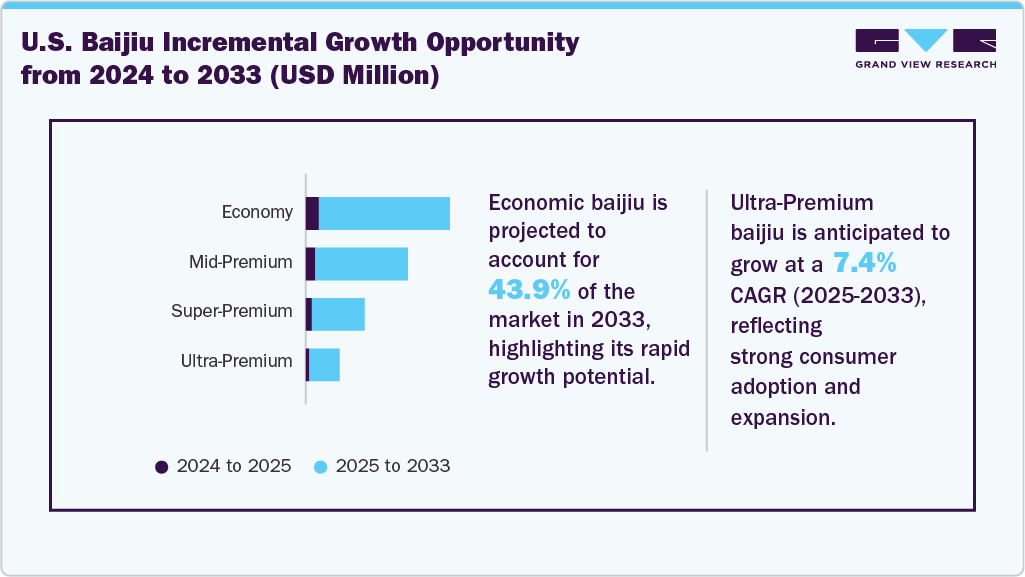

- By price point, economic baijiu led the U.S. baijiu market with a share of 45.1% in 2024.

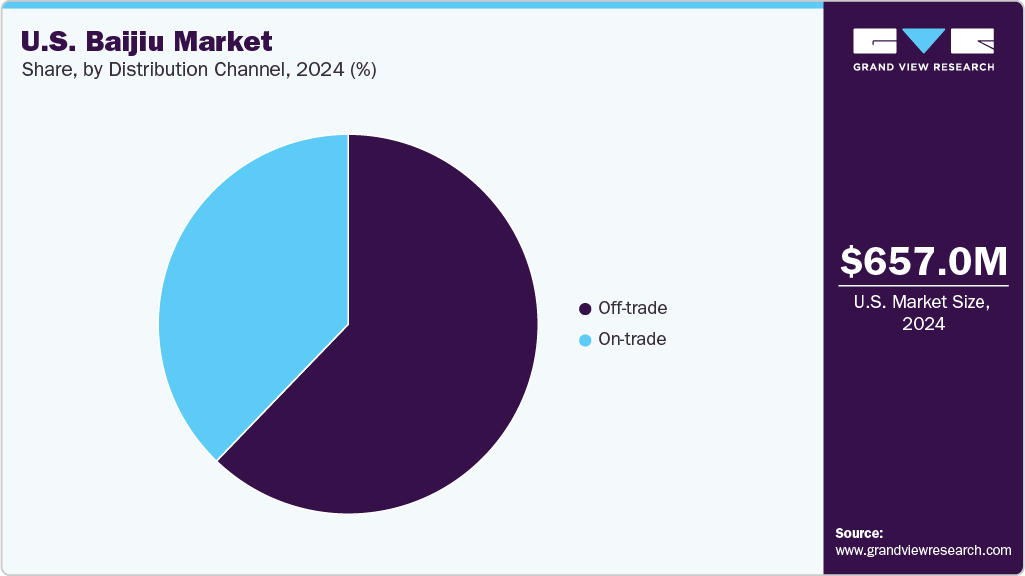

- By distribution channel, the off-trade channel segment accounted for a market share of 62.2% in 2024.

- By price point, ultra-premium baijiu is anticipated to witness a CAGR of 7.4% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 657.0 Million

- 2033 Projected Market Size: USD 1,205.0 Million

- CAGR (2025-2033): 6.9%

American bartenders and mixologists are increasingly experimenting with baijiu in cocktails and tastings, introducing it to consumers as a unique craft ingredient rather than a niche foreign liquor. In the U.S., baijiu is being positioned as a premium and artisanal spirit, appealing to consumers seeking exclusivity and craftsmanship. Instead of competing on volume, brands are targeting niche segments that appreciate high-quality and culturally rich beverages. Limited-edition releases, elegant bottle designs, and storytelling around traditional fermentation techniques have helped baijiu gain traction among collectors and connoisseurs. For example, Kweichow Moutai, one of China’s most prestigious baijiu brands, has introduced luxury editions in the U.S., often priced above premium whisky and cognac, reinforcing baijiu’s high-end image.

The rising Asian diaspora populations and the broader U.S. fascination with Asian cuisine and culture are helping to normalize baijiu consumption. Younger consumers are more open to cross-cultural experiences, and the boom in Asian-inspired bars and restaurants across major cities like New York and Los Angeles has made baijiu a natural fit for fusion cocktails and tasting menus. This cultural openness is transforming baijiu from an unfamiliar Chinese liquor into a conversation-worthy spirit within American nightlife.

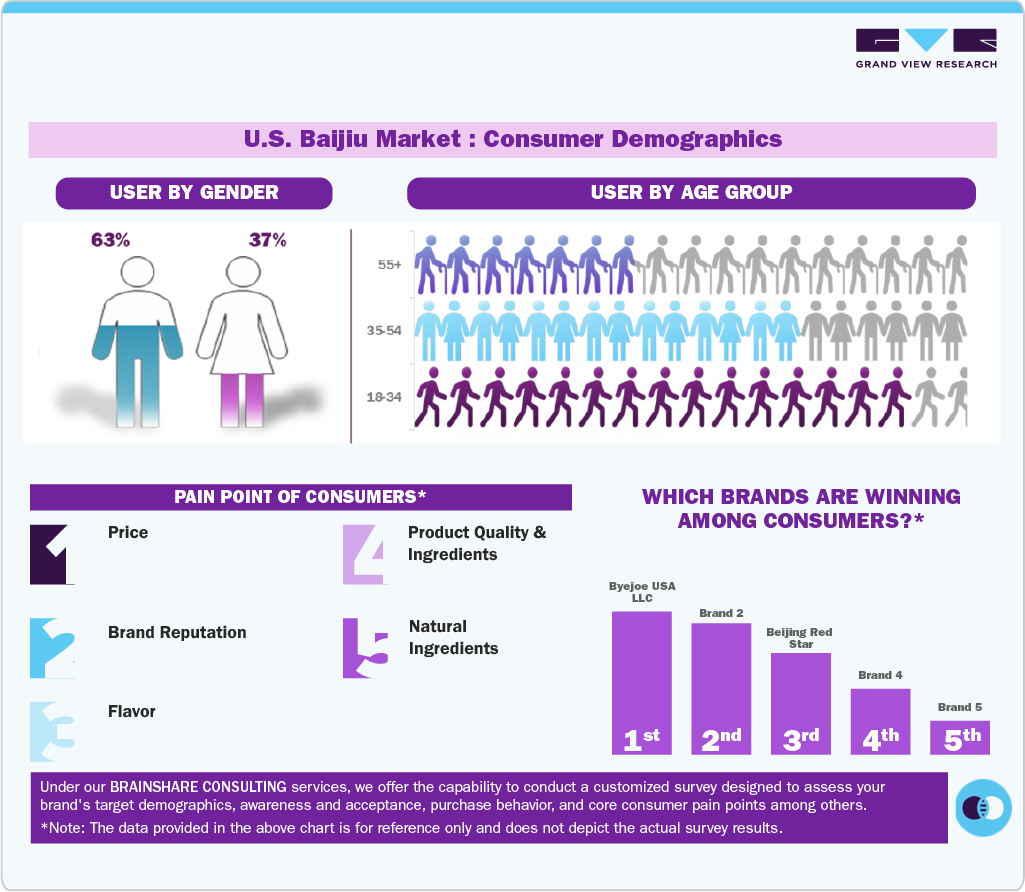

Consumer Insights

The U.S. baijiu industry, while nascent, presents a fascinating landscape of consumer insights, primarily segmented between the Chinese diaspora and an emerging demographic of adventurous American spirit enthusiasts. For the Chinese diaspora, baijiu represents more than just an alcoholic beverage; it's a profound cultural touchstone, evoking nostalgia, tradition, and a sense of home. Their purchasing decisions are often driven by brand familiarity from China, price points reflecting perceived quality, and specific varietals suited for celebrations, gifting, or everyday consumption within their communities.

Conversely, attracting the broader American consumer requires a different approach, focusing on education, versatility, and repositioning. Initial perceptions often involve its strong aroma and flavor profile, which can be a barrier to its acceptance. Insights reveal that these consumers are open to unique experiences, appreciate craftsmanship, and are increasingly curious about global spirits, particularly those with a rich history and complex profile. Strategies should highlight Baijiu's diverse regional styles, its potential in mixology (e.g., as a base for innovative cocktails), and its surprising compatibility with various cuisines beyond Chinese food. Emphasizing its premiumization, artisanal production methods, and storytelling behind its heritage can transform it from an unknown spirit into a sophisticated, intriguing option for the discerning American palate.

Price Point Insights

The economic baijiu segment led the U.S. baijiu industry with the largest revenue share of 45.1% in 2024. Consumer awareness and familiarity with the spirit are still developing, making affordability a key factor for trial and adoption. Most American consumers are unfamiliar with baijiu’s strong flavor profile and fermentation style, so they tend to start with lower-priced options to experiment before committing to premium brands. Additionally, importers and retailers strategically promote affordable baijiu to attract new drinkers in a price-sensitive and highly competitive spirits market dominated by whiskey, vodka, and tequila.

Ultra-premium baijiu is anticipated to witness a CAGR of 7.4% from 2025 to 2033due to a mix of luxury consumption trends, cultural prestige, and gifting appeal. As affluent consumers become increasingly curious about global spirits, baijiu is being rediscovered as an exotic, high-status alternative to established luxury categories, such as whisky or cognac. Chinese heritage brands such as Kweichow Moutai and Wuliangye have leveraged their elite reputation at home to position themselves as symbols of craftsmanship and exclusivity abroad. Their limited-edition releases, often priced in the hundreds or thousands of dollars, appeal to collectors, luxury bars, and culturally sophisticated consumers seeking authenticity and rarity.

Distribution Channel Insights

The sales of baijiu through off-trade channels held the largest share of the U.S. baijiu market, with 62.2% in 2024.They offer broader accessibility, convenience, and affordability for both new and existing consumers. Since baijiu is still an emerging category in the U.S., most purchases occur through retail exploration rather than on-premise experiences. Consumers often prefer to buy bottles for at-home consumption or gifting, especially those interested in trying baijiu for the first time without paying premium bar prices. Additionally, the growth of e-commerce and specialty online liquor stores has made it easier for consumers to access imported baijiu brands that may not be widely available in bars or restaurants.

The on-trade channels segment is expected to grow at a CAGR of 6.6% from 2025 to 2033. Many American consumers are still unfamiliar with baijiu’s intense flavor and aroma, so bartenders and mixologists play a crucial role in introducing the spirit through curated cocktails, tasting flights, and fusion pairings. This educational and experiential approach helps consumers appreciate baijiu’s complexity in a more approachable way.

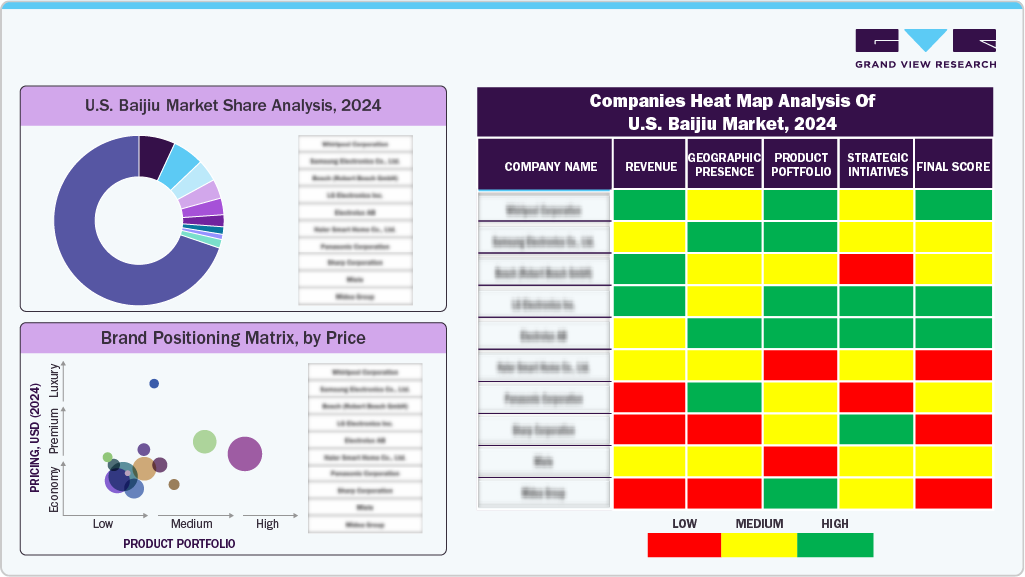

Key U.S. Baijiu Company Insights

Leading players in the U.S. baijiu market include Byejoe USA LLC, Vinn Distillery LLC, Taizi Baijiu, Wuliangye Yibin Co., Ltd., and Luzhou Laojiao Co., Ltd. The market is becoming increasingly competitive, with leading brands focusing on expanding their presence across both online and offline retail channels to improve accessibility and visibility. Companies are actively investing in product innovation, modern distillation methods, and flavor adaptations to suit American palates and attract younger consumers. Growth in the market is being driven by the rising popularity of premium and ultra-premium baijiu, the growing influence of Chinese cultural exports, and the integration of baijiu-based cocktails within bars, restaurants, and upscale hospitality venues in the country.

Key U.S. Baijiu Companies:

- Byejoe USA LLC

- Vinn Distillery LLC

- Taizi Baijiu

- Beijing Red Star Co., Ltd

- Kweichow Moutai Co., Ltd.

- Wuliangye Yibin Co., Ltd.

- Luzhou Laojiao Co., Ltd.

- Jiannanchun Group Co., Ltd.

- Shui Jing Fang Co., Ltd.

- Ming River Baijiu

Recent Developments

-

In January 2025, Chinese baijiu producer Wuliangye Yibin Co., Ltd. launched an eye-catching 3D digital advertisement in New York’s Times Square, marking a major step in its global branding campaign. The ad featured a dynamic animated panda, the brand’s cultural ambassador, set against vivid visual effects and the slogan “Harmony in Diversity”, symbolizing both Chinese heritage and cross-cultural connection. This initiative is part of Wuliangye’s broader international strategy to raise awareness of baijiu among Western audiences and to position itself as a premium, globally recognized spirits brand.

-

In December 2024, Guizhou Guijiu Co., Ltd. announced the launch of its new GUI Series baijiu in the North American market, marking a key step in its global expansion strategy. The series features premium Jiang-aroma baijiu products tailored to international consumers’ tastes, reflecting the brand’s goal to introduce authentic Chinese craftsmanship to Western audiences while positioning itself as a modern, globally competitive spirits company.

U.S. Baijiu Market Report Scope

Report Attribute

Details

Market revenue size in 2025

USD 708.0 million

Revenue Forecast in 2033

USD 1,205.0 million

Growth rate

CAGR of 6.9% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in million 9-liter cases, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Price point, distribution channel, price point - distribution channel

Key companies profiled

Byejoe USA LLC; Vinn Distillery LLC; Taizi Baijiu; Beijing Red Star Co., Ltd; Kweichow Moutai Co., Ltd.; Wuliangye Yibin Co., Ltd.; Luzhou Laojiao Co., Ltd.; Jiannanchun Group Co., Ltd.; Shui Jing Fang Co., Ltd.; Ming River Baijiu

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Baijiu Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the U.S. baijiu market report based on price point, distribution channel, and price point - distribution channel:

-

Price Point Outlook (Volume, Million 9-Liter Cases; Revenue, USD Million, 2021 - 2033)

-

Economy

-

Mid-Premium

-

Super-Premium

-

Ultra-Premium

-

-

Distribution Channel Outlook (Volume, Million 9-Liter Cases; Revenue, USD Million, 2021 - 2033)

-

On-trade

-

Off-trade

-

-

Price Point - Distribution Channel Outlook (Volume, Million 9-Liter Cases; Revenue, USD Million, 2021 - 2033)

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

Frequently Asked Questions About This Report

b. The U.S. baijiu market was estimated at USD 657.0 million in 2024 and is expected to reach USD 708.0 million in 2025.

b. The U.S. baijiu market is expected to grow at a compound annual growth rate of 6.9% from 2025 to 2033 to reach USD 1,205.0 million by 2033.

b. Economic baijiu is the largest segment, accounting for a share of 45.11% in 2024. consumer awareness and familiarity with the spirit are still developing, making affordability a key factor for trial and adoption.

b. Some of the key players in the U.S. baijiu market is - Kweichow Moutai Co., Ltd.; Wuliangye Yibin Co., Ltd.; Luzhou Laojiao Co., Ltd.; Jiannanchun Group Co., Ltd.; Shui Jing Fang Co., Ltd.; Ming River Baijiu; Byejoe USA LLC; Vinn Distillery LLC; Taizi Baijiu; Beijing Red Star Co., Ltd

b. Baijiu’s growing presence in the U.S. is largely driven by rising consumer curiosity toward new and exotic spirits, as well as the efforts of Chinese brands to adapt the drink for Western palates. American bartenders and mixologists are increasingly experimenting with baijiu in cocktails and tastings, introducing it to consumers as a unique craft ingredient rather than a niche foreign liquor.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.