- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Bio Plasticizers Market Size, Industry Report, 2030GVR Report cover

![U.S. Bio Plasticizers Market Size, Share & Trends Report]()

U.S. Bio Plasticizers Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Epoxidized Soybean Oil, Castor Oil-based Plasticizers), By Application (Packaging Materials, Consumer Goods, Automotive & Transport), And Segment Forecasts

- Report ID: GVR-4-68040-218-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Bio Plasticizers Market Size & Trends

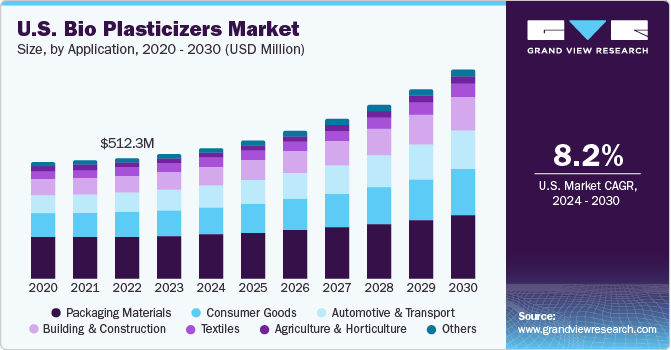

The U.S. bio plasticizers market size was estimated at USD 528.33 million in 2023 and is expected to grow at a CAGR of 8.2% from 2024 to 2030. The surge in demand for bio-based packaging in the food and consumer goods sectors is driving the growth of bio plasticizers. These eco-friendly plastics are more convenient to use and have a higher tensile strength than traditional plastics, and are becoming increasingly popular. Moreover, the adoption of sustainable manufacturing practices in the plastic industry is expected to have a positive economic impact, promote resource efficiency, reduce waste and pollution, and open up new avenues for innovation and growth.

Plasticizers are compounds that are added to a polymer matrix to enhance its chemical properties, increase its flexibility, and facilitate its processing. They reduce the brittleness of the material and impart softness and plasticity. Bio-plasticizers, which are derived from natural and renewable sources such as soybean oil, castor oil, starch, and stearic acid, are typically used to make polymers more pliable and workable. The addition of bio-plasticizers can lower the melt viscosity, glass transition temperature, and elastic modulus of the polymer, thereby improving its characteristics for specific applications.

Bio plasticizers are used in a variety of industries, including automotive, construction, healthcare, and packaging. In the automotive industry, they are used to enhance the flexibility and durability of various plastic components, such as PVC-based interiors, wiring insulation, and gaskets. They also improve the performance of automotive materials, making them more resistant to temperature fluctuations and mechanical stress. The growing focus on lightweight materials and sustainability in the automotive industry complements the use of bio plasticizers.

The increasing sustainability concerns among plastic manufacturers and the rising demand for eco-friendly plastics across various end-user industries are driving the plasticizers industry. With growing global concerns over climate change, the focus on sustainability is intensifying. Plastics are used in a wide range of industries, including packaging, healthcare, building & construction, logistics, aviation, textiles, and others, leading to an increased demand for sustainable practices in the long run, considering the environmental and social impacts. Furthermore, sustainable practices in plastic manufacturing are expected to have a positive economic impact, promote resource efficiency, reduce waste and pollution, and create new opportunities for innovation and growth.

Market Concentration & Characteristics

The U.S. bio plasticizer market is marked by a moderate degree of innovation. There have been developments in bio-based plasticizers to cater to consumer needs and meet environmental standards for sustainable alternatives. However, the rate of innovation in this market is not as fast as in some other sectors. Nonetheless, ongoing research and development activities contribute to a moderate level of innovation in the market.

The market sees a low level of merger and acquisition activities. This is due to the relatively specialized nature of this market and the presence of a few key players, which results in fewer opportunities for significant consolidation through mergers and acquisitions compared to larger markets.

Regulations play a crucial role in the market as they stimulate the demand for eco-friendly alternatives to traditional plasticizers. Strict regulations aimed at minimizing the use of harmful chemicals in consumer products have accelerated the adoption of bio-based plasticizers, leading to a high impact of regulations on market dynamics.

The market offers limited alternatives to bio plasticizers, particularly in industries where eco-friendly options are favored. While some conventional plasticizers are available, the demand for bio-based alternatives remains robust due to environmental concerns and regulatory pressures.

The market experiences a moderate level of product expansion as companies invest in developing new formulations and improving existing products to align with changing consumer preferences and regulatory requirements. However, the rate of product expansion may not be as fast as in mainstream industries due to the specialized nature of bio-based plasticizers.

Application Insights

The packaging material segment dominated the market, accounting for the largest revenue share of 34.46% in 2023. This growth is attributed to the rising consumer preference for sustainable packaging and the increasing issues of landfill pollution globally, leading to a surge in the adoption of packaging products made from bio-plasticizers. Moreover, the strict prohibition on single-use plastics in several U.S. states like New York, California, and Hawaii, is significantly boosting the demand for bio-plasticizer-based plastics in the packaging sector. These bio-plasticizer-based plastics are extensively used in various packaging applications such as food & beverage packaging, personal care packaging, films & sheets, and household care products packaging.

The consumer goods segment also held a substantial revenue share in 2023. Major consumer goods manufacturers are transitioning from traditional plastics to biodegradable plastics to minimize their carbon footprint. Therefore, the manufacturers' growing preference for biodegradable plastics is expected to provide numerous growth opportunities for the global manufacturers of bio-plasticizer-based plastics.

The automotive & transport segment saw substantial growth in 2023. In the automotive industry, bio-plasticizer-based plastics are used in applications like under-the-hood components and interior parts. Bioplastics, due to their high bio-based content, are highly effective in reducing the carbon footprint. They provide impact resistance, UV resistance, high gloss, excellent color ability, and dimensional stability. The use of bio-plasticizers contributes to reducing the overall weight of a vehicle, thereby decreasing the overall transportation costs. All these factors are expected to boost the demand for bio-plasticizer-based plastics in the automotive industry in the future years.

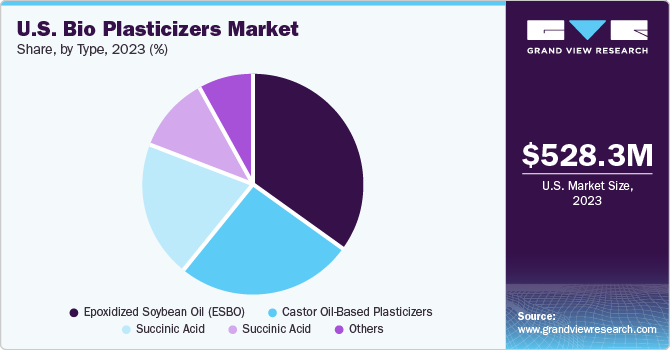

Type Insights

Epoxidized soybean oil (ESBO) accounted for the largest market share of 35% in 2023. This growth is due to several factors such as environmental and health concerns, and regulatory requirements associated with traditional plasticizers. The demand for ESBO has been positively influenced by the increasing awareness of the environmental and health effects of conventional plasticizers. As a result, manufacturers are progressively shifting towards bio-based alternatives. ESBO, a plasticizer derived from soybean oil, is used to enhance the flexibility and durability of plastic materials, particularly those containing polyvinyl chloride (PVC), which are used in various industries such as construction, packaging, and consumer goods.

Castor Oil-Based Plasticizers held a significant market share in 2023, due to their unique chemical composition, which allows them to be used in a range of industrial processes, including the production of bio-based plasticizers. The demand for bio-plasticizers derived from castor oil has increased due to their sustainable sourcing, non-toxicity, biodegradability, and high performance.

In addition, Succinic Acid saw substantial growth in the market in 2023. Succinic acid, derived from various renewable sources, with corn and sugarcane being the most commonly used, is ideal for manufacturers focusing on environmental sustainability. Numerous countries have implemented regulations to limit the use of certain types of plasticizers, especially those derived from petroleum or containing harmful chemicals. This has resulted in an increased demand for alternative plasticizers, including those based on succinic acid.

Key U.S. Bio Plasticizers Company Insights

Research efforts are concentrated in the bio plasticizer industry, on the development of new materials that amalgamate various properties and are anticipated to be widely adopted in the industry in the future. Additionally, to maintain competitiveness in the market, key players are undertaking strategic actions such as mergers & acquisitions, joint ventures, production, expansion, and more.

Key players in the market include Dow Inc.; ACS Technical Products; and Cargill, Incorporated.

-

Dow Inc. operates in three main sectors: industrial intermediates & infrastructure; performance materials & coatings; and packaging & specialty plastics. The company provides its plastic products to a variety of end-use industries such as consumer goods, healthcare, food & beverages, personal care, construction, life sciences, paints & coatings, and paper.

-

ACS Technical Products is a producer of a wide range of chemical products. These include plasticizers, acid scavengers & stabilizers, coalescing agents, epoxy diluents & modifiers, thermoset resins, composite resins, powder coating resins, and asphalt modifiers.

Emery Olechemicals; Valtris Specialty Chemicals and Mayriant Corporation are some other participants in the U.S. Bio Plasticizers market

-

Valtris Specialty Chemicals is a producer of specialty chemical additives and precursors for a variety of applications. These applications span industries such as building & construction, transportation & automotive, packaging, pharmaceutical & medical, household industrial & institutional, coatings, adhesives, sealants, elastomers, industrial, oil & gas, and consumer/personal care.

Key U.S. Bio Plasticizers Companies:

- Avient Corporation

- Cargill, Incorporated

- Dow, Inc.

- ACS Technical Products

- Emery Olechemicals

- Valtris Specialty Chemicals

- PolyOne Corporation

- Vertellus LLC.

- Mayriant Corporation

Recent Developments

-

In February 2024, Cargill made a strategic investment in two processing plants to boost its production and distribution of ready-for-sale beef and pork to retailers in the Northeast region of the U.S. This move was in response to the growing consumer demand for affordable and convenient protein options. The company acquired ready-for-sale meat facilities in North Kingstown, R.I., and Camp Hill, Penn. from Infinity Meat Solutions, a subsidiary of Ahold Delhaize USA. This investment is expected to strengthen Cargill's ongoing partnership with Ahold Delhaize USA companies and enable it to offer high-quality ready-for-sale products to new retail customers.

-

In January 2024, Avient Corporation, a prominent player in the provision of specialized and sustainable material solutions and services, showcased its range of bio-based polymer solutions at Pharmapack 2024, a leading European trade show for the pharmaceutical packaging and drug delivery device industry. The solutions include bio-based polymer colorants, additives, and bio-derived thermoplastic elastomers with lower product carbon footprint (PCF) values, validated by Avient’s PCF Calculator that is certified by TÜV Rheinland for ISO 14067 compliance.

-

In May 2023, Dow Inc. and New Energy Blue entered into a long-term supply agreement in North America. As per the agreement, New Energy Blue will produce bio-based ethylene from renewable agricultural residues, which Dow intends to purchase. This bio-based ethylene is expected to reduce carbon emissions from plastic production and find use in recyclable applications across various sectors like transportation, footwear, and packaging. This agreement is a crucial part of Dow's strategy to develop material ecosystems that value, source, and transform waste into circular products. By partnering with leading technologies and partners for waste collection, reuse, and recycling, Dow is facilitating the scaling of global material ecosystems.

U.S. Bio Plasticizers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 554.67 million

Revenue forecast in 2030

USD 887.76 million

Growth rate

CAGR of 8.2% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons; revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application

Key companies profiled

Avient Corporation; Cargill, Incorporated; Dow, Inc.;ACS Technical Products; Emery Olechemicals; Valtris Specialty Chemicals; PolyOne Corporation; Vertellus LLC.; Mayriant Corporation.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Bio Plasticizers Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. bio plasticizers market report based on type and application:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Epoxidized Soybean Oil (ESBO)

-

Castor Oil-Based Plasticizers

-

Citrates

-

Succinic Acid

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Packaging Materials

-

Consumer Goods

-

Automotive & transport

-

Building & construction

-

Textiles

-

Agriculture & Horticulture

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. bio plasticizers market was valued at USD 528.33 million in the year 2023 and is expected to reach USD 554.67 billion in 2024.

b. The U.S. bio plasticizers market is expected to grow at a compound annual growth rate of 8.2% from 2024 to 2030 to reach USD 887.76 billion by 2030.

b. The Epoxidized soybean oil (ESBO) accounted for the largest market share of 35% in 2023. This growth is due to several factors such as environmental and health concerns, and regulatory requirements associated with traditional plasticizers.

b. The key market player in the U.S. bio plasticizers market includes Avient Corporation; Cargill, Incorporated; Dow, Inc.;ACS Technical Products; Emery Olechemicals; Valtris Specialty Chemicals; PolyOne Corporation; Vertellus LLC.; Mayriant Corporation.

b. The key factors that are driving the U.S. bio plasticizers market include, the surge in demand for bio-based packaging in the food and consumer goods sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.