- Home

- »

- Advanced Interior Materials

- »

-

U.S. Barite Market Size And Share, Industry Report, 2030GVR Report cover

![U.S. Barite Market Size, Share & Trends Report]()

U.S. Barite Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Fillers, Oil & Gas, Chemicals, Others), And Segment Forecasts

- Report ID: GVR-4-68040-251-5

- Number of Report Pages: 82

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Barite Market Size & Trends

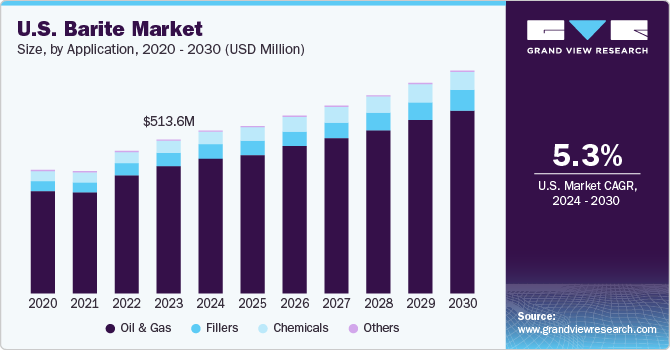

The U.S. barite market size was estimated at USD 513.6 million in 2023 and is expected to grow at a CAGR of 5.3% from 2024 to 2030. The market is primarily driven by the increasing offshore oil and gas drilling activities. Barite is added to the fluid used for drilling oil and natural gas wells to increase its density. The U.S. oil & gas industry is one of the largest markets for barite. A steady rise in tight oil production has played a pivotal role in driving market growth. According to the U.S. Energy Information Administration (EIA), U.S. crude oil production was at a record high of 13.3 million barrels per day (b/d) in December 2023. However, it is projected to experience a slight dip in the middle of 2024 and will surpass the December 2023 record by February 2025.

Barite is a versatile mineral that has several important uses in the healthcare industry. Barite is widely used as a radiopaque agent in diagnostic medical tests including X-rays and CT scans to generate clear images of the gastrointestinal tract and other parts of the body. It is also used as a filler in tablets and capsules to help maintain their shape and size.

Barite mining has potential adverse effects on the environment, causing habitat destruction, soil erosion, and water pollution. This has impelled the mining companies to comply with stringent environmental regulations and mitigate the risks. In the U.S., laws and regulations are authorized by the United States Environmental Protection Agency (EPA). Under the regulations, the metal sector is included in the manufacturing sector (NAICS 31 - 33). It includes the nonferrous metals industry and the metal industry. The presence of strict regulatory norms is aiding ethical manufacturing activities.

Market Concentration & Characteristics

The market growth is medium and is accelerating at a significant pace owing to a moderately fragmented market. U.S. barite manufacturers are actively implementing challenging strategic initiatives such as mergers & acquisitions, new product launches, and production expansion, among others.

Strategic initiatives include mergers & acquisitions and subsidies granted by governments to aid manufacturers’ productivity and efficiency. In July 2022, the U.S. Geological Survey invested USD 2.75 million, in a research fund as a part of President Biden’s Bipartisan Infrastructure Law focused on critical mineral resources such as barite, aluminum, cobalt, and lithium, etc. in Arkansas and Missouri. These initiatives help gain an advantage over other market players. Apart from Arkansas and Missouri, barite is also mined in Georgia and Nevada.

Ilmenite, iron ore, synthetic hematite, nano silica, and celestite are common substitutes for barite. Celestite is considered a good substitute for barite in oil & gas drilling activities due to its similar properties. Moreover, Imperial Industrial Minerals Company produces synthetic iron, namely, hematite and bentonite for use in drilling fluids in the oil & gas industry. These are proven substitutes to barite in the industry. However, the usage of these substitutes is limited as barite is still the most preferred mineral in the oil & gas industry. According to the U.S. Geological Survey, with barite being announced as a critical mineral, the penetration of these substitutes is expected to increase in the coming years.

The impact of regulations on the market is high owing to the rising concerns about the carbon footprint associated with mining activities. The Environmental Protection Agency (EPA) and the North American Industry Classification System (NAICS) group listings provide stringent guidelines for barite, graphite, and bentonite manufacturing and have to comply with NAICS 212325, 212399, and 212393

The U.S. barite industry is moderately competitive due to the presence of several manufacturers. The use of barite is anticipated to rise rapidly across the country owing to increasing demand for drilling fluids used in the oil & gas industry and rising consumption of fillers in paints & coatings, plastics, rubber, cement, and cosmetics industries.

Application Insights

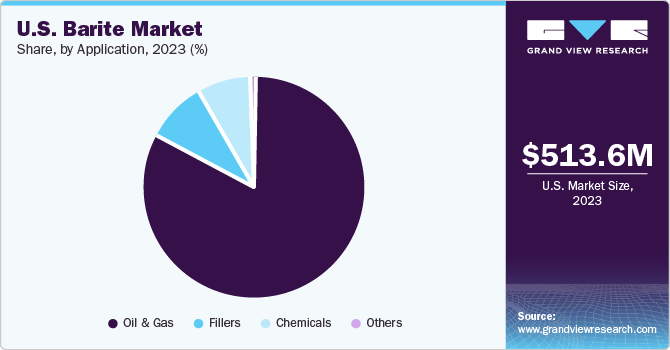

The oil & gas segment accounted for the largest revenue share of over 82.7% in 2023 owing to the rising crude oil extraction in the country. As per the EIA, the U.S. crude oil production broke record with an average production of 12.9 million barrels per day. This strengthens the country’s position in the global oil & gas industry.

Barite powder has a widespread application in elevating the hydrostatic pressure and increasing the density of drilling fluids as it possesses high specific gravity. The softness of this mineral helps in preventing any damage to drilling tools. Barite also acts as a lubricant and cooling agent to avoid overheating drilling tools. The rising penetration of barite in several applications is driving the segment growth.

The fillers segment is expected to expand at the fastest CAGR from 2024 to 2030. Barite as filler is widely adopted due to its nontoxicity, high specific gravity, and chemical inertness. It is an excellent substitute for materials such as titanium dioxide, basofor, and crypton, which are also used as fillers in paints & coatings, and other industries.

Key U.S. Barite Company Insights

For years, the U.S. has heavily relied on Russia and China for imports of critical minerals. However, as the focus on green or sustainable energy and becoming self-reliant in the supply of oil and gas is increasing, the U.S. government has emphasized the need to build a robust supply chain for critical minerals.

Further, there is a threat of entry of international players, which will intensify the existing competition. For instance, in May 2022, Andhra Pradesh Mineral Development Corporation (APMDC) signed MoUs with local firms to expand exports, thereby marking its entry into the U.S. market.

Key U.S. Barite Companies:

- SAE Manufacturing Specialties Corp

- BariteWorld

- Thunderbird Minerals Corp

- CB Minerals LLC

- Etimine USA, Inc.

- Malli Minerals International Inc.

- Excalibur Minerals Corp.

- International Earth Products LLC

- SLB

- ADO USA LLC

Recent Developments

-

In August 2023, Thunderbird Minerals Corp. signed a mineral lease and agreement with Bull Mountain Resources, LLC for the Apache property, California. This expansion will enable Thunderbird to expand its barite manufacturing presence in the U.S.

-

In February 2023, SLB announced the complete acquisition of Gyrodata. The strategic investment will ensure technological advancements in barite production, improve operational efficiency, and improve drilling performance.

U.S. Barite Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 546.0 million

Revenue forecast in 2030

USD 745.3 million

Growth rate

CAGR of 5.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Application

Country Scope

U.S.

Key companies profiled

SAE Manufacturing Specialties Corp;Thunderbird Minerals Corp; BariteWorld; Etimine USA, Inc.; Malli Minerals International Inc.; Excalibur Minerals Corp.; International Earth Products LLC; ADO USA LLC; SLB; CB Minerals LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Barite Market Report Segmentation

This report forecasts revenue & volume growth at the country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. barite market report based on application:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Chemicals

-

Fillers

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. barite market was valued at USD 513.6 million in the year 2023 and is expected to reach USD 546.0 million in 2024.

b. The U.S. barite market is expected to grow at a compound annual growth rate of 5.3% from 2024 to 2030 to reach USD 745.3 million by 2030.

b. Based on application, the oil & gas segment emerged as a dominating segment in the market with a share of over 82.0% in 2023 due to its adoption in oil drilling industries

b. The key market players in the U.S. barite market include SAE Manufacturing Specialties Corp; Thunderbird Minerals Corp; BariteWorld; Etimine USA, Inc.; Malli Minerals International Inc.; Excalibur Minerals Corp.; International Earth Products LLC; ADO USA LLC; SLB; CB Minerals LLC.

b. The key factors that are driving the U.S. barite market include, growing application in mining and healthcare industries and increasing oil & gas production in the country.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.