U.S. Blood Testing Market Summary

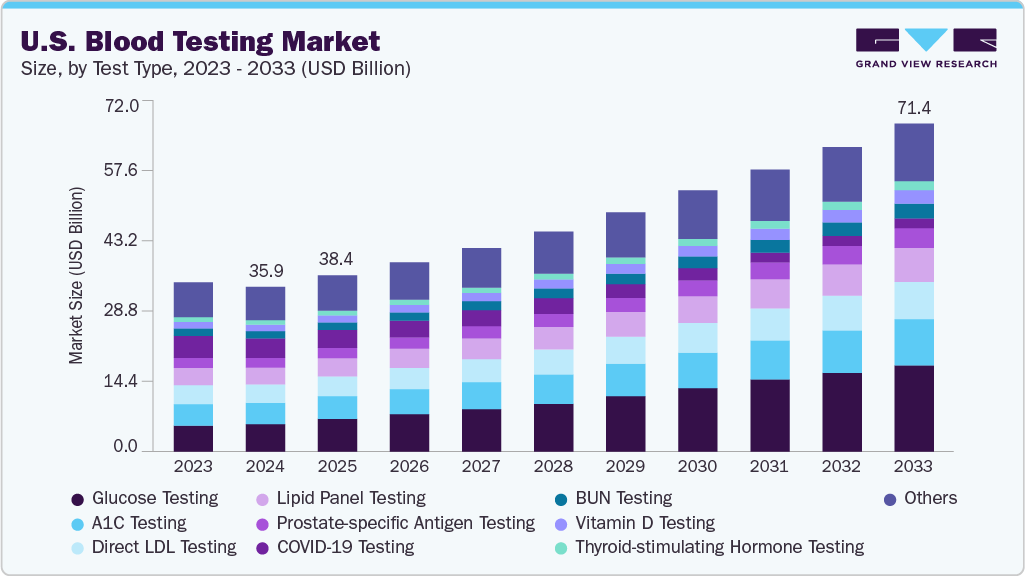

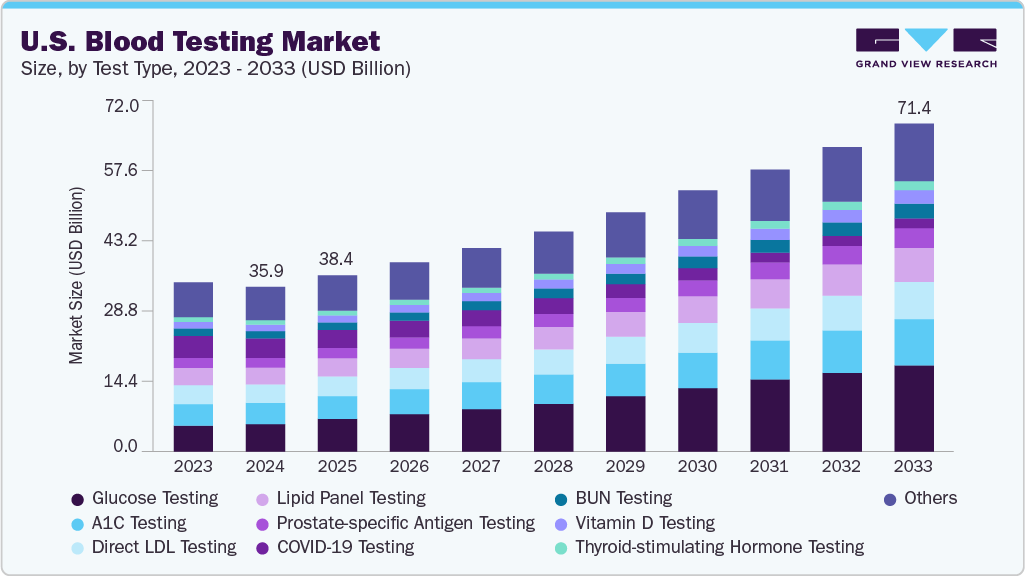

The U.S. blood testing market size was valued at USD 35.90 billion in 2024 and is projected to reach USD 71.41 billion by 2033, growing at a CAGR of 8.1% from 2025 to 2033. The market is primarily driven by the rising prevalence of chronic diseases such as diabetes, cardiovascular conditions, and cancer, which necessitate frequent diagnostic testing and monitoring for effective management.

Key Market Trends & Insights

- In terms of test type, glucose testing accounted for a revenue share of 16.7% in 2024.

- A1C testing is expected to grow at a CAGR of 9.2% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 35.90 Billion

- 2033 Projected Market Size: USD 71.41 Billion

- CAGR (2025-2033): 8.1%

Growing public awareness and a shift toward preventive healthcare, encouraging routine check-ups and early disease detection screening, are the major drivers for this market. In 2024, the Centers for Disease Control and Prevention (CDC) strengthened its core laboratory capabilities to detect and respond to high-priority pathogens. Recent technological innovations are a major catalyst for the market's expansion, improving the accessibility and efficiency of blood testing. For instance, in June 2024, the FDA granted marketing authorization for the first point-of-care Hepatitis C virus (HCV) RNA test, which enables single-visit testing and treatment using a fingertip blood sample.

Other key technological advances that are expected to impact this market are:

-

Artificial Intelligence Integration: AI and machine learning were pivotal in interpreting complex blood test data, enabling earlier disease detection, automation of smear analysis, improved biomarker identification, and reduced diagnostic errors. These systems accelerated result delivery and matched or exceeded clinical gold standards in sensitivity and specificity.

-

Lab-on-a-Chip Technology: Miniaturized devices capable of processing multiple blood tests on a single drop dramatically reduce laboratory demands, increasing access in remote and resource-limited regions while supporting rapid point-of-care diagnostics.

-

Wearable Biosensors: Smart devices (e.g., glucose and hemoglobin trackers) became possible for monitoring real-time, continuous blood composition. These are integrated with telemedicine platforms, improving chronic disease management, patient engagement, and rapid response to changes in health.

-

Molecular Diagnostics & Liquid Biopsy: Advanced molecular testing-especially for oncology and infectious diseases-enabled more specific, sensitive, and earlier detection. Liquid biopsy techniques facilitated noninvasive cancer diagnostics and recurrence monitoring months before clinical symptoms appeared.

- Home-Based and Minimally Invasive Testing: Technologies such as fingertip blood collection (BD’s MiniDraw™, Babson Diagnostics) and photonic chips (SiPhox) allowed patients and clinicians to collect and analyze blood samples at home or outside traditional phlebotomy settings, making blood testing less invasive and more accessible.

Major companies and startups expanded R&D into AI, miniaturized analytics, and patient-centric platforms, collaborating with healthcare systems for early disease detection and personalized prevention services.

The pace of innovation fostered rapid result availability (often bedside or same day), more reliable chronic disease management, and improved patient monitoring through wearables and cloud-connected diagnostic tools.

These transformative innovations positioned the U.S. blood testing market at the forefront of global diagnostics, with continuous advances in digital health, smart devices, and clinical laboratory processes throughout 2024.

Test Type Insights

The glucose testing segment dominated the market with a revenue share of 16.7% in 2024. The segment is driven by the soaring prevalence of diabetes and prediabetes, and the increasing demand for continuous monitoring and at-home solutions. According to the CDC's 2024 National Diabetes Statistics Report, over 38 million Americans have diabetes, with another 97 million adults having prediabetes, creating a vast and ongoing need for testing and management. Technological innovation is a major catalyst in the U.S. blood testing industry. For instance, in June 2024, two new over-the-counter continuous monitoring systems received FDA clearance, broadening access to glucose tracking for people with Type 2 diabetes who do not use insulin. In addition, in September 2024, the FDA approved the first long-term implantable CGM sensor designed to last a full year, reducing the need for frequent sensor replacements for patients.

The A1C testing segment is expected to grow at a CAGR of 9.2% over the forecast period. It is a blood test that measures the average amount of glucose (sugar) attached to hemoglobin in red blood cells over the past two to three months. As red blood cells have a lifespan of about three months, the test provides a reliable, long-term snapshot of blood sugar control. The A1C test is used to diagnose prediabetes and type 2 diabetes and monitor diabetes management in individuals already living with the condition. Recent instances and data points highlight the ongoing importance of this test. According to the NIH report covering August 2021-August 2023, the prevalence of total diabetes in adults was 15.8%. Furthermore, technological innovation is also a major driver in the U.S. blood testing industry.

Key U.S. Blood Testing Company Insights

Some key companies in the U.S. blood testing industry include Abbott, F. Hoffmann-La Roche Ltd, and others.

- BIOMÉRIEUX is a leader in in-vitro diagnostics and offers immunoassay and microbiology systems often used in blood culture and quality-control testing.

Key U.S. Blood Testing Companies:

- Abbott

- F. Hoffmann-La Roche Ltd

- Bio-Rad Laboratories, Inc.

- BIOMÉRIEUX

- Biomerica

- BD

- Quest Diagnostics Incorporated

- Siemens Healthineers AG

- Danaher Corporation

- Trinity Biotech Plc

Recent Developments

- In June 2025, BIOMÉRIEUX announced the strategic acquisition of Day Zero Diagnostics' next-generation sequencing assets to accelerate rapid, genome-based infectious disease and blood-infection testing.

U.S. Blood Testing Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 38.37 billion

|

|

Revenue forecast in 2033

|

USD 71.41 billion

|

|

Growth rate

|

CAGR of 8.1% from 2025 to 2033

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2021 - 2023

|

|

Forecast period

|

2025 - 2033

|

|

Quantitative units

|

Revenue in USD million/billion, and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Test type

|

|

Key companies profiled

|

Abbott; F. Hoffmann-La Roche Ltd; Bio-Rad Laboratories, Inc.; BIOMÉRIEUX; Biomerica; BD; Quest Diagnostics Incorporated; Siemens Healthineers AG; Danaher Corporation; Trinity Biotech Plc

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Blood Testing Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. blood testing market report based on test type: