- Home

- »

- Renewable Energy

- »

-

U.S. Biofuels Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Biofuels Market Size, Share & Trends Report]()

U.S. Biofuels Market (2024 - 2030) Size, Share & Trends Analysis Report By Feedstock (Corn, Sugarcane), By Application (Transportation, Aviation), By Form (Solid, Liquid), By Product, And Segment Forecasts

- Report ID: GVR-4-68040-216-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Biofuels Market Size & Trends

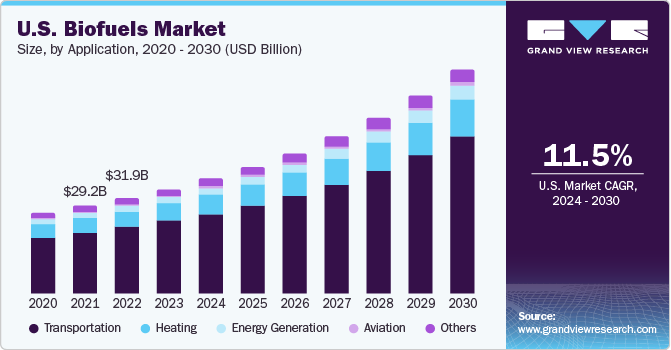

The U.S. biofuels market size was estimated at USD 31.93 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 11.8% from 2024 to 2030. Biofuels can be blended in large quantities with traditional fossil fuels for use in applications such as transportation. Biofuels play a particularly important role in decarbonizing transport by providing a low-carbon solution for hard-to-abate sectors such as trucking, shipping, and aviation. They can often be used in existing engines with little to no modification.

Major factors supporting the growth of the biofuel market in North America include high demand for green fuels, stringent environmental regulations, and high investment in the development of biofuel refineries. Significant drivers including technological advancement and awareness regarding the benefits of biofuel as a clean fuel are likely to boost the North American market. In the U.S., 49 states have implemented ASTM D6751 as state law and have now been mandated to enforce the ASTM D6751 biodiesel standard.

Although biodiesel can replace conventional fuel, its production capacity is not enough to meet the current demand. Thus, the market is highly regulated with various tax incentives in different countries. The Federal Energy Regulatory Commission (FERC) is an independent agency that regulates power markets introduced regulation for biofuel compatibility requirements for underground storage tanks in the U.S. states that fueling station owners need to give notification to the required state and local agencies at least 30 days before switching to underground storage tanks from the other storages.

In the U.S., there are many federal & state incentives to promote the use of biofuels, with a majority of them prevailing in Washington, which has 4 incentive programs and approximately 13 laws for biofuels. Some of the incentive programs and notable regulations in the country include EPA 40 CFR Part 80, Section 1501 of the Energy Policy Act of 2005, and Biodiesel Mixture Excise Tax Credit. Such incentives and regulations result in positive impacts for consumers via growth in the renewable economy.

Market Concentration & Characteristics

The market growth is high and is accelerating at a significant pace owing to a moderately consolidated market. U.S. biofuel manufacturers are actively implementing challenging strategic initiatives such as mergers & acquisitions, new product launches, and production expansion, among others.

The degree of technological innovation is high as it is the most crucial and governing factor in terms of biofuel manufacturing. Some of the widely utilized technologies for the production of biodiesel include enzymatic production, algal biodiesel, and reactive distillation. The latest emerging technologies for biodiesel production involve using algae as feedstock.

The only substitutes for biofuels that are currently available in the market are fossil fuels such as petrol, diesel, and compressed natural gas (CNG). Although CNG is a clean alternative to biofuels, its use still results in low-carbon emissions.

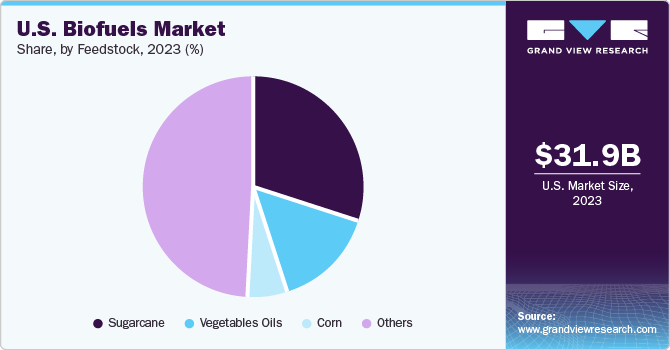

Feedstock Insights

Sugarcane dominated the market, accounting for the highest revenue share of 29.9% in 2023. The process of making ethanol from sugarcane begins with crushing the sugarcane stalks to produce sugar-rich cane juice, which is later fermented using yeast. Companies involved in biofuel production are setting up sugarcane as a feedstock in production facilities to boost the growth of the segment over the forecast period.

Corn is projected to expand at the fastest CAGR from 2024 to 2030. U.S. is the world’s largest corn producer and according to the United States Department of Agriculture (USDA) in 2020, the U.S. had a record high corn yield, growth rate of 3.3% than the previous year. In 2021, the overall production of corn in the U.S. was 15.1 billion bushels. Such a rise in corn production is projected to boost the demand for corn as a feedstock in biofuel production during the forecast period.

Form Insights

Liquid biofuels held the largest revenue share of 49.0% in 2023 and is expected to expand at the fastest CAGR owing to the rising R&D activities for technology innovation. For instance, in 2022, under the United States Inflation Reduction Act (IRA), USD 9.4 billion was made available as a liquid biofuel production investment. Furthermore, depleting fossil fuel resources and growing awareness about environmental sustainability are expected to be a key factor driving the liquid biofuel segment.

Solid biofuels is expected to expand at a significant CAGR during the forecast period. Wood pellets are used to generate heat and electricity. Wood pellets are produced in several steps including feedstock grinding, extrusion, and cooling. Some steps such as moisture control and extortion may require research to optimize the process while utilizing new biomass sources. The launch of wood pellets across the country has increased in recent years. For instance, in September 2022, Enviva Biomass opened its wood pellet manufacturing plant in George County, with an investment of USD 250 million. In June 2021, Delta Biofuel announced an investment of USD 70 million for the development of a biomass pellet plant in Louisiana, US.

Product Insights

The ethanol segment led the market with a revenue share of 30.3% in 2023 owing to its widespread application in energy generation, chemicals, and food & beverages. Ethanol is primarily produced by fermenting sugar. Different types of plant-based raw materials such as corn and sugar are used for its production. Bioethanol is a potential alternative energy source that can lead the way in reducing greenhouse gas emissions.

The wood pellets segment is expected to expand at the fastest CAGR from 2024 to 2030. The demand for wood pellets is projected to rise during the forecast period due to advancements in manufacturing technology, which is increasing the specific density of the wood pellets and price volatility for fossil fuels. Wood pellets have emerged as a key alternative to natural gas boilers and diesel boilers for residential uses.

Application Insights

The transportation segment accounted for a revenue share of 69.7% in 2023. The segment growth is attributed to the adoption of biofuels as an alternative to traditional fuel sources for vehicles such as cars and buses. Furthermore, biofuels require comparatively little modification and have low carbon emissions. The abovementioned factors are fostering segment growth.

The energy generation segment is projected to emerge as the fastest-growing segment during the forecast period. Biofuels are used to generate electricity for backup systems in schools, hospitals, and other residential areas.

Key U.S. Biofuels Company Insights

The key players in the market are investing in research and development activities to set up new processes that yield better quality and reduce costs. They are diversifying their feedstock accessibility to adapt to changing market conditions. The emerging players are focused on catering to niche industries including aviation biofuels, marine biofuels, etc. In addition, the players are taking strategic initiatives such as product innovation and collaborations to establish their presence in the regional and global markets.

Key U.S. Biofuels Companies:

- Poet

- Renewable Energy Group, Inc.

- Clean Energy

- Enviva

- Green Plains, Inc.

- Rentech

- U.S. Gain

- Gevo, Inc.

- World Energy, LLC.

- ECL Group

- Viridos

- Tri-State Biodiesel

- NextEra Energy Seabrook, LLC

- Rio Valley Biofuels

- Arkema

- ACCIONA

Recent Developments

-

In September 2023, the U.S. Department of Energy (DOE) invested USD 23.6 million in funding to nine universities and several industry projects for the development of affordable biofuels and other bioproducts that have a low carbon footprint.

-

In September 2023, Arkema invested USD 130 million for the production of dimethyl disulphide (DMDS), an additive used in manufacturing biofuels at Beaumont. This investment will help Arkema strengthen its market position and support the decarbonization of biorefineries.

-

In August 2023, ACCIONA launched the Fargo-Moorhead flood diversion project, a biofuel manufacturing facility from hydrotreated vegetable oil (HVO). ACCIONA launched the project in collaboration with North American Construction Group and Shikun & Binui USA, promoting the local economy.

U.S. Biofuels Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 35.05 billion

Revenue forecast in 2030

USD 68.29 billion

Growth rate

CAGR of 11.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in thousand TOE, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product, form, application, feedstock

Country Scope

U.S.

Key companies profiled

Poet; Renewable Energy Group, Inc.; Clean Energy; Enviva; Green Plains, Inc.; Rentech; U.S. Gain; Gevo, Inc.; World Energy, LLC.; ECL Group; Viridos; Tri-State Biodiesel; NextEra Energy Seabrook, LLC; Rio Valley Biofuels; ACCIONA; Arkema

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Biofuels Market Report Segmentation

This report forecasts revenue & volume growth at the country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. biofuels market report based on feedstock, form, product, and application:

-

Feedstock Outlook (Volume, Thousand TOE; Revenue, USD Billion, 2018 - 2030)

-

Corn

-

Sugarcane

-

Vegetables Oils

-

Others

-

-

Form Outlook (Volume, Thousand TOE; Revenue, USD Billion, 2018 - 2030)

-

Solid Biofuels

-

Liquid Biofuels

-

Gaseous Biofuels

-

-

Product Outlook (Volume, Thousand TOE; Revenue, USD Billion, 2018 - 2030)

-

Biodiesel

-

Green Diesel

-

Ethanol

-

Wood Pellets

-

Aviation Biofuel (Bio-jet Fuel)

-

Biomethane

-

Syngas

-

Green Hydrogen

-

Others (Biogasoline, Biomethanol, Biobutanol, Bioethers)

-

-

Application Outlook (Volume, Thousand TOE; Revenue, USD Billion, 2018 - 2030)

-

Transportation

-

Aviation

-

Energy Generation

-

Heating

-

Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.