- Home

- »

- Food Additives & Nutricosmetics

- »

-

Stearic Acids Market Size And Share, Industry Report, 2030GVR Report cover

![Stearic Acids Market Size, Share & Trends Report]()

Stearic Acids Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Soaps & detergents, Intermediates, Personal Care, Rubber Processing, Textile, Lubricants), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: 978-1-68038-469-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Stearic Acids Market Size & Trends

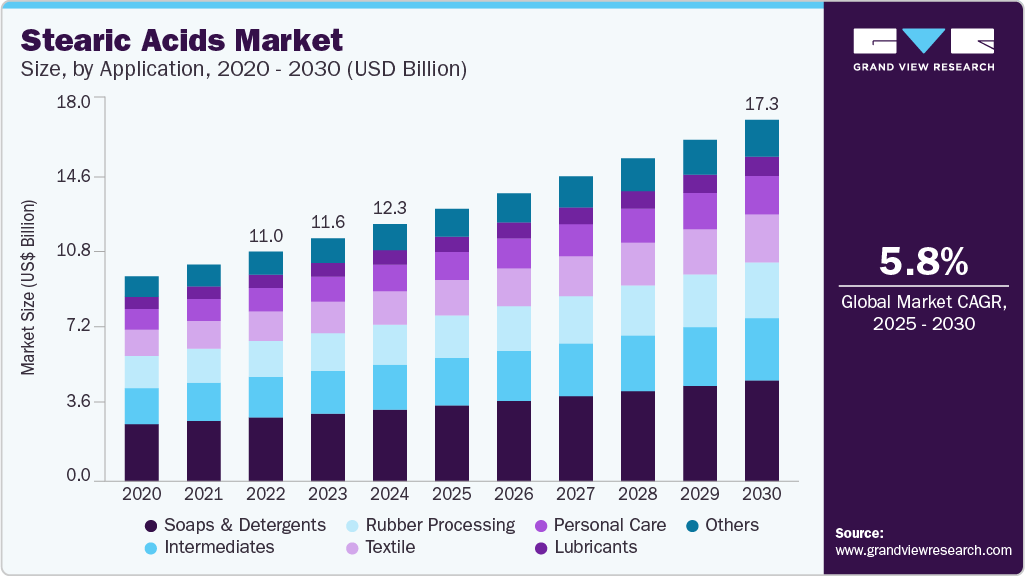

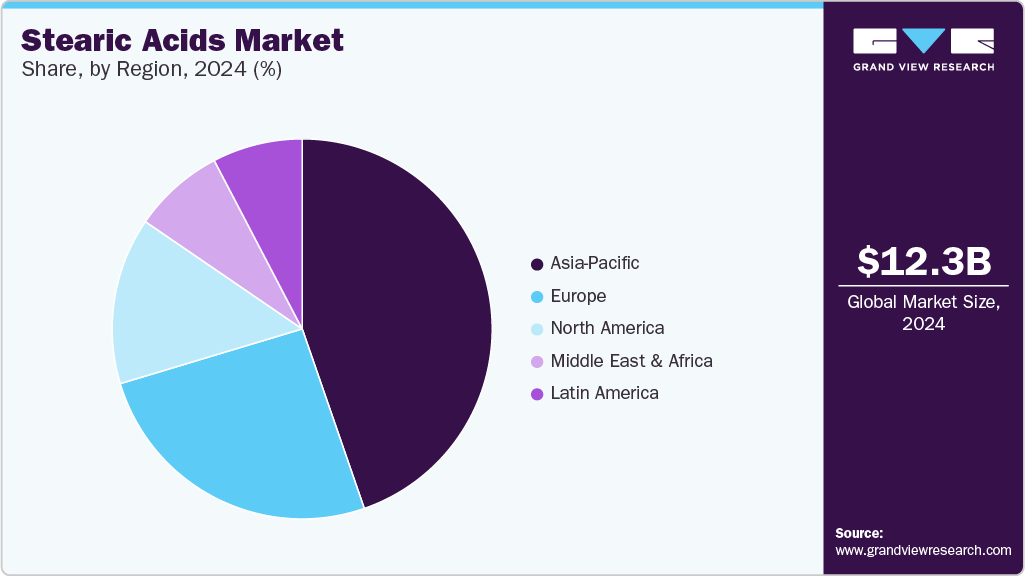

The global stearic acids market size was estimated at USD 12,320.9 million in 2024 and is projected to grow at a CAGR of 5.8% from 2025 to 2030. The market growth is driven by the increasing applications of stearic acid across various industries, including detergents, lubricants, soaps, and personal care.

Key Highlights:

- Asia Pacific stearic acids market held the majority of the global market with a share of 41.8% in 2024.

- The stearic acids market in China held a significant revenue share of the in region in 2024.

- By application, the soaps & detergents segment dominated the market with a revenue share of 27.9% in 2024.

- The personal care application segment is anticipated to witness the fastest CAGR of 6.4% over the forecast period.

The broad range of applications has sparked global interest, leading to substantial investments in research and development activities. This, in turn, is enhancing production and supply chain processes, increasing competition, and propelling market growth.

The growing awareness of personal hygiene and the importance of clean surroundings are major factors driving the demand for stearic acid. This is due to its extensive use in personal hygiene products such as baby care items, moisturizers, emulsifiers, surfactants, and more. Furthermore, the emulsifying properties of stearic acid make it a crucial ingredient in cleaning products such as detergents, soaps, and fabric softeners. The expansion of the personal hygiene and cleaning products market is expected to significantly increase the demand for stearic acid.

Environmental concerns and the push to reduce carbon emissions and dependence on petrochemicals are fueling the demand for sustainable solutions. Products such as stearic acid, derived from natural sources such as coconut and palm oil, are biodegradable and are gaining traction as alternatives that align with sustainability goals.

Drivers, Opportunities & Restraints

The growing use of stearic acid as an emulsifier, thickener, and surfactant in personal care products is a major driver of the market. Its ability to stabilize formulations and provide a smooth texture makes it essential in creams, lotions, soaps, and shampoos. With increasing consumer preference for skincare and hygiene, especially in emerging economies, manufacturers are expanding cosmetic-grade stearic acid production. In addition, the trend toward organic and vegan beauty products is supporting demand for plant-derived stearic acid, further fueling market growth.

Stearic acid is primarily derived from animal fats and vegetable oils such as palm oil, which are subject to significant price fluctuations due to climatic conditions, geopolitical tensions, and supply chain disruptions. This volatility directly impacts production costs and profit margins for manufacturers. In addition, rising concerns over deforestation and sustainability linked to palm oil sourcing are prompting regulatory pressures and consumer backlash, creating further challenges for market stability. Such factors hinder long-term pricing predictability and investment planning in the stearic acid industry.

As industries shift toward sustainability, stearic acid is gaining traction as a key ingredient in the production of biodegradable plastics and eco-friendly surfactants. Its role in enhancing thermal stability and flexibility in bioplastics makes it valuable for packaging and disposable applications. In addition, the push for green chemistry in detergents and cleaning products is driving demand for naturally derived surfactants like stearic acid. With regulatory bodies promoting low-toxicity and renewable formulations, this trend opens new high-value application areas for manufacturers, especially in Europe and North America.

Application Insights

The soaps & detergents segment dominated the market with a revenue share of 27.9% in 2024. This growth is attributed to the multifunctional nature of stearic acid, which serves as a stabilizer, thickening agent, and emulsifying agent. The increasing support from regulatory bodies for the adoption of natural soaps and detergents due to environmental and health concerns is driving the demand for biodegradable stearic acid products. This trend is encouraging manufacturers to use stearic acid as an alternative in soap and detergent production. The rising awareness about skin health is prompting brands to adhere to safety standards while maintaining quality, leading to product innovation and impacting the demand for stearic acid.

The personal care segment is anticipated to witness the fastest CAGR of 6.4% over the forecast period. The growth drivers for this segment are expected to be the rising disposable incomes in many developed and developing nations, which increases the demand for skincare and beauty products, thus expanding the overall cosmetics industry and impacting the growth of products in this segment. The overall growth of the industry is intensifying competition, leading to changing regulatory support and safety standards to address sustainability issues, innovative product development due to rising competition, and pricing competition. These factors are significantly influencing the demand for stearic acid and are expected to contribute to the significant growth of this segment in the forecast years.

Regional Insights

North America stearic acids market growth can be attributed to a combination of factors such as the rising demand for cosmetics and personal care products, the expansion of food industries, the growth of various industrial sectors such as plastics manufacturing and rubber processing, and government initiatives promoting the use of stearic acid. These factors are positively impacting the sales of stearic acid across these industries, thus expected to drive the overall market growth in the region in the coming years.

U.S. Stearic Acids Market Trends

The U.S.stearic acids industry dominated the North America region in 2024 due to innovations in manufacturing processes and technological advancements, leading to efficient stearic acid production with competitive pricing for local industries. Furthermore, the rapid expansion of the detergents and cleaning industry is surging the demand for stearic acid, thus propelling the market in the country.

Asia Pacific Stearic Acids Market Trends

Asia Pacific stearic acids industry held the majority of the global market with a share of 41.8% in 2024 pertaining to the increasing demand from the cleaning and detergent industry, rapid urbanization, and population growth, which are driving consumption and surging the demand for these products. Rising disposable incomes and the expansion of key industries in the market also contribute to market growth.

The stearic acids market in China held a significant revenue share of the Asia Pacific region in 2024, attributed to the extensive industrial applications of stearic acid products, the expanding food industry, the growing cosmetics industry, and the burgeoning personal care sector, all of which are significantly driving the market in the country.

Europe Stearic Acids Market Trends

Europe stearic acids industry held a substantial global market share in 2024 and is expected to grow significantly over the forecast period. The growth drivers for this market are expected to be the rising demand in end-use industries, increasing concerns about sustainability leading to the adoption of eco-friendly products such as stearic acid, and the recovery of key manufacturing industries such as consumer goods and automotive. These factors are positively impacting the sales of stearic acid, thus significantly driving the market growth.

Latin America Stearic Acids Market Trends

The Latin America stearic acids industry is driven by rising demand from the personal care, plastics, and rubber processing industries, particularly in countries such as Brazil, Mexico, and Argentina. Growth in urbanization and consumer spending is fueling the use of cosmetics, soaps, and PVC-based products that utilize stearic acid. In addition, regional manufacturers are increasingly adopting plant-based stearic acid to align with sustainability trends.

Middle East & Africa Stearic Acids Market Trends

The Middle East & Africa stearic acids industry is experiencing moderate growth, driven by rising demand from the cosmetics, detergents, and plastics sectors, especially in GCC countries and South Africa. Expansion of the oleochemicals industry and increasing preference for personal care products are supporting regional consumption. However, the market is somewhat constrained by limited local production and reliance on imports.

Key Stearic Acids Company Insights

Some of the key players operating in the market include Dow and Linde Plc

-

Emery Oleochemicals, LLC is a global producer specializing in the manufacture of high-quality oleochemical products, including stearic acid, derived from renewable sources. Their stearic acid offerings cater to a wide range of applications such as personal care, industrial, and automotive sectors, highlighting their commitment to sustainability and innovation in the oleochemical market.

-

3F Industries Limited is a player in the chemical industry, known for its production of stearic acid and other fatty acids derived from natural oils. Their stearic acid products serve diverse applications, including in the cosmetics, pharmaceuticals, and manufacturing sectors, underscoring their role in delivering high-quality, sustainable solutions to meet market demands.

Key Stearic Acids Companies:

The following are the leading companies in the stearic acids market. These companies collectively hold the largest market share and dictate industry trends.

- Emery Oleochemicals

- 3F Industries LTD

- New Japan Chemical Co.

- Ltd.; Oleon NV

- Wilmar International

- BASF SE

- Cayman Chemical

- Pacific Oleochemicals, Sdn. Bhd.

- Kao Chemicals

- Godrej Industries Limited

- VVF (India) Limited

- Bloomberg L.P.

- Twin Rivers Technologies, Inc.

Recent Developments

-

In February 2024, the Solvent Extractors’ Association of India (SEA) petitioned the Government of India to impose restrictions on the import of finished oleochemical products. Citing the surge in duty-free imports of stearic acid from Southeast Asia, the SEA expressed concerns over the detrimental impact on the domestic oleochemical industry.

Stearic Acids Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13,053.5 million

Revenue forecast in 2030

USD 17,326.7 million

Growth Rate

CAGR of 5.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Emery Oleochemicals; 3F Industries LTD; New Japan Chemical Co., Ltd.; Oleon NV; Wilmar International; BASF SE; Cayman Chemical; Pacific Oleochemicals, Sdn. Bhd.; Kao Chemicals; Godrej Industries Limited; VVF (India) Limited; Bloomberg L.P.; Twin Rivers Technologies, Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Stearic Acids Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global stearic acids market report based on application, and region.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Soaps & detergents

-

Intermediates

-

Personal Care

-

Rubber Processing

-

Textile

-

Lubricants

-

Other Application

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global stearic acids market size was estimated at USD 12,320.9 million in 2024 and is expected to reach USD 13,053.5 million in 2025.

b. The global stearic acids market is expected to grow at a compound annual growth rate of 5.8% from 2025 to 2030 to reach USD 17,326.7 million by 2030.

b. Asia Pacific dominated the stearic acid market with a share of 41.8% in 2024. This is attributable rapid industrialization coupled with rising disposable income level particularly in India, China, and Indonesia.

b. Some key players operating in the stearic acids market include The U.S. Chemical Company LLC., BASF, AkzoNobel, Emery Oleochemicals, Wilmar International, Godrej Industries, Oleon, Pacific Oleochemicals Sdn Bhd, Kao Chemicals, and Kuala Lumpur Kepong (KLK).

b. Key factors that are driving the market growth include increasing penetration of organic chemicals across personal care products such as shaving creams, shampoos, and soaps.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.