- Home

- »

- Biotechnology

- »

-

U.S. Biobanks Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Biobanks Market Size, Share & Trends Report]()

U.S. Biobanks Market (2025 - 2030) Size, Share & Trends Analysis Report By Product & Service, By Biospecimen (Human Tissues, Organs, Stem Cells), By Type (Physical/Real Biobanks, Virtual Biobanks), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-585-1

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Biobanks Market Size & Trends

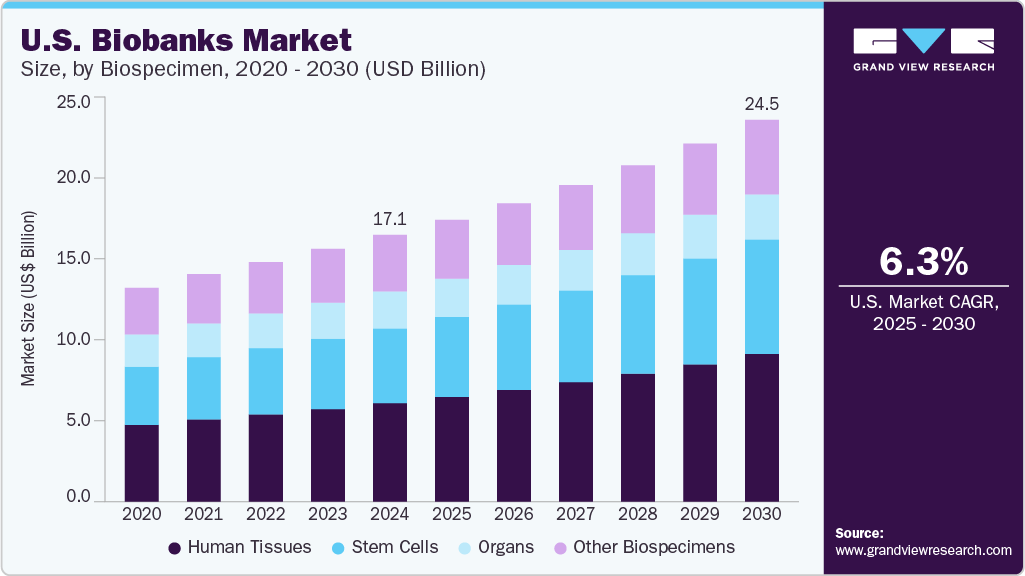

The U.S. biobanks market size was estimated at USD 17.10 billion in 2024 and is projected to grow at a CAGR of 6.26% from 2025 to 2030. This growth is driven by increasing investments in precision medicine and genomics research, rising demand for personalized therapies, and expanding applications of biobanked specimens in drug discovery and diagnostics. In addition, integrating advanced technologies such as AI-driven data analytics, automated sample processing, and cloud-based biobank management systems enhances operational efficiency and data accessibility.

Supportive government initiatives further contribute to market expansion by promoting large-scale biospecimen collection and collaborative research efforts.

Growing Role in Drug Discovery and Development

Biobanks are becoming increasingly integral to pharmaceutical and biotechnology R&D pipelines. The availability of high-quality, well-annotated biospecimens accelerates early-stage research by enabling the identification of novel drug targets and validation of disease-specific biomarkers. Often linked with clinical and genomic data, these samples support patient stratification efforts essential for precision medicine initiatives. By facilitating targeted and hypothesis-driven research, biobanks help companies improve the success rate of drug candidates and reduce the risk of late-stage failures.

In addition, biobanks significantly shorten research timelines by providing immediate access to ready-to-use biological materials for preclinical and clinical studies. This access eliminates the time and cost of new sample collection and allows for rapid study initiation. As biopharma companies increasingly pursue personalized therapies and adaptive clinical trial designs, the strategic value of biobanks in accelerating development cycles, improving trial design, and enhancing regulatory compliance continues to grow. Consequently, partnerships between biobanks and industry stakeholders are expanding, further embedding biobanking into the drug development value chain.

Increase in the Number of Clinical Trials

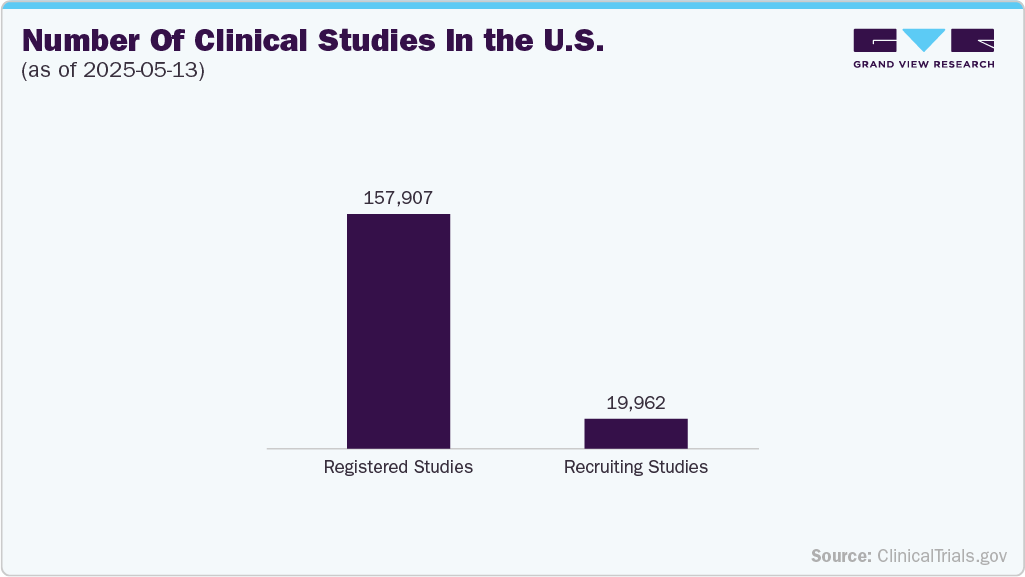

The U.S. remains a dominant global clinical research hub, driven by a robust regulatory framework, well-established healthcare infrastructure, and significant pharmaceutical and biotech companies investment. Over the past decade, the surge in demand for targeted therapies, especially in oncology, rare diseases, and immunology, has translated into an uptick in trial activity. Increasing reliance on real-world evidence and adaptive trial designs has also fueled growth, encouraging more industry-sponsored and investigator-led studies. In addition, regulatory pathways such as the FDA’s Accelerated Approval and Breakthrough Therapy designations have incentivized sponsors to initiate trials domestically to expedite market access.

According to the ClinicalTrials.gov report (as of May 13, 2025), interventional trials constitute most clinical studies in the U.S., indicating a strong industry focus on evaluating the efficacy and safety of new treatments through active testing. In contrast, observational studies represent a smaller fraction, highlighting a preference for proactive trial designs that support regulatory submissions and commercialization strategies. This dominance of interventional trials aligns with broader market trends, where stakeholders prioritize therapeutic innovation, data-driven development, and faster go-to-market pathways.

The expanding clinical trial landscape presents significant opportunities for biobanks, CROs, data analytics firms, and patient recruitment platforms. As more companies seek to fast-track drug development, the demand for high-quality biospecimens, real-time data, and diverse patient populations is rising. In this environment, stakeholders that can offer decentralized trial models, AI-driven protocol optimization, and access to rare disease cohorts will likely gain a competitive edge. Furthermore, ongoing digitization and interoperability of health records are expected to streamline patient matching and accelerate recruitment timelines, ultimately reducing the cost and complexity of running trials in the U.S.

Market Concentration & Characteristics

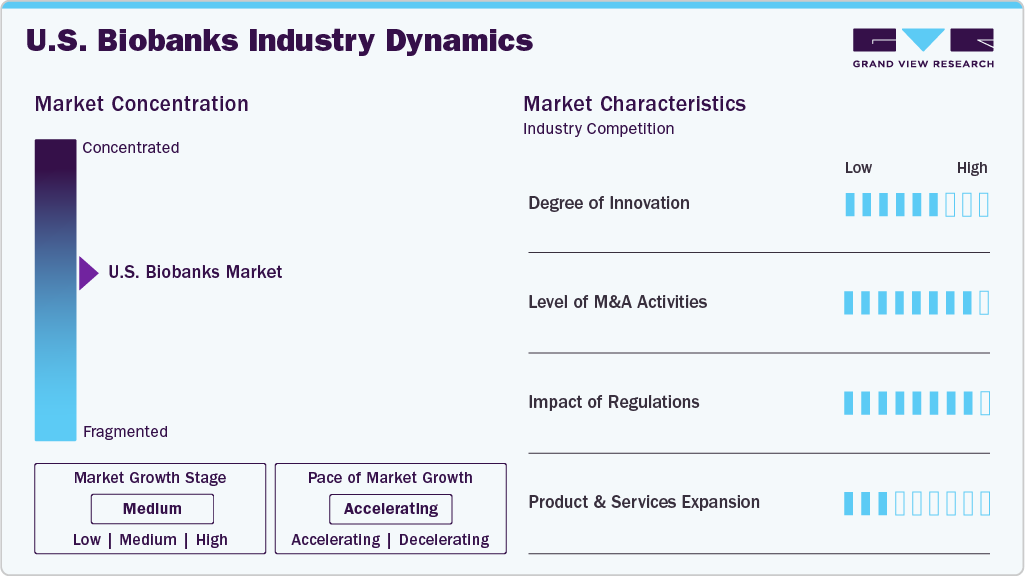

Innovation in the U.S. biobanks industry is accelerating, driven by advancements in automation, AI-powered data analytics, and cloud-based sample management. Integrating electronic health records, growing demand for personalized medicine, and strategic collaborations with pharma and research institutions enhance operational efficiency and research value. These developments enable faster, more precise access to biospecimens, supporting translational research and accelerating drug discovery pipelines.

The U.S. biobanks industry features significant growth in mergers and acquisitions, owing to the rising demand for integrated biorepository services, expansion into precision medicine, and the need for scalable infrastructure. Companies are consolidating to enhance sample diversity, streamline operations, and offer end-to-end solutions across the biobanking value chain. In addition, strategic M&A activity enables access to advanced technologies, broader geographic reach, and stronger partnerships with pharmaceutical, biotech, and academic research organizations.

Regulatory frameworks, primarily governed by the FDA, significantly impact the U.S. biobanks industry by ensuring ethical standards, data integrity, and biospecimen quality. Compliance with guidelines related to informed consent, data privacy (HIPAA), and Good Clinical Practice (GCP) is critical for maintaining public trust and enabling research partnerships. These regulations also shape biobank operations by mandating transparent sample handling, traceability, and standardized protocols, essential for supporting clinical trials, translational research, and eventual regulatory submissions.

The U.S. biobanks industry is witnessing rapid growth and product & service expansion, owing to increasing demand for high-quality biospecimens in precision medicine, drug development, and diagnostics. This growth is further fueled by advancements in sample preservation technologies, data integration tools, and automation, enabling biobanks to offer end-to-end services-from sample collection and storage to genomic analysis and data sharing. In addition, partnerships with healthcare providers and research institutions are expanding the scope and accessibility of biobanking services nationwide.

Product & Service Insights

Based on product & service, the market is segmented into products and services. The services segment held the largest revenue share in 2024 and is anticipated to grow at the fastest CAGR over the forecast period, driven by the increasing demand for sample processing, storage, and data management solutions among pharmaceutical companies, research institutions, and healthcare providers. The rise in outsourced biobanking services-such as sample logistics, genomic analysis, and quality assurance-has enabled organizations to focus on core research while ensuring regulatory compliance and operational efficiency. In addition, the growing complexity of biospecimen handling and the need for standardized protocols have accelerated the adoption of professional biobank services, contributing to the segment’s dominance in the U.S. industry.

Products are expected to grow at a significant CAGR over the forecast period, due to the rising adoption of advanced storage equipment, automated sample handling systems, and laboratory information management systems (LIMS). Increasing demand for high-throughput biobanking infrastructure and improved sample preservation technologies is also driving product uptake as biobanks scale operations to meet growing needs in genomics, precision medicine, and clinical research.

Biospecimen Insights

Human tissues held the largest revenue share of 36.91% in 2024. This was driven by their critical role in disease modeling, biomarker discovery, and drug development, particularly in oncology and regenerative medicine. The demand for well-preserved, annotated tissue samples has surged as researchers increasingly rely on tissue-based studies to understand disease progression and treatment response. In addition, advancements in tissue preservation and imaging technologies have further enhanced their utility across academic and commercial research settings.

The stem cells segment is expected to register the fastest CAGR over the forecast period, driven by growing applications in regenerative medicine, cell-based therapies, and personalized treatment approaches. Increasing R&D investments, clinical trials involving stem cell-based interventions, and advancements in cryopreservation techniques are further accelerating demand. In addition, rising interest in stem cells for neurological, cardiovascular, and autoimmune disorders contributes to segment growth.

Type Insights

Based on type, the market is segmented into physical/real biobanks and virtual biobanks. The physical/real biobanks held the largest revenue share in 2024, driven by their widespread adoption for storing and managing large volumes of biospecimens with strict temperature and quality controls. These biobanks support clinical trials, translational research, and drug development by providing access to well-preserved, annotated biological samples. Their established infrastructure, regulatory compliance, and ability to handle diverse specimen types further contribute to their market dominance.

Virtual biobanks are expected to grow at the fastest CAGR due to increasing digitization of healthcare data, rising demand for remote sample access, and the need for efficient data sharing across research institutions. They enable centralized data integration, enhanced collaboration, and reduced reliance on physical infrastructure, making them ideal for supporting multi-site studies, real-time analytics, and scalable biobanking solutions in genomics and personalized medicine.

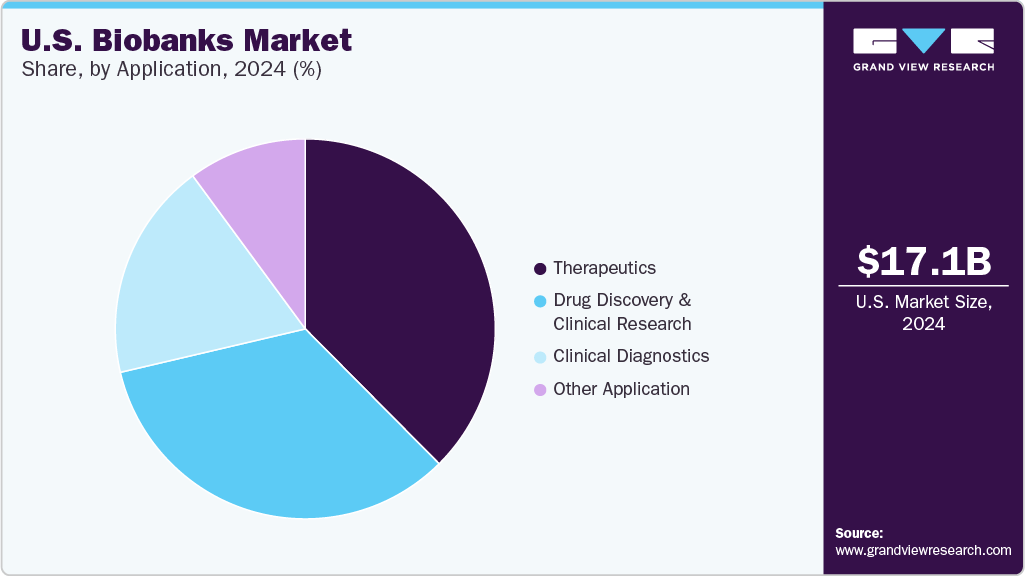

Application Insights

Based on application, the market is segmented into therapeutics, drug discovery & clinical research, clinical diagnostics, and other applications. The therapeutics held the largest revenue share in 2024 and are anticipated to grow at the fastest CAGR over the forecast period. This is driven by the rising use of biobanked samples in developing targeted therapies, regenerative medicine, and personalized treatment approaches. Increased focus on cell and gene therapies and growing investments in translational research further support the segment’s rapid expansion.

Clinical diagnostics are expected to grow at a significant CAGR due to the increasing use of biobanked samples for early disease detection, biomarker validation, and companion diagnostics. The rise in personalized medicine and demand for accurate, data-driven diagnostic tools is further driving adoption, especially in oncology, infectious diseases, and genetic testing.

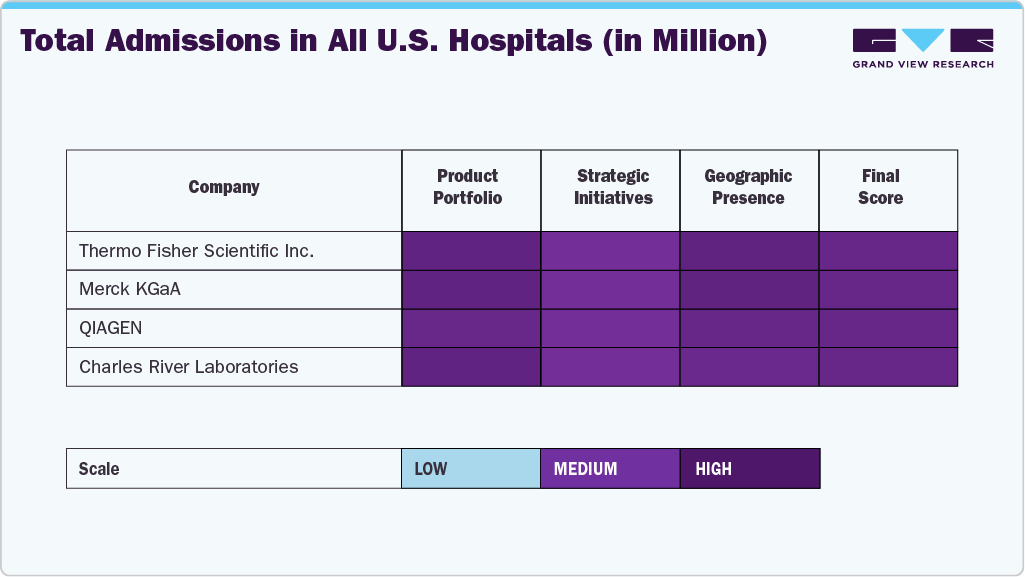

Key U.S. Biobanks Company Insights

The U.S. biobank industry is characterized by established players and emerging innovators, each contributing to the sector’s expansion through strategic investments, product development, and service integration. Market leaders such as Thermo Fisher Scientific, Inc., Merck KGaA, and QIAGEN hold significant shares due to their comprehensive biobanking portfolios, global reach, and advanced laboratory infrastructure. These companies offer a wide range of products and services, including sample storage systems, lab automation, and genomic solutions, enabling them to effectively serve both clinical and research segments.

Emerging and mid-sized companies are gaining traction by offering niche solutions and service-based models. Players such as Hamilton Company, Tecan Trading AG, and ViaCord (Revitty) are expanding their footprint through automated storage, cryopreservation, and cord blood banking innovations. Companies such as Cryo-Cell, BioCision, LLC, and ICBiomedical are differentiating themselves through advanced cold chain logistics, high-performance storage technologies, and GMP-compliant services. These firms are increasingly partnering with healthcare providers and academic institutions to support personalized medicine and regenerative therapies.

The market also sees activity from specialized service providers and software-driven platforms such as Charles River Laboratories, Azenta US Inc., Stemcell Technologies, Biovault Family, LabVantage Solutions Inc., and Precision Cellular Storage Ltd. These companies are addressing critical needs in biobank management, sample tracking, and data integration. As the demand for interoperable systems and scalable biobanking solutions grows, companies offering LIMS platforms and end-to-end digital workflows will likely gain a competitive advantage. Overall, consolidation, innovation, and strategic collaborations continue to shape the competitive landscape of the U.S. biobanks industry.

Key U.S. Biobanks Company Insights

Numerous participants operate in the market. Firms in the industry are undertaking numerous strategies, such as launching novel products, partnerships, and collaborations, to maintain their market presence.

Key U.S. Biobanks Companies:

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- QIAGEN

- Hamilton Company

- Tecan Trading Ag

- ViaCord (Revitty)

- Cryo-Cell

- BioCision, LLC.

- Icbiomedical

- Charles River Laboratories

- Azenta US Inc.

- Stemcell Technologies

- Biovault Family

- LabVantage Solutions Inc.

- Precision Cellular Storage Ltd.

Recent Developments

-

In March 2025, LabVantage Solutions, Inc. launched LabVantage 8.9, the latest version of its flagship LIMS, designed to boost productivity, ensure accuracy and compliance, and streamline complex lab workflows.

-

In February 2025, Merck KGaA, the German healthcare and technology group, was in advanced talks to acquire U.S.-based cancer and rare diseases drugmaker SpringWorks Therapeutics.

U.S. Biobanks Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 24.48 billion

Growth rate

CAGR of 6.26% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, biospecimen, type, application

Country scope

U.S.

Key companies profiled

Thermo Fisher Scientific, Inc.; Merck KGaA; QIAGEN; Hamilton Company; Tecan Trading Ag; ViaCord (Revitty); Cryo-Cell; BioCision, Llc; Icbiomedical; Charles River Laboratories; Azenta US Inc.; Stemcell Technologies; Biovault Family; LabVantage Solutions Inc.; Precision Cellular Storage Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Biobanks Market Report Segmentation

This report forecasts revenue growth and analyzes the latest trends in each of the sub-segments from 2018 to 2030. Grand View Research has segmented the U.S. biobanks market report based on product & service, biospecimen, type, and application.

-

Product & Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Products

-

Biobanking Equipment

-

Temperature Control Systems

-

Freezers & Refrigerators

-

Cryogenic Storage Systems

-

Thawing Equipment

-

-

Incubators & Centrifuges

-

Alarms & Monitoring Systems

-

Accessories & Other Equipment

-

-

Biobanking Consumables

-

Laboratory Information Management Systems

-

-

Services

-

Biobanking & Repository

-

Lab processing

-

Qualification/ Validation

-

Cold Chain Logistics

-

Other Services

-

-

-

Biospecimen Outlook (Revenue, USD Million, 2018 - 2030)

-

Human Tissues

-

Organs

-

Stem Cells

-

Adult Stem Cells

-

Embryonic Stem Cells

-

IPS Cells

-

Other Stem Cells

-

Other Biospecimens

-

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Physical/Real Biobanks

-

Tissue Biobanks

-

Population Based Biobanks

-

Genetic (DNA/RNA)

-

Disease Based Biobanks

-

-

Virtual Biobanks

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapeutics

-

Drug Discovery & Clinical Research

-

Clinical Diagnostics

-

Other Application

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.